Table of Contents

Did your loan application get rejected because of a poor credit score? Well, you are not the only one. Many people across India face loan rejections because of low credit scores. A good CIBIL score is the key to unlocking easy loan approvals, lower interest rates and better credit card offers to fulfill your financial dreams.

But the question is, "How can you increase your CIBIL score in India and how long will it take?" These questions often haunt those who have experienced loan rejections due to a lower score.

If you are one of those searching for answers to these questions, you are in the right place. This guide reveals everything you need to know about the CIBIL score, including the top 10 actionable strategies that really work in 2025. So, let us unlock better loan approvals, higher limits and exclusive financial products.

What is a CIBIL Score?

A CIBIL score can be defined as a three-digit number from 300 to 900 representing your creditworthiness, including your credit history, rating and report. India has four credit scores: Credit Information Bureau (India) Limited (CIBIL), Experian, Equifax and Highmark. The CIBIL is the most popular credit score among Indians.

It is calculated by TransUnion CIBIL, the first credit bureau licensed by the RBI for issuing credit scores. This calculation is based on your historical credit records, including your loan and credit card repayments. This is why people in India often use CIBIL and credit scores interchangeably.

Purpose and Uses:

- Used by money lenders like banks or financial institutions to discover the creditworthiness of an individual before giving loans or credit cards.

- It is the first thing that is noted for a loan approval process.

- A higher credit or CIBIL score makes you more likely to get a loan. You can get loan approvals easily with lower interest rates.

Now that you understand what a CIBIL score is, the question is, how much is considered a good credit score? Let us find out.

What is a Good CIBIL Score?

If your CIBIL score exceeds 750, you are in the ‘sweet spot.’ Think of it this way, a good score (from 700 to 799) makes loan approvals smoother for you with low interest rates.

CIBIL Score Ranges and Their Meanings:

| CIBIL Score Range | Credit Rating | Meaning & Implications |

|---|---|---|

| 750 - 900 | Excellent & Very Low Risk | High chance of loan approval, best interest rates, and favourable terms. |

| 700 - 749 | Good & Dependable Borrower | Good approval chances, but slightly higher interest rates. |

| 650 - 699 | Fair & Moderate Credit Risk | Possible approval, but with stricter terms or higher rates. |

| 550 - 649 | Poor/Fair | Higher rates and stricter conditions; loans may be harder to obtain. |

| Below 550 | Poor & Very High Risk | Unlikely to get loans or credit cards; applications often rejected. |

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Now, what if your score does not match the standards of a good CIBIL score? Well, there is no need to worry; here are some tips for you to increase your CIBIL score.

Start Your SIP TodayLet your money work for you with the best SIP plans.

10 Effective Ways to Improve Your CIBIL Score in India

Consistent and responsible financial habits are the keys to a good CIBIL score. Here are the 10 easiest ways to improve an individual's CIBIL score in India:

-

Pay Your Bills on Time

One delay in credit card payment can stay on your report for years. It is worth 35% of your CIBIL score. Pay off all credit card bills, EMIs and loan payments before they become a headache.

-

Reduce Credit Utilisation Ratio (CUR)

Lenders prefer a credit limit usage or CUR below 30%. So, if your limit is Rs 1,00,000, try not to cross Rs 30,000, as this shows them you are responsible with credit.

-

Maintain a Healthy Credit Mix

If you want to demonstrate your financial maturity, keep your portfolio balanced. Try to maintain a combination of secured loans and unsecured credit.

-

Do Not Apply for Multiple New Credits

Applying for multiple loans or cards can hurt your credit score, so keep it down as each new application activates a hard inquiry on your credit records, which can cause your score to drop.

-

Keep an Eye on Your CIBIL Report

Review your credit report regularly to find errors, such as incorrect balances or limits. If you find mistakes, raise a dispute immediately to get them corrected.

-

Set Up Auto-Payments or Reminders

Linking your bills straight to your bank account or setting helpful reminders on your phone will prevent you from forgetting payments and keep your credit record clean.

-

Keep Old Credit Accounts Active

It might feel tempting to clean up and close old credit accounts, but holding onto them works in your favour. A longer, healthy credit history is a plus when lenders look at your profile.

-

Plan Your Credit in Advance

A little planning goes a long way. Think ahead of time about your borrowing needs, like loans or new cards. It will help you show stable financial habits and avoid struggling for quick loans.

-

Pay Off High-Interest Dues Immediately

Do not let high-interest debts pile up and cost you more. Clearing these dues lightens your payment load and increases your credit score quickly and efficiently.

-

Monitor Your Credit Score Regularly

Checking your CIBIL score every few months helps you spot problems early and improve. Staying up-to-date means you’re never caught off guard by a sudden drop.

Also Read: How to Save Money from Salary Monthly? Best Ways in India

Let us learn why having a good credit score is crucial and the benefits of having one.

Why Do You Need to Have a Good CIBIL Score?

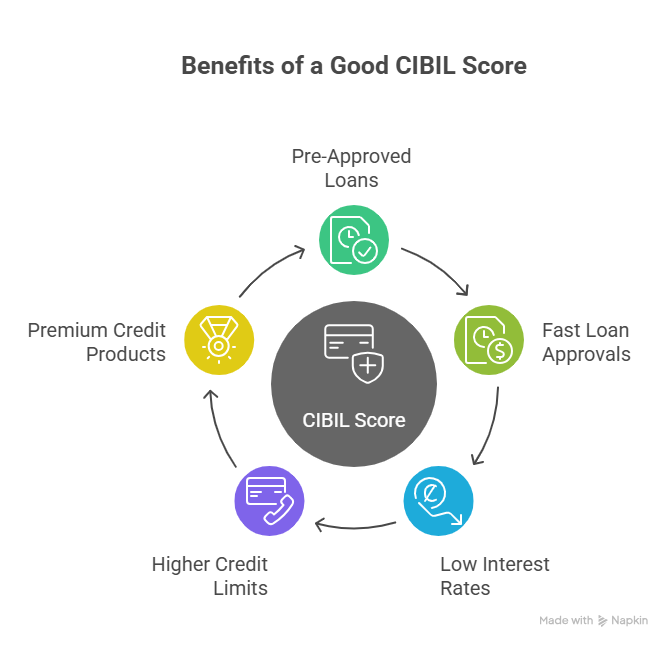

A good CIBIL score is crucial because it impacts your financial life. Here are the benefits of having a good CIBIL score:

- Pre-Approved Loans: A good CIBIL score also increases your chances of getting pre-approved loans, with minimal paperwork.

- Easy and Fast Loan Approvals: A CIBIL score of 750 or higher will increase the chance of your loan applications being approved faster.

- Low Interest Rates: Lenders often offer loans with low interest rates to borrowers with higher credit scores.

- Higher Credit Limits: With a high credit score, you can apply for a higher credit limit on your credit cards and other credit lines.

- Access to Premium Credit Products: A strong score enables you to obtain premium credit cards with better rewards, cash back, and exclusive perks.

Now, you must be impatient to know how long it will take to increase your CIBIL score, right? Keep reading to get an idea.

How Long Does It Take to Strengthen a CIBIL Score?

Depending on your credit history and financial discipline, strengthening your score can take several months to a year. The following are the factors and timelines for increasing a CIBIL score:

-

1-2 months (For minor issues)

If you have minor problems like high credit utilisation or errors in your report, it will take you only a few months to improve your credit score. Reducing your credit limit usage to 30% and correcting errors in the report takes 30 to 45 days.

-

3-6 months (Recovering from missed payments)

If you have missed past payments, it will take you nearly 3 to 6 months to increase your CIBIL score. To rebuild your score, you must be consistent and avoid being late with payments for several months.

-

6-12 months or more (For major issues and jumps)

The recovery process is longer for serious negative activities, like many missed payments or late loan settlements. It may take a year or longer for a person with a credit score less than 600 to jump to a range of 750+ credit score.

Pro Tip: Use a Mutual Fund Screener to search, filter, and compare mutual funds.

In the next heading, let us learn how to increase the credit score from 600 to 750.

Smart Investments, Bigger Returns

How Can the CIBIL Score be Increased From 600 to 750?

If you are someone with a credit score around 600 and want to increase it to 750 or more, follow the steps described below:

Step 1: Pay all your due payments on time

Your credit history makes up 35% of your CIBIL score, so missed payments can lower it, while consistent ones can boost it. Set reminders and automate payments for better consistency.

Step 2: Clear high-interest debts and lower your CUR (Credit Utilisation Ratio)

Your CUR affects your credit score by 30%, and lenders prefer it below 30%. To lower your CUR, reduce credit card usage, pay off high-interest loans and request a credit limit increase.

Step 3: Check your CIBIL report regularly for errors

Sometimes, errors in your report can also result in a low credit score. Get your free CIBIL report and check your score regularly. If you find any errors, raise a dispute on CIBIL's online dispute resolution portal.

Step 4: Avoid applying for multiple loans

When applying for a new credit application, a hard inquiry is recorded, which negatively impacts your credit score. Limit new credit applications and use a "quotation search" instead of a credit application search.

Step 5: Diversify your credit mix

A balanced and diversified portfolio shows you can handle various financial tasks responsibly. Maintain a balance of secured & unsecured loans and consider using a secured credit card.

Important Read: Best SIP Plans to Reach 1 Crore for a 50k Salary?

So, building and preserving a solid CIBIL score can help you get better financial opportunities and save you money in the long run.

Conclusion

To wrap this up, increasing your CIBIL score is not just about money. A good CIBIL score can improve loan rates and make credit access easier. In India, anyone can improve their credit score by applying simple tricks like paying bills on time, managing their credit mix and keeping an eye on their score.

Improving your score takes time, but good habits pay off whether you fix past mistakes or aim for top-tier offers. Good credit opens doors to your next wise money decision.

Related Blogs:

- Is SIP a Safe Investment in 2025? Truth Of Secure Investing

- Top Investment Banking Companies in India: Who To Trust?

FAQs

-

What is the difference between CIBIL and credit scores?

A CIBIL score is a credit score calculated by TransUnion CIBIL. A credit score is a number that shows your creditworthiness and any authorised bureau can issue it.

-

How often should I check my CIBIL score?

It is wise to check your CIBIL score at least once every quarter to detect errors early and keep your credit profile healthy.

-

Why did my CIBIL score drop suddenly?

Sudden drops may occur due to missed payments, high credit utilisation, multiple new loan applications or errors in your credit report.

-

Can errors in my CIBIL report be corrected? How?

You can correct it by disputing incorrect entries by raising a dispute on the CIBIL website’s dedicated portal.

-

Is a CIBIL score mandatory for all types of loans in India?

Most banks and NBFCs require a CIBIL score for loan approvals (like home loans or personal loans) and even some credit cards.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)