Table of Contents

Are you confused about where to park your money? Should you go for Fixed Deposits (FDs) for safety or take a risk with Mutual Funds for higher returns? Choosing an appropriate investment option can feel like crossing a maze when both options have their advantages, risks and ideal scenarios. Still, the answer lies in a sound investment strategy that depends on your investment goals, risk appetite, and horizon.

But the question is, "What really sets these two investment options apart and which one fits your financial goals better?" The FDs that offer consistent, guaranteed returns with low risk or the Mutual Funds that can lead to higher growth but come with some volatility.

So, this guide aims to resolve your dilemma by clarifying the key differences between a mutual fund and a fixed deposit. And help you choose the best option.

What is a Fixed Deposit?

An FD is an investment instrument used in finance to allow individuals to invest a fixed amount of money in a lump sum (all at once) at a pre-agreed interest rate. FDs provide guaranteed results with a lower rate of risk.

Putting your money in FDs depends on your financial goals and market conditions. The Unity Small Finance Bank offers the highest FD interest rate of 9.5% per annum for a tenure of 1001 days.

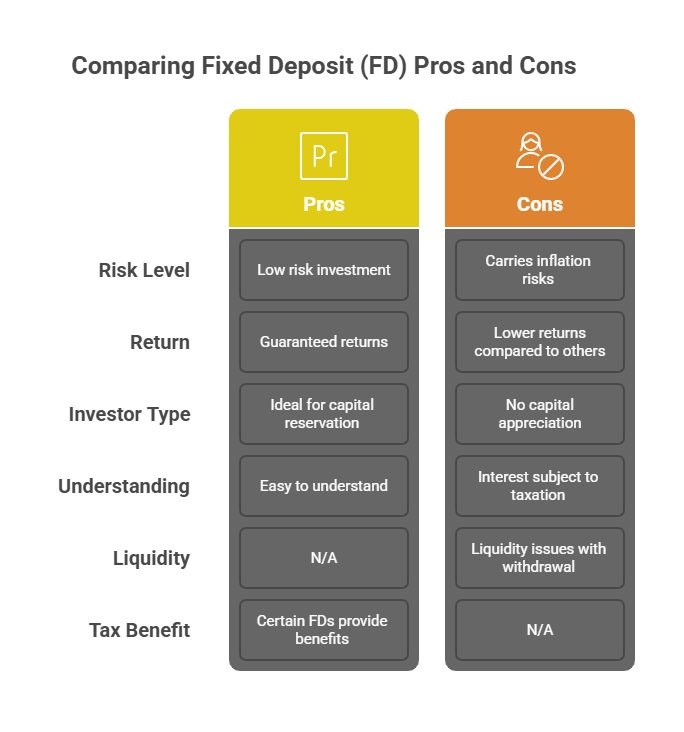

Pros of FDs:

- They are often considered low-risk investments.

- The interest rate is fixed beforehand, ensuring guaranteed returns.

- Ideal for investors who place the capital reservation on top.

- Easy to understand and manage.

- Certain FDs, like tax-saving FDs, provide tax benefits to investors.

Cons of FDs:

- Carries inflation risks as they may be unable to keep up with it.

- Involves liquidity issues tied to early withdrawal of money.

- It has lower growth than other investment options.

- Interest earned on FDs is subject to taxation.

- FDs do not provide the opportunity for capital appreciation.

Fixed Deposits are a safe bet if you want steady returns, while Mutual Funds can give you a chance for better profits but come with risks. Let us see what they offer.

What are Mutual Funds?

Mutual funds are investments where multiple investors invest their money in a diversified portfolio of stocks, bonds or other securities for wealth creation.

The most popular way of investing in mutual funds is through SIP, which allows investors to invest a fixed amount in instalments.

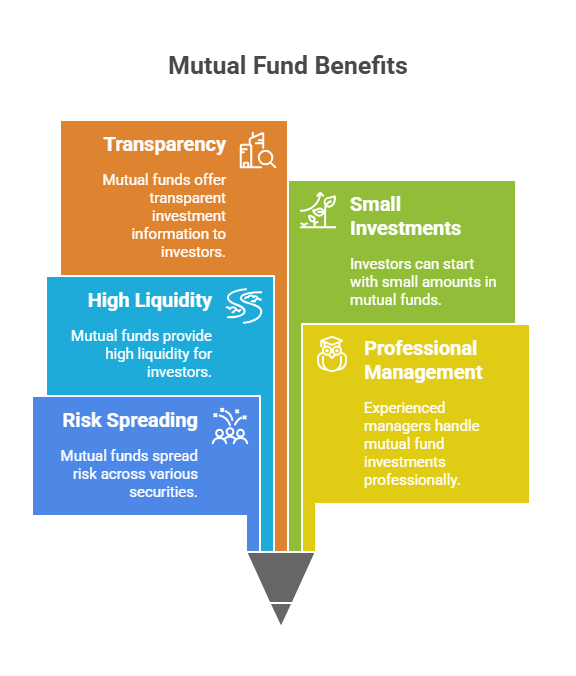

Pros of Mutual Funds:

- Invest in a wide range of securities, which helps spread risk.

- Managed by experienced and professional fund managers.

- Displays high liquidity.

- Allow investors to start with relatively small amounts to invest.

- Provides transparency to investors on their investments.

Cons of Mutual Funds:

- Charge management fees and other expenses.

- Investors have no direct control over the individual securities.

- They are dependent on market fluctuations.

- The variety of options and structures can be complex.

- Certain types of mutual fundsmay have lock-in periods.

Important Tip: Use a SIP Calculator to estimate the returns on your SIP.

Difference Between Mutual Funds and Fixed Deposit

Here are the key differences between mutual funds and fixed deposits:

| Features | Mutual Funds | FDs |

|---|---|---|

| Investment Type | Invests in a diversified portfolio of stocks, bonds or other instruments. | A fixed amount is stored with a bank or financial institution for a specified term. |

| Returns | Returns are variable and depend on market performance. | Returns are fixed and predetermined at the time of investment. |

| Risk Level | Subject to market risks but has potential for growth. | Low risk with guaranteed returns. |

| Liquidity | Generally, liquid assets can be bought and sold easily. | Less liquid as may have penalties for early withdrawal. |

| Investment Horizon | Suitable for both short-term and long-term investments, depending on the fund type. | Typically suited for short to medium-term investments, with fixed tenures. |

| Taxation | Tax on capital gains applies to mutual funds. | Interest earned is subject to income tax in FDs. |

| Management | Professionally managed by fund managers. | No active management. |

| Minimum Investment | The investment amount varies from fund to fund. | Usually has a minimum deposit requirement. |

| Purpose | Aims for wealth creation and capital appreciation over time. | Primarily for capital preservation and earning fixed-interest income. |

| Investment Mode | Can invest through a lump sum or SIP (regular monthly investment). | Typically, lump sum deposits. |

Let us see how different mutual funds and FDs are when it comes to the potential returns offered by them.

Also Read: What is SIP? How Does It Work to Grow Your Wealth?

Mutual Fund vs Fixed Deposit, Based on Returns

Here is how mutual funds stack up against fixed deposits when it comes to returns:

| Features | Mutual Funds | FDs |

|---|---|---|

| Return Potential | Higher potential returns, especially in equity funds. | Fixed and predictable returns, typically lower than mutual funds. |

| Average Returns | 12–15% (long-term average returns) | 6–8% (fixed returns, pre-tax) |

| Return Variability | Returns can fluctuate based on market conditions. | Returns are stable and guaranteed. |

| Inflation Impact | Potential to outpace inflation, making them suitable for long-term wealth creation. | Returns may not keep up with inflation, decreasing purchasing power over time. |

| Taxation on Returns | Subject to capital gains tax. 10% for long term if income is above Rs 1L and 15% for short term. |

Fully taxable according to the tax slabs. TDS is applied if the income is more than 40K. |

| Investment Horizon | Suitable for both short-term and long-term investments. | Typically suited for short to medium-term investments. |

Now, you must be curious about which investment option is better for you. Keep scrolling if you want to know.

Must Read: Mutual Fund Vs Stocks: Which is Better Investment in 2025

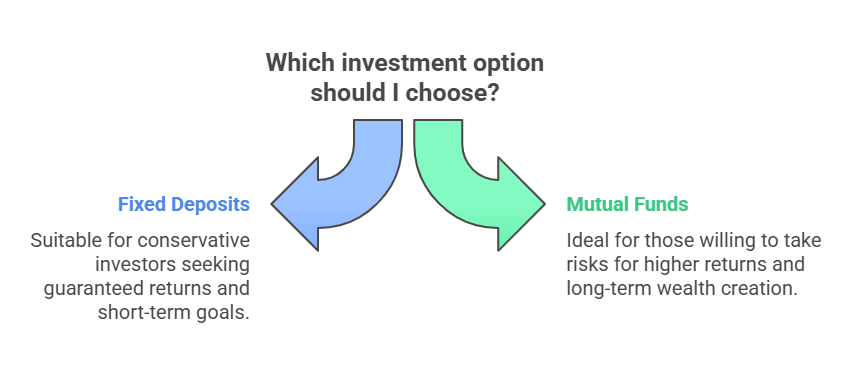

Which is Better, FD or Mutual Fund

The choice between FDs and mutual funds depends on individual financial goals, risk appetite and investment horizons.

The following are the factors based on the different goals of investors that one should consider when choosing between an FD and a Mutual Fund:

Risk Tolerance

- FDs are for those conservative investors who seek guaranteed returns.

- Mutual funds are suitable for those ready to face market fluctuations for returns.

Investment Horizon

- FDs are fit for short and mid term returns.

- Mutual funds, especially with SIP, are ideal for long term wealth creation.

Liquidity Needs

- FDs may have penalties for early withdrawal, showing less liquidity.

- Mutual Funds may generally have better liquidity.

Income Generation

- FDs offer regular interest income, which is suitable for retirees.

- Mutual funds (with SIP) allow reinvesting returns for better growth, which is ideal for younger investors.

Tax Considerations

- FDs are taxed according to the investor's income tax slab.

- Mutual funds have capital gains and tax implications, which may vary.

By knowing the differences between Fixed Deposits and Mutual Funds, you can make smart choices that fit your money goals and risk tolerance.

Pro Tip: Use a SWP Calculator to withdraw fixed amounts periodically from your investments.

Conclusion

In short, FDs (Fixed Deposits) and Mutual Funds are both investment vehicles, but are very different. FD is perfect for short-term plans, while mutual funds (specifically with SIP) are more suitable for long-term investment goals.

Which is better depends on your investment goals, risk appetite and investment horizon. One should consider these factors before choosing an option for investing.

Related Blogs:

- Investing in SIP is Good or Bad? Learn the Pros & Cons

- What is the Difference Between SIP and Mutual Fund?

FAQs

-

What are Fixed Deposits?

Fixed Deposits are savings accounts where you deposit your money for a set duration at a fixed interest rate. They provide guaranteed returns with a reduced risk rate.

-

What are Mutual Funds?

Mutual Funds collect money from multiple individuals and put it into a mix of assets, managed by experts. They aim for better returns over time.

-

Who Should Invest in a Fixed Deposit?

For the ones who want to avoid risks, seek stable returns and have short-term goals, Fixed Deposits might be a good fit for them.

-

Who Should Invest in Mutual Funds?

The one aiming for long-term growth & can handle some market fluctuations, Mutual Funds could be suitable for you.

-

Which is Better, FD or MF?

Fixed Deposits give you safety and guaranteed returns, while Mutual Funds could provide higher returns but come with risks. Your choice should depend on your financial goals and conditions.

-

Who Can Invest in Fixed Deposits and Mutual Funds?

Anyone can invest in Fixed Deposits & Mutual Funds, including individuals, businesses & organizations, if they meet the eligibility criteria.

.webp&w=3840&q=75)

(1).webp&w=3840&q=75)

(1)_(1).webp&w=3840&q=75)