Table of Contents

- JioBlackRock Flexi Cap Fund NFO: Key Details

- What is the JioBlackRock Flexi Cap Fund?

- What Powers JioBlackRock Fund with AI (Aladdin) + SAE

- JioBlackRock Flexi Cap Fund: Investment Strategy

- JioBlackRock Flexi Cap Fund: Asset & Portfolio Construction

- JioBlackRock Flexi Cap Fund NFO Suitability

- How JioBlackRock Flexi Cap Fund Manage Risk?

- Who Should Invest in JioBlackRock Flexi Cap Fund?

- To Conclude: JioBlackRock Flexi Cap Fund Review

The newly launched JioBlackRock Flexi Cap Fund NFO is now live! Opening for subscription on 23rd September and closing on 7th October 2025, this exciting fund offers investors a unique blend of AI technology and active equity investing in India.

What's the buzz about? Powered by Jio Financial Services and global investment leader BlackRock. This innovative scheme falls under the Flexi Cap Fund category and brings the Systematic Active Equity (SAE) approach, allowing you to build a diversified, technology-driven portfolio.

This latest NFO is based on the JioBlackRock Flexi Cap Fund's slogan, "Cutting through the noise, a smarter way to invest."

So, without further delay, let us dive into the most exciting fund launch of 2025, JioBlackRock Flexi Cap Fund Review.

JioBlackRock Flexi Cap Fund NFO: Key Details

Here are the key details about the newly launched NFO by Jio BlackRock:

| Field | Details |

|---|---|

| Scheme Name | JioBlackRock Flexi Cap Fund |

| Issue Open Date | September 23, 2025 |

| Issue Close Date | October 7, 2025 |

| Category | Flexi Cap - Active Equity (Open-ended) |

| Benchmark | Nifty 500 Total Return Index (TRI) |

| Minimum Application Amount (Rs.) | ₹500 (Lump Sum / SIP) |

| Fund Managers | Tanvi Kacheria, Sahil Chaudhary |

| Plans & Options | Regular & Direct; Growth & IDCW (Dividend) |

| Facilities Offered | SIP, SWP, STP, Online Digital Access |

What is the JioBlackRock Flexi Cap Fund?

The JioBlackRock Flexi Cap Fund is an open-ended dynamic equity scheme in the first actively managed flexi-cap category. It invests in large, mid, and small-cap stocks, aiming for long-term capital appreciation.

This flexi-cap fund allows the fund manager to make decisions and adapt the portfolio based on market conditions.

However, this takes all the attention from the market as it is powered by AI technology (Especially Aladdin tech + Systematic Active Equity (SAE) from BlackRock, which combines human insight and the power of technologies and machine learning.

What Powers JioBlackRock Fund with AI (Aladdin) + SAE

At the heart of the JioBlackRock Flexi Cap Fund is Aladdin®, BlackRock’s own AI-powered risk management and investment analysis platform.

Aladdin® performs thousands of stress tests weekly, tracking risks across over 5,000 factors, including interest rates, political instability, currency fluctuations, etc.

This SAE approach and Aladdin support fund managers opinin and secure the portfolio by diversification.

The Systematic Active Equity (SAE) approach adds value by combining machine learning, alternative data, and human expertise.

It analyses macro-economic trends, social media sentiment, consumer behaviour and more, providing unbeatable insight that traditional strategies cannot match.

_68dbd0b3cb757.png)

Why Aladdin® Matters

- AI-Powered Signals: 1,000+ Indian stocks with 400+ India-specific signals.

- Bench-Aware:Aladdin helps track risks across the entire market, maintaining a portfolio that adapts dynamically to shifts in market conditions.

- Institutional Backing:Aladdin powers BlackRock's global operations, managing over $11.6 trillion in assets, giving JioBlackRock a state-of-the-art technology.

Start Your SIP TodayLet your money work for you with the best SIP plans.

JioBlackRock Flexi Cap Fund: Investment Strategy

This fund follows a modern investment strategy called as Systematic Active Equity (SAE) approach that blends advanced technology with human expertise to make smarter investment decisions. Here is how it works:

- AI-Driven Quantitative Models: The fund uses artificial intelligence (AI) to analyse huge amounts of market data, helping to identify potential investment chances quickly and accurately.

- Integration of Big Data and Machine Learning: This SAE strategy can adapt the changing market conditions by processing large datasets and using machine learning.

- Human Oversight for Risk Management: The technology plays a major role but experienced fund managers Ms. Tanvi Kacheria and Mr. Sahil Chaudhary expertise lead to the mitigation of risk.

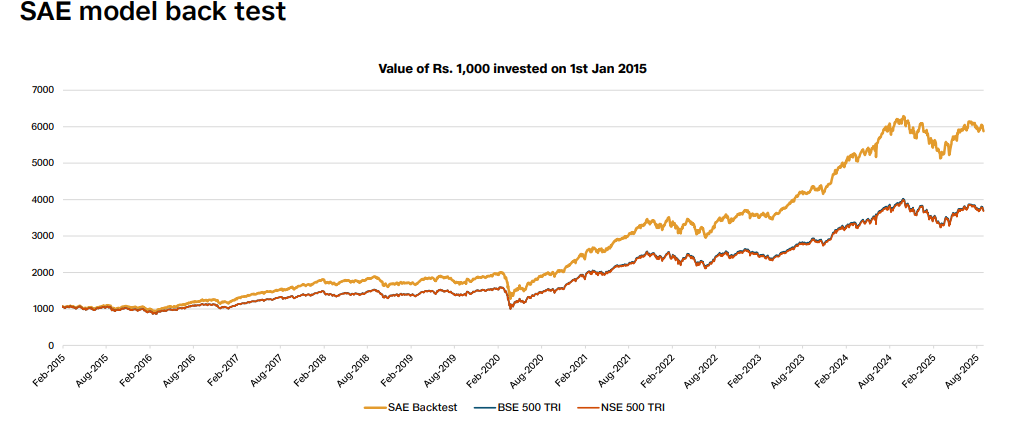

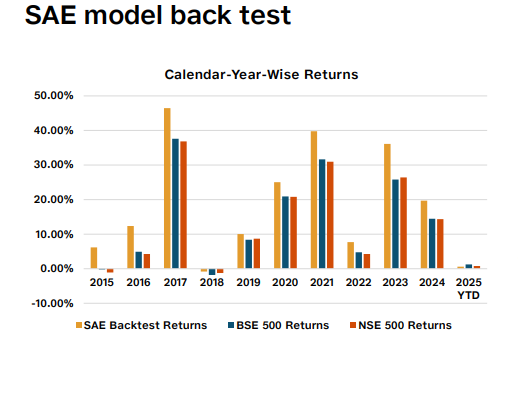

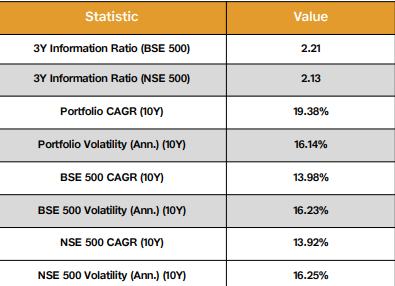

- Back-Tested Performance Metrics: The strategy has been tested using historical data to calculate its effectiveness, providing confidence that it can deliver the desired outcomes.

- Mitigate Market Volatility: Investors can also invest in the fund via Systematic Investment Plans (SIP), which build disciplined and regular investments over time.

JioBlackRock Flexi Cap Fund: Asset & Portfolio Construction

The JioBlackRock NFO offers flexible asset allocation across large, mid, and small-cap stocks, adapting to market conditions. Unlike traditional multicap funds, the fund manager can allocate capital within limits.

Portfolio Strategy:

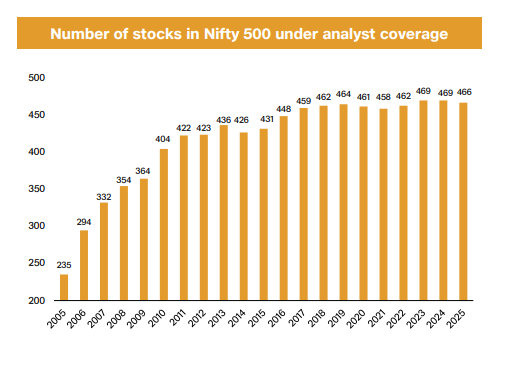

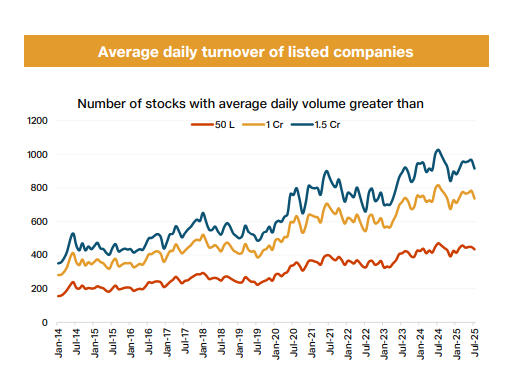

- Stock Selection: Aladdin analyses over 1,000 stocks across multiple sectors or market caps and reduces them based on liquidity, growth potential and risk factors.

- Risk Control: The SAE approach secure constant monitoring of risks, making adjustments based on real-time data & historical performance.

- Benchmark-Aligned: The fund is benchmarked against the Nifty 500 TRI, providing a broad market exposure across 500 of India’s top companies.

JioBlackRock Flexi Cap Fund NFO Suitability

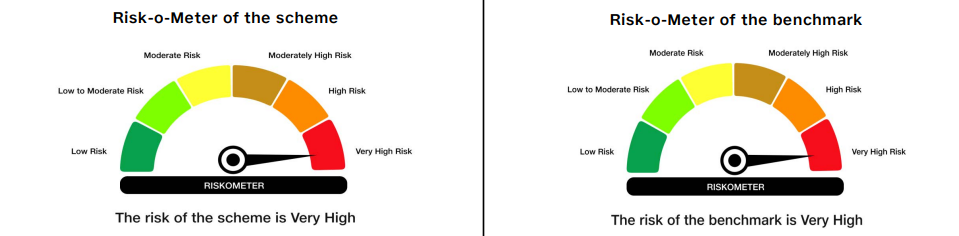

The JioBlackRock Flexi Cap Fund is an equity mutual fund and thus carries market risk, it is prepared to manage that risk.

Due to its equity exposure, the fund is rated as very high risk, which may not suit those with a low tolerance for volatility.

This JioBlackRock mutual fund is best for long-term investors such as 5- 7+ years who want growth and diversified equity exposure.

*Since it is a new fund with no performance history, start small and track its progress for 6-12 months before investing more.

How JioBlackRock Flexi Cap Fund Manage Risk?

Here are a few key measures that the JioBlackRock mutual fund uses to manage risk:

- It uses stock sizing rules to prevent overexposure to any single asset, ensuring a balanced approach.

- The fund also focuses on diversification across sectors and market caps to reduce overall risk.

- Additionally, human experts ensure that the portfolio is actively monitored and adjusted as required using AI and technology.

Who Should Invest in JioBlackRock Flexi Cap Fund?

Before considering this fund know these key points:

- The JioBlackRock Flexi Cap Fund is ideal for investors looking for long-term growth due to its combines technology-driven with active management to help you get financial goals.

- It also includes tech-savvy investors that are comfortable with AI-driven strategies, offering a unique chance to invest in an innovative and data-backed approach.

- This fund is best suited for you if you have a moderate to high-risk tolerance.

Smart Investments, Bigger Returns

To Conclude: JioBlackRock Flexi Cap Fund Review

In conclusion, the JioBlackRock Flexi Cap Fund is an innovative latest NFO for 2025. Its AI-powered strategies, global expertise and flexible investment approach offer a unique opportunity for investors seeking to diversify and grow their portfolios.

Do not miss out, subscribe today and be part of this newly funded NFO launch!

.webp&w=3840&q=75)

.webp&w=3840&q=75)