Table of Contents

- Mahindra Manulife Banking & Financial Services Fund NFO: Basic Details

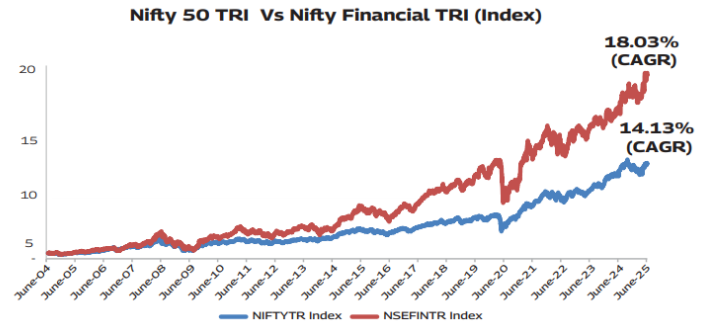

- Nifty500 TRI vs NIFTY Financial Services TRI - Historical Performance

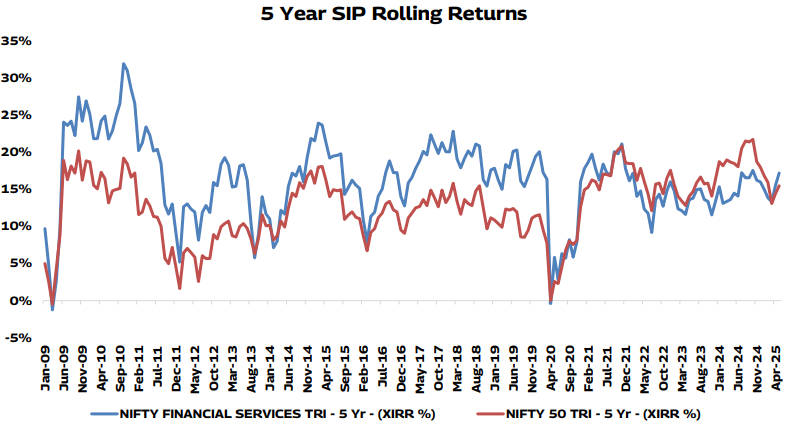

- Analysing SIP Returns of NIFTY Financial Services TRI

- Mahindra Manulife Banking & Financial Services Fund NFO: Asset Allocation

- Mahindra Manulife BFSI: Stock Selection Process

- Who Should Invest in Mahindra Manulife Banking & Financial Services Fund NFO?

- To Conclude Mahindra Manulife Banking & Financial Services Fund NFO Review

Are you ready to invest in Mahindra Manulife Banking & Financial Services Fund NFO, where opportunities evolve and BFSI follows?

If yes, this newly launched NFO opened its subscription on 27th June and will close on 11th July 2025.

However, if you are asking, "Why should you invest in this NFO?"

Imagine being a part of a transformative journey; it sounds interesting, right?

The Mahindra Manulife Banking & Financial Services Fund NFO offers exactly that opportunity, an investment in the rapidly evolving BFSI sector. With digital platforms like UPI driving change and an increasing demand for financial products.

But, another question remains, "Could it become the Best NFO 2025 in the Banking & Financial Services Fund?"

Let's find that out in this in-depth fund review.

Mahindra Manulife Banking & Financial Services Fund NFO: Basic Details

The table below covers the key information on the newly launched fund by Mahindra Manulife Mutual Fund 2025:

| Scheme Name | Mahindra Manulife Banking & Financial Services Fund |

|---|---|

| Issue Open Date | 26th June 2025 |

| Issue Close Date | 11th July 2025 |

| Category | Equity: Sectoral-Banking |

| Benchmark | Nifty Financial Services TRI |

| Minimum Application Amount | Rs.1000 |

| Fund Managers | Mr. Vishal Jajoo & Mr. Chetan Sanjay Gindodia |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

| Facilities Offered | Lumpsum/SIP/SWP |

Nifty500 TRI vs NIFTY Financial Services TRI - Historical Performance

The Nifty Financial Services index has given 18.03% returns since inception, strongly outperforming the Nifty 50 TRI at 14.13%, CAGR (Compounded annual returns).

You can look at the graph below to compare the historical performance of the two indices:

The above graph shows that in 1st year, the Nifty Financial Services TRI gave a growth of Rs.10,000 with 23.35% returns as compared to the Nifty 50 TRI, which only returned 11.40%.

Analysing SIP Returns of NIFTY Financial Services TRI

The graph below shows that the Nifty Financial Services TRI gave maximum SIP returns that went up to 30.4%, whereas in comparison, the Nifty 50 TRI maximum returns were only near 20.3%.

Pro Tip: Let your money grow with Mutual Funds small steps, big returns.

Mahindra Manulife Banking & Financial Services Fund NFO: Asset Allocation

The asset allocation (% of Net Assets) of this newly launched Mahindra Manulife Banking & Financial Services Fund NFO will be as follows:

| Types of Instruments | Minimum Allocation (% of Net Assets) | Maximum Allocation (% of Net Assets) |

|---|---|---|

| Equities & Equity related securities of companies engaged in banking & financial services sector | 80 | 100 |

| Equity and equity related instruments of companies other than those mentioned above | 0 | 20 |

| Debt and Money Market Securities (including TREPS (Tri-Party Repo) and Reverse Repo in Government Securities) | 20 | |

| Units Issued by REITs and InvITs | 10 |

Mahindra Manulife BFSI: Stock Selection Process

The key parameters and other economic indicators used by the Mahindra Manulife Banking & Financial Services Fund NFO are:

- Universe of NFSI ideas in the Equity market.

- Selection of around 75+ investible ideas through the investment process.

- Evaluation of macro-economic indicators, policy environment, earnings growth, relative valuations and market conditions.

- Active portfolio Management by stock selection across verticals.

Who Should Invest in Mahindra Manulife Banking & Financial Services Fund NFO?

This latest NFO by Mahindra Manulife Mutual Fund is best suited for the following type of investors:

- Investors interested in the Banking and Financial Services Sector.

- Those willing to take on higher risk for long-term growth.

- Investors looking for sector-focused investments.

- Suitable for those with a medium to long-term investment outlook.

- Ideal for individuals who can handle market ups and downs.

- A good choice for diversifying a portfolio with a financial sector focus.

To Conclude Mahindra Manulife Banking & Financial Services Fund NFO Review

To wrap up, if you are planning strategically, investing in the latest NFO Mahindra Manulife Banking & Financial Services Fund would be a smart choice. Why?

This new fund offer investments in the rapidly evolving BFSI sector, marking a golden opportunity for you to invest in India's future. You can start with a SIP (systematic investment plan) and gradually plan to increase your investments by observing the performance of this fund in the long term.

.webp&w=3840&q=75)