Table of Contents

- What is the 5-Year Rolling Return of SBI Equity Hybrid Fund?

- SIP Returns of SBI Equity Hybrid Fund

- SBI Equity Hybrid Fund Review 2025: Analysing Asset and Market Allocation

- Sector Allocation of SBI Equity Hybrid Fund?

- Is the SBI Equity Hybrid Fund Good to Invest? Portfolio Review

- SBI Equity Hybrid Fund Investment Strategy: How Does It Work?

- Who is the Expert behind the SBI Equity Hybrid Fund?

- Analysing the Risks of SBI Equity Hybrid Fund: What Investors Should Know

- Conclusion

Introducing one of the top performers in the hybrid category, the SBI Equity Hybrid Fund With a consistent performance and impressive NAV of 299.5842, this fund has delivered strong returns, even when the market has been volatile. This raises the question, "Is the SBI Equity Hybrid Fund worth investing in 2025?"

Well, the secret of this Fund's success is its ability to deliver consistent growth with solid NAV. With its innovative risk management, this fund has earned the trust of many investors. Let’s dive into the review of the SBI Equity Hybrid Fund and see why it is worth investing in 2025

What is the 5-Year Rolling Return of SBI Equity Hybrid Fund?

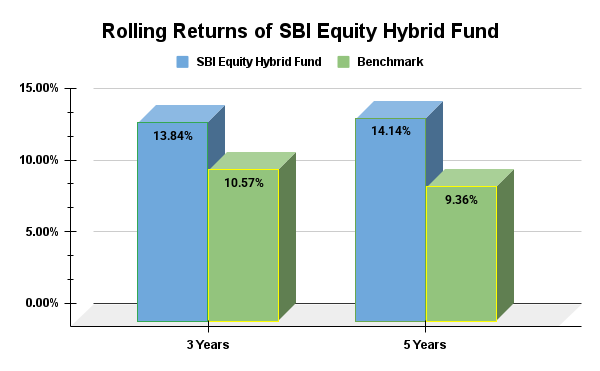

Let us see the rolling returns, which will help us determine how consistent the fund's performance is over different periods.

You can check the graph below for data:

Compared to the Hybrid Aggressive fund, the SBI Equity Hybrid Fund stands out with impressive 5-year rolling returns of 14.14% and 3-year returns of 13.84%. This consistent performance surpasses the category average, making it a great choice for investors looking for stability and growth. With over 91% consistency, it adapts well to changing market downturns.

Let us take a look at the SIP returns of the SBI Fund.

SIP Returns of SBI Equity Hybrid Fund

The SBI Equity Hybrid Fund has generated solid SIP returns, outperforming the category average over the 3 and 5-year. Here is how the fund compares:

- 3-Year SIP Returns:17% (better than the category average of 13.09%)

- 5-Year SIP Returns:25% (slightly below the category average of 13.59%)

For comparison, the AK Hybrid Aggressive TRI has delivered 11.16% returns over 3 years and 11.15% over 5 years, showing that the SBI Equity Hybrid Fund consistently outperformed the category, making it a solid choice for SIP investments.

Pro Tip: Know your future returns using the SIP Calculator in 3 easy steps.

Moving on to the next heading, Fund Growth Review 2025, with its allocation.

SBI Equity Hybrid Fund Review 2025: Analysing Asset and Market Allocation

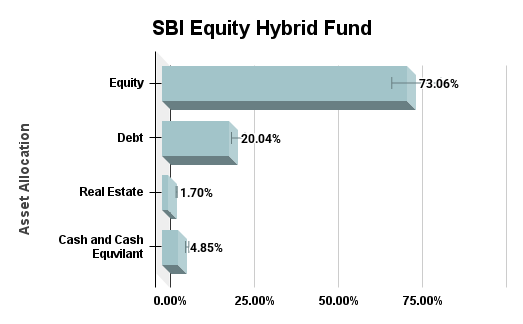

The SBI Equity Hybrid Fund follows a top-down and bottom-up approach, focusing on equity. With 73.06% of its assets invested in stocks, its purpose is for growth. It also keeps 20.04% in debt for stability, a small portion in real estate (1.70%), and 4.85% in cash for liquidity.

You can see the figure for yourselves in the graph below:

Suppose you compare this fund to the average Hybrid Funds, which generally has more balanced allocations. This fund tilts more towards equity, making it a good option for investors looking for growth but with some stability from the debt portion.

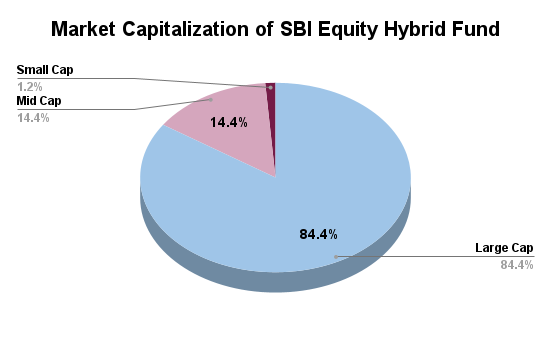

Now, look at the market capitalization of the SBI Equity Hybrid Fund. This fund focuses majorly on large-cap stocks (84.4%), which offer stability and less volatility. It distributes 14.39% to mid-cap for growth potential, with a small portion of 1.21% to small-cap stocks, providing a highly rewarding investment.

This balance between large-cap stability and mid-cap growth secures long-term returns while managing risk. The fund focused on stability, making it a solid choice for conservative investors while offering growth opportunities through mid-cap stocks.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Sector Allocation of SBI Equity Hybrid Fund?

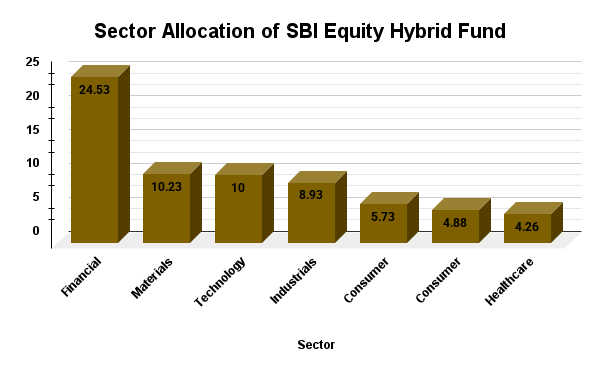

The SBI Equity Hybrid Fund's sector allocation is well established with a strong focus on financials (24.53%), followed by materials (10.23%) and technology (10%). This provides high exposure to sectors expected to perform well in 2025, ensuring balanced risk and reward.

The above graph shows that the diversified approach fund’s sector allocation is placed with growth sectors, providing investors a chance to profit from high-performing industries.

Don't Miss: Best Mutual Funds to Invest in 2025: Low-Risk Options for High Return

Moving forward, to know if this fund is the right fit for your portfolio.

Is the SBI Equity Hybrid Fund Good to Invest? Portfolio Review

The SBI Equity Hybrid Fund has a well-balanced mix of equity stocks and debt instruments, helping to reduce risks while allowing for growth. The fund managers track and adjust the portfolio with market conditions.

With a portfolio turnover ratio of 22%, below the category average of 139%, the fund follows a buy-and-hold strategy for long-term financial goals.

Diversified allocation and high-quality debt holdings help cushion downside risk, making it a good investment for investors who want moderate growth with stability.

The fund’s model-driven, diversified approach provides balance. While its conservative equity tilt and quality debt holdings may lead to lower long-term returns than more aggressive hybrid funds, the limited small-cap exposure may lead to lower long-term returns.

Pro Tip: Use an SWP Calculator to visualize your investment growth and set goals.

Next, let’s dive into the SBI Equity Hybrid Fund investment strategy.

SBI Equity Hybrid Fund Investment Strategy: How Does It Work?

The SBI Equity Hybrid Fund follows a hybrid strategy, with a mix of equity for growth and debt for stability. Its goal is to give capital appreciation while managing volatility through diversified portfolios. The SBI balances the risk-reward ratio in market swings.

Mr. Rama Iyer Srinivasan, the fund’s lead manager, follows a mastermind strategy, using a mix of top-down and bottom-up research. He values the macroeconomic factors like interest rates and market trends while focusing on fundamentals like earnings growth and debt levels.

The fund focuses on large-cap stocks for stability and allocates to mid/small-cap stocks for growth. It holds around 44 stocks, a more concentrated approach than the category average of 56 stocks.

While in debt, the fund invests in high-quality securities like government bonds and low-risk corporates to provide liquidity and capital preservation.

This raises the question “Who is the expert behind the SBI Equity Hybrid Fund?”

Who is the Expert behind the SBI Equity Hybrid Fund?

The expert behind the SBI Equity fund, Mr. Rama Iyer Srinivasan, a senior fund manager with over 30 years of experience, along with Rajeev Radhakrishnan and Mansi Sajeja, both of whom bring mastery in debt and equity investments. Their model-driven, collaborative approach assures a well-researched & balanced strategy.

Under its SBI in-house team, the fund has consistently delivered solid returns, even during market fluctuations. It is a perfect option for investors looking for long-term stability & growth.

Must Read: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

Let us break down the potential risks and what investors should know before investing.

Smart Investments, Bigger Returns

Analysing the Risks of SBI Equity Hybrid Fund: What Investors Should Know

Analysing the SBI Equity Hybrid Fund with a combination of stock and debt quality ensures growth and stability.

1.Stock Quality: The fund focuses on companies with strong elements, high growth potential, and strong cash flow while maintaining a price-to-earnings (PE) ratio of 77. With earnings growth of 13.99%, sales growth of 13.44%, and cash flow growth of 14.28%, the fund stands for consistent and reliable returns.

You can see the valuations in the table below:

| Fundamental Ratios | Value |

|---|---|

| Sales Growth | 13.44 |

| Earnings Growth | 13.99 |

| Cash Flow | 14.28 |

| P/E - Valuations | 23.77 |

2.Debt Quality: On the debt side, the fund invests in high-quality securities with an AA+ credit rating, offering a 9% yield to maturity and an average maturity of 7.58 years. The Macaulay duration of 4.89 years ensures the debt portfolio is well-managed to mitigate the impact of interest rate fluctuations.

You can analyse in the table above:

| Debt Quality | Value |

|---|---|

| Avg Credit Rating | AA+ |

| Yield to Maturity (%) | 6.9 |

| Average Maturity | 7.58 |

| Macaulay Duration | 4.89 |

Conclusion

To sum up, the SBI Equity Hybrid Fund is a reliable investment option for 2025. With a solid NAV, consistent returns and a balanced approach to equity and debt, this fund offers the perfect mix of growth and stability.

Moreover, a Mutual Funds should be a wise addition to Investors' portfolios who are looking for a balanced investment that adapts to market changes and provides consistent returns.

Also Read :

- Gold BeES vs Gold ETFs: Expert Comparison to Invest in Gold

- How to Increase CIBIL Score in India?

- Old vs New Tax Regime 2025: Key Differences & Best Choice

Frequently Asked Questions

-

Is the SBI Equity Hybrid Fund a good option for long-term investors in 2025?

Yes, it is a wise choice for long-term growth. With consistent performance, a balanced portfolio and a solid track record, it is ideal for managing risk and growing wealth.

-

What makes the SBI Equity Hybrid Fund different from other hybrid funds?

It focuses on 44 high-quality stocks, mixing large-cap stability and mid-cap growth. Its dynamic allocation and strong debt instruments make it different from others.

-

What risks should investors consider before investing in the SBI Equity Hybrid Fund?

The equity portion carries market risk, but the debt portion helps reduce it. There is still exposure to interest rate and credit risks, so align risk tolerance before investing.

-

Can I invest in the SBI Equity Hybrid Fund through SIP?

Yes, you can invest via SIP, making investing small amounts at regular intervals easy.

-

How does the debt portion of the SBI Equity Hybrid Fund impact its performance?

The debt portion provides stability, with AA+ rated securities helping protect against market volatility and ensuring steady returns.

.webp&w=3840&q=75)

-1.webp&w=3840&q=75)