Table of Contents

Are you looking to invest in high-growth funds in 2025? If yes, you should definitely consider investing in the ICICI Prudential Small Cap Fund. Why?

Well, it is among the best small cap mutual funds that gave 41.94% annualised returns in the last 2 years, crowning itself as the top performer in its category.

But, not only is it praised for its performance, the ICICI Prudential Mutual Fund has built this fund to chase long-term gains, making it an appealing choice for risk takers.

However, let's see what the experts have to say about this small cap fund review, which will help you see if this is the right time to invest in this fund or not.

Overview of ICICI Prudential Small Cap Fund Review

The ICICI Prudential Small Cap Fund is a standout performer in the small cap fund category, having a cash buffer of up to 10-11% and delivering 16.7% average annualised returns in the last 5 years.

So, "What sets it apart from other Small Cap Mutual Funds?" Well, its investment style is absolute in identifying macro trends, like domestic consumption and niche sectors and starts investing in early budding companies, meanwhile establishing a growth-focused strategy that will give you high returns during bullish markets.

Let’s look at another factor that sets the ICICI Pru small cap fund apart from its peers.

What are the Returns of ICICI Prudential Small Cap Fund?

The ICICI Prudential Small Cap Fund has had a bit of a mixed performance lately. It was almost flat over the past year, with a return of about -0.01%, but showed a strong two-year return of 41.94%. And, if you look at the last three years, it is still doing well, with returns of around 23.37%.

Over the past three years, the fund has achieved an average return of 18.32%, with a consistency rate of 66.42%. On the other hand, the NIFTY Small Cap 250 index shows a 3-year return of 19.57% with a slightly better consistency rate of 69.91%.

Let us analyse the rolling returns more clearly with the help of a graph:

Get your SIP returns in 5 mins using the SIP Calculator free of cost.

Now that we have the fund's recent performance, let us look at the investment strategy behind its potential for growth and stability.

ICICI Prudential Small Cap Fund Portfolio Review

The mutual fund has a strong foundation with a solid portfolio. Let's check out the ICICI Prudential Small Cap Fund's portfolio more closely:

1. Asset Allocation

The ICICI Prudential Mutual Fund has a clear breakdown of where it puts its money, that is, about 88.32% is in stocks, 1.57% in Debt Mutual Funds and 10.11% in cash.

| Asset Allocation | Percentage |

|---|---|

| Equity | 88.32% |

| Debt | 1.57% |

| Cash & Cash Equity | 10.11% |

2. Market Cap Allocation

The ICICI Prudential Mutual Fund has done a very fine job when it comes to market cap allocation of this small cap fund. This Mutual Funds major allocation is in small cap at 43.13%, giving high returns from the emerging small cap companies. Wherein, 41.37% is allocated in mid-cap stocks that balance the risky nature of small cap mutual funds and bring more stability to the portfolio.

Lastly, the least allocation of 15.50% is in large-cap stocks, which makes it somewhat steady by investing in large, established companies.

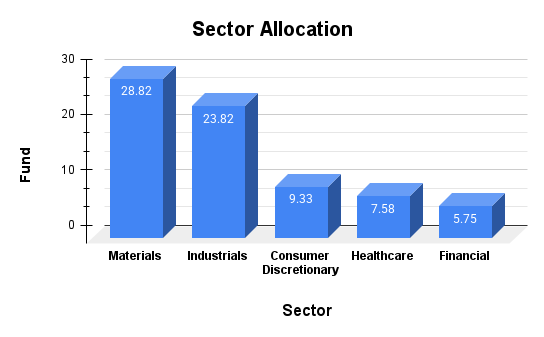

3. Sector Allocation

The main focus of the ICICI Prudential Small Cap Fund is on the cyclical sectors, with 28.82% invested in materials and 23.82% in industrial companies.

Although, this small cap mutual fund is slightly tilted towards companies that are engaged in infrastructure spending, supporting economic growth. That is why 9.33% of its money is spent on the consumer discretionary, reflecting exposure to demand-driven businesses, while Healthcare (7.58%) and Financials (5.75%) have smaller weightings.

The overall portfolio tells you that ICICI Pru small cap fund is invested in mixed sectors, which tend to grow when the economy is growing.

4. Stock Quality

The sales growth of 6.89% and earnings standing at 13.90% show that the ICICI Prudential Small Cap Fund is heavily investing in growing companies that are generating revenue and profits at a faster pace.

However, the sudden drop in the cash flow by -4.94 % is not a good sign, indicating that there were delays in the cash collection or simply that the cost was too high for mutual funds.

Although it seems that investors are sentimental towards the ICICI Prudential Mutual Fund's reputation, as the PE Ratio (Price-to-earnings ratio) stands at 22.44%, meaning even though the stocks are expensive, investors are investing expecting long-term growth in the future.

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 6.89% |

| Earnings Growth | 13.90% |

| Cash Flow | -4.94% |

| PE- Valuations | 22.44% |

Turn your investments into regular income – try the SWP Calculator now.

Why is it Good to Invest in ICICI Prudential Small Cap Fund?

Let us break down the factors that describe why ICICI Prudential Small Cap Fund is a good investment:

-

High Growth Potential

As this fund generally invests in small companies, it carries more potential for expansion than large companies. Small companies provide investors with higher returns as they grow and capture more market shares.

-

Strong Fund Management

The Fund is managed by experienced managers with a strong track record and certain expertise. This small cap mutual fund is well known for its strong research & investment approaches that help during market fluctuations.

-

Diversification

By investing in small companies, the fund can diversify its portfolio across different sectors & asset classes. This factor reduces the risk associated with specific individual sectors.

-

Long-Term Performance

Previously, small cap funds have often topped large cap and mid cap funds. The ICICI Prudential Fund has performed well consistently, making it a good option for investors looking to invest for the long term.

-

SIP Flexibility

This fund supports SIP, which allows investors to invest small amounts of money regularly. This method can help lower the effects of changes in market conditions.

-

Focuses on Quality Stocks

The fund gives prioritizes investing in strong small cap companies with strong management and fundamentals, which can lead to stable growth and reduce overall risks.

-

Tax Effectiveness

As it falls under the equity fund category, the LTCG, that is, long term capital gains from this fund are taxed at 10%, which is better than many other investment options.

Who Manages the ICICI Prudential Small Cap Fund?

The ICICI Prudential Small Cap Fund is managed by Anish Tawakley, who took over on September 18, 2023, with Aatur Shah joining as a co-manager on April 21, 2025.

The fund benefits from its strong research team, known for its deep understanding of small-cap stock investments. With the analysis ability of Tawakley and the research skills of the team, the fund spots promising opportunities while effectively managing risks and volatilities by practicing diversification.

Conclusion

To conclude the ICICI Prudential Small Cap Fund Review 2025, it states that after exploring the components of this fund, it is a solid option for the growth potential of your investment in small-cap stocks.

What is more amazing is that you can start SIP in this scheme with just Rs. 500. So, why wait?

Grab this opportunity and invest in small cap stocks that have great growth potential and be ready to see some good returns in the next few years.

Also Read :

- SIP or Lump Sum, Which Is Better for You in 2025\

- What is Corpus Meaning in Finance Mutual Funds?

- Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

FAQs

-

How much does this mutual fund charge as expense ratio?

The Small Cap Fund demands about 1.75%, which includes prices related to management and operations.

-

What is the AUM or fund size of this mutual fund?

The AUM for this small cap fund is nearly Rs 10,000 crores, showing it is popular with investors.

-

What is risk level of ICICI Prudential Smallcap Fund?

This fund has a high risk level since it focuses on small cap stocks, which tend to be a bit unstable.

-

Is there any lock-in period in this mutual fund?

No, there is no lock-in period for this Small Cap Mutual Fund. You can cash out whenever you want.

-

How do I invest in ICICI Prudential Smallcap Fund?

You can invest through online platforms, mutual fund distributors or directly on the fund's website.

-

How can I redeem my investments in ICICI Prudential Smallcap Fund?

To redeem, just submit a request through your investment platform or the fund's official website.

-

What are the returns of ICICI Pru Smallcap Fund?

This Small Cap Fund has given a return of about -0.01% over the past year and 41.94% over the last two years.

_(1).webp&w=3840&q=75)

_(1).webp&w=3840&q=75)