Table of Contents

- Overview of SBI PSU Fund

- What is the 5-Year Rolling Return and SIP Return of the SBI PSU Fund?

- SBI PSU Fund Investment Strategy

- Who is the Mastermind Fund Manager Behind SBI PSU Fund?

- SBI PSU Fund Portfolio Review 2026 with Asset and Market Allocation

- What is the Sector Allocation of the SBI PSU Fund?

- Top Holdings of SBI PSU Fund

- Is the SBI PSU Fund Good for Long Term Investment?

- To Conclude SBI PSU Fund Review 2026

As 2026 kicks in, the government has started investing heavily and implementing reforms for the public sector and you can achieve solid long-term growth from this. How? By simply investing in the PSUs or public sector units in 2026. One of the best options to do so is PSU mutual funds. But the question is, which PSU fund should you pick? Well, introducing to you the SBI PSU Fund that invests over 80% of its money in many public sector companies like NTPC, SBI and GAIL.

This fund, by one of the well-known AMCs, SBI Mutual Funds, also offers more than 30% SIP returns over 3 and 5 years that outperform the benchmarks.

Wondering if you should consider it for your 2026 portfolio? Dive into this SBI PSU Fund Review 2026 for a detailed analysis of performance, risks and rewards to make informed investment decisions.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Overview of SBI PSU Fund

Launched on July 7, 2010, by SBI Mutual Fund, the SBI PSU Fund is an open-ended Equity mutual fund scheme that focuses on long-term capital growth by primarily investing in a diversified portfolio of equity and debt or money market instruments of PSUs (Public Sector Undertakings).

This fund is classified as a thematic fund with a "Very High" risk level. The fund manager actively invests and is required to put at least 80% of its assets into PSU stocks, that is, shares of government-owned companies and their subsidiaries.

Here are the basic details of the SBI PSU Fund:

| Factors | Value |

|---|---|

| AMC | SBI Mutual Fund |

| AUM | Rs 5,813.27 Crore (as of December 31, 2025) |

| Current NAV | Rs 37 (as of January 14, 2026) |

| Benchmark | BSE PSU Total Return Index |

| Expense Ratio | 0.83% |

| Exit Load | 0.50% if redeemed within 30 days |

| Risk Level | Very High |

| Minimum SIP Amount | Rs 500 |

| Minimum Lump Sum Amount | Rs 5,000 |

Must Read: SBI Focused Fund Review: Should You Invest in 2026?

Now, let us review the performance of this fund and determine if it is consistent with its returns or not.

What is the 5-Year Rolling Return and SIP Return of the SBI PSU Fund?

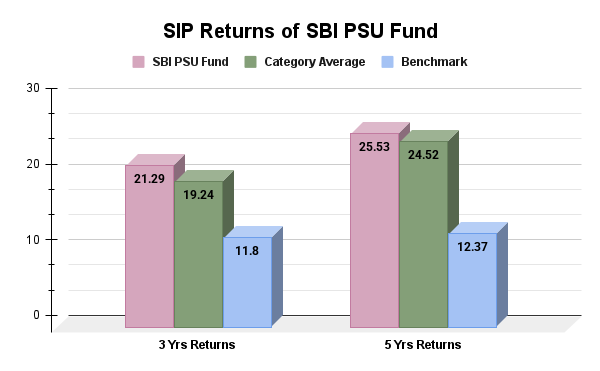

The SBI PSU Fund has been consistently beating its benchmark with its rolling returns as well as SIP Returns. As of December 1, 2025, the fund has delivered an outstanding performance in terms of its SIP returns with 21.29% 3-year and 25.53% 5-year returns, surpassing both its benchmark (Nifty 50 TRI) and category average. Look at the graph below for the comparison of SIP growth:

According to the above graph, the Mutual Funds has outperformed its benchmark by 9.49% margin for 3 years and 13.16% for 5 years. There was also a difference of 2.05% for 3 years and 1.01% for 5 years with the category average.

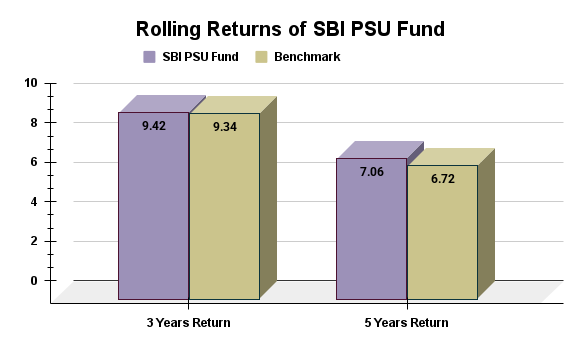

The picture of rolling returns was not so impressive, but still, the fund managed to beat the benchmark (Nifty CPSE TRI) of 9.34% (3-year) and 6.72% (5-year) with 9.42% (3-year) and 7.06% (5-year), as shown in the graph below:

Consistency levels of the fund were also close to the benchmark, indicating that the fund can perform well, but not in every phase. But the SBI PSU Fund ranks among the top in its category when we look at SIP performance.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Next, let us understand the investment strategy that the fund manager of the SBI PSU Fund follows.

Best Mutual Funds for 2026 Backed by Expert Research

SBI PSU Fund Investment Strategy

The consistent returns of the SBI PSU Fund you saw above are not random, they are the result of a well-researched investment strategy that the fund follows for consistent growth. The main aim of its growth-oriented sectoral strategy is to achieve long-term capital appreciation by primarily investing in the equity securities of the PSUs and their subsidiaries, along with selected debt or money market instruments from PSUs for balance.

These types of mutual funds focus on growth within a PSU thematic framework, targeting companies that benefit from strong government support and have stable cash flows. It invests in sectors such as infrastructure, energy and finance, making it an interesting option.

However, the fund not only sticks to large companies. It balances the stability of large caps with selective mid and small cap stocks, while tapping the potential from PSU reforms and capital expenditure (capex) cycles.

Now that you know the proven investment strategy of the fund, you must want to know who is the one that came up with it. So, let us meet the mastermind behind this strategy in the next part.

Who is the Mastermind Fund Manager Behind SBI PSU Fund?

Well, the name of this genius is Mr. Rohit Shimpi, who took charge of this fund in 2018. He holds over 15 years of experience in the financial markets and before this fund house, he also served in big companies, including JP Morgan’s offshore research center and HDFC Standard Life Insurance.

Mr. Shimpi uses two research methods: top-down and bottom-up. The top-down method looks at big trends, like government policies, infrastructure spending and energy changes. The bottom-up method focuses on individual companies that have strong fundamentals, low debt, growing revenue and efficient operations.

Backed by the strong research team of SBI mutual fund and using the expertise from a partnership between the State Bank of India and AMUNDI (France), his strategy became even more active during the post-2020 economic recovery, where his informed decisions led the fund to benefit from PSU reforms and growth in the infrastructure and energy sectors.

Also Read: Top Performing Equity Mutual Funds 2026: Highest Return Picks

Moving on, let us analyse the portfolio composition of this fund.

SBI PSU Fund Portfolio Review 2026 with Asset and Market Allocation

The fund has a focused portfolio in line with its PSU theme and maintains a high conviction with its thematic investment strategy. The fund has a moderate turnover at around 30-40%, showing a mix of stable investments in PSUs and some changes based on market trends.

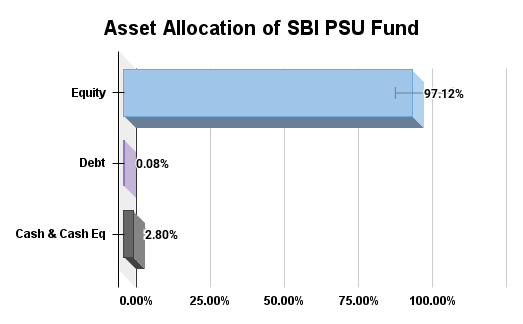

Asset Allocation

As of December 1, 2025, the fund is highly focused on the stocks of equity mutual funds, with 97.12% invested in domestic PSU equities. To grab some market opportunities and for some liquidity, the fund allocates a minimal part to debt (0.08%) and a moderate cash buffer (2.8%). Prefer the graph below:

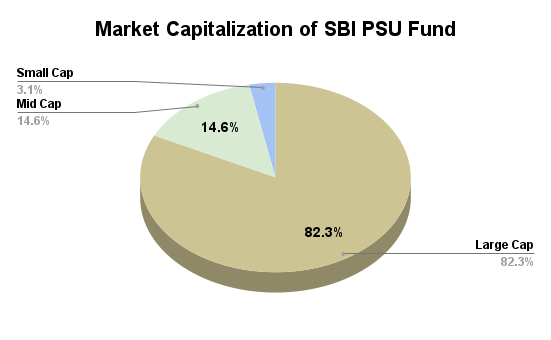

Market Cap Allocation

The fund invests mainly in large government-backed companies, making up 82.30% of its portfolio. This focus on stable firms provides security to investors. The fund also includes 14.57% in mid-sized companies and 3.13% in small companies. This approach adds growth potential but comes with increased risk, balancing stability with opportunities for higher returns.

This balanced mix of large cap stability and mid cap growth is essential for long-term wealth creation, especially in a very high-risk category like PSU equity mutual funds. This shows diversified sector allocation and strong fundamentals that help manage risks, even while focusing on a single theme.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

In the next heading, you will come across the sector allocations of this fund. So, keep reading.

Start Your SIP TodayLet your money work for you with the best SIP plans.

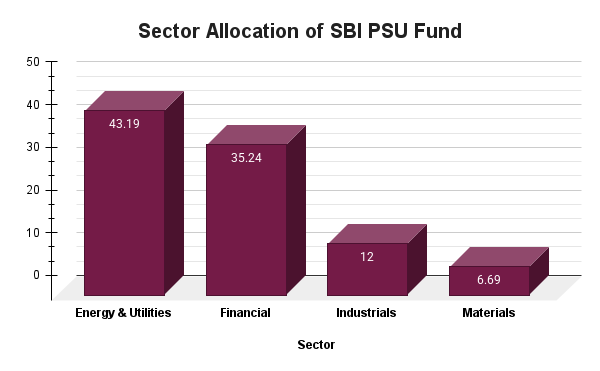

What is the Sector Allocation of the SBI PSU Fund?

The fund's portfolio is mainly focused on investments in Energy and Utilities (43.19), like Power Grid Corp and GAIL India, in PSUs. It has a slightly bigger share in Financial Services and Industrials compared to the average fund, showing a strategic interest in banking, defense and manufacturing booms. Other than this, the fund allocates 6.69% in Materials to add a resilient infra edge.

This focused approach offers safety and potential growth for SIP investors. It allows them to benefit from policy-driven growth without taking excessive risks. This makes it a great fit for conservative portfolios this year.

In the next part, let us explore the top 5 current holdings of the fund.

Top Holdings of SBI PSU Fund

The SBI PSU Fund holds about 24-25 stocks, mainly in PSUs (Public Sector Units), to balance risk and reward. The following are the top 5 current holdings of the fund, which make up about 51% of the portfolio, indicating moderate concentration:

| Stock Name | Allocation (%) |

|---|---|

| State Bank of India | 16.76% – 16.87% |

| Bharat Electronics Ltd | 8.91% – 9.27% |

| NTPC Ltd | 8.24% – 8.75% |

| GAIL (India) Ltd | 8.63% |

| Power Grid Corp of India | 8.02% |

Now, the main question: "Is this fund really suitable for your long-term investments in 2026?" Let us know.

Is the SBI PSU Fund Good for Long Term Investment?

The SBI PSU Fund is riskier because it focuses on a specific sector, but its strong stock quality makes it a good choice for long-term investors in 2026. It has a lower P/E ratio of 11.36, which suggests it offers better value.

The fund shows strong earnings growth of 8.91% and sales growth of 9.27%, indicating long-term growth potential. However, it is essential to monitor the cash flow growth, which is currently at -10.13%. Prefer the table below:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 9.45% |

| Earnings Growth | 6.69% |

| Cash Flow Growth | -8.82% |

| P/E Ratio (Valuations) | 11.45 |

The investment strategy of the SBI PSU Fund focuses on the careful selection of high-quality stocks from various industries. It looks for companies with good growth potential and reasonable price-to-earnings (PE) ratios. This approach helps balance risk and opportunity and has been necessary for its performance.

Pro Tip: Use a SWP Calculator to plan for your regular mutual fund unit withdrawals.

Smart Investments, Bigger Returns

To Conclude SBI PSU Fund Review 2026

In short, the SBI PSU Fund stands out in PSU mutual funds with its sector-focused approach, strategy and quality stock holdings. This mutual fund mainly invests in PSU (Public Sector Units).

Its strategy diversifies investments to benefit from government-driven PSU growth, while also managing risks through careful and targeted investments. Investors should know their risk capability and suitability with their long-term financial goals before investing.

Related Blogs:

- Top 10 Mutual Funds for SIP in 2026: Best Picks to Grow Wealth

- Top 5 Mutual Funds for Lumpsum Investment 2026: Expert Picks

FAQs

-

Should you invest in the SBI PSU Fund in 2026?

If your investment period is more than five years, consider investing through a SIP, as it has given over 30% growth in the last 3-5 years.

-

Risks of SBI PSU Fund?

This investment is highly volatile, sensitive to changes in PSU policies and underperforms in private sector rallies.

-

When to exit the SBI PSU Fund?

You should exit this fund if government policy slows down reforms in PSUs, private banks surge by 20% and if your horizon is less than 3 years.

-

Is the SBI PSU Fund suitable for beginners?

This investment is suitable for new investors who plan to invest for at least 5 years. You can invest through SIPs.

-

What is the future outlook for the SBI PSU Fund in 2026-2027?

The government plans to invest Rs 12 lakh crore in public projects, sell some assets and focus on energy transition. If reforms happen quickly, expect returns of 20-25%.

Disclaimer: The views and opinions expressed in this blog are for informational purpose only and do not constitute financial, investment or legal advice. Mutual Fund investments are subject to market risks, always read the scheme documents carefully. It is advisable to consult a qualified financial advisor before making any investment or trading choices.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.png&w=3840&q=75)