Table of Contents

Do you know why the corpus is considered the backbone of every fund you invest in? The meaning of corpus in finance is the actual amount of money in any scheme or a fund, without excluding returns or profit, known as a corpus.

The fund manager smartly uses the collected corpus to invest in equity, debt & other market objectives.

To put it in simple words, a higher corpus eventually leads to better diversification, sharper strategies & higher potential to manage the volatile Mutual Funds market.

In this blog, you will learn the corpus fund meaning in finance with different sources, benefits, uses & the corpus fund impact in real estate.

Let's begin with the meaning of corpus fund in finance.

What is a Corpus Fund in Finance?

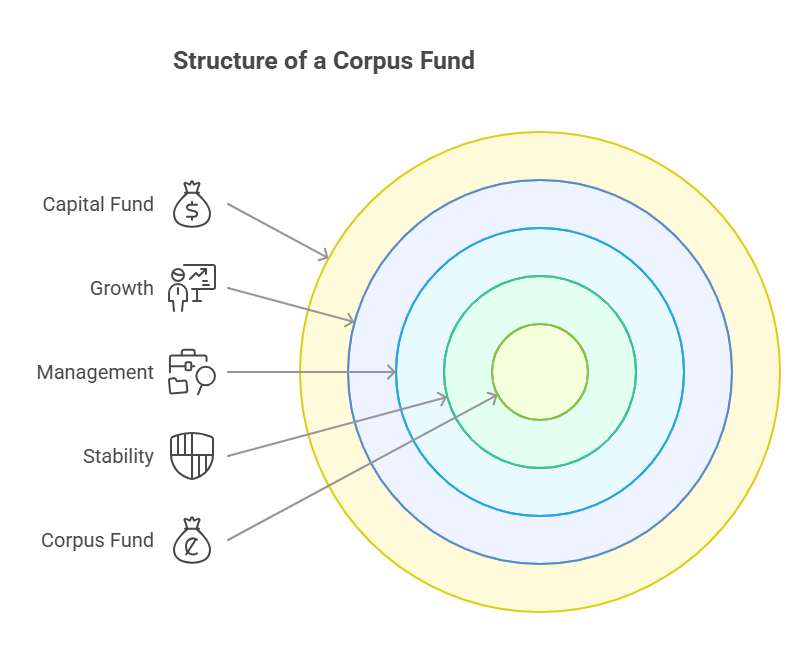

In finance, the term corpus refers to the total amount of money that you invested in a fund or scheme. It represents the principal amount, without excluding any returns, profits, or interest gained. Corpus funds are the foundation upon which all future returns & compounding growth are built.

For example: If you invest Rs 5,00,000 in a mutual fund, that Rs 5,00,000 is your corpus (total amount you invest). Over time, as the fund earns returns, say it grows to Rs 6,50,000, the extra Rs 1,50,000 is the return on your corpus. But the initial investment of Rs 5,00,000 remains the corpus.

Key Highlights:

- Corpus fund works as a collection of investmentsmanaged together with a long-term purpose.

- Gives stabilityand acts as a backup fund for future use.

- Managed by AMCs (Asset Management Companies),which focus on maximizing returns while reducing risks.

- Also known as the Capital Fundor Endowment Fund.

- There is a difference between the capital Fund and corpus Fund. Corpus Fund is a permanent base amount, often built from donations or one-time contributions, while capital fund includes all capital assets & reserves, reflecting the net worth of an organization.

- In mutual funds, AUM (Assets Under Management)is often called the corpus.

- It can be created with a small amount of a SIP (Systematic InvestmentPlan). Over time, your contributions grow into a powerful financial potential.

Let's understand with an example, imagine you invest Rs 10 lakhs in an RD, but only use the compounding interest every year, while your main capital stays untouched. That is how a corpus workflow works- safely, slowly, and strategically.

Also Read: Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

Ready to uncover the treasure sources behind corpus funds? Explore the unexpected source that supports these funds in our next headline.

What Are the Various Sources of Corpus Funds?

Think of corpus funds as a financial build through shareholders, donors, and sometimes government help to keep an organization strong, stable, and achieving its goals. Corpus funds are the backbone of any organization, giving it the power to be sustainable. Let us break it down:

Key Sources of corpus funds are as follows:

-

Shareholders

It is the primary contributor. The Individuals, institutions, or company's investment capital helps organizations to maintain & grow the company.

-

Donations

A major source for NGOs and charitable trusts. Funds come from individuals, corporations, or business groups. Donations are frequently provided to remain and generate money.

-

Government Support

Given to sectors with public importance (like education, health, and infrastructure). Helps in building a strong foundation for long-term projects or development schemes.

Point to be noted: A corpus fund is usually non-refundable. It is a permanent fund meant for long-term stability & not returned to contributors.

Benefits of Corpus in Mutual Fund

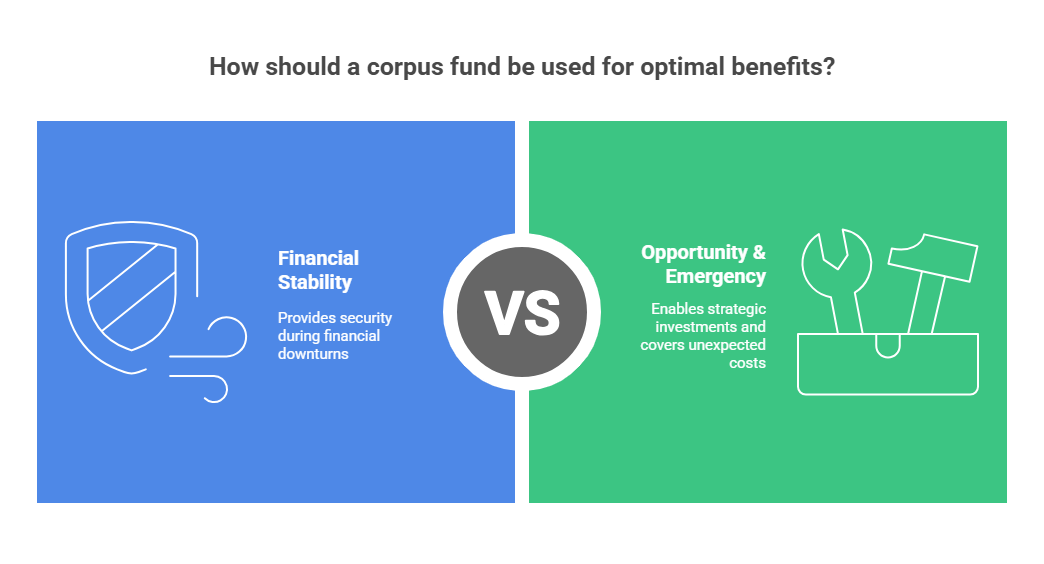

A corpus fund is not for daily purposes. It provides long-term safety for security, opportunity & emergencies. Think of it as your organization’s financial backup plan, always there when you need it most. Here is why it matters

Key Benefits of a Corpus Fund:

Financial Stability

- During harsh times, a corpus fund surprise for financial security. The corpus fund can pay expenses while maintaining organizational continuity in unfavourable situations of an unexpected drop in income until things bounce back financially. To maintain stability & prevent issues, financial safety is essential.

Long-Term Saving

- The corpus fund allows people or organizations to benefit from these opportunities. In this case, if a contract occurs, the corpus fund may be used to finance an organization's equipment investment. This smart spending could end up in long-term cost savings and functional benefits.

Emergency Cover

- A corpus fund could be utilized for dealing with unexpected emergencies. To avoid financial stress and ensure that operations will continue without unpredictable financial issues, it could be used to cover unexpected costs like necessary maintenance.

Fund Fact: In housing societies or institutions, a corpus fund is mandatory as part of the agreement or membership terms.

How Are Corpus Funds Used?

The corpus funds are not suited for daily commercial purposes. Corpus mutual funds are invested smartly & the purpose is to be used for long-term goals. Here is how to use it:

-

Invest for Growth

To invest in equity, debt, or real estate, the returns are used to help and support the organization for a long time. Compounding returns helps in long-term growth.

-

Support Big Projects

Corpus fund can be used by a non-profit organization by spending the interest on facility expansions, equipment deals & building construction. Using the initial amount ensures the fund distribution.

-

Run Programs Smoothly

To run or initiate programs in non-profit organizations demanding cash support, this mutual fund provides a consistent source of income, ensuring that these programs run smoothly.

-

Act as an Emergency Backup

In periods of economic crisis, corpus money is utilised as an emergency need while balancing between security & adaptability by giving the organization. It provides the flexibility required to deal with uncertain situations without compromising its key objectives.

News Flash: “Are you still struggling with finding the right plan?” Choose the best SIP plans starting at just Rs.3000 per month.

How Is the Corpus Fund Used in Real Estate?

The corpus fund provides unexpected financial support for any real estate, helping with maintenance, enhancements, and the security of your home.

- Maintenance and Repairs: The Corpus Fund helps cover high maintenance costswithout using the actual amount.

- Infrastructure Upgrades: The fund can be used to upgrade & change common facilitiesin society.

- Emergency Situations: Handling unexpected situations as an emergency backup quickly.

- Future Expansion:This mutual fund can be used as the initial savings fund for further projects & less the chances of taking loans.

Also Read: Real Estate Vs Mutual Funds: Which Is Better For Long-term?

Conclusion

To sum up, the corpus is the backbone of every mutual fund. Whether you are investing through a SIP or a lump sum, your money contributes to this growing pool. The corpus in finance plays a crucial role in growth, support & mainly in emergencies. It provides long-term stability, covers various expenses & often gets a boost through government support. A larger corpus means more power to diversify, manage risk, and aim for better returns.

So, the next time you invest, remember you are not putting money in a fund; you are building a strong foundation for the financial journey.

Frequently Asked Questions

1. What is corpus in retirement?

It is the total money you save by retirement to cover your expenses & lifestyle after you stop working.

2. What does corpus stand for in finance?

Corpus means the total money invested in a fund by all investors, basically the full size of the fund.

3. How is the retirement corpus calculated?

Subtract your current age from your planned retirement age. More years left means more time to grow a bigger retirement corpus.