Table of Contents

Are you a running business looking for an effective way to reduce your tax liabilities? If yes, then knowing what is Input Tax Credit can turn out to be a powerful way for you.

If you are interested in unlocking ultimate growth, then you should consider reading this blog.

This post will show you what is Input Tax Credit in GST (Goods and Services Tax), how to claim it and how it can help you reduce your tax liabilities.

Let’s begin with understanding the meaning of input tax credit in GST in the next heading.

What is Input Tax Credit in GST?

In general, the Input Tax Credit or ITC is a process under GST (Goods and Services Tax). This process allows you to reduce the tax you pay on your inputs from the tax you own on the outputs generated by your business.

This process of ITC initially lowers your overall tax liability. This system is designed to eliminate the chain-formation effect of taxes, where tax is imposed on a tax, to promote a more systematic tax structure.

The main objective behind the Input Tax Credit is to reduce the overall tax burden of businesses and promote growth.

The benefits of ITC also include helping businesses to invest in SIPs or Mutual Funds to generate extra income and encourage them to invest in growth-oriented assets like the ELSS Mutual Fund (Equity-linked schemes).

Well, to get a clearer picture of the topic, the next heading covers the example explaining how the input tax credit is levied on goods you may buy in India.

Input Tax Credit Example Explained

Let us break down the concept of 'What is input tax credit' by using an example for your better understanding:

Assume a manufacturer running his own business. He buys the goods for Rs 20,000 & pays 18% GST on it, which amounts to Rs 3,600.

Now, he is trading the final product for Rs 30,000 & also collects 18% GST on the sale, which amounts the GST to Rs 5,400. The manufacturer can claim an ITC of Rs 3,600 (GST on purchase) and reduce his tax liability.

His reduced tax liability will be Rs 5,400 (GST on sale) - Rs 3,600 (GST on purchase), which is Rs 1,800. Now he only needs to pay the amount of Rs 1,800 for GST, which will reduce his overall tax burden and promote efficient cash flow.

With the saved amount, the manufacturer can start SIP or a mutual fund to generate additional income, which can help him in tax liability management and increase his wealth.

Previously, you learned all about how GST is applied, lets take a second to understand the rulebook as well.

Keep scrolling to the next heading to learn the compliance rules regarding the GST on ITC (Input tax credit).

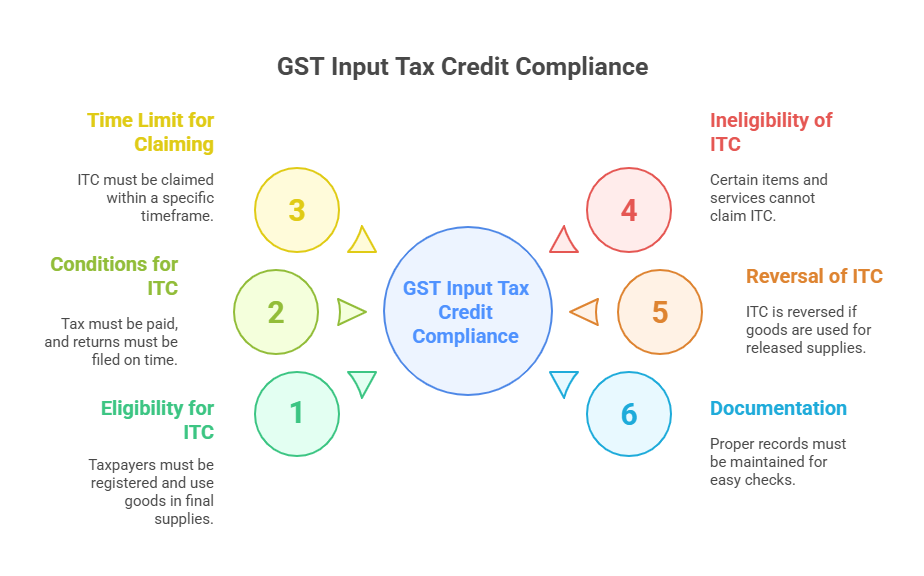

What is the GST Rule for Input Credit?

The rules associated with Input Tax Credit process under the GST framework are introduced to ensure that you can efficiently claim these credits while maintaining harmony with the law:

The key GST compliance rules related to ITC are:

Input Tax Credit Eligibility

- The taxpayer should be registered under GST to claim ITC.

- The goods and service on which ITC is claimed must be used in making final supplies.

- Taxpayers must possess a valid tax documentation issued by a registered supplier.

Conditions for ITC

- ITC can only be claimed if the tax is already been paid.

- Taxpayers must do the GST return filing before the time limit.

- The details of the ITC claimed must match the details provided by the supplier in their GST return.

Time Limit for Claiming

- ITC must be claimed within the year in which the goods & services were received.

- Or you can claim it by the due dates of filing the returns for September of the following financial year.

- Claim ITC on the date, whichever is earlier.

Ineligibility of ITC

- There are certain items and services on which ITC can not be claimed, so you must check the eligibility of the product.

Reversal of ITC

- If the goods or services are used for already released supplies, ITC is reversed.

- If the taxpayer pretends to be a registered person but he is not, ITC is reversed.

Tax Documentation & Record Keeping

- Taxpayers must maintain proper documentation, including invoices, debit notes, and records of ITC claims, to ensure easy check.

Also Read: What is Advance Tax? Tips for Effective Tax Planning

How to Claim ITC from GST?

Described below is a step-by-step guide for you to understand how can you claim an Input Tax Credit from GST:

Step 1: Verify Eligibility

- Ensure you are a registered taxpayer under GST.

- Ensure the goods & services you are claiming ITC on are eligible for credits.

Step 2: Obtain a Valid Tax Invoice

- Take a valid tax invoice from your supplier and the following details should be included:

| Supplier's GSTIN |

| Invoice date |

| Invoice number |

| Description of goods or services |

| Quantity and value of goods or services |

| GST rate and amount |

Step 3: Check Supplier GSTIN

- You need to verify the supplier GSTIN on the GST portal to make sure it is rational and active.

Step 4: Match ITC with GSTR-2A

- Match the ITC claims with the data displayed on GSTR-2A to make sure that the ITC claimed is not more than the amount on GSTR-2A.

Step 5: Claim ITC in GSTR-3B

- Claim the ITC in GSTR-3B, the monthly return for taxpayers.

Step 6: Pay GST Liability

- The payment should be made within the due date to avoid penalties.

Step 7: Preserve Records

- Maintain accurate documents of ITC claims process, including invoices, debit and credit notes.

Must Read: What is Professional Tax in Salary? Learn Tax Slabs, Deductions

What are Eligible and Ineligible Input Tax Credits?

The input tax credits can not be claimed on every good, they are ineligible to claim on certain goods and services. Let us look at the details:

| Eligible Input Tax Credit | Ineligible Input Tax Credit |

|---|---|

| Raw Materials and Components | Personal Consumption |

| Capital Goods | Exempt Supplies |

| Input Services | Motor Vehicles |

| Goods & Services Used for Business | GST Paid on Composition Scheme |

| GST Paid on Reverse Charge | Membership Fees |

| Goods for resale | Goods Lost, Stolen, or Destroyed |

| Tax paid on imports | Food and Beverages |

If you find yourself asking, “Am I eligible for ITC claims?” You are headed towards the right path.

Keep scrolling to get the answer you need in the next heading.

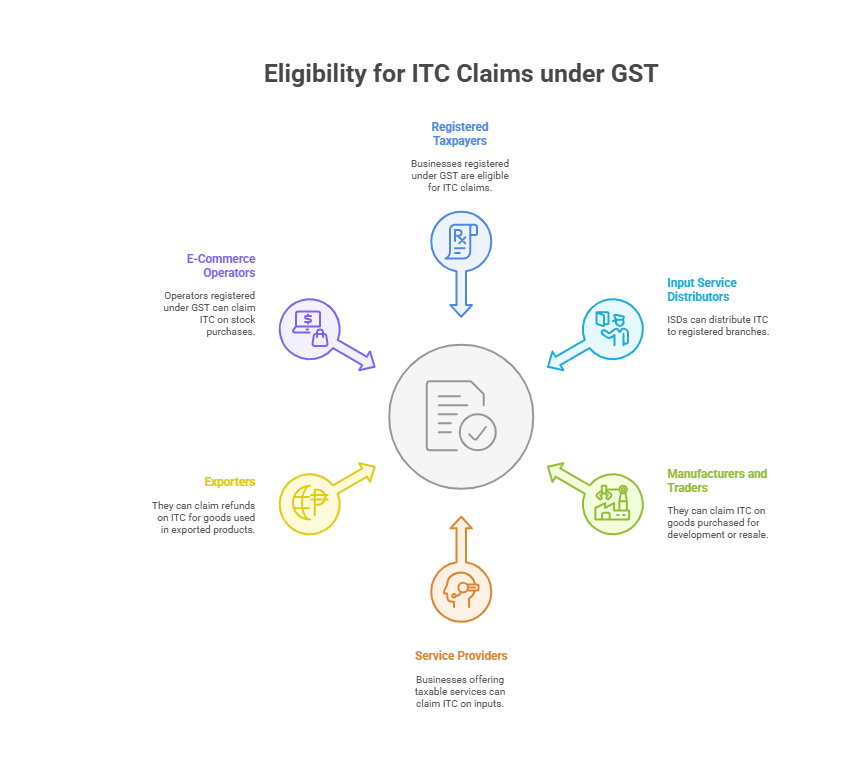

Who is Eligible for ITC Claims?

To be eligible for ITC claims under the GST regime, the following entities must meet the specified conditions:

-

Registered taxpayers

Businesses or taxpayers that are GST registered taxpayers.

-

ISD (Input Service Distributors)

ISD can distribute ITC to their branches that are registered under GST.

-

Manufacturers and Traders

They can claim ITC on the goods they purchased for the development process or resale.

-

Service Providers

A business that offers taxable services can claim ITC on inputs and input services.

-

Exporters

There is a GST refund for exporters that is capital goods tax credits , used for making products that are exported.

-

E-Commerce Operators.

Operators registered under GST can claim ITC on the purchases of stocks for their business.

Conclusion

In conclusion, Input Tax Credit (ITC) is a powerful tool for your business to reduce your tax liabilities and promote efficient cash flow management.

By understanding what is input tax credit, how to claim it and the rules and conditions associated with it, businesses can optimize their tax savings and invest in SIP (Systematic Investment Plan) or mutual fund investment to achieve their financial goals.

FAQs

-

What is your input tax credit?

Input Tax Credit (ITC) refers to the tax you pay on your inputs reduced from the tax you own on the outputs generated by your business.

-

What is the meaning of ITC?

The amount of GST paid by a registered person on the purchase of goods & services used for business purposes is known as an input tax credit or ITC.

-

How is ITC calculated in GST?

Add up the GST paid on all eligible gains during the appropriate tax period. Determine which inputs qualifies for ITC based on GST law. Multiply the total GST paid on buying by the input percentage to calculate the total ITC.

-

What is the mechanism of ITC?

The input tax credit is a procedure to avoid the cascading of taxes that is 'tax on tax' in simple words.

-

How does the GST mechanism work?

GST works by charging a combined tax on the delivery of goods & services that are collected at every stage of the supply chain. For example, a producer sells goods to a wholesaler for Rs. 1,00,000 with 18% GST.

-

What is ineligible for input tax credit?

ITC is not available for goods that are lost, stolen, destroyed, dismissed or given as gifts or free samples. Businesses must report such plans in their data, admitting the ineligibility of ITC on these items.

-

Who is not eligible for GST?

Tax-free goods like petrol and alcohol for human utilization are not eligible for GST. Items included in the zero rated list, meaning that their fixed tax rate is 0%, are free from GST.