Table of Contents

- HDFC Small Cap Fund Key Details

- HDFC Small Cap Fund Performance: Rolling Return & SIP Returns

- What Makes HDFC Small Cap Fund a Good Investment?

- HDFC Small Cap Fund Portfolio Review

- What is the Sector Allocation of HDFC Small Cap Fund?

- Analysing the Stock Selection & Quality of HDFC Small Cap Fund

- Risk Analysis of HDFC Small Cap Fund

- Conclusion

Are you confused about adding the HDFC Small Cap Fund to your investment portfolio for 2025? This is the perfect time to consider it. With a current NAV of Rs 62.74, this fund has consistently delivered exceptional returns and impressive growth, outshining many of its peers in the small-cap category. HDFC Mutual Fund has effectively captured the potential of India’s fast-growing small-cap sector.

But what truly sets it apart? Why should you consider the HDFC Small Cap Fund over other options, especially in the current market environment?

In this review, you will explore the HDFC Small Cap Funds returns, performance and investment strategy, cutting through the confusion to reveal the truth. How has this small-cap fund risen to the top, making it a top choice for 2025? Let us find out.

HDFC Small Cap Fund Key Details

The HDFC Small Cap Fund is a top performer in the small-cap equity mutual fund, known for its strong growth potential. With a robust AUM of Rs 36,284 Crore as of September 2025, it stands out for its stable compounding approach rather than chasing short-term momentum.

The fund targets high-potential small-cap stocks with strong growth prospects for long-term wealth creation.

Founded on December 10, 1999, HDFC Asset Management Company Ltd. is one of India’s most trusted fund houses. HDFC AMC Ltd. is managed with sponsorship from HDFC Ltd. & Standard Life Investments Limited.

Key Features of HDFC Small Cap Fund

| Fund Manager | Chirag Setalvad (Managing the fund since 2014) |

|---|---|

| Launch Date | 2014 |

| Expense Ratio | 1.09% |

| Category | Small-Cap Equity Fund |

| NAV | Rs 62.74 (As of Sep 2025) |

| Minimum SIP | Rs 500 |

| Risk Level | High |

| AUM | Rs 36,284 Crore (As of Sep 2025) |

Now, let us dive into the funds performance.

HDFC Small Cap Fund Performance: Rolling Return & SIP Returns

The HDFC Small Cap Fund returns have consistently delivered outperforming returns, but like any small-cap fund, there can be slight fluctuations depending on market crises.

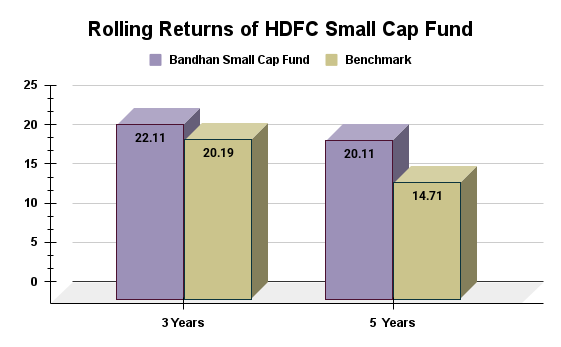

This brings us to a common question: "How well has the HDFC Small Cap Fund performed over the long term?" To answer this, let us examine the performance over three and five-year rolling periods.

The above graph shows HDFC Small Cap Fund delivered 22.11% returns over 3 years, outperforming its benchmark and over 5 years, it returned 20.11%, marking the benchmark's 14.71%.

The funds consistency remains strong, with 79.33% consistency over 3 years and 70.12% over 5 years, shows that the fund reliable over different market conditions.

SIP Returns

Now, look at the SIP returns. Over the last 3 years, the HDFC Small Cap Fund has delivered impressive SIP returns of 19.84% over the past 3 years and 23.04% in the previous 5 years.

Compared to the category average and benchmark returns, this fund has consistently outperformed in both the short and long term.

Pro Tip: Know your future returns using the SIP Calculator in 3 easy steps.

Now, moving to the next important heading, what makes the HDFC Small Cap Fund stand out from other small-cap funds?

What Makes HDFC Small Cap Fund a Good Investment?

The HDFC Small Cap Fund catches the eye for its strategy & research-driven stock selection, making it a top choice for 2025. But what makes it truly a strong investment option? Let us break it down:

1. Investment Strategy of HDFC Small Cap Fund

The HDFC Small Cap Fund follows a buy-and-hold strategy, investing in small-cap companies with higher growth potential. Its focus on long-term returns helps manage short-term market fluctuations & capture high-growth opportunities. This Small Cap Fund considers undervalued businesses with the potential to become future market leaders.

Mr Setalvad uses a bottom-up research process to track companies based on balance sheet strength, profitability (ROE, ROCE) and management quality. This approach also adds macro trends, such as India's consumption boom and infrastructure growth, ensuring investments are well-positioned for future growth.

What sets the HDFC Small Cap Fund apart from others is its quality-first approach, which focuses on undervalued stocks with strong fundamentals. This allows this mutual fund to outperform its peers while managing risk through diversification and prudent stock selection.

2. Fund Manager Expertise

The expertise of its fund managers, lead this fund to become the top choice managed by Chirag Setalvad, since 2014. With 26 years of experience, Setalvad's expertise in small and mid-cap equities, focusing on upcoming market leaders.

In the Setalvads leadership, HDFC fund assets have grown from about Rs 5,000 Cr in 2014 to Rs 36,284 Cr by September 2025, reflecting investors trust in it.

In June 2023, Dhruv Muchhal joined as a co-manager. Together, they blend deep research and analysis of macro trends, which helps the fund maintain strong performance.

Let us now take a closer look at the HDFC portfolio review.

Start Your SIP TodayLet your money work for you with the best SIP plans.

HDFC Small Cap Fund Portfolio Review

The HDFC Small Cap Fund get a diversified portfolio, investing in 80+ stocks across high-growth sectors. This disciplined approach safely coverage and reduces market risk, with a strong focus on long-term capital appreciation.

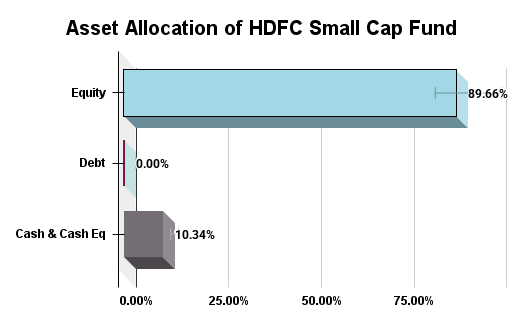

Asset Allocation

In 2025, the HDFC Small Cap Fund is mainly targeted on equity, with 89.66% allocated & 10.34% in cash equivalents for liquidity.

This asset allocation captures the market opportunities.

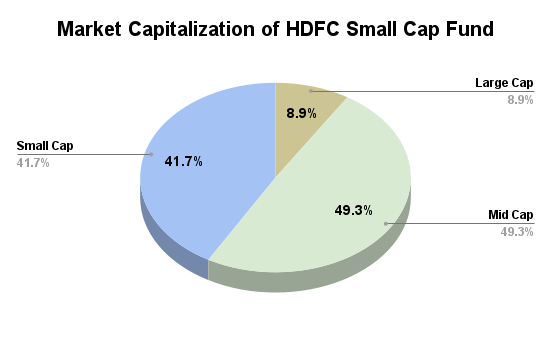

Market Capitalization Allocation

The HDFC Mutual Fund market cap allocation balance between small, mid and large-cap stocks. It majorly invests in small-cap (40-42%) and mid-cap (47-49%) stocks, while allocating a smaller portion to large-cap (7-9%) stocks, manage both high growth potential and stability.

Next, explore the sector allocation of this mutual fund.

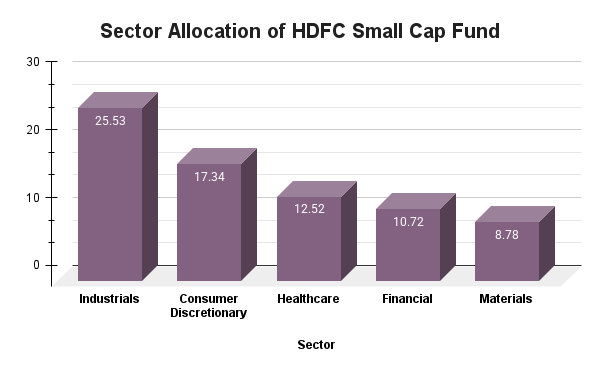

What is the Sector Allocation of HDFC Small Cap Fund?

The HDFC Small Cap Fund follows a well-diversified sector allocation, focusing on high-growth areas of the economy, such as in industrials, consumer cyclical, technology and financial services. Here is a breakdown of its sector allocation:

The HDFC Small Cap Fund holds 82 stocks across 15+ sectors, with no stock more than 5% of the portfolio and the top 10 holdings under 25%. With a low turnover ~20%, the fund follows a buy-and-hold strategy to support long-term growth.

Now, analyse the stock selection and quality of stocks.

Analysing the Stock Selection & Quality of HDFC Small Cap Fund

The HDFC Small Cap Fund uses a research-driven approach for selecting stocks, based on key factors and following parameters:

- Business Scalability and Competitive Positioning

- Profitability Metrics (ROE, ROCE, Margins)

- Balance Sheet Strength (Low Leverage, Strong Cash Flows)

- Management Quality and Governance Standards

The fund favours businesses with sustainable growth and long-term visibility, a core value of its investment strategy.

Stock Quality

Now, let us break down the stock quality of the HDFC Small Cap Fund based on these parameters:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 8.16% |

| Earnings Growth | 13.51% |

| Cash Flow Growth | 1.82% |

| P/E Ratio (Valuations) | 22.11 |

The HDFC Small Cap Fund has P/E ratio of 22.11, which is lower than the category average of 25.52%, reflecting that its stocks are priced at a premium due to expectations of future growth. The sales and cash flow growth are relatively modest, suggesting moderate growth potential.

This raises the question, "Is the HDFC Small Cap Fund suitable for long-term investors? "Due to its premium valuation and growth strategy, this fund is ideal for investors with a high-risk appetite and a long-term horizon of 7+ years who want to capitalise on the growth of small-cap stocks.

Moving forward to risk analysis of HDFC Small Cap Fund.

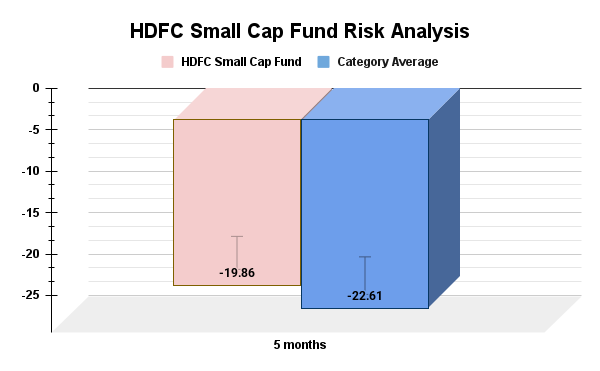

Risk Analysis of HDFC Small Cap Fund

The HDFC Small Cap Fund has a high-risk level due to its focus on small cap stocks, which is more volatile & sensitive to market changes.

However, it offers stronger risk-adjusted returns, as seen in its Sharpe ratio of 0.99 and alpha of 3.13, shows a solid performance relative to the level of risk taken. Check out the risk analysis of this fund below:

While the fund experiences higher volatility, with a maximum drawdown of -19.86%, it manages to recover more quickly compared to its peers, showing its flexibility during market corrections.

Let summarize the HDFC Small Cap Funds review.

Smart Investments, Bigger Returns

Conclusion

To conclude the HDFC Small Cap Fund review, it offers high growth potential & returns on small-cap stocks. Although the HDFC mutual fund has been considered a high-risk fund, diversification, outstanding returns with strong consistency make it a smart option for long-term investors.

However, if you are comfortable with volatility and have long-term goals, it can be an excellent fit for your portfolio.

Frequently Asked Question (FAQs)

-

How can I invest in the HDFC Small Cap Fund?

You can invest via SIP or lumpsum through the HDFC Mutual Fund website or online platforms, with a minimum SIP of Rs 500.

-

What is the expense ratio of the HDFC Small Cap Fund?

The expense ratio of the HDFC Small Cap Fund is 1.09%, which is competitive for a small-cap equity fund.

-

What are the tax implications of investing in HDFC Small Cap Fund?

Long-term capital gains (LTCG) over Rs 1 lakh are taxed at 10% without indexation, while short-term capital gains (STCG) are taxed at 15% if held for less than 3 years.

-

Can I redeem my investment anytime in the HDFC Small Cap Fund?

Yes, you can redeem your investment anytime, but short-term capital gains tax applies if redeemed within 3 years.

.webp&w=3840&q=75)

.webp&w=3840&q=75)