Table of Contents

You would always trust an expert's opinion, right? So, it's worth noting that experts are currently excited to introduce a new opportunity the Axis India Manufacturing Fund, a promising addition to sectoral mutual funds. This manufacturing fund targets rapidly expanding companies within the manufacturing sector, which has shown remarkable growth in recent times. With the support of Axis Mutual Fund's reputation for identifying top-performing investments and consistently delivering high returns. In this analysis, we'll delve into how the fund's strategy positions it for long-term success and the potential for repeating its impressive track record.

What is the Investing Strategy of Axis India Manufacturing Fund?

The Axis India Manufacturing Fund adopts a strategic investment approach by carefully selecting companies across the entire manufacturing sector value chain.

This includes companies that manufacture raw materials, intermediates, capital goods, and consumer durables, as well as those engaged in exports.

However, it focuses on the active allocation in emerging sectors and a bottom-up approach to identify potential winners within the manufacturing theme.

Specifically, this Thematic Fund targets high-quality companies with strong returns on Equity and earnings growth, acquiring them at reasonable valuations.

Utilizing a Multi-cap stock selection strategy with the aim of delivering superior risk-adjusted returns over the long term, and makes us feel confident that investing in manufacturing is a good strategy.

Meet the Mastermind Behind the Axis India Manufacturing Fund

It's great to have Mr. Shreyas Devalkar, an experienced expert in equity and Mutual Funds, leading the Axis Manufacturing Fund. With over 15 years of experience in fund management and equity analysis, he brings a wealth of expertise to the table. Mr. Devalkar has successfully managed prominent funds like Blue-chip, Midcap, and Multi-Cap Funds, showcasing strong strategic portfolio management skills and a proven track record of delivering consistent performance across diverse market segments.

-(1)_666c23097838d.png)

Shreyash Devalkar

Fund Manager

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Now that we know who's leading the way, let's conduct a detailed analysis of the recent performance of the Axis Manufacturing Fund.

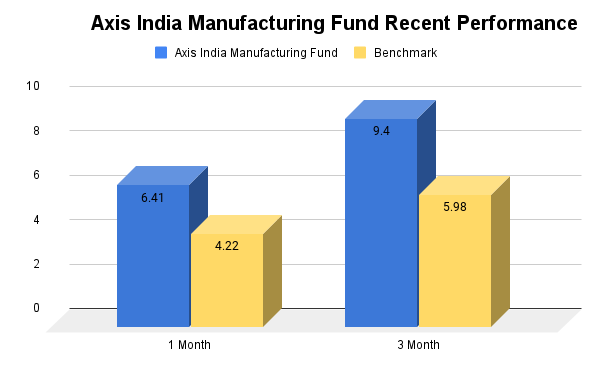

Recent Performance

The Axis Manufacturing Fund has outperformed its benchmark, the NIFTY 500 TRI, in the short term. In the last 1 year, the fund has delivered a return of 6.41%, which is higher than the NIFTY 500 TRI's return of 4.22%. Over the past 3 years, the fund's return is 9.40%, compared to the NIFTY 500 TRI's 5.98%.

While in the 5 year and 10-year NIFTY 500 TRI's have shown impressive returns of 22.23% and 39.57%, respectively.

This performance is particularly promising, as this fund has consistently outperformed the average performance of other Manufacturing Mutual Funds within its category. It is satisfying to observe the fund's outstanding performance across various market conditions.

What Makes the Axis India Manufacturing Fund’s Portfolio Strategy Stand Out?

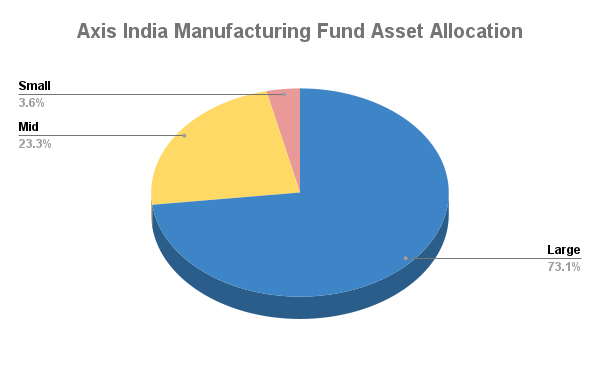

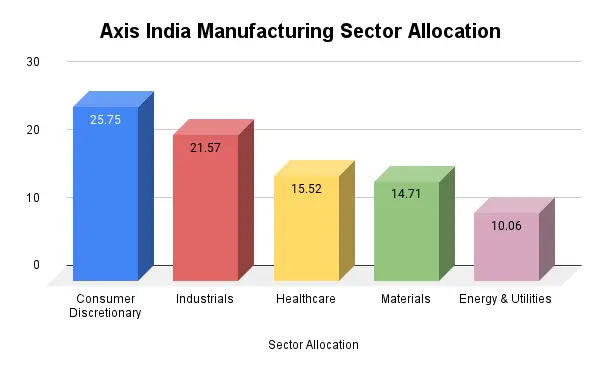

In today’s equity, market allocations heavily favour the service sector, this presents an opportunity to diversify a portfolio with a dedicated thematic fund like Axis Manufacturing MF it is time to know about how its portfolio allocation operates.

The Axis Manufacturing Fund maintains a diversified portfolio with a recent focus on large and mid-cap stocks, comprising 76% of its investments. This strategic allocation targets sectors with high growth potential, balancing risks with the stability of established large businesses for a balanced and diversified approach.

Investments are spread across various sectors like Consumer Discretionary, Industrials, and Healthcare which make up 62% of the allocation. Key holdings include Mahindra & Mahindra Ltd achieving 92% returns and Tata Motors Ltd giving 136.49% returns in 1 year. With this, it has positioned itself for growth and is likely to continue generating high returns in this portfolio.

The fund's recent strategic moves include significant buys such as Hindustan Aeronautics Ltd one of the world's oldest and largest aerospace and defence manufacturers.

and Schaeffler India Ltd., while it has reduced holdings in companies like Sun Pharmaceutical Industries Ltd. and TVS Motor Company Ltd due to their recent decline in short-term performances.

Explore the Top 3 Manufacturing Mutual Funds And Power Up Your Portfolio!

Stock Quality

When we look at the stocks in the Axis Manufacturing Fund, we focus on four key things: sales growth, profitability, cash flow, and the price-to-earnings (PE) ratio. The fund includes companies that are growing fast, with average sales growth of 16% and a profit margin of 23%. These companies also have a 23% increase in cash flow. Even with this strong growth, their PE ratio is relatively low at 25.64, showing that Axis is buying growth companies at reasonable prices. Axis's skill in finding companies with high returns on equity and earnings growth makes it one of the Best Thematic Mutual Fundswith excellent companies in it.

Suitability

The Axis Manufacturing Fund is well suited for investors who exhibit a high appetite for risk and possess a long-term investment horizon spanning 3 to 5 years. The fund focuses on the dynamic manufacturing sector, which is known for its in-built market volatility, it appeals to investors comfortable with taking on higher levels of risk. By investing with SIP you can reduce some risk with long term growth. Axis's track record of identifying and investing in growing companies further solidifies this fund as a strong choice for investors seeking substantial returns over the medium to long term. This fund is growth-oriented, so if you want to produce alpha and are interested in the industrial industry, this scheme is meant for you.

Transform your financial future with ICICI Manufacturing Mutual Fund - where growth meets opportunity!

.webp&w=3840&q=75)

.webp&w=3840&q=75)