Table of Contents

- ICICI Prudential Balanced Advantage Fund - Growth

- HDFC Balanced Advantage Fund - Growth Plan

- Baroda BNP Paribas Balanced Advantage Fund-Regular Plan -Growth Option

- SBI Balanced Advantage Fund - Regular Plan - Growth

- Edelweiss Balanced Advantage Fund - Regular Plan - Growth Option

Tata Balanced Advantage fund

Tata Balanced Advantage Fund, a hybrid nature fund falls in the dynamic asset allocation category and invests money in equity and bonds, but fund managers flexibly change the allocation as per their expertise and knowledge.

So it saves us from the risk of the equity market falling but also generates good returns in a positive equity market. Tata's balanced advantage was recently launched in the category in January 2019

This blog will review this fund to know will this fund keep its brand name up and can a first time first-investor or low-risk appetite investors start Online SIP and create wealth with an average annual rate of 12% in the medium-term.

Analyze the performance of Tata Balanced Advantage Fund

Return Analysis

Let's first analyze the performance of this fund after its launch.

So we will check its 1-year and 3-year average annual returns since launch is 10.04% and 12.93%. and its category average is 7.61% and 8.8% both outperform in category average, but it hasn't outperformed its benchmark during this period.

.xlsx_652e0e6a1d057.png)

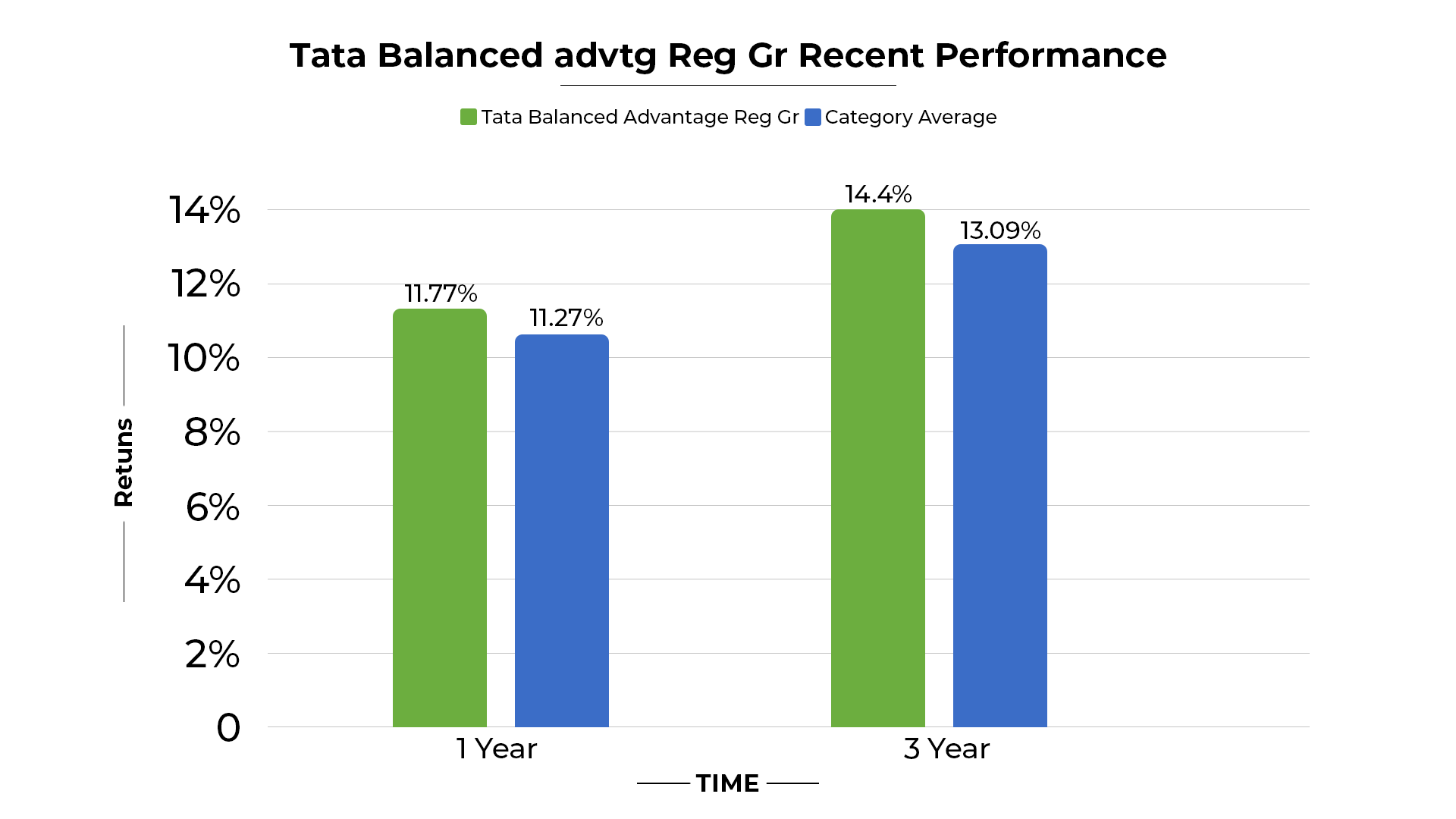

Recent performance

Now see the recent market ie last 1 year & 3 Year period. During this period Tata Balanced Advantage fund has given 11.77% and 14.04% returns. Fund outperforming both the category average of 11.27% and 13.09.

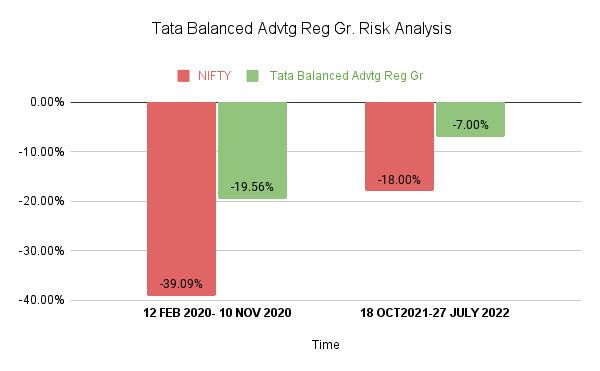

Risk analysis

- Tata Balanced Advantage Fund effectively managed risk from February 12, 2020, to November 10, 2020 (-19.56%), Compared to its benchmark (Nifty50) this fund recovered on time.

- Similarly, during the period from October 18, 2021- 27, 2021 July (7.00%), when we compared it to its benchmark (Nifty 50), This fund recovered on time and performed well.

- The standard deviation of this fund is comparatively low among its peers.

- Which means its returns are less volatile. So its risk management seems good. In contrast, it also shows that the returns are also moderate.

- The Sortino Ratio tells you how well an investment has performed relative to the risk of losing money.

The Sortino ratio is 2.09%, indicating that the fund has achieved a favourable risk-adjusted performance. This shows that on average, the fund has been able to generate returns that more than compensate for the level of downside risk it has taken. It's a positive sign for investors, indicating that the fund has managed risk effectively while achieving attractive returns relative to that risk.

- The Alpha of Tata Balanced Fund is 2.41% indicating that the fund has outperformed its benchmark.

Portfolio Analysis

Equity Allocation

Tata Balanced Advantage fund's total asset of equity allocation is 53.31%. Of the total equity allocation, 89.74% is invested in large-cap stocks. The remaining 10.26% of the equity allocation is invested in mid-cap stocks. This allocation indicates that a smaller portion of the fund's equity investments are in mid-cap companies.

Tata Balanced Advantage Fund's portfolio is diversified across sectors, with the top five being financials (15.74%), energy (7.53%), technology (4.08%), construction (3.54%), and healthcare (3.45%). This balanced approach aims to capture growth opportunities while spreading risk across different sectors, aligning with the fund's goal of providing investors with a well-diversified investment option.

Debt Allocation

The fund's 27.29% is invested in debt securities, of which 23.17% in government securities. A modified duration in this fund indicates that the fund's bond holdings are less likely to experience significant price volatility due to changes in interest rates.

In this fund, approximately 1.49% of the total assets are invested in real estate. This allocation is relatively small compared to other asset classes within the fund.

Tata balanced advantage fund signifies that nearly 17.91% of the fund's assets are currently held in cash.

Conclusion

- Since its January 2019 launch, the fund has shown strong performance.

- Effective Risk Management: It has managed risk well during market volatility.

- Flexibility of the fund in asset allocation allows it to adapt to market conditions, offering a balance between equity and debt investment.

- Tata Balanced Advantage Fund offers a compelling investment choice for those seeking a well-diversified, balanced approach to wealth creation and capital preservation.

Read More: Is SBI Balance Advantage Fund Right for You? Fund Reviews 2023