Table of Contents

The Manufacturing Mutual Funds are currently trending as sectoral funds due to their strong performance over the past year. Similar to sector funds, they invest in companies within specific sectors and have the potential to generate high returns. However, their performance may not be consistent due to the cyclical nature of sector growth. Despite this, manufacturing funds are considered the best sectoral mutual funds for several reasons: -

- They offer diversification across industries and sectors within the manufacturing theme.

- The manufacturing segment is expected to experience substantial growth due to government reforms and policies aimed at making India a global manufacturing hub.

- Manufacturing funds typically provide more consistent returns and better risk management compared to sectoral funds.

Selection Parameters of Best Manufacturing Mutual Funds?

When selecting the best manufacturing Mutual Funds, several key factors guide our decision-making process:

-

Investing Strategy

We seek funds that employ a growth investing style, focusing on high-growth, quality companies for the long term, and purchasing them at reasonable valuations or discounted prices.

-

Returns Consistency

Prefer those funds that consistently outperform benchmark indices like nifty 500 or nifty manufacturing index in all market scenarios.

-

Risk Management

We examine how well the fund manages risk by looking at its performance during market downturns, preferring funds with lower volatility and higher Sharpe ratios, which indicate effective risk management

-

Diversified Portfolio

We prefer funds that diversify investments in companies of different sizes, such as large and small caps. Additionally, we ensure proper industry and sector diversification.

-

Quality Stocks

We seek funds investing in quality stocks with low P/E ratios, robust sales and earnings growth, increasing cash flow, and a significant allocation in top-performing companies.

Take the first step towards financial success - Start SIP Now!

Top 3 Manufacturing Mutual Funds

| Scheme Name | Launch Date | AUM (Crore) | 3 Months Returns (%) | 6 Months Returns (%) |

|---|---|---|---|---|

| ICICI Prudential Manufacturing Fund | 07-10-2018 | 3883 | 10.99 | 29.83 |

| Quant Manufacturing Fund | 05-08-2023 | 652 | 9.49 | 32.63 |

| Axis India Manufacturing | 21-12-2023 | 4683 | 14.7 | |

| Category Average | 11.42 | 27.74 | ||

| NIFTY 500 TRI | 3.59 | 13.76 |

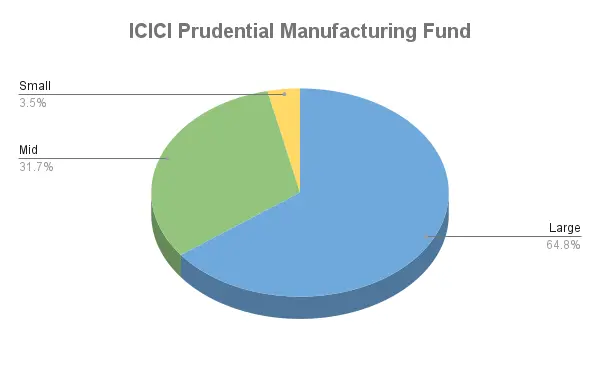

1. ICICI Prudential Manufacturing Fund

The ICICI Prudential Manufacturing Fund is considered the top choice in its category due to its status as the oldest and most successful fund. It has shown an impressive one-year return of 70%, compared to the Nifty 500's 36%. Since its inception, the fund has consistently delivered an average annual return of 26% over five years.

The fund uses a buy-and-hold approach, strategically investing in quality companies and holding them for the long term. ICICI's strong sector analysis allows it to identify trends and capitalize on undervalued stocks, resulting in high returns.

The fund's current portfolio comprises large-cap and mid-cap stocks, with over 50% allocation in sectors such as automobiles, capital goods, materials, and metal mining, all of which are currently trending in the market. For investors seeking a long-term investment with a buy-and-hold strategy and consistent returns, the ICICI Prudential Manufacturing Fund is the ideal choice.

ICICI Pru Manufacturing Fund Stock Holdings

| Stocks | Holdings | 1 Year Returns |

|---|---|---|

| Ultratech Cement Ltd. | 7.79% | 28.73% |

| Maruti Suzuki India Ltd. | 5.87% | 32.90% |

| Larsen & Toubro Ltd. | 5.55% | 53.85% |

| Sun Pharmaceutical Industries Ltd. | 3.64% | 49.75% |

| Siemens Ltd. | 3.62% | 88.47% |

| JSW Steel Ltd. | 3.56% | 25.44% |

| Reliance Industries Ltd. | 3.55% | 26.93% |

| Cummins India Ltd. | 2.97% | 101.86% |

| BEML Ltd. | 2.75% | 161.58% |

| Aurobindo Pharma Ltd. | 2.66% | 88.94% |

explore the latest performance and portfolio updates of ICICI Mnufacturing Fund!

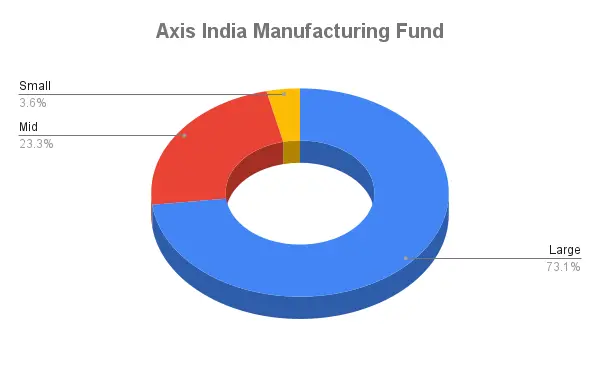

2. Axis India Manufacturing Fund

The Axis Manufacturing Fund has recently been launched and has provided an 11% return in the last 3 months, while the Nifty has only given a 2% return. The reason for choosing this fund is related to Axis's effective investment strategy in the manufacturing sector.

Manufacturing is a growing theme, and Axis specializes in identifying companies with long-term profit potential in this sector. Their investment style focuses on identifying promising companies with high returns on equity and earnings in growing and emerging industries, purchasing them at reasonable valuations, and holding onto them for the long term.

The average sales growth of stocks in the current portfolio is 15.62%, while the earnings growth is 23%, and the cash flow growth on the quality side is 39%. On the valuation side, the pay ratio is 25.64, indicating that the fund is slightly overvalued.

Axis India Manufacturing Fund Stock Holding

| Stocks | Holdings | 1 Year Returns |

|---|---|---|

| Mahindra & Mahindra Ltd. | 5.91% | 104.33% |

| Tata Motors Ltd. | 5.44% | 71.23% |

| Reliance Industries Ltd. | 5.18% | 26.93% |

| Sun Pharmaceutical Industries Ltd. | 5.04% | 49.45% |

| Bajaj Auto Ltd. | 3.64% | 106.30% |

| Bharat Electronics Ltd. | 3.43% | 141.59% |

| Maruti Suzuki India Ltd. | 2.49% | 32.90% |

| Siemens Ltd. | 2.47% | 88.47% |

| Tata Steel Ltd. | 2.40% | 63.68% |

| Cipla Ltd. | 2.38% | 56.77% |

Don't miss out - the valuable insights on the Axis India Manufacturing Fund!

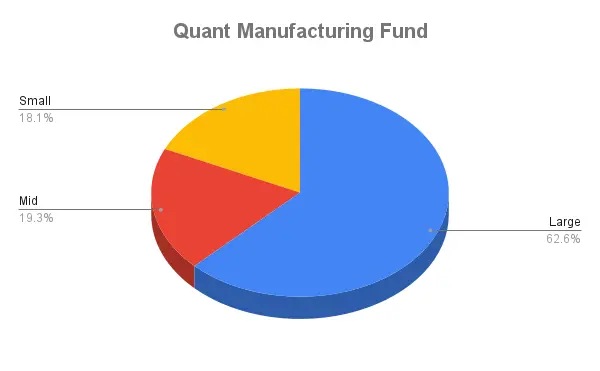

3. Quant Manufacturing Fund

The last fund is based on an active investing strategy, which involves buying trending sectors or stocks at the right time and exiting at the right time to generate high returns. While this strategy carries high volatility risk, it also offers excellent returns. The fund is called the Quant Manufacturing Fund, and it focuses on the growth of the manufacturing theme. In the past 6 months, the fund has provided a 33% return, while the Nifty 50 has only given an 18% return.

One of the key factors behind its strong performance is its portfolio allocation and active management. Quant uses accurate predictive analysis to identify which sectors and stocks will trend in the future, allowing them to strategically time their investments. This approach consistently demonstrates its effectiveness across all their funds.

Therefore, investors seeking high returns by timing industries and stocks within the manufacturing theme can invest directly in this fund without the need for extensive effort.

For example, the fund currently has a significant portion of its investments in small and mid-cap stocks within the power & energy and metal & mining sectors, which are currently trending. This targeted approach allows the fund to generate rapid returns. It's important to note that this fund is not suitable for all investors and is more appropriate for those with an aggressive investment style due to the high short-term volatility risk associated with it."

Quant Manufacturing Fund Stock Holding

| Stocks | Holdings | 1 Year Returns |

|---|---|---|

| Reliance Industries Ltd. | 9.15% | 26.93% |

| Housing & Urban Development Corporation Ltd. | 7.63% | 314.40% |

| Samvardhana Motherson International Ltd. | 7.05% | 95.47% |

| United Spirits | 6.94% | 49.87% |

| Steel Authority Of India Ltd. | 6.04% | 82.13% |

| HDFC Bank 27/06/2024 | 5.70% | - |

| Adani Power Ltd. | 5.12% | 179.20% |

| Britannia Industries Ltd. | 4.69% | 15.62% |

| Aditya Birla Fashion and Retail | 4.73% | 56.69% |

| Arvind Ltd | 4.53% | 195.32% |

| Tata Power Company Ltd | 4.44% | 103.04% |

Is this scheme a good fit for your portfolio? Quant Manufacturing Funds

.webp&w=3840&q=75)