Table of Contents

- ICICI Prudential Balanced Advantage Fund - Growth

- HDFC Balanced Advantage Fund - Growth Plan

- Motilal Oswal Balance Advantage Fund (MOFDYNAMIC) - Regular Plan - Growth Option

- Baroda BNP Paribas Balanced Advantage Fund-Regular Plan -Growth Option

- Edelweiss Balanced Advantage Fund - Regular Plan - Growth Option

SBI Balanced Advantage Fund Regular Growth

Introduction

Investing your hard-earned money wisely is a crucial step towards achieving your financial goals and securing your future. The world of mutual funds offers a diverse range of options to help you grow your wealth, and one such option that stands out is the SBI Balanced Advantage fund - Regular growth.

Balancing Act: Asset Allocation

The SBI Balanced Advantage Fund excels in balancing equity and debt allocation. It optimizes returns while mitigating risk by adjusting allocation based on market conditions. In a bullish market, it leans towards equities for potential growth, while in uncertain markets, it shifts towards debt for stability.

Growth Option: What does it mean

The “Regular Growth” option signifies that any gains or dividends earned from the fund are reinvested into the fund, rather than being distributor to the investor.

This reinvestment can lead to the compounding of your wealth over time, potentially increasing the value of your investment.

Let’s look into the past performance of the fund.

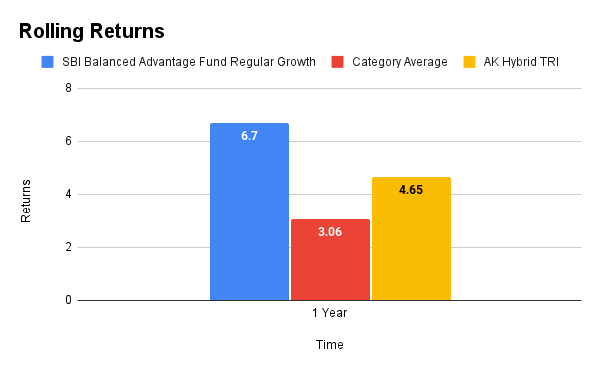

Rolling Returns

To assess the fund’s consistency, we examine rolling returns for 1,3 and 5-years holding periods. Since the fund was launched on 5 August 2021, rolling return data for those timeframes is not available.

However, looking at the one-year rolling returns, we see that the fund delivered an normal return of 6.7%, higher than its benchmark return of 4.65%. This suggest that the fund has the potential to perform well in the near future.

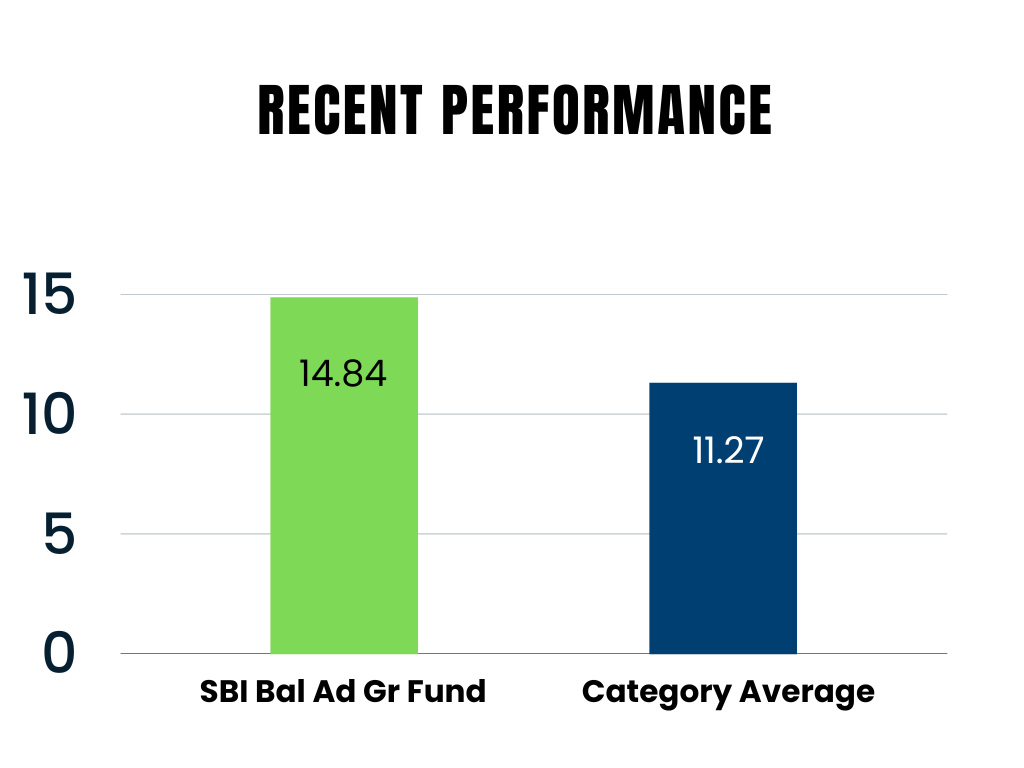

Recent Performance

When we examine the performance graph of latest 1 year period returns, it becomes evident that the fund has performed impressively. It has delivered a one-year return of 14.84%, which surpasses the category average return of 11.27%. This performance suggests that the fund has demonstrated the ability to perform well in the near future.

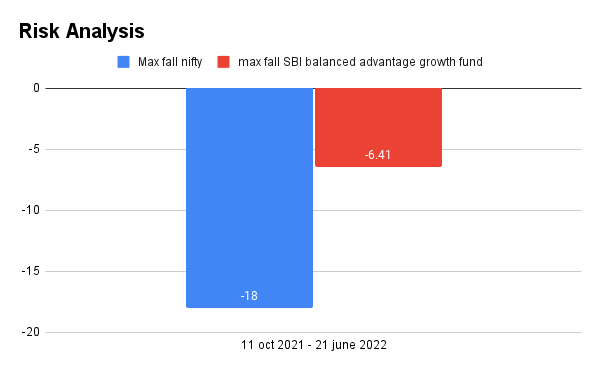

Risk Analysis

Since fund launched after 2020 market crash. In this scenario, we can assess the fund's performance based on the period from October 11, 2021, to June 21, 2022. During this period, we observed that the Nifty 50 index experienced a maximum decline of -18.00%, while the SBI Balanced Advantage Growth Fund showed a comparatively smaller decline of -6.41%. This indicates that the fund had a delayed recovery during that specific period.

Portfolio Segregation

To acquire a better understanding of the fund, consider how it has divided its investments across various sectors.

Equity Allocation

The total allocation made in equity segment by the fund is 49.96%.

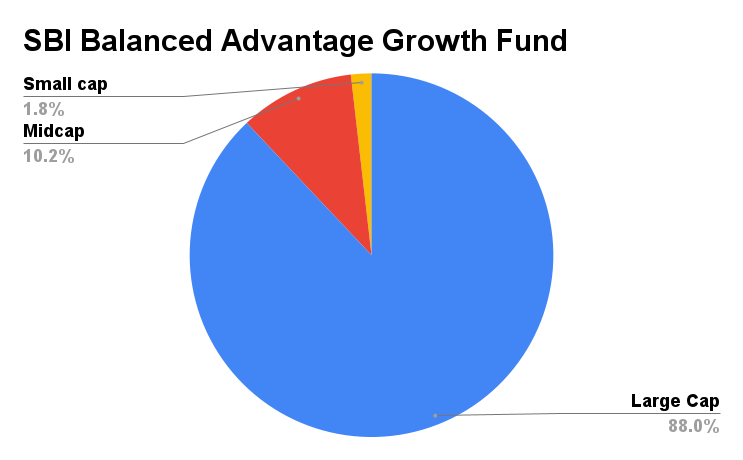

By considering the above pie chart which depicts the market cap allocation of the fund.

Market Cap Allocation

The fund has invested total of Equity (87.97% in Large cap, 10.22% in Midcap, 1.82% in small cap).

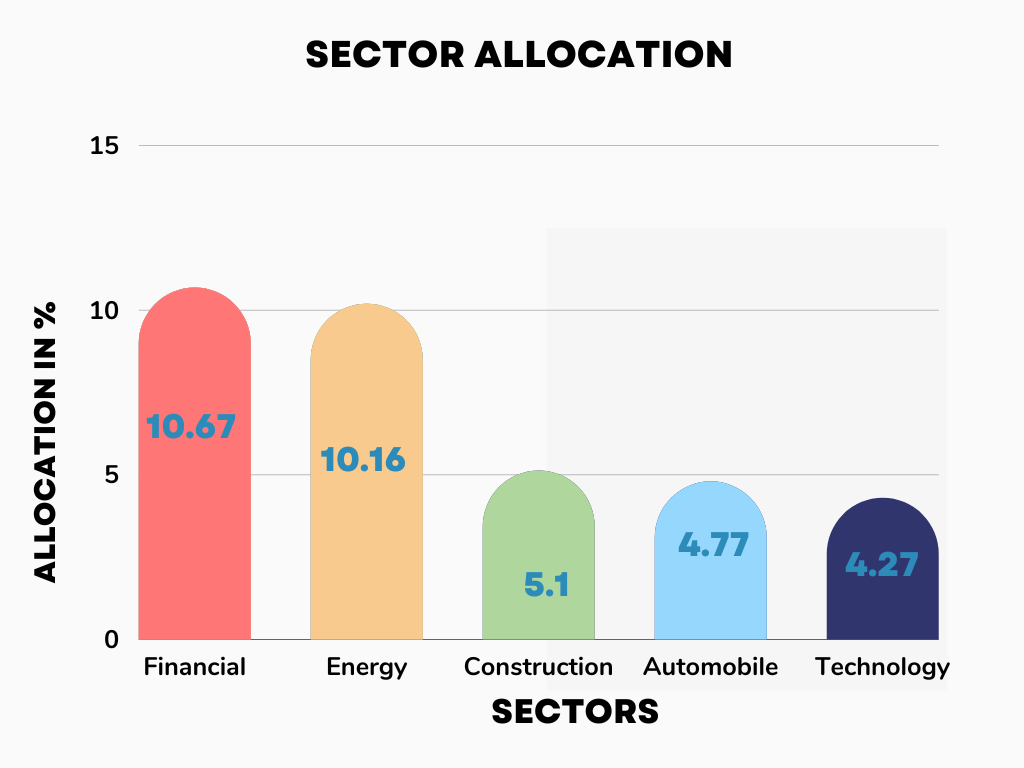

Now we have seen the Equity Market Cap allocation we will see the sector wise allocation of the fund.

Funds top 5 sectors where it has invested its majority of money are:

- Financial – 10.67

- Energy – 10.16

- Construction – 5.1

- Automobile – 4.77

- Technology – 4.27

If you want to invest into these top funds, then do make investment through online SIP.

Debt Allocation

Followed by this it has invested total 25.31% in debt fund into which it has invested around 36.10 % in governments bonds and 13.99% in corporate bonds.

The modified duration for these funds is 3.68, Effective Maturity is 5.24, and weighted coupon 7.49, as the funds exhibits a relatively higher modified duration within its category. This suggests that if interest rates were to decrease, the fund has the potential to generate favorable returns from its bond investments. On the other hand, in the event of an interest rate increase, the fund is expected to be less impacted, indicating a moderately aggressive approach in managing its debt investments. And total of 24.73% in cash.

Conclusion

The SBI Balanced Advantage Fund - Regular Growth is an attractive investment choice, skillfully balancing equity and debt allocation for optimized returns.

Its " Growth" option supports wealth compounding. Despite being relatively new, it has delivered an impressive one-year return, outperforming its benchmark and category average, indicating future potential.

Effective risk management is evident in its resilience during a challenging market period. The fund primarily focuses on large-cap stocks, maintains sector diversity, and strongly manages its debt allocation. Consider your financial goals and risk tolerance, and consult with a financial advisor for tailored guidance on your investment decisions.

Read More : Is Motilal Oswal Balanced Advantage Fund Right for You? Reviews 2023.