The wait is finally over! From basic living to luxury lifestyles, the newly launched Motilal Oswal Consumption Fund NFO 2025 is here to enter into India’s next phase of growth.

Opening for subscription on 1st October and closing on 15th October 2025, this thematic fund aims to rise in consumer spending that is taking India’s economy to cloud nine.

Guided by the motto “Think Equity, Think Motilal Oswal,” the fund invests in industry titans from FMCG to digital platforms. As India builds its position as one of the largest and fastest-growing consumer markets, this latest NFO offers investors a front-row seat to the country's expanding consumption journey.

So, let us explore one of the most exciting fund launches of 2025 the Motilal Oswal Consumption Fund Review.

Motilal Oswal Consumption Fund NFO: Key Details

Here are the basic details of the newly launched NFO by Motilal Oswal AMC:

| Scheme Name | Motilal Oswal Consumption Fund |

|---|---|

| Issue Open Date | 1 October 2025 |

| Issue Close Date | 15 October 2025 |

| Category | Open-ended Thematic Equity (Consumption Theme) |

| Benchmark | Nifty India Consumption TRI |

| Minimum Application Amount (Rs.) | Rs. 500 (SIP/lumpsum) |

| Fund Managers | Mr. Varun Sharma & Mr. Bhalchandra Shinde |

| Plans & Options | Direct & Regular Plans, Growth & IDCW |

| Facilities Offered | SIP, SWP, lumpsum |

What is the Investment Strategy of Motilal Oswal Special Consumption Fund?

The Motilal Oswal Consumption fund blends high-quality businesses with high-growth opportunities to capture India’s expanding consumption story.

This newly launched NFO Motilal Oswal Consumption Fund

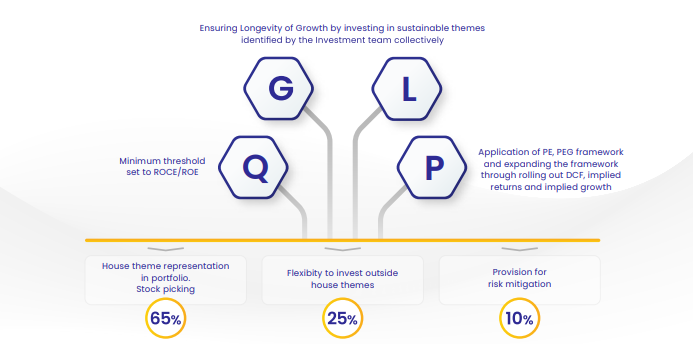

follow a unique approach called "QGLP" which stands for Quality, Growth, Longevity and Price.

This approach helps Mr. Sharma to pick companies that have:

- Quality – solid balance sheets and reliable management,

- Growth – consistent earnings & expanding business opportunities,

- Longevity – the ability to stay connected for years &

- Price – stocks available at a reasonable value.

The portfolio is built with about 65% in core consumption companies, 25% flexibility to invest outside the theme and 10% kept for risk management.

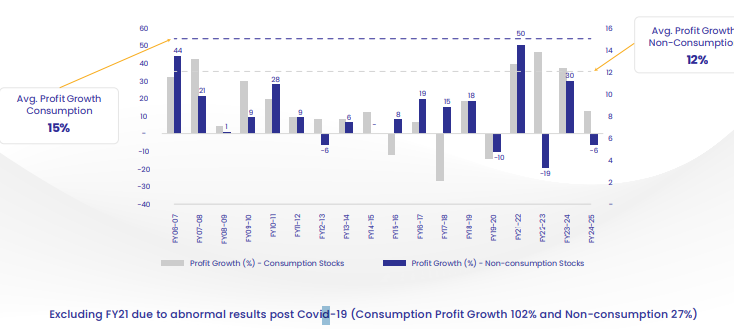

Motilal Oswal calls this a “Hi-Quality, Hi-Growth” approach. It simply means that this fund invests in companies that are both financially strong and capable of long-term growth. To help investors benefit from the power of quality and growth together.

Must Know: Should You Invest in NFOs?

Why the Consumption Theme Matters for Long-Term Investors

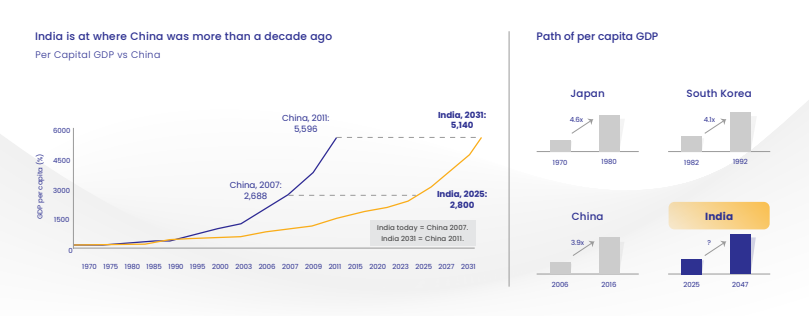

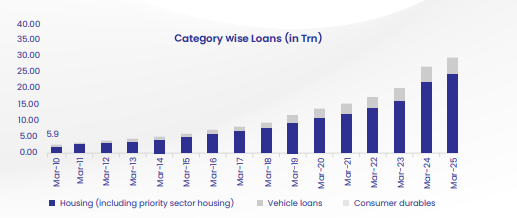

India is one of the largest & fastest-growing consumer discretionary markets in the world. As incomes rise and lifestyles change, people are spending more disposable income on everything from food and fashion to housing, travel and the digital world.

The Motilal Oswal Consumption Fund focuses on strong businesses like FMCG, retail, automobiles, financial services and digital platforms sectors that form the backbone of India’s consumption story.

For long-term investors, this theme offers both stability and consistent growth, as needs and wants become essential nowadays. India’s middle class continues to progress with time.

Don’t Miss: New NFO Alert: JioBlackRock Flexi Cap Fund – Active Equity

Asset Allocation and Sector Exposure of the Consumption Fund

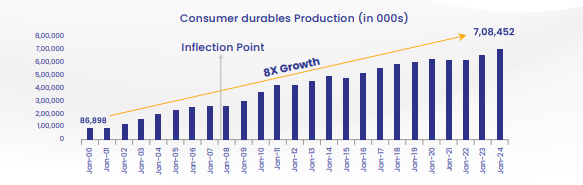

The Motilal Oswal Consumption Fund invests mainly in equity and equity-related assets of companies that support India’s consumption growth. The portfolio blends FMCG, retail, automobiles, financial services and consumer durables to pick up both essential and lifestyle spending.

The funds focus moves from “Kal” (essentials) to “Aaj” (lifestyle) and further to “Kal” (experiences), showing how Indian consumers are shifting from basic needs to luxury products and experiences.

Around 65% of the fund stays within the core consumption theme, 25% for diversification and 10% is taken for risk management.

Motilal Oswal Consumption Fund Performance and Who Should Invest

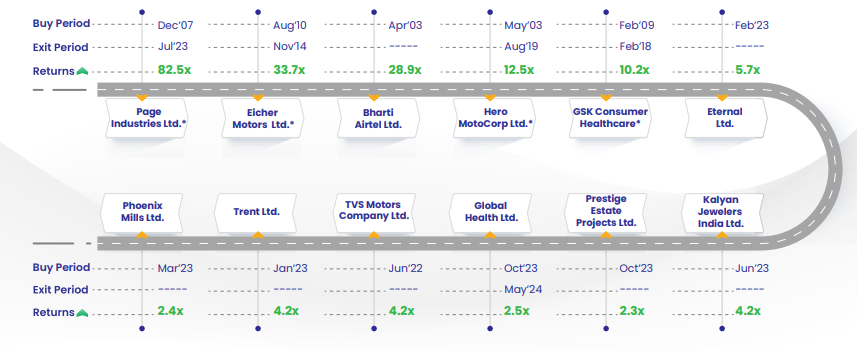

Mr Varun Sharma & Niket Shah are the mastermind fund manager behind Motilal Oswal Consumption Fund, there expertise and deep knowledge lead this fund, supported by Motilal Oswal AMC’s strong research and QGLP framework, the fund approach helped the AMC to build a solid track record in equity schemes.

This bring the question" So, who should consider investing?"

This fund is ideal for long-term investors who want exposure to India’s growing consumption market and can handle short-term market trends.

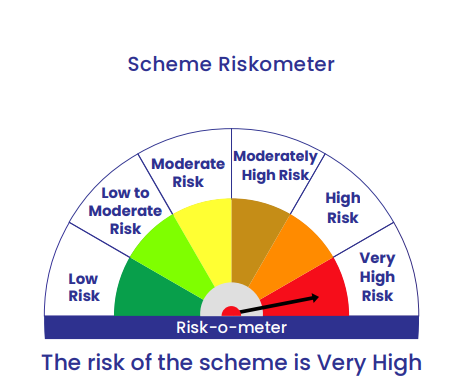

As in the riskometer, it indicated very high risk beating the benchmark Nifty India Consumption TRI.

It suits those looking to diversify their portfolio with a thematic equity fund focused on long-term capital appreciation by investing in equity & related securities of companies linked to India’s consumption and consumer-driven sectors.

Investors looking for consistent compounding returns through high-quality, growth-oriented companies. This latest NFO is smart addition to your portfolio for equity allocation, for better returns invest for at least five years or more.

Conclusion

To wrap up the Motilal Oswal Consumption Fund Review, it can be said that if you prefer to invest in a growth-oriented thematic fund focused on India’s rising consumer demand, this NFO could be a smart choice.

With sectors, this fund turns out to be one of the best NFOs of 2025 for investors who believe in India’s consumption story.

You can start investing through a lumpsum or by SIP even with 500 a month is gradually increase your investment over time.

.webp&w=3840&q=75)