Table of Contents

- What are the Rolling Returns of Kotak India EQ Contra Fund Compared to its Benchmark?

- What is the Contrarian Investing Style Adopted by Kotak India EQ Contra Fund?

- What’s in the Kotak India EQ Contra Fund Portfolio?

- How has the Kotak India EQ Contra Fund's Recent Performance Been?

- Is Kotak India EQ Contra Fund Suitable for Investors?

- Endnote

The Kotak India EQ Contra Fund is a hidden gem of Kotak mutual fund offerings. It has a strong track record of wealth creation with an initial ₹1 lakh investment growing to ₹13.1 lakh after its NFO launched in 2005.

In the recent 1 year, the fund has delivered 53% of amazing returns to its investors.

This success was achieved by applying a perfect contrarian investing style to the funds.

So let us do a complete quantitative and qualitative analysis of this fund to understand its quality and preparation for future performance.

What are the Rolling Returns of Kotak India EQ Contra Fund Compared to its Benchmark?

Kotak India EQ Contra Fund made the best use of opportunities available, outperforming the benchmark and its category peers by a significant margin.

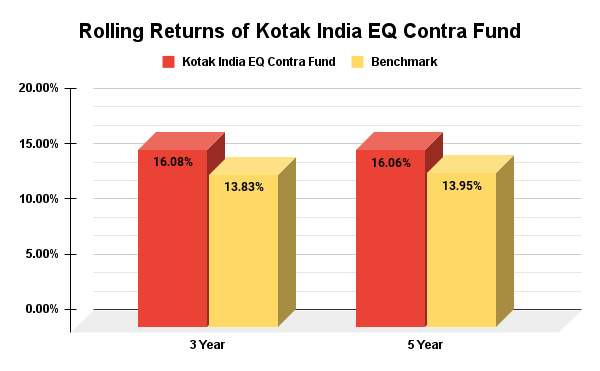

The performance of this fund is quite consistent as 3 years average annualized returns are 16.08% while the benchmark has delivered only 13.83% returns. This shows the fund has outperformed its benchmark index.

Let’s understand it with the help of below graph:

Now, if we talk about consistency, it has also given 82% consistent returns in 3 years and 80% in 5-year time frame which means the fund manager has efficiently applied a good strategic approach.

What is the Contrarian Investing Style Adopted by Kotak India EQ Contra Fund?

As a Contra-style fund, the Kotak India EQ Contra Fund follows a contrarian investment strategy, ensuring at least 65% of its portfolio is allocated to equities. When building its portfolio, the fund uses a smart approach that blends quantitative and fundamental analysis methods.

It identifies stocks that have underperformed in their respective sector to seek out stocks trading below their long-term average valuations and those with valuations lower than their industry peers.

The strategy also targets stocks trading below their 200-day moving average (DMA). It also focuses on picking financially strong stocks that haven't performed as well as the broader market index, Nifty 500. By sticking to these rules, the goal is to find undervalued stocks poised for growth and improvement in the future.

In short, with this strategy, you can make exponential returns but the risk is also high which is why it is necessary to have a proper portfolio allocation and diversification.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

So let us check how the Kotak Contra Fund decides where to invest its money, and what influences these decisions.

What’s in the Kotak India EQ Contra Fund Portfolio?

The Kotak India EQ Contra Fund has built a well-rounded portfolio with approximately 65 stocks across different sectors as of May 31, 2024. It has a 67% allocation in large-cap stocks that provide stability to it. At the same time, keeping 21.17% in mid-cap and 12.59% allocation in small cap stocks.

The top 10 holdings, including giants like ICICI Bank, HDFC Bank, and Reliance Industries, make up nearly 29% of the portfolio's value. The fund avoids overexposure by limiting each stock to less than 5% of its holdings and focuses on long-term investments.

In recent years, the fund has seen notable gains from investments in companies like Cummins India, ICICI Bank, and SBI. It strategically balances investments between cyclical and defensive sectors to spread risk.

The fund's price-to-earnings ratio (PE ratio) is 17.72, slightly higher than the category average, suggesting a good valuation. On average, the companies in its portfolio are seeing around 13.3% sales growth, 17.48% profitability, and a 32.23% increase in cash flow. You can check the below table to study the data:

| Fundamental Ratios | Value |

|---|---|

| Sales Growth | 13.3% |

| Earnings Growth | 17.48% |

| Cash Flow Growth | 32.23% |

| PE- Valuations | 18.53% |

Overall, Kotak India EQ Contra Fund effectively combines a fundamental outlook with quantitative models to manage its portfolio, emphasizing high-conviction investment decisions across market cycles.

Well, actions speak louder than words, so let’s analyze this fund’s recent performance to prove it is a worthy investment.

How has the Kotak India EQ Contra Fund's Recent Performance Been?

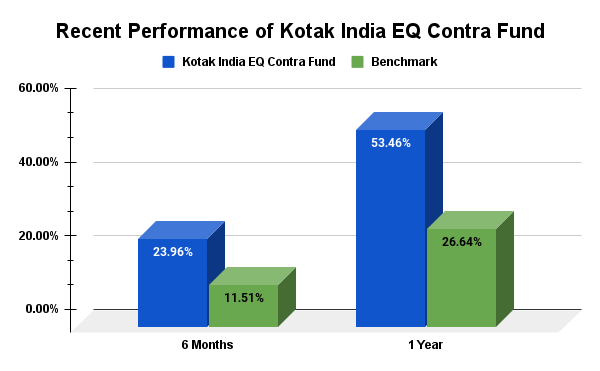

Kotak EQ Contra Fund has returned 23.96% over six months and 53.46% over one year. In comparison, the NIFTY 50 TRI benchmark has provided 11.51% over six months and 26.64% over one year, highlighting the fund's superior performance. The fund has generated better returns than the overall market benchmark, indicating its strong performance.

Last but not least, don’t forget to check the suitability to know whether or not this scheme is right for you.

Is Kotak India EQ Contra Fund Suitable for Investors?

Kotak India EQ Contra Fund is a good choice for investors looking for a stable investment option with a contra-style approach. It focuses on identifying undervalued, fundamentally sound companies in large-cap and mid-cap segments, avoiding risky bets for quick gains. Over time, the fund has consistently beaten its benchmark index, though it may lag behind others in shorter periods. It's ideal for investors with a long-term horizon of at least 5 years.

Endnote

If you are an investor who thinks outside the box, the Kotak Contra Fund, with its unique contrarian investing style, is a perfect fit. Given that there are only three funds in this category, it's wise to start your SIP early to take advantage of this rare opportunity.

Don’t Miss Your Chance to Check Out the Only Two Other Funds in This Category.

1.SBI Contra Fund: Is this Best Mutual Fund for 2024?

2. Invesco India Contra Fund: Beating the Markets with Its Contrarian Strategy