Table of Contents

- SBI Small Cap Fund Overview

- Investment Strategy of SBI Small Cap Fund

- Performance Analysis of SBI Small Cap Fund

- SBI Small Cap Fund Portfolio Composition Overview

- Who is the Fund Manager of the SBI Small Cap Fund

- Analysing the Quality of Stocks of SBI Small Cap Fund

- Top 10 Holdings of the SBI Small Cap Fund

- Should You Invest in the SBI Small Cap Fund in 2026?

- Conclusion for SBI Small Cap Fund Review

Did you know the SBI Small Cap Fund has been a consistent performer, with 23.45% returns in the last five years, beating the Nifty 50 TRI by great margins? Yes, you got that right.

But to find a good small cap fund, is consistency what you should seek or are there other factors? Well, of course, good diversification, experienced fund managers and a clear investment strategy go a long way to making a fund a good investment.

That is why this expert SBI Small Cap Fund Review will weigh this fund of the SBI Mutual Fund house on every parameter, from its performance over the years, strategy, allocation of assets, stock quality and risk profile, so you won't leave any stone unturned to certify that SBI Small Cap Fund is indeed a good investment for you in 2026. So, let us begin.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

SBI Small Cap Fund Overview

The SBI Small Cap Fund is an open-ended investment scheme that falls under the category of equity mutual funds. Launched by SBI Mutual Fund, this scheme primarily invests in the stocks of small companies and aims for long-term capital growth. This fund invests in a well-diversified range of small-cap stocks (at least 65%) and rises on the high growth potential of the small-cap companies.

The fund is available in both regular and direct plans, but the direct growth option offers a lower expense ratio and slightly better returns. This fund also carries a very high risk level, making it suitable mainly for aggressive investors with a long-term investment horizon.

Here are the basic details of the SBI Small Cap Fund:

- Launch Date: September 9, 2009

- AUM: Rs 36,272 Crore.

- Expense Ratio (Direct): 74%.

- NAV (As of December 19, 2025): Rs 191

- Minimum SIP: Rs 500.

- Minimum Lump Sum: Rs 5,000 (Regular Plan).

- Benchmark: BSE 250 SmallCap TRI (Total Return Index).

- Exit Load: 1% if redeemed within 1 year and no exit load thereafter.

Now, let us explore the investment strategy of this small cap fund.

Investment Strategy of SBI Small Cap Fund

The investment philosophy used by the SBI Small Cap Fund is based on a growth-oriented strategy while using a "Buy & Hold" approach to earn high returns for your portfolio. This investment approach has enabled this small cap fund to identify scalable businesses with strong growth potential so that it can easily purchase the stocks at reasonable prices.

Moreover, this small cap fund has spread its investments across 68 stocks to minimize the risk. This investment style has helped the SBI Small Cap Fund to become a good investment alternative amongst the various other Small Cap Mutual Funds. Its unique investing style is smartly crafted to make substantial returns in the long term by investing in fast-emerging small cap companies.

Hence, its investment approach makes it a good choice for new as well as experienced investor looking to grow their money fast in the mutual fund industry.

Must Read: Best Small Cap Mutual Funds for Long Term Investment in 2025

Now, let us analyse the overall performance of this fund to know whether it is suitable for 2026.

Best Mutual Funds for 2026 Backed by Expert Research

Performance Analysis of SBI Small Cap Fund

Here is the detailed performance analysis of the SBI Small Cap Fund based on its rolling returns and SIP returns:

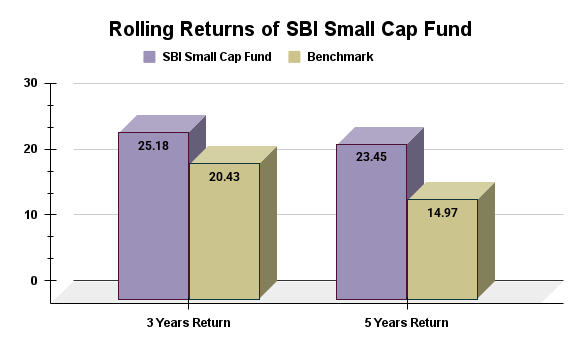

Rolling Returns

The fund has outperformed its benchmark on a rolling return basis over the last years. You see, in the last 3 years, this small cap fund has given 25.18% returns, which shows how amazingly beaten its benchmark of 20.43%. Similarly, it delivered 23.45% returns in the 5 years, outperforming its benchmark of 14.97%.

You can refer to the graph below to see the data on your own:

With these returns, it has shown its ability to withstand the volatile market and still give sound returns to its investors.

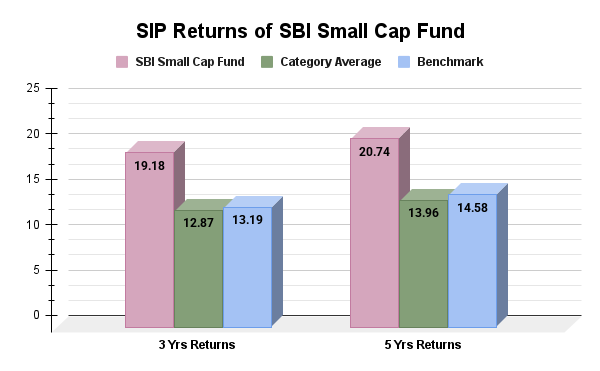

SIP Returns

The SBI Small Cap Fund has not performed as well as the market or other similar Mutual Funds over the past 3 and 5 years. It gave a return of 7.79% in the last 3 years and 12.47% over 5 years, which is lower than the returns of the benchmark index and the average category returns.

The graph below shows the data on its performance based on SIP returns:

The SBI small cap fund has performed poorly because many small cap stocks dropped in price. This decline happened as those stocks were trading at high valuations, which could not be sustained.

Moreover, these types of ups and downs are more common than you may realise when investing in small cap mutual funds. Why?

Well, the SBI small-cap fund's strategy involves focusing on smaller, high-growth companies and avoiding large caps that offer higher returns, but investing in this fund makes it more susceptible to volatility and potential highs and lows from time to time.

Pro Tip: Use an SBI SIP Calculator to estimate future returns of your SBI mutual fund SIP investments.

Let us explore the portfolio composition of this mutual fund.

Start Your SIP TodayLet your money work for you with the best SIP plans.

SBI Small Cap Fund Portfolio Composition Overview

The following are the allocations of the SBI Small Cap Fund Portfolio, including the fund's assets, sector and market cap allocation:

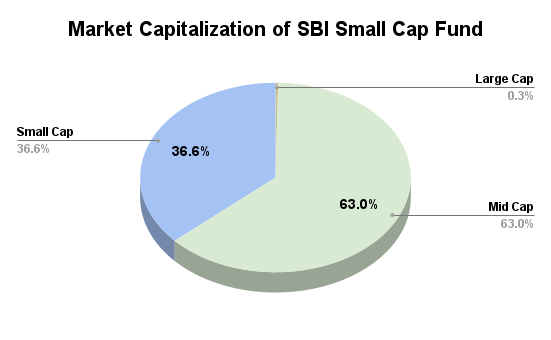

Market Cap Allocation

The market cap allocation of this fund has been smartly done, by keeping 36.64% in the small-cap stocks, focusing on small-sized and fast-growing companies, yet keeping 63.03% in the mid-cap stocks to balance growth with moderate risk in the portfolio.

Take a look at the pie chart below to see the distribution more clearly:

At last, this small cap fund is investing in companies that are still expanding to provide an opportunity to make the next multi-bagger returns in the long term.

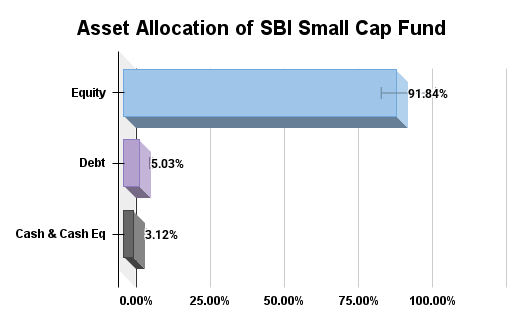

Asset Allocation

The portfolio of the SBI Small Cap Fund is heavily tilted toward equity, with 91.84% in stocks and only about 8% in debt and cash together. This makes it suitable for aggressive, long-term investors who can handle sharp market ups and downs. More conservative investors may want to increase the debt portion for stability and keep a bit more in cash for liquidity and rebalancing.

Refer to the graph below for a clear picture:

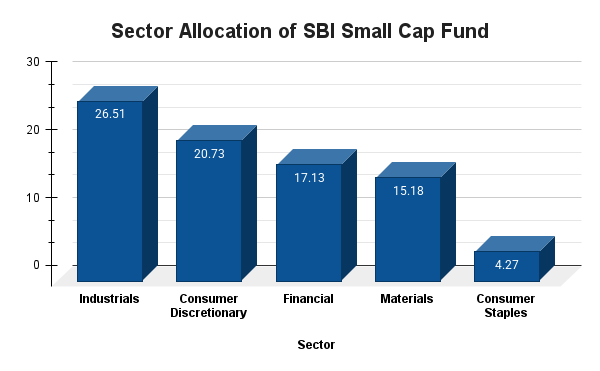

Sector Allocation

This fund has a growth-focused strategy with higher investments in the industrial sector at 26.51% and 20.73% allocation in consumer discretionary, as these sectors perform well when there is economic expansion or a rise in consumer spending.

Let's review the chart before you delve into more statistics:

By looking at the above chart, the fund seems slightly overweight towards the financial sector with 17.13% allocation. Likewise, it has invested a small portion of 4.27% in consumer staples, which will give stability during market downturns.

Furthermore, after a close expert review, the fund is underweight in the materials sector (15.18%), hoping to avoid exposure to more volatile sectors.

Also Read: Top Performing Equity Mutual Funds 2026: Highest Return Picks

In the next part, you will get to the one who is the mastermind behind the fund's strategy. So, keep reading.

Who is the Fund Manager of the SBI Small Cap Fund

The fund we are discussing is in excellent hands with Mr. SR Srinivasan, who has over 25+ years of experience in the financial field. He is a well-known equity mutual fund manager who has been leading the SBI India Small Cap Fund since November 16, 2013. Under his leadership, this scheme has consistently outperformed its peers and the benchmark in the last 1 year.

He has many years of experience in equity markets, with prior roles at Principal AMC, Oppenheimer & Co., Indosuez WI Carr and Motilal Oswal Mutual Fund.

Along with his support team, including Mohan Lal (Co-manager since May 2024), Predeep Kesavan (Analyst support) and backed by the research team of SBI Mutual Fund, he has taken the fund's track record to another height. The fund's AUM has reached Rs 36,272 Crore by December 2025, increasing from Rs 700 crore in 2013.

Srinivasan’s expertise lies in identifying high-growth small-cap companies with strong fundamentals, leveraging SBI’s research to navigate the volatile small-cap space effectively.

Next, let us analyse the stock quality of the fund.

Analysing the Quality of Stocks of SBI Small Cap Fund

The higher PE ratio of the SBI Small Cap Fund is 28.43% vs 25.86% of its category average means that the stocks are purchased at a premium price that reflects expectations of seeing strong future growth. Meanwhile, its earnings growth (17.31%) is also higher than the category average and the sales (10.75%) are close to margins.

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 10.75% |

| Earnings Growth | 17.31% |

| Cash Flow Growth | -2.07% |

| P/E Ratio (Valuations) | 28.43 |

Looking at the above table, the experts conclude that the fund portrays strong growth potential, but the higher P/E ratio (Price-to-Earnings) indicates a higher level of risk. Hence, you need to be cautious before investing.

Let us explore the top 10 holdings of this fund in the next heading.

Top 10 Holdings of the SBI Small Cap Fund

The following are the top 10 holdings of the SBI Small Cap Fund:

| Holding Name | Holding Value |

|---|---|

| Ather Energy | 3.98% |

| City Union Bank | 3.11% |

| SBFC Finance | 2.67% |

| E.I.D.-Parry (India) | 2.65% |

| Kalpataru Projects International | 2.61% |

| Chalet Hotels | 2.37% |

| Navin Fluorine International | 2.37% |

| Krishna Institute of Medical Sciences | 2.33% |

| K.P.R. Mill | 2.29% |

| Doms Industries | 2.28% |

Now, the main question is, "Should you invest in this fund in 2026?" Let us know.

Should You Invest in the SBI Small Cap Fund in 2026?

Market experts indicate that small-cap stock prices have normalized after the 2025 corrections, making it a potentially good time for long-term investment. In 2026, the SBI Small Cap Fund is suitable for high-risk tolerance investors willing to commit to a long-term investment, despite potential short-term fluctuations.

Experts believe small-cap stocks may recover in 2026 following a decline in 2025, with more attractive valuations compared to large-cap stocks. The SBI Small Cap Fund has a strong track record of outperformance, thanks to disciplined stock selection by experienced fund manager Mr. R. Srinivasan.

To use this fund effectively without risking your overall goals, use a SIP approach, limit your investment to about 20–25% of your total equity and plan to invest for at least 5–7 years.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Smart Investments, Bigger Returns

Conclusion for SBI Small Cap Fund Review

To wrap up the SBI Small Cap Fund Review, it summarizes that if you are willing to bet on making higher returns, you need to level up your risk tolerance. And if you are looking to invest in a small cap fund, then the SBI small cap mutual fund is the best option.

It has been a consistent performer and it checks out on all the parameters with a green light. However, you can start investing via SIP (Systematic Investment Plan) and hold onto your investments for 5+ years, which will help manage the risk in your 2026 investments.

Related Blogs:

- Top 10 Mutual Funds for SIP in 2026: Best Picks to Grow Wealth

- Top 5 Mutual Funds for Lumpsum Investment 2026: Expert Picks

FAQs

-

Who should invest in the SBI Small Cap Fund in 2026?

This fund is suitable for investors who can tolerate sharp fluctuations, have long-term goals and a stable core portfolio.

-

What are the key risks of the SBI Small Cap Fund?

The main risks of the SBI small cap fund are high volatility, liquidity risks and fund-specific risk.

-

How much of my portfolio should I allocate to the SBI Small Cap Fund?

You should keep 20-25% of your equity portfolio in small-cap stocks; you can include the SBI Small Cap Fund in this.

-

Can beginners start with the SBI Small Cap Fund?

As a beginner, it is better to start with large-cap or flexi-cap funds and move to small-caps once you get some good market knowledge.

-

What documents or data should I check before investing in 2026?

Before investing, review the scheme information document (SID), fact sheet, latest portfolio, expense ratio and riskometer.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)