Table of Contents

- Comparatively high & stable returns

- Adjusted Risk

- Backed by top AMCs

- High Growth

Investors without a doubt are like water without fish, both appear desolate in absence of the other. It is really necessary that these doubts are shared and the answers are sought. So, in this blog, we are discussing one such confusion that is common in investors while choosing a large and midcap scheme between Mirae Asset Emerging Bluechip Fund and Canara Robeco Emerging Equities Fund. Let’s see which is better among the two.

Table of Content

- Fund Facts : Mirae Asset Emerging Bluechip Fund & Canara Robeco Emerging Equities Fund

- How Is Mirae Asset Emerging Bluechip Different from Canara Robeco Emerging Equities?

- Investment Strategy

- Asset Allocation

- Past Performance

- Risk Management

- Consistency in Returns

- Which One to Choose? Mirae Asset Emerging Bluechip Fund G or Canara Robeco Emerging Equities Fund G

- Conclusion

According to SEBI, large and midcap funds are the open-ended schemes that invest mainly in the equity and equity-related instruments of large and midcap companies such that the minimum investment in each is 35% of the total assets individually. Large-cap companies are the top 100 companies while mid-cap companies are the next 101 to 250 companies in terms of the full market capitalization. Let’s read about these two large and midcap funds.

Fund Facts: Mirae Asset Emerging Bluechip Fund & Canara Robeco Emerging Equities Fund

| Basic Information | ||

|---|---|---|

| Parameters | Mirae Asset Emerging Bluechip Fund | Canara Robeco Emerging Equities Fund |

| Category | Large and MidCap Fund | Large and MidCap Fund |

| Benchmark | NIFTY Large Midcap 250 TRI | S&P BSE 200 TRI |

| Launch Date | 7/9/2010 | 3/11/2005 |

| Asset Size | Rs. 6,120 crore(As on Aug 31, 2018) | Rs. 4,033 crore(As on Aug 31, 2018) |

| Fund Managers | Neelesh Surana | Miyush Gandhi |

| Expense Ratio | 2.26%(As on August 31, 2018) | 1.98%(As on August 31, 2018) |

| Minimum Lumpsum | Rs 5,000 | Rs 5,000 |

| Minimum SIP | Rs 1,000 | Rs 1,000 |

| Exit Load | 1% for redemption within 365 days | 1% for redemption within 365 days |

- Both the funds are managed by different renowned fund houses, while one is backed by Mirae Asset Mutual Fund, the other by Canara Robeco Mutual Fund.

- Canara Robeco Emerging Equities Fund is older than Mirae Asset Emerging Bluechip Fund by five years.

- Mirae Asset MF’s scheme has more assets under management as on August 31st, 2018 compared to the Canara Robeco MF’s.

- There is a difference in the expense ratio of the two schemes, while the scheme by Mirae Assets has the ratio of 2.26%, while that of the other one is 1.98%.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

How Is Mirae Asset Emerging Bluechip Fund Different from Canara Robeco Emerging Equity Fund?

Every scheme is unique, and therefore different from the other. There are usually many reasons on the basis of which one can differentiate between the two schemes. Following are some of the points that denote the same about these two schemes.

Investment Strategy

Mirae Asset Emerging Bluechip Scheme - Mr. Neelesh Surana has been investing the assets under this scheme strategically. The businesses selected are those with scalability and sustainable competitive advantage with strong growth and visibility in the market. It also focuses on the stocks that are available in the market at reasonable price following the principle of margin of safety.

Canara Robeco Emerging Equities Scheme - The fund manager Mr. Miyush Gandhi focuses on selecting those companies for investment which have high potential to become the future leaders of tomorrow. Here, the growth consistency and the profit margin of a company is also checked. Active investment style is followed by the fund manager in addition to the in-house research.

Asset Allocation

_5baf6abe899b8.jpg)

Above pie chart showcases the equity allocation of Mirae Asset Emerging Bluechip Fund. The assets under this scheme have been allocated across equities such are large, mid, small, and giant cap. The investment made in big companies is 51% while that in mid cap companies is 40%.

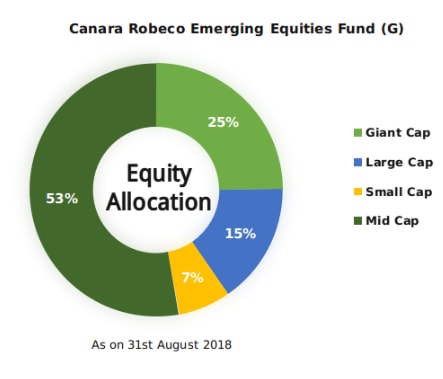

The above pie chart displays the allocation of assets in equity and its related instruments. The allocation has been done across the equities with major investment in the mid cap companies followed by giant and large-cap companies. This allocation appears to be fine category-wise and involves high scope of attractive returns.

| Sectors | Mirae Asset Emerging Bluechip Fund(Asset Allocation %) | Canara Robeco Emerging Equities Fund(Asset Allocation %) | ||||

|---|---|---|---|---|---|---|

| Cyclical | ||||||

| Basic Material (Agriculture, Chemical, Metal & Mining, Steel, Building Materials) | 13.95% | 12.75% | ||||

| Consumer Cyclical (Auto related industries, Travel & Leisure, Marketing Cos, Apparel & Furniture Mfg Cos) | 14.01% | 17.70% | ||||

| Financial Services | 30.75% | 24.41% | ||||

| Real Estate | 0.00% | 0.00% | ||||

| Sensitive | ||||||

| Communication Services | 0.00% | 0.00% | ||||

| Energy | 7.95% | 3.21% | ||||

| Industrial | 6.47% | 11.94% | ||||

| Technology | 9.11% | 7.99% | ||||

| Defensive | ||||||

| Consumer Defensive | 7.79% | 9.25% | ||||

| Healthcare | 8.77% | 8.82% | ||||

| Utilities | 1.20% | 3.93% | ||||

| As on August 31, 2018 | ||||||

- Both the schemes have invested largely in the financial sector which appears to be a good bet considering the present market and the coming time. However, Mirae has invested more compared to the other scheme.

- While Mirae Asset Emerging Bluechip Fund has invested around 18% in the defensive sector, Canara Robeco has inclined 22% of the assets in the same.

| Top 10 Holdings (Mirae Asset Emerging Bluechip Fund) | ||||||

|---|---|---|---|---|---|---|

| Stock Name | Weightage (%) | Absolute Returns | Valuation | |||

| 1 Year | 5 Year | P/BV | PE | |||

| HDFC Bank | 5.45 | 10.54% | 224.39% | 4.63 | 29.54 | |

| ICICI Bank | 4.86 | 11.79% | 82.67% | 1.93 | 42.82 | |

| Kotak Mahindra Bank | 4.45 | 17.72% | 235.47% | 4.19 | 33.95 | |

| Reliance Industries | 4.16 | 53.32% | 198.24% | 2.62 | 21.8 | |

| Havells India | 3.24 | 32.52% | 384.53% | 9.72 | 47.89 | |

| Info Edge (India) | 3.16 | 44.14% | 358.88% | 8.3 | 97.91 | |

| State Bank of India | 2.99 | 2.17% | 61.42% | 1.17 | 0 | |

| Bharat Financial Inclusion | 2.93 | 13.04% | 718.89% | 4.78 | 23.06 | |

| Tata Steel | 2.66 | -0.69% | 122.38% | 1.22 | 5.07 | |

| Divi's Laboratories | 2.53 | 45.33% | - | 5.82 | 37.77 | |

| Vinati Organics | 2.35 | 35.75% | 1241.79% | 7.46 | 36.3 | |

| Tata Chemicals | 2.28 | 15.40% | 184.59% | 1.53 | 7.07 | |

| As on August 31, 2018 | ||||||

Mirae Asset Emerging Bluechip Fund has invested around 40% of the assets across 12 companies mentioned in the above table. Almost all the companies have provided great five year returns.

| Top 10 Holdings (Canara Robeco Emerging Equities Fund) | ||||||

|---|---|---|---|---|---|---|

| Stock Name | Weightage (%) | Absolute Returns | Valuation | |||

| 1 Year | 5 Year | P/BV | PE | |||

| ITC | 4.08 | 13.66% | 26.83% | 6.86 | 31.27 | |

| Reliance Industries | 3.08 | 53.32% | 200.87% | 2.62 | 21.8 | |

| Atul | 2.76 | 40.83% | 839.08% | 4.14 | 29.48 | |

| Tata Motors | 2.54 | -43.26% | -31.84% | 0.70 | 16.68 | |

| Yes Bank | 2.52 | -37.19% | 211.75% | 1.74 | 10.38 | |

| Axis Bank | 2.48 | 20.67% | 191.64% | 2.40 | 0 | |

| Bajaj Finserv | 2.48 | 20.20% | 879.36% | 4.23 | 32.68 | |

| Sun Pharmaceuticals Inds. | 2.25 | 26.45% | - | 3.85 | 42.33 | |

| Britannia Inds. | 2.21 | 31.78% | 640.02% | 18.72 | 65.35 | |

| M&M Financial Services | 2.19 | 5.24% | 58.27% | 2.59 | 22.17 | |

| Divi's Laboratories | 2.19 | 45.33% | - | 5.82 | 37.77 | |

| Whirlpool | 2.11 | 14.38% | 753.33% | 9.26 | 46.59 | |

| As on August 31, 2018 | ||||||

The investment made here in the top twelve companies in which it has invested majorly is around 31% of the total assets. This shows the diversification of its assets which is good in terms of the risk management.

Past Performance

| Return Analysis | Trailing Returns (As on September 21st, 2018) | 3 - Year Rolling Returns | |||||

|---|---|---|---|---|---|---|---|

| Scheme Name | Since Launch | Last 5 Years | Last 3 Years | Dec 2013 to Dec 2016 | Dec 2014 to Dec 2017 | Dec 2014 to Dec 2017 | May 2015 to May 2018 |

| S&P BSE 200 TRI | - | 14.46% | 0.68% | 38.74% | 32.80% | 36.49% | 31.75% |

| Mirae Asset Emerging Bluechip Fund | 21.43% | 31.65% | 17.82% | 136.23% | 109.43% | 90.67% | 67.13% |

| Canara Robeco Emerging Equities Fund | 17.67% | 31.57% | 14.87% | 127.29% | 93.27% | 76.31% | 59.30% |

| *Note: Rolling Returns are in absolute terms | |||||||

- The average annual returns by Mirae Asset Emerging Bluechip Fund since inception is 21.43% while that by Canara Robeco Emerging Equities Fund is 17.67%.

- In three-year period, the benchmark has been beaten down badly by both the schemes. Mirae Asset Emerging Bluechip Fund is the topper among these three.

- The five-year return by both the schemes is much more than the return generated by the benchmark S&P BSE 200 TRI. However, if we compare the returns by both schemes, the former one has surpassed the latter.

Risk Management

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | Max Drawdown | Upside | Downside |

| Category | 14.46 | 1.01 | 0.78 | -17.70% | 98 | 104 |

| Mirae Asset Emerging Bluechip Fund | 14.97 | 1.02 | 1.08 | -14.25% | 114 | 100 |

| Canara Robeco Emerging Equities Fund | 17.45 | 1.17 | 0.88 | -21.16% | 113 | 109 |

| As on August 31, 2018 | ||||||

- The standard deviation and Beta of the two schemes is more than that of their category. This shows that the returns of these schemes are prone to fluctuations more, comparatively. In addition to this it can be said that Canara Robeco Emerging Equity Fund is more likely for the same.

- Compared to the benchmark, the Sharpe ratio of the schemes is more which indicates towards the capability of scheme to generate returns with the risk taken. The higher the ratio the better it is as here, it is seen that Mirae Asset scheme has a great Sharpe ratio.

- Talking of the maximum drawdown, the Mirae Asset Scheme is better than the other two while the drawdown of Canara Robeco scheme is much more than the benchmark.

Mirae Asset Emerging Bluechip Fund G

- The one-year return generated by this scheme is 4.69%, three-year return is 17.17% and five-year return is 31.24% as on September 27th, 2018. This shows that the returns have only increased with time and that too by a good margin.

- The best performance of this scheme has been when it generated 107.82% as the rate of return in the period September 2013 to September 2014.

- Its worst performance was as low as -19.97% for the period November 2010 till February 2011.

Canara Robeco Emerging Equities Fund G

- This scheme generated one-year return of 3.34%, three-year return of 14.13%, and five-year returns of 31.03% as on September 27th, 2018. The rate of return has risen with time which is a good sign of growth.

- The best return has been yielded by this scheme in the form of 184.76% for the period of March 2009 till March 2010.

- During the period of December 2007 to December 2008, this scheme has yielded negative return of -67.47%.

Which One to Choose? Mirae Asset Emerging Bluechip Fund or Canara Robeco Emerging Equities Fund

After going through all the major points, let’s see what we can conclude from them.

- Talking of performance, Mirae Asset Emerging Bluechip Fund is clearly the winner, it has surpassed Canara Robeco Emerging Equities Fund in all the scenarios.

- Risk-wise, scheme by Mirae Asset Mutual Fund has managed it nicely with good a Sharpe ratio.

- Canara Robeco Emerging Equities Fund has diversified the stocks across the companies more than the other scheme.

- Consistency of both the schemes is good. The best and worst periods of Canara Robeco Emerging Equities show that it has fluctuated much more as the return are high in best period but are very low in the worst period.

Overall, Mirae Asset Emerging Bluechip Fund appears to be the right choice in terms of performance, risk management, and consistency.

Conclusion

Selection of the right scheme mainly depends on the investor’s needs and portfolio’s requirement. Make sure that you conduct proper research regarding the scheme you are willing to invest in. If you are willing to add Mirae Asset Emerging Bluechip Fund to your portfolio or even Canara Robeco Emerging Equities Fund, then all you need to do is log in to MySIPonline. For any assistance any time, feel free to connect with our experts on the same platform. You may post an investment related query here.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Must Read