Table of Contents

- Baroda BNP Paribas Balanced Advantage Fund-Regular Plan -Growth Option

- HDFC Balanced Advantage Fund - Growth Plan

- ICICI Prudential Balanced Advantage Fund - Growth

- Tata Balanced Advantage Fund-Direct Plan-Growth

- Edelweiss Balanced Advantage Fund - Regular Plan - Growth Option

Benefits of Baroda BNP Paribas Balance Advantage Fund : Reviews 2023

The Baroda BNP Paribas Balanced Advantage Fund is getting noticed for two reasons:

Firstly it's a hybrid fund that balances stocks and bonds, and its dynamic asset allocation lets managers adapt to market changes effectively.

Secondly, the fund consistently delivers top returns in its category, showcasing the expertise of its managers and the potential for attractive investor returns.

This review will explore the fund’s investment strategy in depth to help you determine if it’s suitable for your SIP investment over a medium to long duration. It’s an attractive option for investors seeking a balance between risk and returns, aiming for higher returns than traditional fixed-income investments while avoiding the full volatility of the equity.

Investing Strategy

This fund employs a distinct investment strategy that combines various valuation metrics and economic indicators to allocate between equity and bonds. While bonds contribute to risk management, this fund stands out by actively seeking wealth creation through both equity and debt.

What makes it unique is its aggressive management of the equity segment, with a focus on small and mid-cap stocks. This approach has consistently led to strong performance compared to its peers in the category.

Consistency Outperformance

The fund has consistently ranked as a top performer in terms of outperformance stability on the metric.

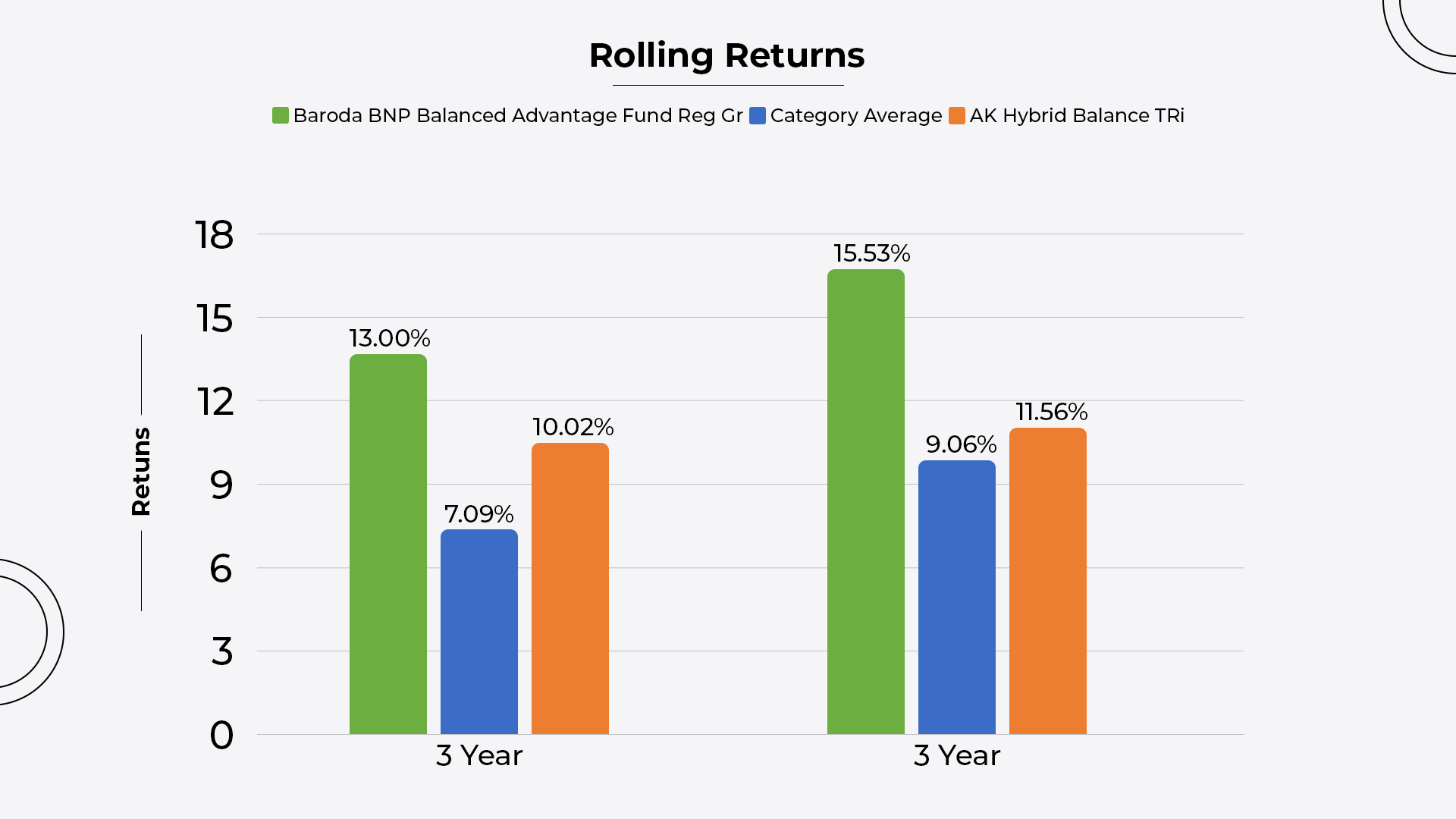

The graph provides a visual representation of the fund’s consistent performance over various time frames. It displays data from different periods alongside their respective benchmarks, allowing for comparisons in various market conditions.

Rolling Returns (1-Year Holding Period):

Over the past year, the fund has delivered an impressive rolling return of 13 significantly surpassing its benchmark, which stood 10.02.

Rolling Returns (3-Year Holding Period):

Looking at a three-year horizon, the fund’s absolute returns stand at an impressive 15.53, further underscoring its strong performance compared to the benchmark, which is 11.56.

These findings highlight the fund's consistent track record of outperforming its benchmark over both 1-year and 3-year periods.

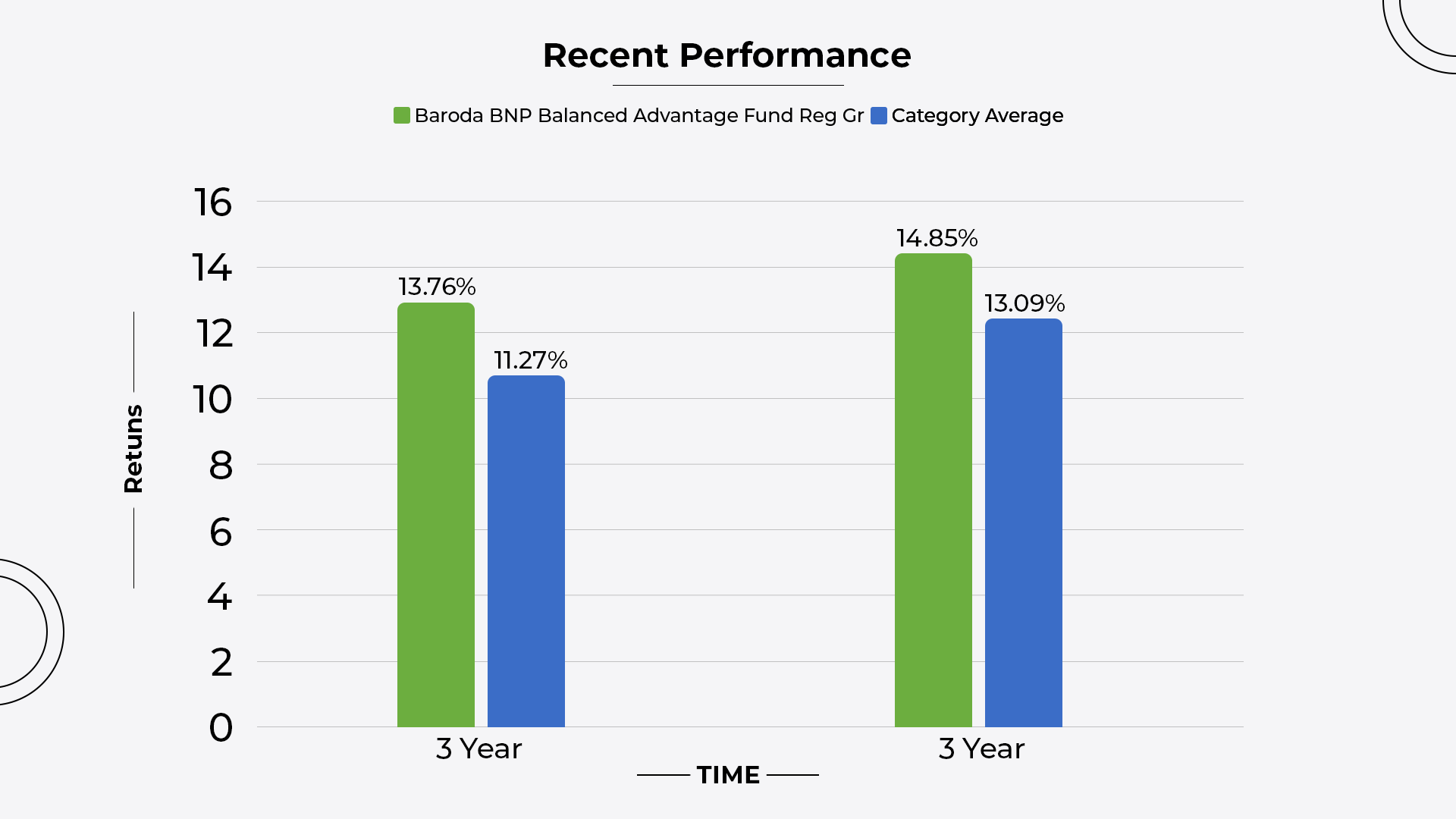

Recent Performance

In the recent 1 yr The fund delivered an impressive performance with returns of 13.76%, significantly surpassing the category average. Over the past three years, the fund continued its strong performance with returns of 14.85%, slightly outperforming its benchmark, which recorded 13.09.

The fund has showcased impressive performance over both the one-year and three-year holding periods, demonstrating its ability to deliver strong returns and outperform its peers and benchmark consistently.

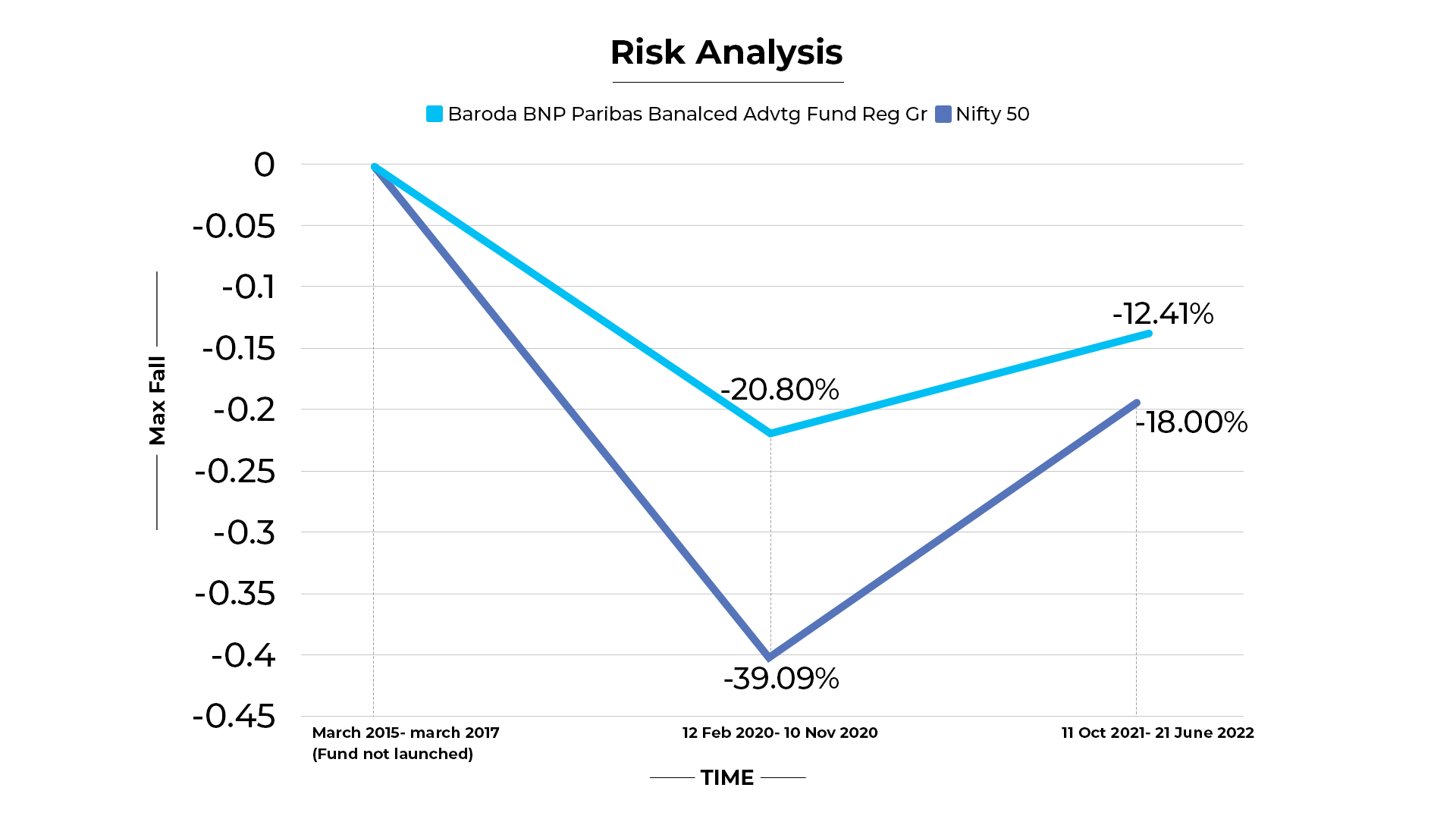

Risk Analysis

Describing risk analysis as a “compass” highlights its role in providing the direction for making informed decisions, capital protection, compliance and strategic adaptability.

Now let’s look how this compass guide us in different directions:

As we see the graph, in the early period from March 2015 to March 2017, the fund was not yet introduced.

Moving to a later phase, specifically from February 12, 2020, to November 10, 2020, the Nifty 50 Index experienced a significant decline of -39.09%. In contrast, the Baroda BNP Paribas Balanced Advantage Fund Regular Growth exhibited resilience with a smaller decline of -20.80%.

Transitioning to a more recent phase, spanning from October 11, 2021, to June 21, 2023, the Nifty 50 Index faced its most challenging period with a decline of -18.00%. During this same period, the Baroda BNP Paribas Balanced Advantage Fund Regular Growth maintained its stability with a more modest decline of -12.41%.

past performance is not a guarantee of future results in the world of investments. Therefore, investors and analysts often look at the fund's current holdings, assets, and strategy to assess its potential for future success.

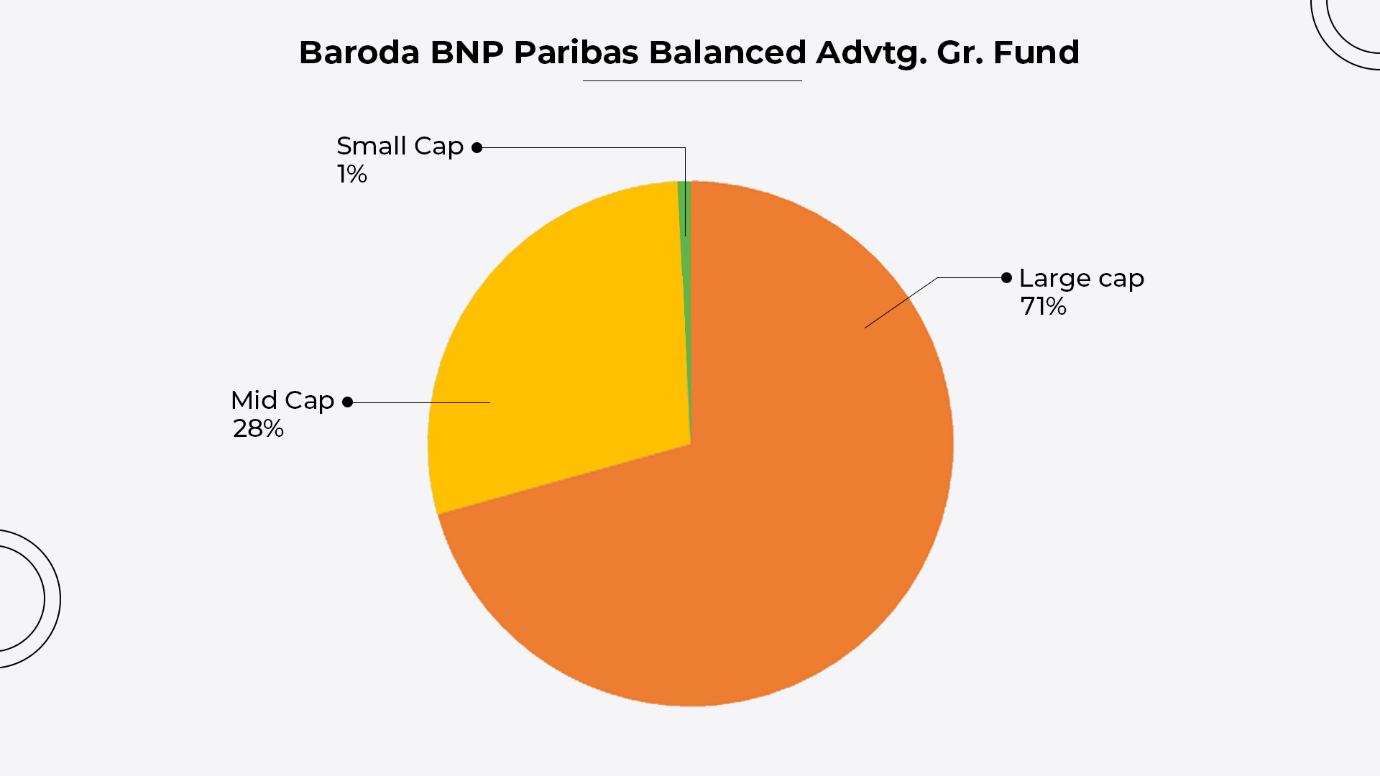

Portfolio Allocation

It's about finding the right mix of different types of investments that suit you.

With 70% of its portfolio in equity and 27% in debt, this fund stands out for maintaining a substantial equity allocation. While other funds in the category shifted towards debt, this fund has remained committed to equities.

What's noteworthy is its strategic approach, with a significant portion of its equity allocation invested in large-cap stocks (70%), while the remaining 28% is allocated to mid-cap stocks.

Equity Segment Allocation

Market cap allocation:

The fund has invested total of 70.68% in large cap fund, 10.32% in midcap fund, and 7.47% in small cap fund.

You have the option to invest in these companies via online SIP (systematic Investment Plan).

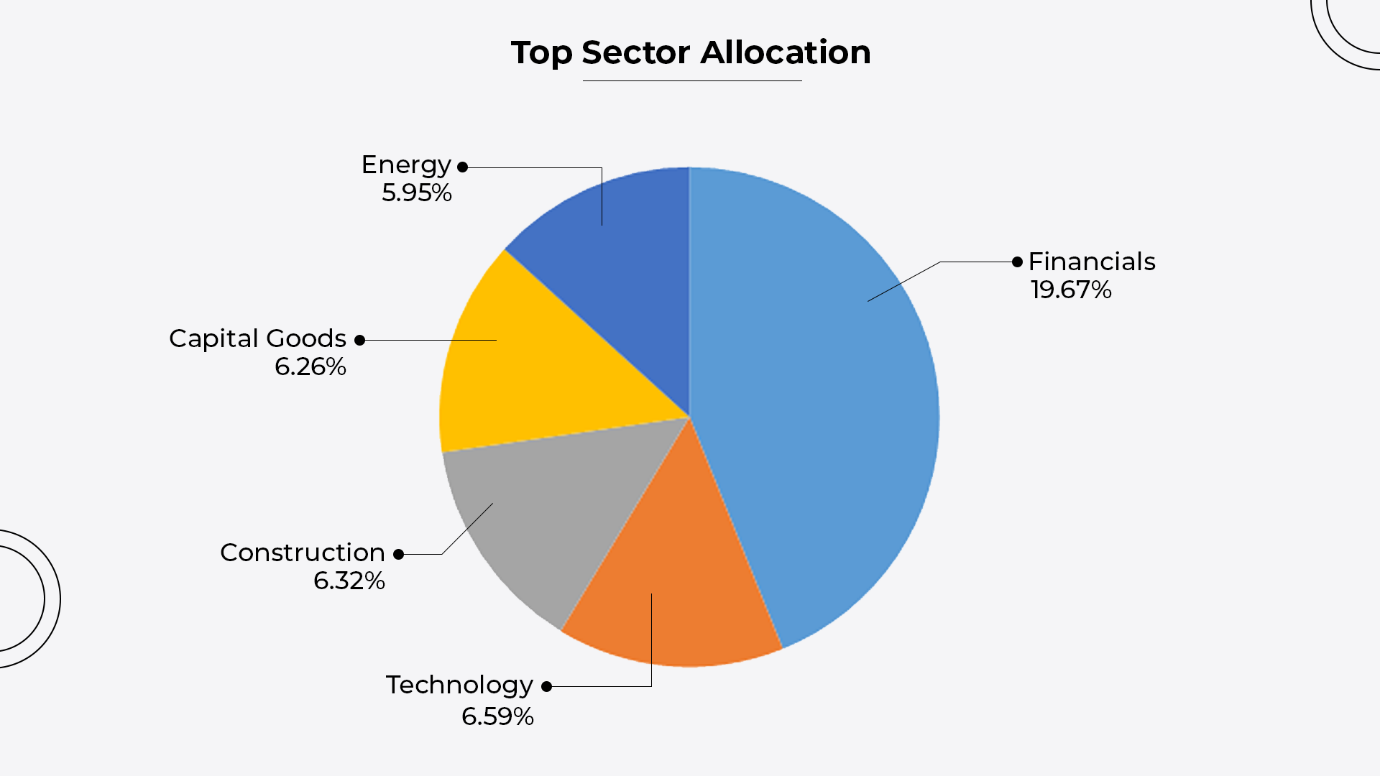

It’s top sectors are:

Financials: 19.67%

Technology: 6:59%

Construction: 6.26%

Capital Goods: 6.26%

Energy: 5.95%

This also demonstrates its objective to allocate funds to expanding sectors in pursuit of favorable returns.

Debt Allocation

Followed by this it has invested total 27.00% in debt fund into which it has invested around 65.41% in Corporate Bonds and 15.90 in Government Bonds. The modified duration for these funds is 2.11, effective maturity is 3.25 and weighted coupon is 7.75, as the low modified duration suggests that bonds or bond portfolio are relatively less affected by fluctuations in interest rates.

And total of 3.88% in cash.

Some General Information about the fund:

NAV – NAV of Baroda BNP Paribas Balanced Advantage fund as of 28 September, 2023 is RS. 18.79.

AUM – AUM of Baroda BNP Paribas Balanced Advantage fund as of 1 October, 2023 is RS. 3329.665.

Fund Size: The fund has shown a satisfactory performance when evaluated based on the Fund Size Metrics.

Fund Manager:

Sanjay Chawla has an extensive 33-year experience in managing equity funds and has been overseeing this particular fund since its inception on November 14, 2018.

Prashant Pimple, with 24 years of experience, has been managing this debt fund since October 21, 2022.

Conclusion

In our analysis, we've observed a unique balance within this fund. Although it falls into the category of dynamic asset allocation, typically associated with risk management, its internal strategy, past performance, and current portfolio lean towards a more aggressive approach compared to its peers.

This fund is particularly well-suited for investors who are aiming for high risk-adjusted returns over a medium to long investment horizon. It caters to those individuals who are comfortable with taking on a higher level of risk, albeit not exceeding the risk associated with the equity market, but are willing to accept the highest risk within this specific category.

Read More : Is it good to Invest in HDFC Balanced Advantage Fund? Fund Review 2023