Table of Contents

Ever thought, "I should have invested in that sooner"? Often, we overlook opportunities at first that prove to be valuable later. Right now, you have a great chance with the NFO Invesco India Manufacturing Fund.

Yes, the NFO has opened for investment from July 25th, 2024, and will close on August 8th 2024. In the coming blog, the expert will share with you the details about this fund along with benefits and the reasons as to why and who may invest in it.

Basic Fund Details

| Basic Details | Information |

|---|---|

| Scheme Name | Invesco India Manufacturing Fund |

| Issue Open Date | 25.07.24 |

| Issue Close Date | 08.08.24 |

| Category | Thematic- Manufacturing |

| Benchmark | Nifty India Manufacturing TRI Index |

| Minimum Application Amount | Rs.1000 |

| Fund Managers | Mr. Amit B. Ganatra and Mr. Dhimant Kothari |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

Before diving into what this scheme holds, let us look at the promising future of the Manufacturing Sector.

How the Manufacturing Sector Has Fared So Far?

India's manufacturing sector is growing rapidly with full support from government policies and a strong market. After years of slower growth, manufacturing has picked up pace, with recent growth rates of 8-8.5%, surpassing overall economic growth.

Now making up 14.2% of the economy, it's expected to grow to 21% by 2034, with output rising from $459 billion in FY24 to $1,657 billion by FY34.

Key advantages include a vast domestic market, competitive costs, and robust government support like the PLI scheme and free trade agreements. This makes India an exciting and attractive hub for manufacturing growth.

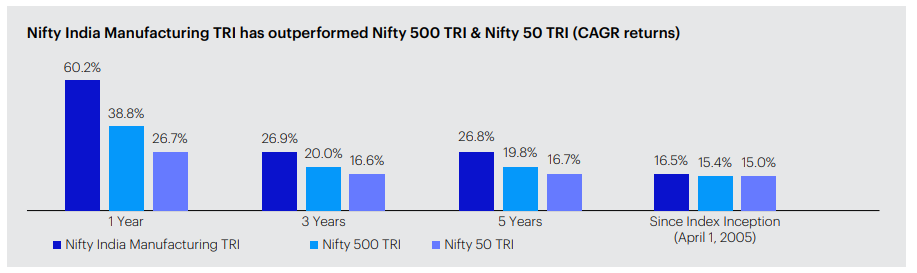

Let us shed some light on the statistics with the help of a graph:

In the above graph, the Nifty India Manufacturing TRI has shown impressive performance compared to the Nifty 500 TRI and Nifty 50 TRI. In the past year, it has outperformed these benchmarks by over 32%. Over the last 3 and 5 years, it has maintained a lead of around 6.9% and 7% respectively. Even over 20 years (up to April 1, 2023), it has surpassed the Nifty 500 TRI by about 1.1%. This consistent outperformance highlights the strong growth and potential of the Indian manufacturing sector, making it a promising area for investment.

Investment Strategy of Invesco India Manufacturing Fund

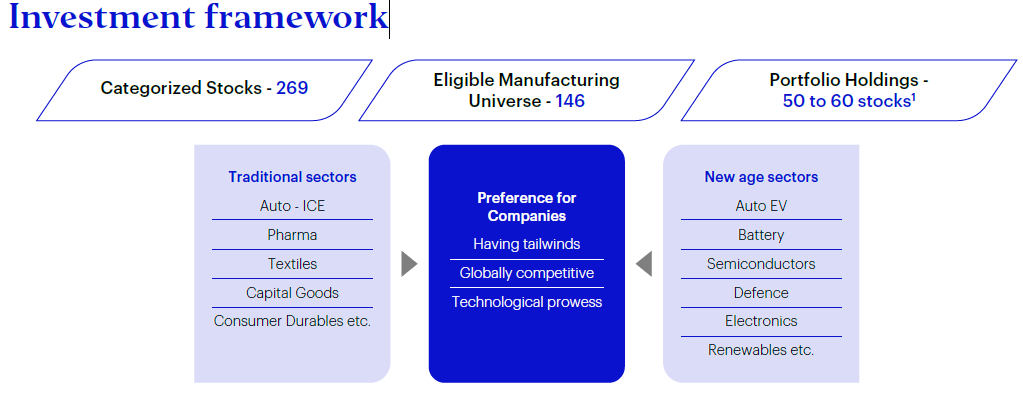

It lives up to its tagline, which is, that the market might be topsy-turvy. Your portfolio does not have to be. Therefore, it follows an investment strategy focused on building a 50-60 stock portfolio from a universe of 269 stocks, including 33 large-cap, 48 mid-cap, and 65 small-cap stocks.

You can check the below picture for more clarity:

It presents a strong portfolio which targets companies with growth potential, favorable policies, global competitiveness, and tech innovation, spanning both traditional (e.g., auto, pharma) and new-age sectors (e.g., EVs, semiconductors).

Therefore, this Mutual Funds scheme is launched with specific positive pre-set notions to provide a unique opportunity to its investors.

Let’s delve into learning the about the management of this new scheme.

Masterminds of Invesco India Manufacturing Fund

The Invesco India Manufacturing Fund is in good hands with Mr. Amit having 21 years in equity research, is the Director & Head of Equities at Invesco and Mr. Dhimant, a Chartered Accountant with 20 years of experience, has managed around INR 65 billion in assets for over 6 years. Their extensive knowledge in manufacturing and industrial sectors means they are well equipped to manage this fund effectively.

Who Should Invest in Invesco India Manufacturing Fund?

This fund suits investors who plan to invest for 5-8 years. Managed by Invesco India Mutual Fund, it benefits from the strong reputation of Invesco AMC. Starting an early SIP will be a smart move to boost your portfolio’s growth and flexibility.

Read Our Latest Blog's on Manufacturing Scheme's.

1. Manufacturing Funds Trending: Why You Should Take in Your Portfolio?

2. Top 3 Manufacturing Sector Mutual Funds in India

3. Quant Manufacturing Fund: Comprehensive Review and Analysis 2024

4. Axis India Manufacturing Fund: What Experts Say About It?

5. Review of HDFC Manufacturing Fund: Is it Worth Investing?

.webp&w=3840&q=75)

.webp&w=3840&q=75)