Table of Contents

- Check the investment style of the scheme

- Match the objective of fund with your own.

- Access your risk taking capacity.

- Analyze the long term performance

- Analyze the track record of fund managers.

INTRODUCTION:

Mirae Asset Emerging Bluechip Fund is the star performer fund, with good consistency and high performance. But the fund is underperforming in this bull phase of market, so let’s check it with complete analysis of the fund

Return Analysis :

Return analysis in mutual funds involves evaluating the historical performance, which includes analyzing the consistency of fund performance beating its benchmark and peers of Large & Midcap category. Also check the recent performance to know if the consistency is still valid or not.

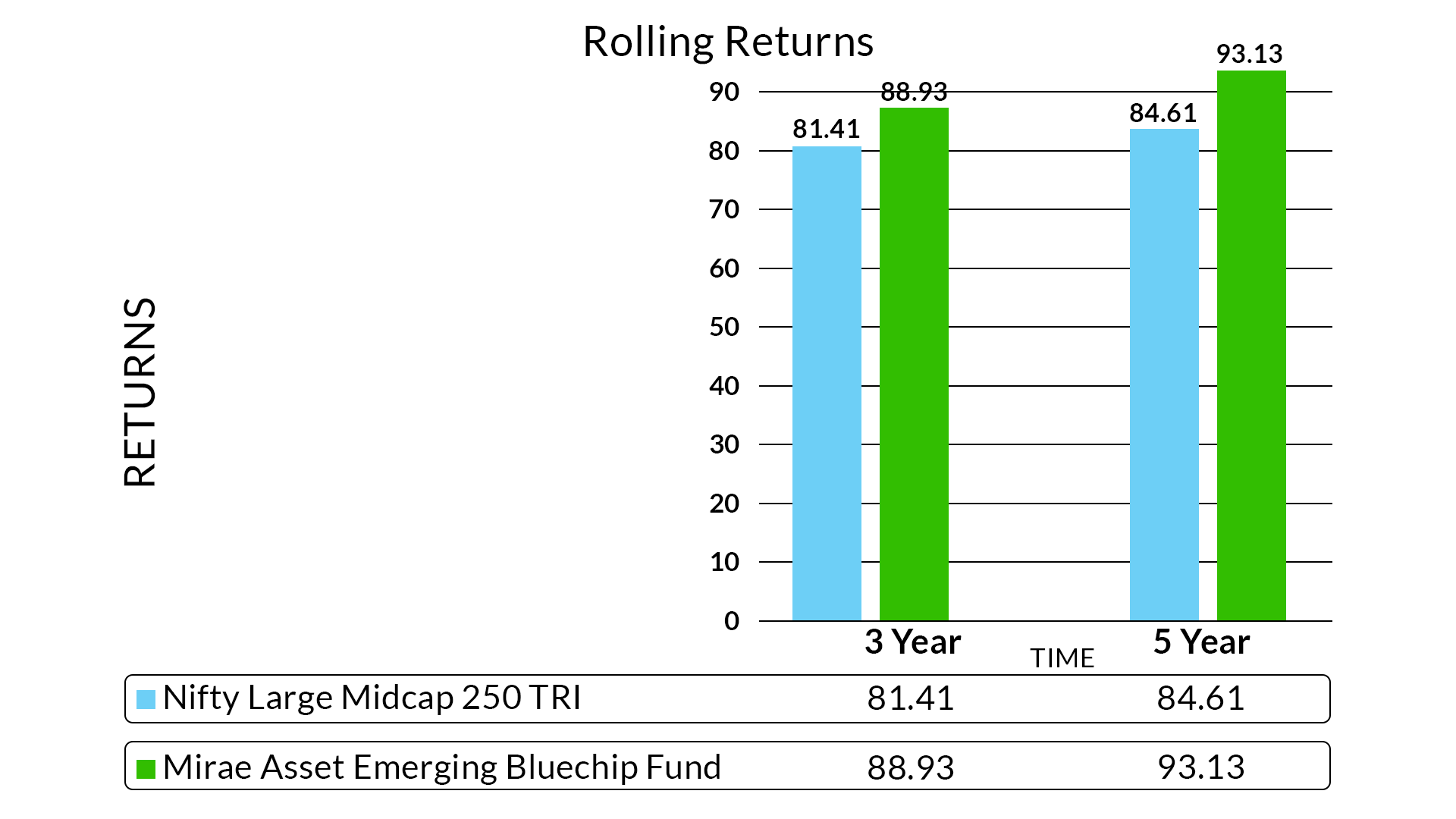

Referring to the above graph:

The word consistency holds a very simple meaning which says how the fund has performed in every cycle compared to its benchmark and peers. For this, we calculate rolling returns.

So, this fund’s average 3 & 5 years absolute returns are 88.93 and 93.13 which are much higher than the benchmark performance. This clearly shows that historically this fund has strong consistency in beating benchmark returns, also its returns are very high.

Firstly, we checked the consistency of the fund, after thorough analysis the fund has continuously performed and beaten the benchmark. After this now we will check the current performance of the fund.

Considering the above graph:

So, we hereby check the recent performance of 1 year and 3 years with their respective benchmark.

In the last 1 year September 2022 to September 2023, the market had two phase one is the correction phases and the second phase has a good rally.

As we can see in the graph the overall 1-year period return of benchmark i.e. (Nifty Large Midcap 250 TRI) is 17.51 but the fund was not able to beat its benchmark returns as the returns generated by the funds are 14.58, even if we stretch the duration to 3 years then too the fund is not able to beat the returns as the 3 years’ period return of benchmark i.e. (Nifty Large Midcap 250 TRI) is 26.19 and the returns of the fund is 23.4.

The fund was star performer in past, currently underperformer even when the market is in bull phase.

Risk Analysis :

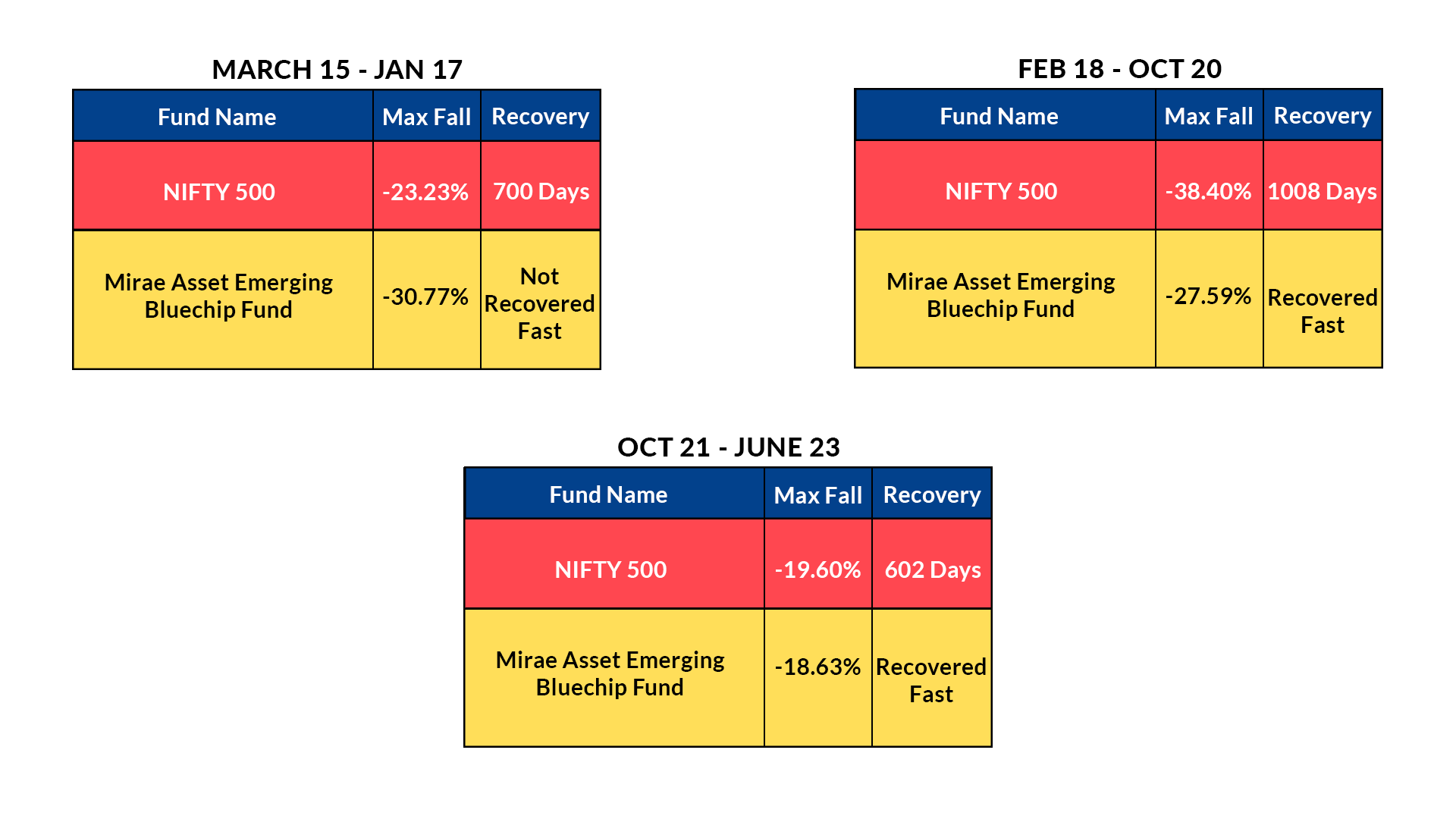

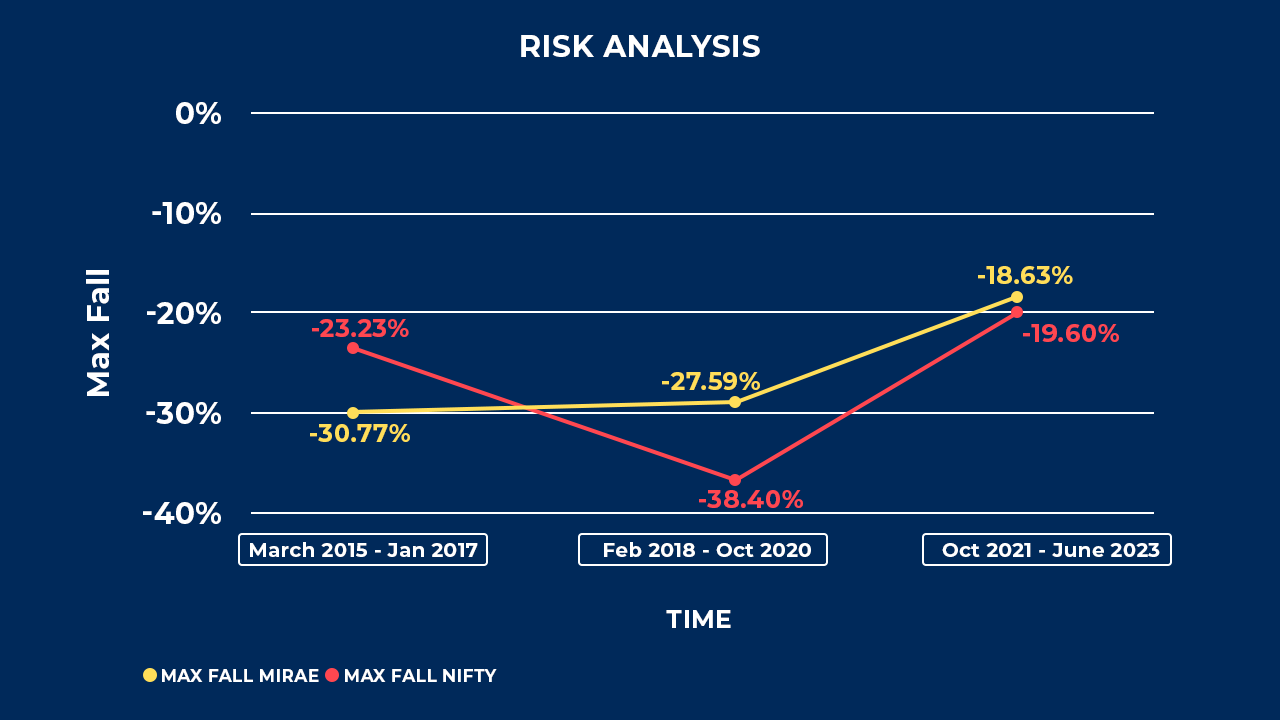

Risk is closely tied to Bear Market phases :

In a bear market, when things decline, profits go down, and investments can suffer. This is often high volatile but can lead to losses. Good managers tend to control negative returns in market fall or during correction phase and try to recover fast.

Now let’s see how Mirae Asset Emerging Fund performance under the Bearish Market Phase:

Here, in the 1st phase of market decline, the fund was unable to recover quickly in accordance with its benchmark, but was successful in doing so in the following two phases and also outperformed the benchmark, which shows that fund has strong risk management and ability to recover quickly through significant market declines. This can also be seen by the fact that the fund’s standard deviation is [14.54 v/s 14.81(category average)] is lower than the average of its category, which indicates the fund is slightly less volatile, which is preferable for investor who desire lower risk and stable investment.

Portfolio Analysis :

So, the fund is star performer with good risk management qualities but underperformer in recent bull phase.

Now let’s check the current portfolio to know will it resume its star performance or remain underperformed.

Market Cap Allocation :

The Fund has more allocation in Giant & large stocks which gives good safety to the portfolio but it missed the opportunity of creating alpha from small & midcap stocks strong rally in last 6 months.

Sector Allocation :

Sector wise its core allocation is in financials, health & technology stocks again these sectors are safe sectors but remain underperformed in this bull phase of market. So, this also leads to underperformance in the fund against benchmark

Top 10 sector holdings of the fund are:

1. HDFC Bank Ltd.

2. ICICI Bank Ltd.

3. State Bank of India

4. Axis Bank Ltd.

5. Reliance Industries Ltd.

6. Larsen & Turbo Ltd.

7. SKF India Ltd.

8. Infosys Ltd.

9. Bharat Forge Ltd.

10. National Thermal Power Corporation Ltd.

Neelesh Surana and Ankit Jain are responsible for managing the money. Surana is the CIO of the equity and lead manager. He is an excellent manager who used a bottom-up stock picking strategy to produce above average returns.

The portfolio manager’s well-constructed approach has handled allocations in midcaps effectively.

They have successfully implemented their strategy with a well-structured approach that effectively managed allocations in mid-cap investments. Their ability to stay fully invested and maintain their confidence in their investment decisions, even in challenging situations, has been a key factor contributing to the fund's long-term success. This has not only benefited the fund's performance but has also instilled trust among investors, as evidenced by the fund's growth.

Conclusion:

While the fund may be experiencing a short-term underperformance, it's important to recognize that its long-term track record remains outstanding. This temporary dip in performance should not undermine the fund's overall effectiveness. Over the course of a complete market cycle, it has consistently demonstrated its ability to outshine its peers within the same category by a significant margin.

.webp&w=3840&q=75)