Table of Contents

- ICICI Prudential Balanced Advantage Fund - Growth

- HDFC Balanced Advantage Fund - Growth Plan

- ICICI Prudential Balanced Advantage Fund - Monthly IDCW

- Baroda BNP Paribas Balanced Advantage Fund-Regular Plan -Growth Option

- Tata Balanced Advantage Fund-Direct Plan-Growth

Edelweiss Balanced Advantage Regular Growth

Introduction

The Edelweiss Balanced Advantage Fund is a type of mutual fund that falls under the special category of hybrid funds – dynamic asset allocation. This category is known for its ability to strike a balance between equity and debt investment, making it an attractive choice for risk-averse investors looking for a blend of stability and growth potential.

Under this present scenario, it’s crucial to find options that provide stability, growth, and a balanced approach to wealth creation. This fund comes under one such investment avenue that is famous for Quality Investment and managing funds with highest level of risk management. Like using forensic analysis skill while selecting stocks in the portfolio.

In this blog, we’ll take a closer look at this fund and why it might be a smart choice for investors seeking a balanced investment option.

Performance History

In order to assess its suitability for their specific investment goals and risk tolerance investors should review the fund’s historical performance.

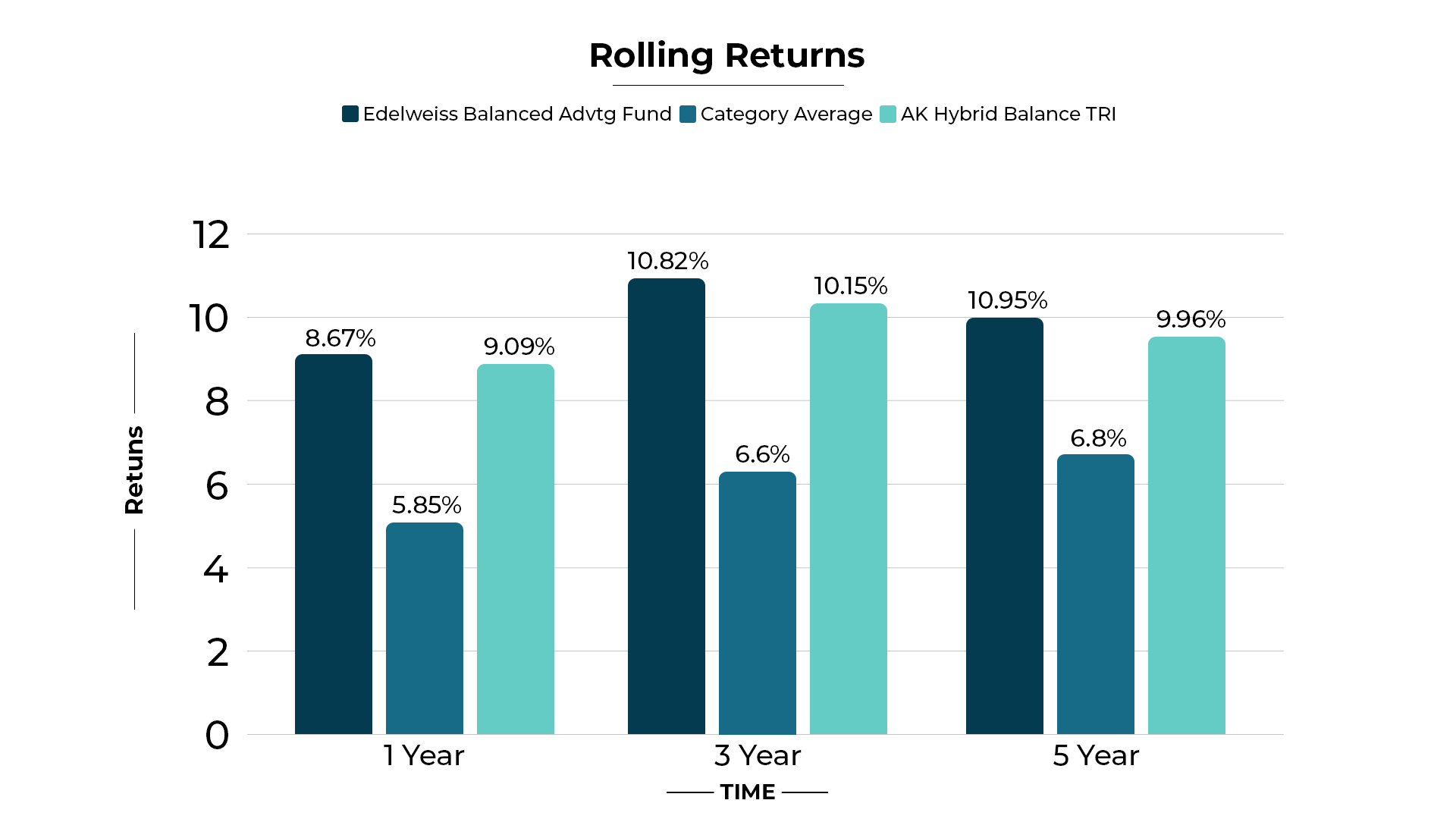

To provide a clearer understanding of the fund’s consistency, we will now proceed to examine a graphical representation of these rolling returns.

The fund’s performance can be analyzed through its annual average returns, specifically over 1- year, 3-year, and 5-year periods, comparing it to the benchmark index. Here’s a breakdown of these returns:

- 1-Year Returns: The fund yielded a return of 8.67%, slightly below the benchmark’s return of 9.09%.

- 3-Year Returns: Over a 3-Year horizon, the fund delivered return of 10.82%, equivalent to the benchmark’s return of 10.15%.

- 5-year returns: Looking at a more extended 5-year window, the fund outperformed significantly with returns of 10.95%, whereas the benchmark achieved returns of 9.96%.

The fund has consistently been stable and reliable. Over 1-year, 3-year, and 5-year period, it delivered competitive returns. Although fund performance is slightly higher compared to its benchmark returns, it still showed a strong track record of reliability. This means it can offer steady returns to investors, fitting their goals and risk tolerance.

This analysis highlights the fund’s impressive track record of consistent performance, consistently delivering returns slightly higher than the benchmark returns.

Now that we’ve looked at how the fund has been doing consistently, let’s see how it’s been performing recently.

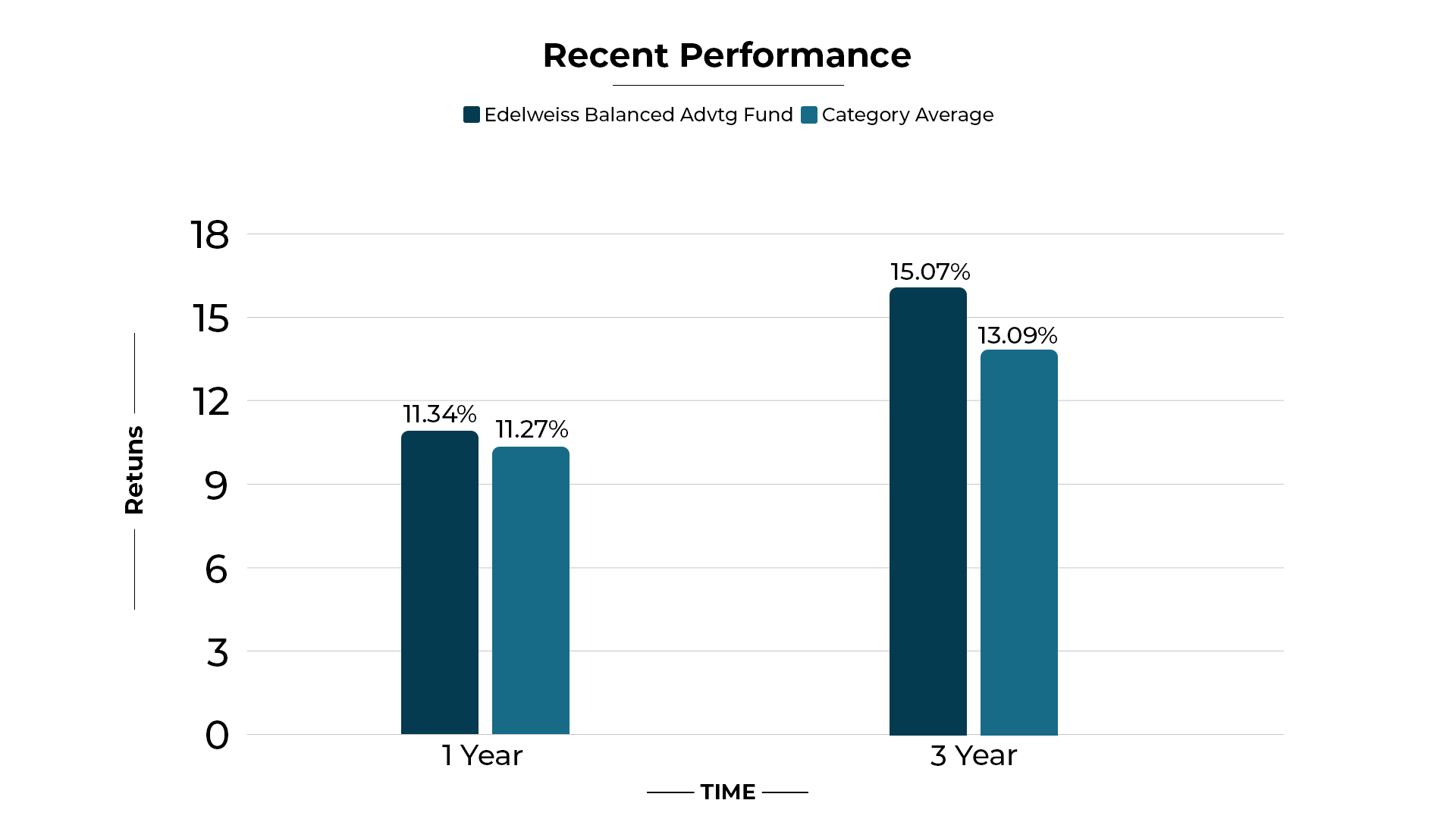

In this graph, we’ve analyzed the performance data for two different time periods: One year and Three years, comparing them to their respective benchmarks.

Over the course of the last year, the fund yielded a return of 11.34%. Interestingly, this return aligns precisely with the benchmark’s performance, which also stood at 11.27%. In other words, both the fund and the benchmark achieved very similar returns during this one-year timeframe.

When we extend our analysis to 3 year duration, we find that the fund’s performance stands out even more. The fund’s return over this period was 15.07% higher than the category average return of 13.09%.

The fund consistently meets the category’s average returns and from time to time, it deliver slightly higher returns.

Since we know it’s really good at managing risks, let’s find out how it did when the market had problems and went down.

Risk Analysis:

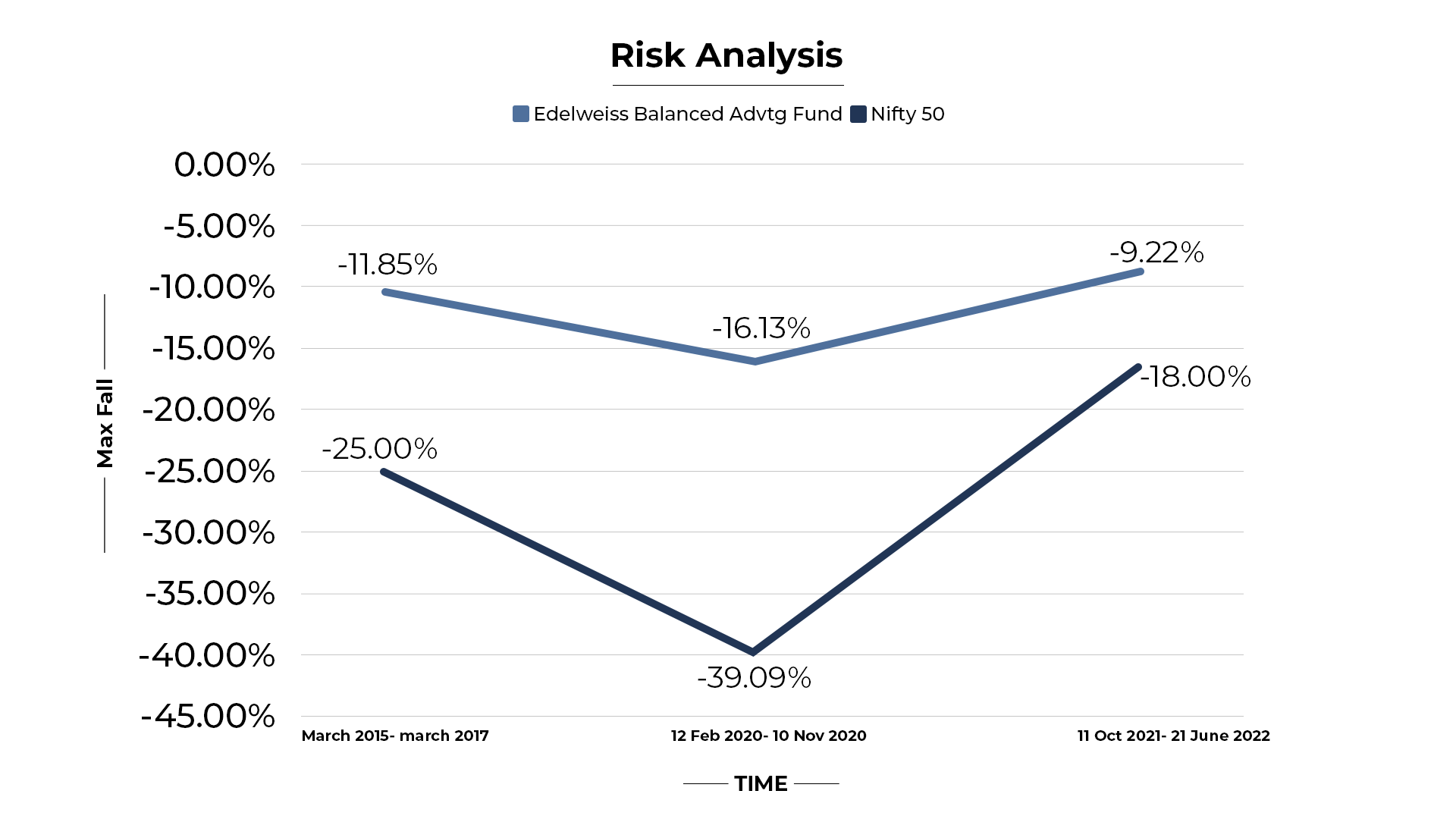

Let’s take a closer look at how the fund reacted during three notable period of market decline:

The edelweiss balanced advantage regular growth fund has proven to be strong during three tough times in stock market.

In first period from March 2015 to March 2017, When the Nifty 50 went down by 25.00%, this fund only went down by 11.85%. It bounced back quickly.

In the second period, from February 12, 2020, to November 10, 2020, when the nifty 50 had a big drop of 39.09%, the Edelweiss Balanced Advantage Growth fund only went down by 16.31%. It recovered pretty fast.

In the third period, from october 18, 2021, to Ju;y 27, 2022, when the nifty 50 faced another tough time with a big drop of 18.00%, the Edelweiss Balanced Advantage Regular Growth Fund again showed its strength by going down only by 9.22%.

This is why it’s known for managing riks well. It keeps your money safe and still manages to make more money compared to most similar funds. That’s why it’s considered one of the best-performing funds for people who want to be moderately careful with their investments. Moreover, investing in this fund is made convenient through online SIP.

Now Let’s have a look on its investing strategy:

Asset Allocation strategy

EEHI:

Edelweiss Equity Health Indicator (EEHI) is a tool that edelweiss uses to protect and grow your money in the stock market. It invests more when the market is up and less when it’s down.

EEHI is based on two main pillars: Market Trend and Health of the Trend. EEHI uses math-based signs to figure out how the market is doing and how strong that signal is. It picks the best ones to make smart decisions in real-time.

EEHI cares more about big losses than ups and downs. It looks at how much your money drops from its highest point to its lowest. This helps protect your investments from big losses and matches your comfort with risk.

Bull Trend:

When EEHI is positive, like a sunny day, we invest more in stock for potential of higher returns.

Bear Trend:

When EEHI suggest trouble, like a storm coming, we put more money into safer things like bonds to protect our investment.

Equity Segment:

This fund really pay attention to the quality, growth, and value of investments. Our research starts from the bottom, looking at individual, to make the best choices.

Debt Segment:

“Duration with accrual strategy” means patient with investments that take time to pay off (like bonds) and we steadily collect income from them over time, instead of expecting quick returns.

Porfolio Analysis

While doing the portfolio Analysis of this particular we come to know how the asset allocation is done so that the financial objective of the fund can be achieved while keeping in mind the risk associated with this fund.

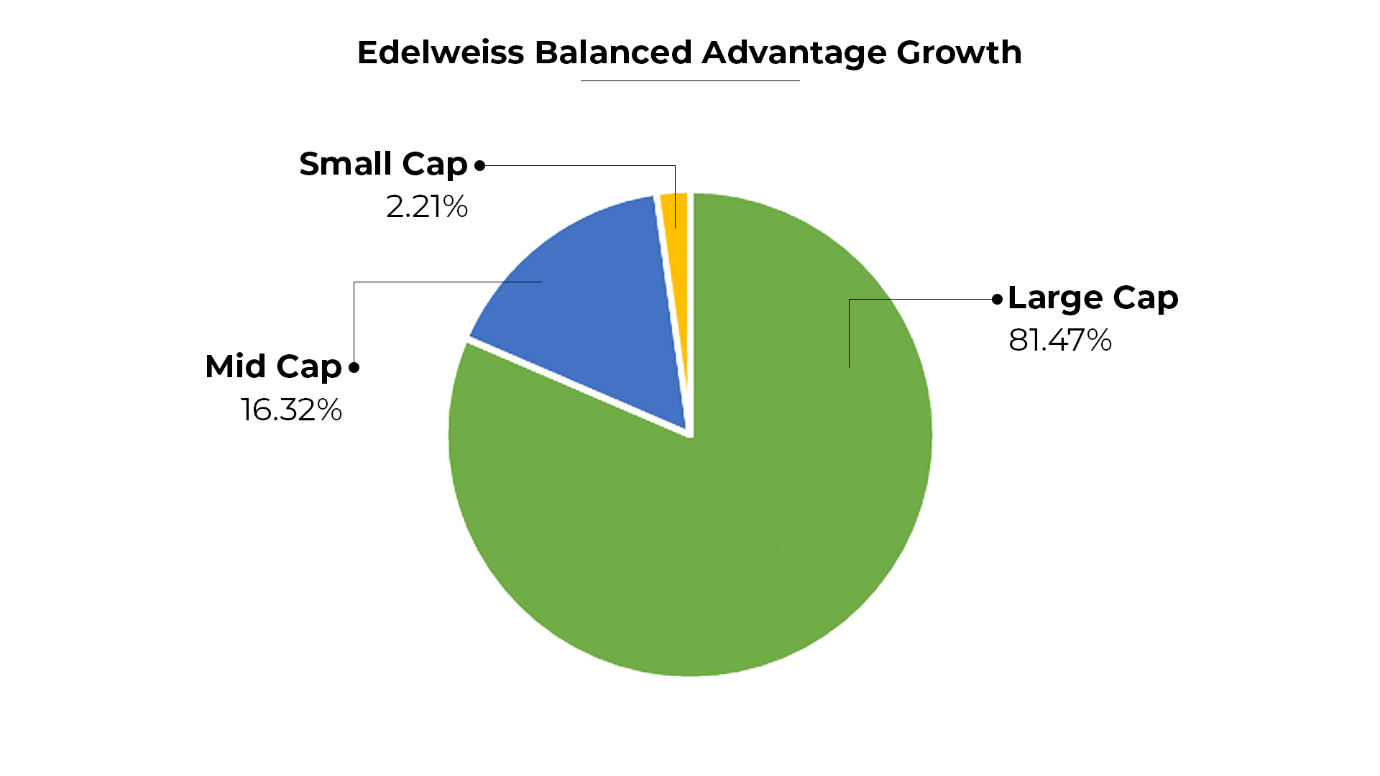

Market Cap Allocation:

The market cap Allocation of this fund under equity segment is divided under large cap, Midcap and Small cap funds.

Fund has allocated 81.47% in Large cap, 16.32% in Mid cap, and 2.21% in small cap.

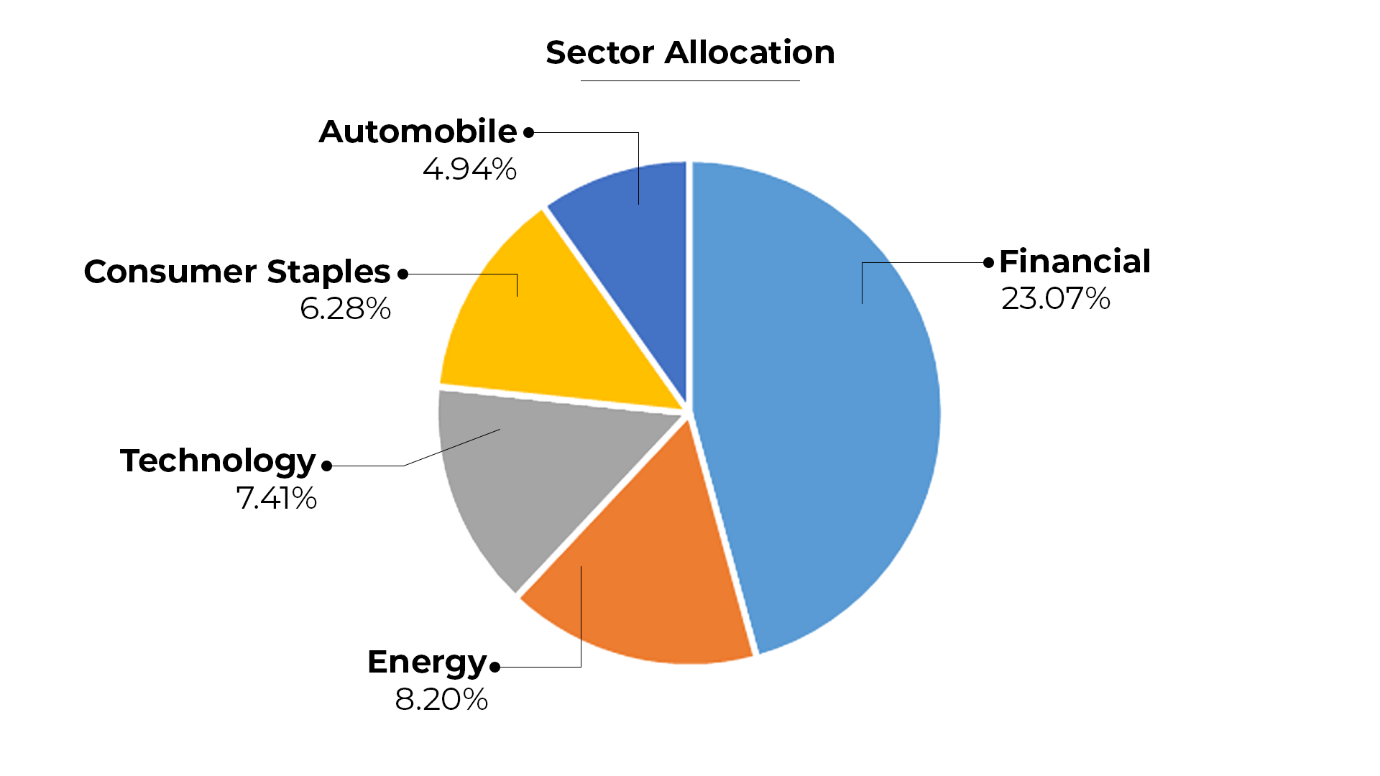

Top Sector allocation of the fund is:

Sector allocation is a way to spread your risk and seize opportunities by deciding how much to invest in each sector to create a well diversified portfolio.

This fund has distributed its investment portfolio in different financial sectors are:

Financial – 23.07%

Energy – 8.20%

Technology – 7.41%

Consumer staples – 6.82%

Automobile – 4.94%

Followed by this the fund has invested in debt segment in total of (21.62%) under which it has invested 42.26% in Government bonds and (22.98%) in corporate bonds.

The fund has also invested 0.26% of its part in Real Estate and 4.89 of its part in cash.

Let’s have a look at some basic details:

- NAV (Net Asset Value) - The Edelweiss Balanced Advantage Fund - Regular Plan's current net asset value as of September 26, 2023 is Rs 40.18 for the Growth option of its Regular plan.

- AUM (Asset Under Mnagement) – Fund’s AUM is 9,395 crores as of 30/06/2023.

- Expense Ratio: The expense ratio of the fund is 0.49%, which is lower than the average.

- Fund Manager:

Mr. Bhavesh has been in charge of the scheme since August 2017, with 14 years of experience. Mr. Bharat Lahoti, a 17-year veteran, has been in charge of the scheme since September 2017."

Rahul Dedhia, with 13 years of experience, has been managing the scheme since November 23, 2021.

Conclusion

The Edelweiss Balanced Advantage Regular Growth Fund presents a compelling investment opportunity. Its historical performance, resilience during market downturns, and thoughtful asset allocation strategies make it an attractive choice for investors seeking stability and growth. With experienced fund managers and a competitive expense ratio, it offers a well-rounded investment option. However, investors should conduct their own research and consider their financial goals and risk tolerance before investing.

Read More : Is Baroda BNP Paribas Balance Advantage Fund 2023 Right for You?

.webp&w=3840&q=75)