Table of Contents

- Overview of SBI Focused Fund

- Analysing the Performance Consistency of the SBI Focused Fund

- Introduction to the Fund Manager of the SBI Focused Fund and His Investment Strategy

- Current Top Holdings of the SBI Focused Fund

- Portfolio Composition of the SBI Focused Fund

- Analysing the risks associated with the SBI Focused Fund

- Is the SBI Focused Fund a Good Investment in 2026?

- Tax Implications in the SBI Focused Fund

- Should You Invest in the SBI Focused Fund in 2026?

- Concluding SBI Focused Fund Review

Imagine investing in a fund whose manager bets 46% of the assets on just 10 stocks and still manages to deliver 16.46% rolling returns. Sounds unreal, right? But the SBI Focused Fund, the equity-focused scheme from SBI Mutual Fund and its fund manager, Rama Iyer Srinivasan, made it a reality.

Did you know the SBI Focused Fund has turned a simple SIP into 18.43% returns over three years, beating its benchmarks? Well, this is not the only achievement. It has also delivered consistent rolling returns and that too with efficient risk management.

Looks perfect for the market vibes in 2026, but does it fit in your portfolio? Let us figure it out by analysing its performance, risks, portfolio, strategies and many more things in this SBI Focused Fund Review. So, dive in to know if it is your next big move.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Overview of SBI Focused Fund

The SBI Focused Fund (Previously known as SBI Focused Equity Fund) is an open-ended Equity mutual funds scheme from SBI Mutual Fund, launched on January 1, 2013. It primarily invests in a concentrated portfolio of equity and equity-related instruments to gain capital appreciation in the long term. It typically holds a maximum of 30 stocks from different market sizes to achieve strong growth. The fund is highly suitable for aggressive investors seeking long-term capital appreciation through a focused portfolio.

Here are the basic details of the SBI Focused Fund:

| Factors | Value |

|---|---|

| AMC | SBI Mutual Fund |

| AUM | Rs 42,773 Crore |

| Current NAV | Rs 432 (as of 7 January) |

| Benchmark | Nifty 500 TRI |

| Expense Ratio | 0.74% |

| Exit Load | 0.25% if redeemed within 30 days and 0.10% if redeemed after 30 days but on or before 90 days |

| Risk Level | Very High |

| Minimum SIP Amount | Rs 500 |

| Minimum Lump Sum Amount | Rs 5,000 |

Now, let us analyse the performance of this fund in the market.

Best Mutual Funds for 2026 Backed by Expert Research

Analysing the Performance Consistency of the SBI Focused Fund

Here is the detailed analysis of the rolling returns and SIP returns of this fund compared to its benchmark and peers:

Rolling Returns and Consistency

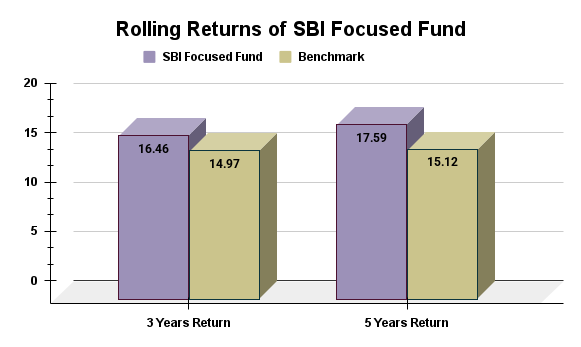

Rolling returns show how steady investments are over different time periods. For this Focused Mutual Funds, the rolling returns have consistently outperformed its benchmark. Look at the graph below for a comparison:

The above graph shows that the rolling returns of this fund have outperformed its benchmark by around 1.50% difference over 3 years and by around 2.50% difference over 5 years. In terms of consistency, the fund has beaten the benchmark for both time frames.

SIP Returns

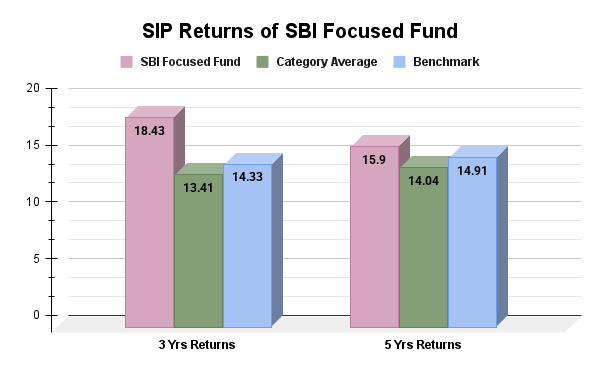

The SBI Focused Fund delivers impressive returns for investors using a SIP. It generated 18.43% growth over three years and 15.9% over five years. These figures exceed the category averages of 13.41% and 14.04% with a broad difference, as well as the benchmark at 14.33% and 14.91%. Look at the graph below:

These results highlight how rupee-cost averaging helps manage market fluctuations, allowing the fund's strong investment choices to benefit steady investors.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Now, let us meet the mastermind behind the success of the fund and understand the strategy he follows.

Introduction to the Fund Manager of the SBI Focused Fund and His Investment Strategy

Managing the SBI Mutual Fund since its inception (2004) as the head of equity, the fund manager uses the strategy called Growth at a Reasonable Price (GARP). He plans to involve only 30 stocks and use a mix of domestic and international investments to take advantage of strong opportunities in companies of all sizes.

The name of the one who has come up with this master plan is Rama Iyer Srinivasan. He is not an ordinary person, he holds over 20 years of experience in asset management. He has previously worked with top firms like Motilal Oswal, Principal AMC, Oppenheimer & Co. and Indosuez WI Carr.

Srinivasan has been operating the SBI Focused Fund since its launch; his specialty is to select stocks from a bottom-up approach with a focus on growth. He focuses on strong investments in quality companies. Under his guidance, the main goal of the fund is to generate long term capital by investing in a concentrated portfolio of high-quality equity and equity-related instruments with strong growth potential.

His confident choices of the stocks show the fund's potential, as 46% of the fund's assets are allocated to the top 10 stock picks. His long tenure has contributed to the fund's consistent outperformance through market cycles. With his experience, the fund shows a normal turnover rate at 37% and the fund is moderately active in adjusting its stock weightings to take advantage of market opportunities, while still sticking to a clear investment strategy.

Must Read: Top 10 Mutual Funds for SIP in 2026: Best Picks to Grow Wealth

Let us get to know what the top 10 holdings of this fund, picked by the fund manager, Rama Iyer Srinivasan.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Current Top Holdings of the SBI Focused Fund

Here is the list of the top 10 holdings of the SBI Focused Fund, which make up to 46% of the fund's assets:

| Rank | Stock Name | Allocation |

|---|---|---|

| 1 | Alphabet Inc Class A | 8.71% |

| 2 | HDFC Bank Ltd | 6.60% |

| 3 | Muthoot Finance Ltd | 6.13% |

| 4 | State Bank of India | 5.26% |

| 5 | Bajaj Finserv Ltd | 4.90% |

| 6 | Bharti Airtel Ltd (Rights) | 4.84% |

| 7 | Kotak Mahindra Bank Ltd | 4.47% |

| 8 | Bajaj Finance Ltd | 4.34% |

| 9 | EPAM Systems Inc | 4.30% |

| 10 | Adani Power Ltd | 3.79% |

Next, you will explore the portfolio allocations of this fund, so keep reading.

Portfolio Composition of the SBI Focused Fund

The analysis of portfolio composition of the SBI Focused Fund will include its allocations across market capitalisations, asset classes and different sectors, which are:

Market Cap Allocation

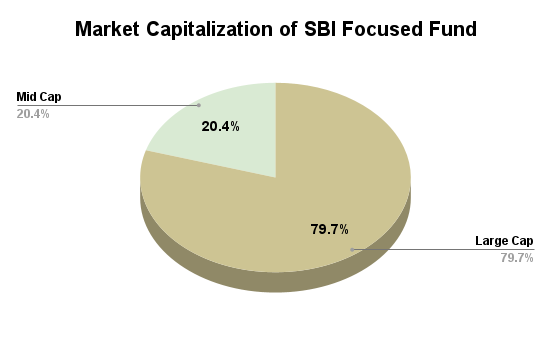

This fund invests only in large and mid-cap stocks for consistent growth over time. With this exposure, the SBI Focused Fund keeps things stable with some growth factors. The fund has allocated most of its portfolio in large-caps, that is, 79.65% and the rest is in mid-caps (20.35%).

The fund does not invest in small companies. This helps you avoid large price changes. This strategy is suitable for investors who want stable returns and aim to match benchmarks.

Asset Allocation

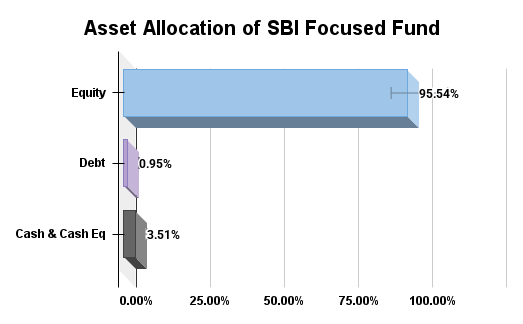

This fund outperforms its benchmark and peers consistently, with a 95.54% focus on equity. It has minimal debt for added stability and holds cash to take advantage of market dips without needing to sell assets. The low cash levels allow for full market gains, which explains the 17.59% rolling returns over five years and 87% consistency. Look at the graph below:

However, because it invests entirely in equity, it can be volatile, so this fund is suitable for patient, aggressive investors rather than conservative ones.

Sector Allocation

SBI Focused Fund is investing in areas that support India's growth. It has 31.7% of its investments in financials, which is higher than the category average of 29.94%, as it provides stability during uncertain times. It also has 17.85% in technology and 15.86% in consumer discretionary, as these sectors drive innovation, including global companies. It also includes energy and utilities at 9.47% and materials at 9.25% to benefit from infrastructure.

These choices are not random; they reflect a smart strategy. Banks are driving a credit boom, technology is expanding through digital growth and consumers are spending more as their incomes rise.

Also Read: Top Performing Equity Mutual Funds 2026: Highest Return Picks

Moving on, let us analyse the risks associated with this fund's investment.

Analysing the risks associated with the SBI Focused Fund

The SBI Focused Fund shows strong performance with its risk statistics. It has lower volatility at a standard deviation of 10.49, compared to the average of 12.81 of other mutual funds in its category. A standard deviation below 11% means smoother rides than other investments. It also has an excellent Sharpe ratio of 1.05, which is better than the 0.79 average and over 1, which indicates that the fund will generate good returns for the level of risks taken.

The fund’s alpha is 4.02, surpassing the 1.06 benchmark, showing that the managers are providing real value above market benchmarks and its defensive beta is 0.73, lower than the average of 0.92. A beta below 0.8 helps keep things steady during market downturns. Look at the table below:

| Risk Factors | SBI Focused Fund | Category Average |

|---|---|---|

| Standard Deviation | 10.49 | 12.81 |

| Sharpe Ratio | 1.05 | 0.79 |

| Alpha | 4.02 | 1.06 |

| Beta | 0.73 | 0.92 |

These figures indicate that the fund effectively manages risk while driving returns. This success comes from smart investments in financials (31.7%) and technology (17.85%).

In the next section, let us look at the analysis of the fund's stock and determine if it is a good investment in 2026.

Is the SBI Focused Fund a Good Investment in 2026?

If your investment objective is to achieve growth while managing risk efficiently, then the SBI Focused Fund is the best bet for you. The stock quality metrics strongly support this statement.

Stock Quality Analysis

The portfolio of this fund has a P/E ratio of 28.91, which is higher than the category average of 23.84. This suggests investors are betting on strong growth companies. The earnings growth is 14.17%, sales growth is 15.09% and cash flow growth is 13%. These are impressive numbers that indicate the fund is made up of profitable companies. This performance has led to a 3-year annual return of 18.43% and a Sharpe ratio of 1.05.

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 15.09% |

| Earnings Growth | 14.17% |

| Cash Flow Growth | 13% |

| P/E Ratio (Valuations) | 28.91 |

A higher P/E ratio means that investors are willing to pay more for companies known for their quality. These companies show strong sales and cash flow growth, which helps explain their higher returns. The investment strategy has an alpha of 4.02 and a beta of 0.73, indicating some defense against market fluctuations.

This portfolio has sector allocation that benefits from India’s growth in capital spending and consumer spending, especially with recent cuts from the RBI. With a focus on larger companies (80% of the portfolio), it is highly suitable for doing a SIP in 2026.

But, in 2026, the is a good option for aggressive investors who plan to invest for more than five years. It performs better than others in its category in terms of returns, risks and quality. Consider starting a SIP now for a successful future ahead.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

Lastly, let us understand the tax implications of the fund.

Tax Implications in the SBI Focused Fund

The SBI Focused Fund is one of the equity mutual funds, meaning it invests over 65% of its money in stocks. This fund follows specific tax rules in India for both capital gains and dividends. Here are the capital gain taxes of this fund, which depend on the holding period of the units:

| Holding Period | Tax Treatment | Rate / Details |

|---|---|---|

| Short-Term (< 12 months) | STCG | 20% flat + surcharge + 4% cess |

| Long-Term (> 12 months) | LTCG up to ₹1.25 lakh / year | Exempt |

| Long-Term (> 12 months) | LTCG above ₹1.25 lakh / year | 12.5% + surcharge + cess (no indexation) |

Next, you will see if your portfolio is suitable for this fund and if you should include it in your portfolio.

Should You Invest in the SBI Focused Fund in 2026?

You can consider investing in the SBI Focused Fund in 2026 if your profile matches the one given below.

The Ideal Investor Profile

- High to very high risk tolerance.

- A long-term investment horizon, typically 5-7 years or more.

- If you aim for long-term wealth creation and capital appreciation.

- Suitable for investors who understand that equity investments are subject to market risks.

The SBI Focused Fund can be a suitable option for providing diversification to an existing, more conservative portfolio.

Concluding SBI Focused Fund Review

In short, the SBI Focused Fund is a good choice for investors willing to take on moderate risks and looking for growth over five years or more. It focuses on quality investments and has a smaller portion (15-25%) in riskier assets, which perform well in strong market years like 2026.

It also provides great returns through SIP and has strong risk statistics. Just keep an eye on your overall exposure to avoid unexpected value changes.

Related Blogs:

- Top 5 Mutual Funds for Lumpsum Investment 2026: Expert Picks

- Smart SIP Strategy to Build a ₹2 Crore Wealth in 2026

FAQs

-

How quality-focused is the SBI Focused Fund's portfolio?

The fund focuses on quality, that is, a high P/E ratio, good earnings, sales and cash flow growth, only focusing on 25-30 stocks.

-

Who should invest in the SBI Focused Fund?

Investors with high risk tolerance and a more than 5-year investment horizon, seeking growth over time, can invest in this.

-

Can I invest in the SBI Focused Fund via a lump sum or only SIP?

You can invest in the SBI Focused Fund both ways. It allows a lump sum of Rs 5000 and an SIP of Rs 500.

-

How does the SBI Focused Fund fare in bear markets?

A defensive beta of 0.73 of the fund helps reduce losses. Its focus on large-cap stocks for stability, which make up 79.65% of our portfolio.

-

Where to buy the SBI Focused Fund and track performance?

You can buy via popular investment platforms, apps or directly from the fund house website.

.webp&w=3840&q=75)

.webp&w=3840&q=75)