Table of Contents

- Investing Strategy of ICICI Prudential Multi Asset Fund

- SIP Returns: ICICI Prudential Multi Asset Fund Earning Potential

- Understanding the Risks of ICICI Prudential Multi Asset Fund

- Portfolio Allocation

- Equity Allocation

- Stock and Quality of ICICI Prudential Multi Asset Fund

- How ICICI Prudential Multi Asset Fund Allocates to Debt

- Conclusion

ICICI Mutual Fund, one of India's leading fund houses, offers the ICICI Prudential Multi Asset Allocation Fund as part of its diverse range of mutual fund offerings. This highly diversified scheme is designed to build a healthy portfolio, boasting an impressive asset under management of Rs. 41,160 crores as of 31 May 2024, and with the SIP (systematic investment plan) investors can generate higher returns in the long term and increase their wealth over time. Now, let's explore the ICICI Multi-Asset investing strategy and review it in detail to gain a thorough understanding of this fund.

Investing Strategy of ICICI Prudential Multi Asset Fund

The ICICI Multi Asset Allocation Fund is a multi-asset, highly diversified investment fund. It actively manages investments across all asset classes including equities, debt, and other securities, to leverage opportunities and reduce risks based on market conditions.

One of the key strengths of ICICI multi asset is its expertise in managing both equity and bond asset classes. Their investment team conducts detailed macroeconomic analysis to understand broad market trends and economic indicators. ICICI Prudential multi asset fund is proficient in bottom-up analysis, which involves carefully researching specific stocks and bonds to identify high quality investments.

SIP Returns: ICICI Prudential Multi Asset Fund Earning Potential

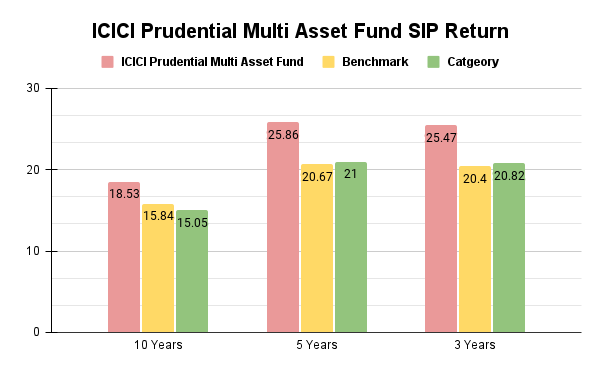

If you started a Rs. 3,000 monthly SIP in the ICICI Multi Asset Allocation Fund ten years ago. Then this consistent investment has grown to a huge capital of Rs. 9.5 lakh. surprisingly, the fund has delivered an annualized return of 18.53% over this period, significantly outperforming fixed deposit returns by a wide margin.

Also, the fund has not only outperformed the returns of the Nifty 50 but also beat the average returns of its category, highlighting the potential of disciplined SIP investments in well-managed mutual funds to build considerable wealth over time while benefiting from superior market performance.

Over the past 5 years of performance ICICI multi-asset fund shows it's not going to take back down, so it has delivered an impressive annualized return of 25%. This performance significantly exceeds both the benchmark and the average returns of its category are 20.67% and 21.00% respectively. Investors can trust in the fund's consistent outperformance and strong track record in delivering above-average returns in the multi asset category.

If we talk about the 3 years of performance this fund has made a hat-trick, so in 3 years ICICI multi asset fund has also shown strong performance, delivering exceptional returns of 25.47%. The overall track record of the fund is impressive, consistently outperforming its benchmark Nifty50 of 20.4% and category averages of 20.82%. Additionally, through systematic investment plans (SIPs), the fund has helped investors create significant wealth over time.

Understanding the Risks of ICICI Prudential Multi Asset Fund

| SD | Sharpe Ratio | Alpha | Max Drawdown in 3 Year |

|---|---|---|---|

| 7.60% | 2% | 10.73% | -4.19% |

The ICICI Multi Asset Allocation Fund is characterized by low volatility, making it an ideal choice for low-risk investors. The Sharpe and Alpha ratios indicate a strong risk-to-reward ratio, with an Alpha of 10.73 demonstrating that the fund delivers significantly higher returns than the Nifty 50. Over the last 3 years, the fund has experienced minimal drawdown, highlighting its effective risk management.

After getting the idea of risk let us explore what is in the ICICI Prudential Multi Asset Portfolio.

Portfolio Allocation

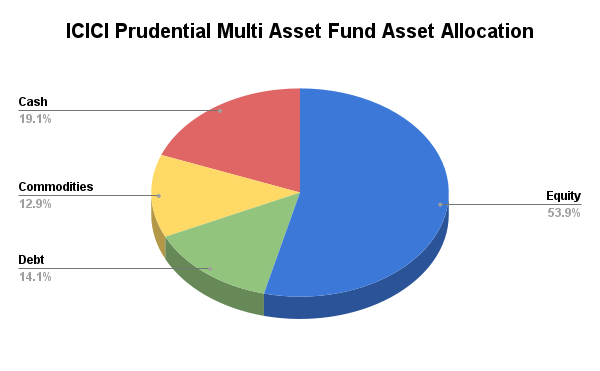

According to the recent portfolio update, this ICICI Multi Asset Allocation Fund has allocated 53% to equities, 14% to debt, 12.9% to commodities, and remaining in cash. This shows that the fund has invested half of its portfolio in the equity market while maintaining a diversified approach across other asset classes. The cash holdings suggest that the fund is keeping money in hand to grab the opportunity of market.

The fund has the highest allocation in equities. What benefits does this allocation bring to the fund?

Equity Allocation

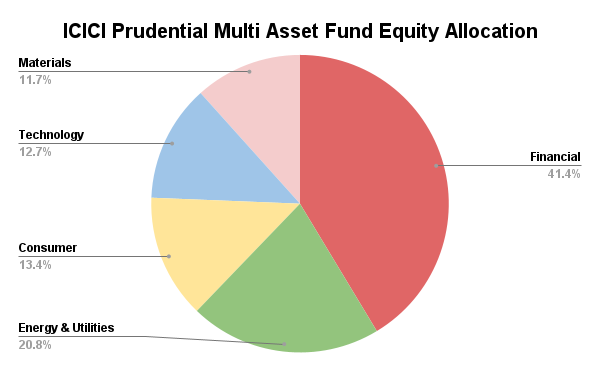

The ICICI Prudential Multi Asset Allocation Funds equity allocation is well-diversified and strategically linked with the fund's goal of long-term capital appreciation.

1. Financial Sector: The fund's largest stock exposure is in the Financial sector, which accounts for 41.4%, Investing in banking, insurance, and financial services to benefit from economic growth and rising consumer demand.

2. Energy & Utilities: This allocation is 20.08% which reflects the fund's recognition of the importance of energy and infrastructure in supporting the country's economic development and the potential for growth in these sectors.

3. Consumer Discretionary: The fund has also allocated 13.04% to the Consumer Discretionary sector which targets companies that benefit from increasing consumer spending and changing lifestyle preferences in India, tapping into the consumption-driven growth of the economy

4. Technology: The technology sector, which has been a consistent outperformer in recent years, accounts for 12.07% of the portfolio. Focusing on emerging trends and innovations in technology, which are likely to drive future growth.

5. Materials: Finally, the fund has an 11.07% allocation to the Materials sector. Investing in companies that produce and process essential commodities and raw materials, supporting the industrial and manufacturing sectors crucial for economic development.

Stock and Quality of ICICI Prudential Multi Asset Fund

The quality-focused equity portfolio of the ICICI Prudential Multi-Asset Allocation Fund is impressive. The stocks selected demonstrate strong sales and earnings growth while maintaining attractive valuations in terms of low P/E ratios. This combination of high-quality fundamentals and reasonable valuations suggests the fund is well-positioned to deliver sustainable long-term returns for its investors.

| Fundamental Ratio | Value |

|---|---|

| Sales Growth | 14.29% |

| Earning Growth | 21.20% |

| PE Value | 15.84% |

How ICICI Prudential Multi Asset Fund Allocates to Debt

In terms of its debt investments, this Mutual Fund adopts a very careful approach. Treasury Bills account for the vast majority of its holdings (63%). T-Bills are short-term securities issued by the government, which are considered to be one of the safest investments. Because of their short maturity and government backing, they are essentially as good as holding cash.

Additionally, the fund holds bonds issued by the government and other high-quality, stable businesses. This conservative allocation means the fund focuses on safety and liquidity, aiming to protect the principal investment while generating modest returns.

While talking about the quality the fund invests in high-quality bonds. Many of these bonds have an AA+ rating, indicating they are very secure. The average maturity of these bonds is 2.1 years, which means they are relatively short-term, further reducing risk. Despite the low risk, these bonds offer a good return, with an average interest rate of 7.56%.

Conclusion

ICICI Prudential multi asset mutual fund is a gold mine for investors seeking low risk and high returns. It has provided excellent returns through its SIP options, helping investors build significant wealth over time.

The fund managers and analysts have demonstrated fantastic skill and expertise in managing the fund. They have balanced the portfolio well, ensuring safety even with high market valuations, and are prepared to seize opportunities if the market falls.

Currently, the portfolio is very safe, focusing on high-quality, short-term bonds and Treasury Bills. This conservative approach protects your investment while still offering solid returns.

Looking ahead, the future of this fund looks promising. It's one of the best options for SIP investment, providing a balanced mix of safety and potential for growth.

Read Our Latest Trending Blogs on Mutual Fund Investment

1. Tata Small Cap Fund: A Leader with 35% Annualized SIP Returns

2. SBI PSU Fund: A Detailed Review for 2024

3. Is Kotak Small Cap Fund a Good Investment for 2024?

.png&w=3840&q=75)

.webp&w=3840&q=75)