Table of Contents

Did you hear that JP Morgan, one of the top investment banking companies, has generated a total revenue of $2.68 billion in the 1st quarter of 2025? Yes, JP Morgan has once again secured its place amongst the list of Top Investment Banking Companies in India, outperforming last year's runner-up, Goldman Sachs.

Well, "Are you ready to make billions by investing in the best investment banking companies in India?", if yes, let's get you out of the pickle answering the most asked question- "Which investment banking companies in India are trustworthy?"

Let's get started with this post revealing the top 10 investment banking companies in India, so for once you can put money where your mouth is.

Keep scrolling to catch the hidden gems of the Indian Banking Sector.

What is Investment Banking in India?

Investment banking is a special segment of the banking or financial services sector. It helps companies, governments and large institutions in raising capital or funds, managing assets and making informed decisions for finances. This industry plays a vital role in the economic development of the country.

These investment banks help large firms like JP Morgan, Goldman Sachs, Barclays Bank and more to grow significantly in the Indian market.

Investment banking companies work on a much larger scale than commercial banks, which only offer day-to-day banking services to individuals and small companies.

Main Services provided by the investment banks in India are:

- Capital Raising: They help in raising capital through various financial instruments like equity and debt.

- Mergers and Acquisitions (M&A): They help companies in overcoming the complexities of mergers and acquisitions and make strategic decisions.

- Financial Advisory: Provide expert advice on strategies, reconstruction, valuation and risk management for large firms.

- Trading and Brokerage: Provide institutional clients with the facility of buying and selling financial securities.

- Research: Conduct thorough research on companies, economic trends and the market to give details and recommendations to the client.

Let us explore the top 10 investment banking companies in India and know “Which company is best for investment banking in India?”

Listing Top Investment Banking Companies in India

The investment banking companies in India help businesses, institutions and government bodies in raising their funds, M&A advisory, managing IPO (Initial Public Offerings) and finance reconstruction.

The investment banking company, "JP Morgan", has secured the first rank in the list of the top investment banking companies for the year 2025 with net revenue of $45.68 billion. It has also gained the position of the fifth-largest bank globally with total assets of $ 3.9 trillion, making it one of the best investment banking companies in India.

Here is the list of the Top 10 investment banking companies in India, operating in 2025:

| Rank | Name | Founded In | Services | Headquarter |

|---|---|---|---|---|

| 1 | JP Morgan | 1935 | M&A, capital raising, financial advisory, risk management | Mumbai |

| 2 | Goldman Sachs | 2004 | Wealth management, securities trading, global markets, investment banking | Bengaluru and Mumbai |

| 3 | Barclays Bank | 1997 | Capital raising, M&A, wealth management, structured finance | Mumbai, Delhi and Pune |

| 4 | Avendus Capital | 1999 | Wealth Management, M&A, Private Equity | Mumbai |

| 5 | Edelweiss Financial Services | 1995 | Debt capital, M&A, asset management, retail and HNI advisory services | Mumbai |

| 6 | Axis Capital Limited | 2005 | Equity capital markets, M&A, IPO management, structured finance | Mumbai |

| 7 | ICICI Securities Limited | 1995 | Equity capital markets, M&A, institutional broking, private wealth management | Mumbai |

| 8 | JM Financial Institution Securities | 1973 | IPO management, private equity, wealth management, financial advisory | Mumbai |

| 9 | O3 Capital Global Advisory Services | 2006 | Finance Advisory, Private Equity, M&A | Mumbai |

| 10 | IDBI Capital | 1993 | Corporate finance, project advisory, debt and IPO management | Mumbai |

Let us look at the highlights of these leading, top investment banking companies:

1. JP Morgan- The Top Investment Banking Company in India in 2025

An American financier and investment banker named John Pierpont (JP) Morgan established this global investment banking company in 1871. JP Morgan is headquartered in New York and has an office in Mumbai, India. It has ranked as the fifth-largest bank globally with total assets of $ 3.9 trillion.

Services Provided by JP Morgan:

- Financial Advisory and Investment Banking.

- Mergers & acquisitions (M&A).

- Fundraising and securities trading.

- Risk management and Asset management.

2. Goldman Sachs

Goldman Sachs has achieved the second position among the best investment banking companies in the world. Goldman Sachs has a strong foothold in India, with offices in Bangalore and Mumbai. Founded in 1869, it has also ranked in the Fortune 500 list of the largest United States corporations by total revenue.

Services Provided by Goldman Sachs:

- Wealth management and financial advisory.

- Investment banking, mergers and acquisitions (M&A).

- Securities trading and global markets services.

- Risk management and Asset management.

3. Barclays Bank

Barclays Bank has been working in India (with branches in Mumbai, Delhi and Pune) for a long time now, as a multinational financial services provider.

Services Provided by Barclays Bank:

- Corporate and investment banking.

- Wealth and asset management, M&A advisory.

- Risk management and trading services.

4 .Avendus Capital

Avendus Capital was founded in 1999 and it is one of the leading investment banking companies in India, headquartered in Mumbai. It is highly popular for its customized services for HNIs and businesses.

Services Provided by Avendus Capital:

- M&A Advisory and equity capital markets.

- Investment Banking.

- Wealth management and asset management solutions.

5. Edelweiss Financial Services

Edelweiss Financial Services was established by Rashesh Shah and Venkat Ramaswamy in 1995. Located in Mumbai (India), it carries a strong reputation in the investment banking sector.

Services provided by Edelweiss Financial Services:

- Corporate debt restructuring and asset management.

- Financial Advisory and Investment Banking.

- Private equity and venture capital services.

6. Axis Capital Limited

This investment banking company comes under Axis Bank in India and was founded in 2005. It has executed some of the largest retail IPOs (size-wise) in India.

Services Provided by Axis Capital:

- Equity and Debt Advisory.

- IPO management and Investment banking.

- Structured Finance and M&A Advisory.

- Private wealth management.

7. ICICI Securities Limited

It was founded in 1995. It has several business lines, including equity research, wealth management and retail brokerage.

Services Provided by ICICI Securities:

- Investment Banking and Financial Advisory.

- Private wealth management and retail broking.

- Institutional broking and IPO placements.

- Capital market advisory services.

8. JM Financial Institutions Securities

Established in 1973, this investment banking company has over fifty years of experience in providing solutions to clients.

Services Provided by JM Financials:

- Investment banking and wealth management.

- Institutional securities and corporate finance.

- M&A, IPOs and private equity advisory.

9. O3 Capital Global Advisory Services

This investment company is popular for its innovative strategies and expertise in the industry. This is a mid-market investment banking company.

Services Provided by O3 Capital Global Advisory:

- Corporate finance and M&A advisory.

- Private equity services and investment banking services.

- Asset management and wealth management services.

10. IDBI Capital

IDBI Capital Markets & Securities Ltd was established by IDBI Bank. IDBI Capital is a trusted partner with its complete provision of financial services.

Services Provided by IDBI Capital:

- Capital markets advisory(for both debt and equity).

- Investment Banking and Portfolio Management.

- Wealth and IPO Management.

- Debt restructuring and project advisory.

Now, you are familiar with the top banking companies of India. Let us check out the factors when choosing the best investment bank for your transactions.

Also Read: How To Start SIP Investment In India

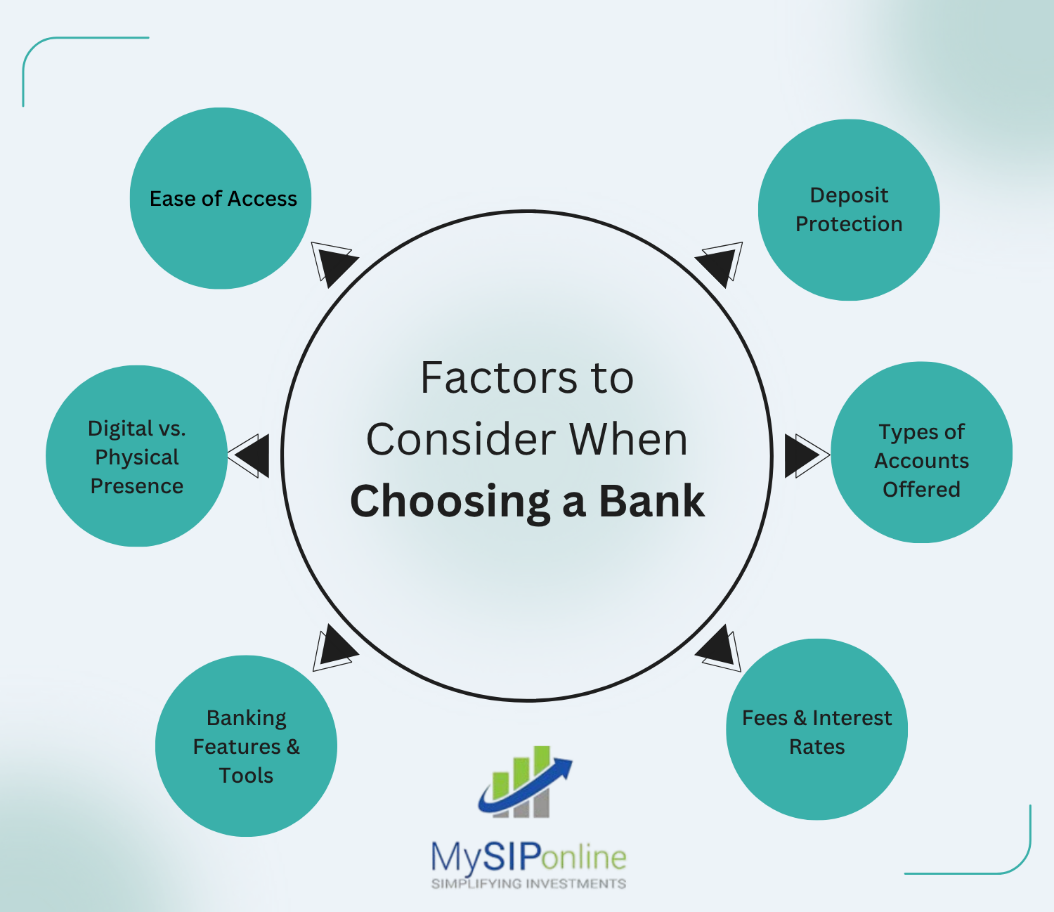

Factors to Consider When Choosing an Investment Bank

Listed below are the main factors that are crucial to understand when selecting the best from Investment Banking Companies for yourself:

Expertise and Experience

- Search for a bank with a deep understanding and a strong track record.

- Examine their experience with other transactions similar to them according to size, type and complexity.

- Confirm the involvement of senior bankers and request the performance metrics.

Fit and Relationship

- Consider the alignment of the bank's culture and its team with your company.

- Match the size of the investment bank to your requirements and identify if your investment requires a global network.

- Look for a bank that provides a personalized approach to your needs.

Financial and Strategic Considerations

- Go through the fee structure of the bank thoroughly and check carefully if there are any potential conflicts of interest.

- Look for a bank that provides access to the decision-makers and a broad network of buyers or sellers.

- Make sure that the bank has a realistic valuation methodology and positioning strategy.

- Inquire about the bank's aftermarket support services if considering an IPO.

Other key aspects include a bank's reputation and references, Technology and research capabilities, commitment to ethical standards and long-term vision.

Now, the most common question is, “What would I get from these banking companies?” You will come to know why in the next part.

Importance of Investment Banking Companies

Investment Banking Companies in India offer a range of services that provide ways for businesses and government bodies to overcome financial challenges. Here is why investment banking companies are vital for your business:

- Raising Funds for Businesses: Investment Banks provide assistance to your company through stocks, bonds and other financial instruments, helping in the company's growth.

- Facilitate M&A: Investment helps in identifying and constructing Mergers and Acquisitions deals. They give advice and help in managing these transactions.

- Providing Financial Advisory: Investment Banking Companies provide valuable advice on financial decisions to help companies achieve growth and stability.

- Ensuring Market Liquidity: By acting as a negotiator in trading activities, investment banks ensure that assets can be bought and sold quickly and efficiently, hence providing liquidity.

- Promoting Economic Growth: Investment Banking Companies help in the economic growth and development of major infrastructures by providing fundraising and effective resource allocation.

Pro Tip: Use a Mutual Fund Screener to filter your funds and make smart decisions.

Do not go away, the best tips that will help you land a job at a top investment banking company are waiting for you.

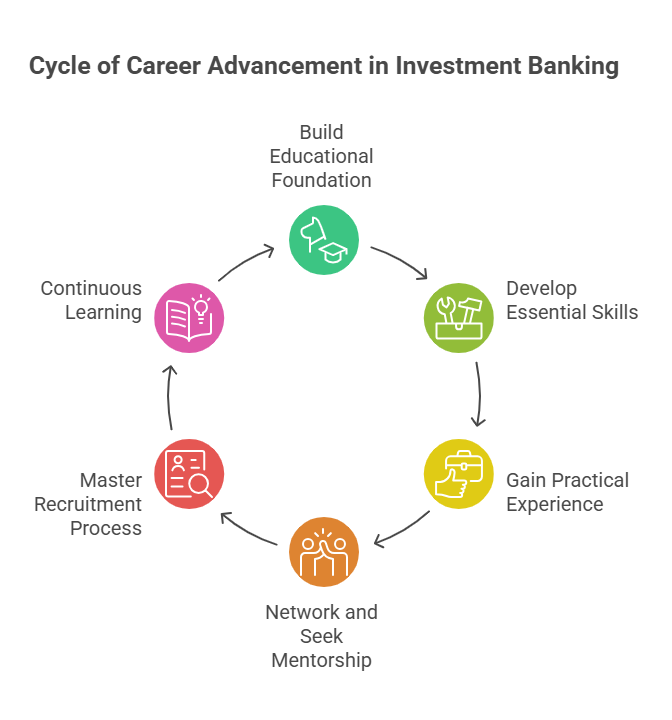

Tips for Landing a Job at a Top Investment Banking Company

Follow the tips given below to land a job in the Top Investment Banking Companies:

- Build a strong educational background in finance or related fields.

- Develop the essential skills (technical and soft) needed.

- Gain some experience in the field through internships or analyst programs.

- Create good networking, build connections and seek mentorship.

- Master the recruitment process, tailor your resume and practice for the interview.

- Learn continuously, stay informed and develop a habit of adaptability.

Pro Tip: Use a SIP calculator to estimate the future value of your mutual fund investments.

Also Read: What Is The Best Date For Sip

Conclusion

To wrap up the things, for 2025, the top investment banking companies in India include the renowned firms like JP Morgan and Goldman Sachs, and domestic players like Axis Capital, Avendus Capital, and ICICI Securities. It is crucial to evaluate the factors like expertise, cultural fit and financial strategies to ensure a successful partnership.

Selecting one from these as an investment banking partner can help achieve your goals while supporting economic progress. Whether you are a business aiming to grow or an individual seeking success, partnering with a good investment bank is important for reaching your targets and dealing with today's tricky financial market.

FAQs

-

Which investment bank pays the most in India?

The investment banks that pay the most in India include the global giants like Goldman Sachs, JP Morgan, and Morgan Stanley.

-

What are the four main areas of investment banking?

The four main areas of investment banking include Merger and Acquisitions (M&A), Capital Market, Sales & Trading and Research & Advisory.

-

What are the basics of investment banking?

Investment banking is a special part of finance. It helps big companies, governments and other organizations with fundraising, deal with complex transactions and provide financial advice.

-

What Do Investment Banks in India Do?

The top investment banks in India provide clients with crucial services like Fundraising, M&A, Financial Advisory, Trading & Brokerage and Research.

-

How do investment banks earn revenue?

The investment banks in India generate their revenue generally from advisory fees, underwriting fees, trading profits and asset management fees.

-

What is the role of an investment banker?

An investment banker is a financial expert who advises clients on services, structures & negotiates deals and conducts financial analysis, valuations & due diligence.

-

Can an individual work with an investment bank as a client?

Yes, HNIs (high-net-worth individuals) and accredited investors can work with an investment bank for Wealth Management and Private Banking, Portfolio Management Services, Investment Advisory and Custom Structured Financial Products.

_(1).webp&w=3840&q=75)

.webp&w=3840&q=75)