Table of Contents

SBI Mutual Funds is a very well-known fund with a legacy of 36 years and also trusted as India's flagship government-backed mutual fund. SBI Mutual Funds offers a SIP plan that allows investors to regularly invest a fixed amount on a weekly, monthly, or quarterly basis. This strategy promotes disciplined saving and provides the advantage power of compounding to maximize returns over time.

SBI Fund House provides multiple mutual fund schemes it’s quite difficult to invest in all at once so to make it easy let’s see the Top 5 SIP SBI Funds in which you can invest according to your desire or financial goal.

Presenting the List of Top 5 SBI SIP Mutual Funds:

| Fund Name | Launch Date | AUM (Crore) | SIP Returns (3 Year) |

|---|---|---|---|

| SBI Technology Opportunities Fund | 01-01-2013 | Rs. 3,814 | 15.11% |

| SBI Long Term Equity Fund | 01-01-2013 | Rs. 25,738 | 28.85% |

| SBI Contra Fund | 14-07-1999 | Rs. 34,366 | 29.43% |

| SBI Large & Mid Cap Fund | 28-02-1993 | Rs. 25,629 | 20.77% |

| SBI Magnum Mid Cap Fund | 29-03-2005 | Rs. 20,316 | 24.40% |

Let us examine more closely.

1. SBI Technology Opportunities Fund

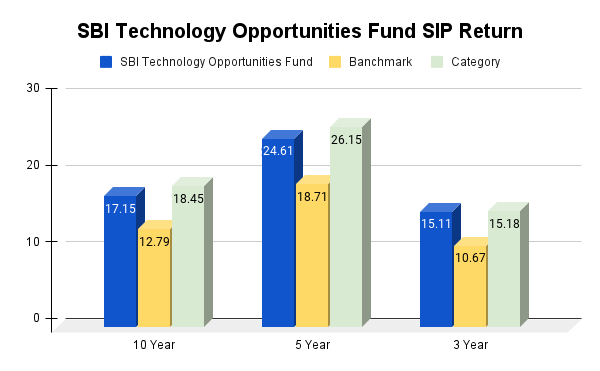

Launched on January 1, 2013, with an AUM of Rs. 3,814 crores, the SBI Technology Opportunities Fund is a match made in heaven if you are looking for strong SIP returns the fund has consistently outperformed its benchmark, BSE Teck TRI, over the past 10, 5, and 3 years. Managed by Vivek Gedda, the fund focuses on technology stocks with an average P/E ratio of 29.04%, indicating investments in growth-oriented and higher-valued companies within the sector.

Ideal for investors targeting substantial returns, the fund offers exposure to the dynamic technology industry. Its diversified portfolio spans various tech sectors, balancing growth potential with moderate risk. The SBI Technology Opportunities Fund is tailored for medium to long-term investors seeking to capitalize on the growth trajectory of the technology sector.

If this fund matches your goals, dive into the details of the SBI Technology Opportunities Fund!

2. SBI Long Term Equity Fund

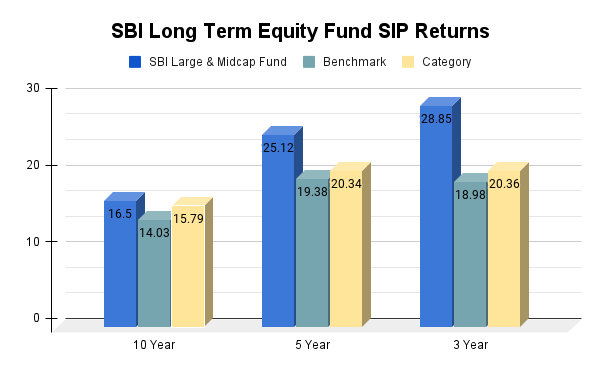

The SBI Long Term Equity Fund, launched on 01-01-2013 and currently managing Rs. 25,738 crores in assets under Dinesh Balachandran's supervision since 10-Sep-2016, has consistently outperformed its SIP returns both its benchmark and category averages over the past 10, 5, and 3 years.

With portfolio companies boasting an average sales growth of 14.63%, the fund focuses on firms demonstrating robust market competitiveness and durability.

With diversified exposure across sectors including Financials, Energy & Utilities, Industrials, Consumer Discretionary, Technology, and Materials, the fund blends mid and small-cap stocks for potential high returns during market rallies and stability from large-cap holdings during volatility. It suits investors with a minimum 5-year horizon seeking growth and sector diversification.

For more details, click on your favourite fund: SBI Long Term Equity Fund!

3. SBI Contra Fund

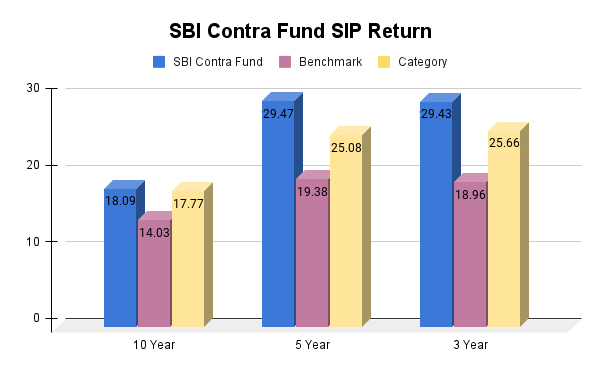

The SBI Contra Fund, launched on 14-07-1999 and managing an AUM of Rs. 34,366 crores, the SIP returns of this fund consistently outperformed its peers and category averages over the past 10, 5, and 3 years. Notably, it has achieved an impressive annualized earnings growth rate of 23.55%, indicating strong profitability potential among its holdings and driving stock price appreciation.

With a substantial 20.81% allocation to the financial sector, including banking, insurance, and other financial services, the fund underscores attractive investment opportunities perceived by its managers. The fund's performance stood out during the 2020 market downturn by limiting downside risk and excelling in subsequent market upswings.

Under the guidance of Mr. Dinesh Balachandran, the SBI Contra Fund has delivered superior returns, maintaining a diversified portfolio across market caps and sectors to avoid concentrated risks. It is well-suited for investors seeking a Contrarian investment approach, with a recommended investment horizon of 5-7 years.

Get Your Free Research Study of the SBI Contra Fund!

4. SBI Large & Mid Cap Fund

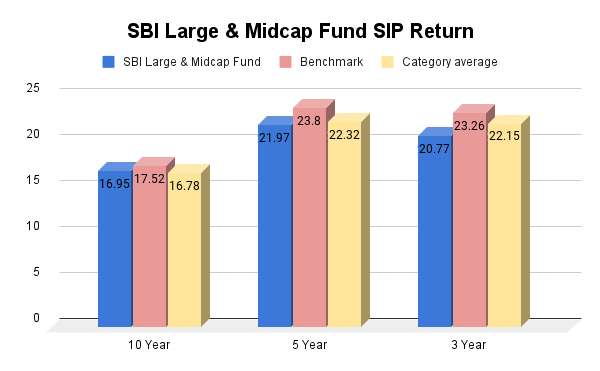

The SBI Large & Mid Cap Fund, launched on 28-02-1993 and currently managing an AUM of Rs. 25,629 crores, has shown a 10-year return of SIP returns of 16.95%. While slightly below its benchmark of 17.52% and the category average of 16.78%, the fund is overseen by Mr. Saurabh Pant, a capable fund manager. Stocks within the fund carry an average PE ratio of 22.99%, indicating reasonable valuation relative to the market with potential for future growth.

This fund is ideal for long-term investors aiming for growth and diversification. Its strategy blends large and mid-cap companies, strategically positioned to navigate market volatility. With a focus on companies offering growth potential at reasonable valuations, the SBI Large & Midcap Fund appeals particularly to moderate-risk investors looking at a minimum 5-year investment horizon.

Look at the Detailed Analysis of: SBI Large & Mid Cap Fund!

5. SBI Magnum Mid Cap Fund

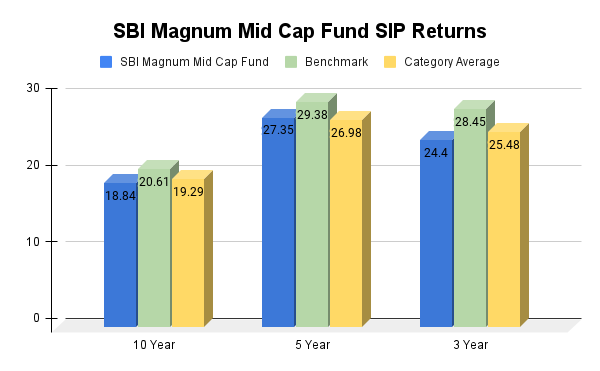

SBI Magnum Mid Cap Fund was introduced to investors on 29 March 2005 and has an asset under management (AUM) of INR 20, 316 crores. if you had invested Rs. 3,000 every month through a SIP over the last 10 years, your total investment would be Rs. 3,60,000. With an 18.84% SIP return, the value of your investment today would be Rs.10,45,280.

The stocks invested in the SBI Magnum Fund portfolio boast an earnings growth of 22.32%, showcasing its ability to identify robust mid-cap companies with stable earnings. known for its durability and consistent top performance in its category, the fund focuses on a diversified portfolio of 60-70 stocks across sectors, making it ideal for investors seeking long term growth from potential market leaders over 5 to 7 years.

Explore Growth with the SBI Magnum Mid Cap Fund today!

Final Words

- Diverse Choices: SBI Mutual Fund offers varied SIP options across sectors and market caps.

- Consistent Performance: Funds led by experienced managers consistently outperform benchmarks.

- Strategic Fit: Choose funds based on your risk tolerance and investment goals.

- SIP Advantage: SIPs ensure disciplined investing with the potential for long-term growth.

Choosing the right SBI Mutual Fund for SIP requires aligning your goals with the fund's strategy and risk profile for effective wealth accumulation.

Did You Ask for Expert Advice on Selecting Your Funds – Get Free service

Read More Our Blog on Mutual Funds for Daily Market Update.

1. SBI PSU Fund: A Detailed Review for 2024

2. SBI Contra Fund: Is this Best Mutual Fund for 2024?

3. SBI Small Cap Fund : Is It a Safe Investment Choice in 2024?

.webp&w=3840&q=75)