Table of Contents

India is aiming to hit 2 trillion dollars in exports with a strong 15% annual growth rate between FY24 and 2030. HSBC Mutual Fund House launched a fund that will help you to be a part of India’s export story. Introducing the HSBC India Export Opportunities Fund, this fund concentrates on businesses that get more than 20% of their income from overseas sales. The HSBC equity fund will invest 80-100% in businesses that are profitable from exports. This fund is open from September 5, 2024, to September 19, 2024.

Details of HSBC India Export Opportunity Fund

| Basic Fund Details | |

| Issue Open Date | 05-September-2024 |

| Issue Close Date | 19-September-2024 |

| Category | Equity: Thematic |

| Benchmark | NIFTY 500 TRI |

| Minimum Application Amount | Rs. 5000 |

| Fund Managers | Abhishek Gupta |

| Exit load | 1% for redemption within 1 year |

Investment Strategy of HSBC India Export Opportunity Fund

The HSBC India Export Opportunity fund manager will focus on identifying export-oriented companies for this Mutual Fund. The fund will invest 80% in equity and 20% in other areas. HSBC Export Opportunities Fund operates like a multi-cap fund and has the flexibility to invest in large, mid, and small-cap companies across the market capitalization.

The fund managers follow the 4Cs approach, which is as follows:

1. Company Moat: The manager of the HSBC equity fund selects companies that outperform their competitors based on their business models and also evaluates the company's brand perception, which means the end user experience of the customer.

2. Corporate Governance: The expert managers select companies known for good corporate governance, meaning those that follow all rules and regulations.

3. Cash Flow: The fund managers assess the cash flow generated by a company's business to understand how well the company manages their cash before making any investments. Strong cash flow indicates a strong financial condition.

4. Comparative Valuation: Fund managers compare the valuation of competing companies based on metrics such as PE ratio and PB ratio.

After considering these 4 points, the company will be added to the HSBC Mutual Funds portfolio.

Why Choose HSBC India Export Opportunities Fund

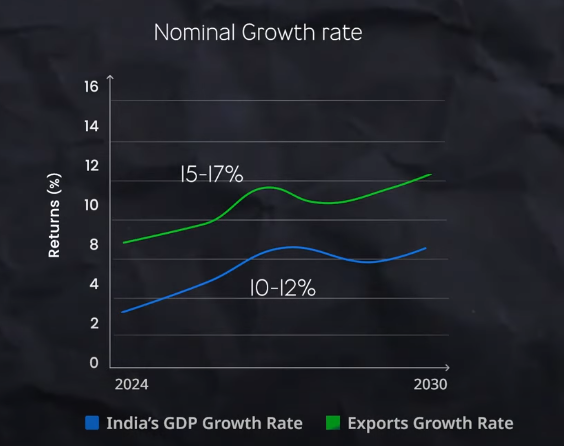

- This fund is fabricated to take benefit from the Growing export sector of India, this export rate has been growing 10% every year, which is growing 5% faster than the GDP.

- India's future perspective is to reach 2 trillion dollars by 2030, which reflects a strong annual growth rate of 15%.

- A company that generates more than 20% of its income from exports is the target investment target of the HSBC India Export Opportunities Fund.

- With the goal of profiting from this expanding trend in India's export industry, the fund will commit 80–100% of its assets to these export-focused businesses.

The Recent Launched HSBC Mutual Funds Performance

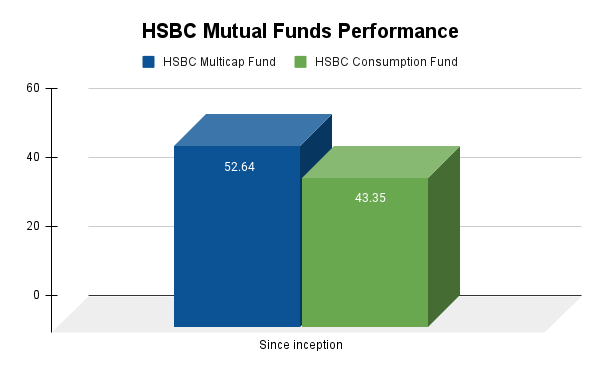

The recent fund launched by the HSBC fund house has given top-notch performance:

Investors received a healthy return of 52.64% from the HSBC Multi Cap Fund since its launch. Seeking the highest returns, this fund makes investments over a broad spectrum of equities from various market sizes. This fund is suited for investors who want a growth-oriented fund and invest for a longer duration.

However, the HSBC Consumption Fund has also given amazing returns to investors of 43.35% since its inception. This fund capitalizes on India's expanding consumer goods demand; this fund primarily invests in companies in the consumption industry. If investing in the consumption trend appeals to you and you're hoping for high profits, this is a terrific alternative.

If We Talk About the Nutshell

Investing in India's booming export market, which has been developing at a rate higher than the country's GDP, is made possible by the HSBC India Export Opportunities Fund. Because the fact that India plans to export a total of 2 trillion dollars by 2030, this fund targets businesses whose main source of income is exports. Strong corporate governance, robust cash flow, competitive values, and robust business models are the top priorities for the fund's well-defined management approach. It's suited for investors who wish to take part in India's export development story, you can also invest in this fund with an SIP (systematic investment plan) to create a disciplined investment, this new fund offers an attractive future, especially considering the excellent performance of previous HSBC new fund offer (NFO). This fund is a great choice if you want to make a wise investment that benefits from India's economic potential.