Table of Contents

- What are Specialised Investment Funds?

- What is the SIF Investment Strategy?

- What are the Requirements for Specialised Investment Funds

- Who Can Set Up a Specialised Investment Funds?

- How to Invest in SIF for Beginners?

- What are the Benefits of New SIF SEBI Funds?

- What is the Difference Between a Mutual Fund And an SIF?

- Things to Consider Before Investing In SIFs

- What Does SIF Offer Investors?

- Risk Mitigation in SIF

- Who Should Invest in SIF?

- Is a SIF Right For You?

- Conclusion

Dated 27th February 2025 marked a historic moment with SEBI launching SIF (Specialized Investment Funds), bridging the gap between traditional Mutual Funds & portfolio management services (PMS).

If you are among those who feel mutual funds are too restrictive, on the other hand, managing portfolio services seems like taking a big leap? Well, offering relief to Indian investors, announcing SIF investment will give more flexibility in managing investment strategies.

In this guide, you will find how to invest in SIF even if you are a beginner to mutual funds as well as how the SIF investments is tailor-made for high-net-worth investors like you, helping you work in the niche areas around your portfolio.

What are Specialised Investment Funds?

A Specialized Investment Fund (SIF) is an investment vehicle that bridges the space between your regular funds and Portfolio Management Services (PMS). It is a regulatory framework started by SEBI (Securities and Exchange Board of India) and came into effect on April 1, 2025.

SIF funds in India provide experienced and HNIs (High-net-worth investors) access to sectors that regular mutual funds typically do not invest in. This sector involves private equity, real estate or infrastructure.

The following are the features involved in the Specialised Investment Funds in India:

- Minimum Investment: The minimum investment of Rs 10 lakh is required to get started with SIFs, making it appropriate for institutional investors and HNIs.

- Strategies Flexibility: Fund managers of SIF funds are free to implement different strategies dynamically, unlike regular mutual funds.

- Using Derivatives: They can use derivatives to achieve higher growth and not just to protect against losses, but it may also result in bigger risks.

- Investments Targeted: SIFs can give you access to niche markets that traditional funds can not provide by focusing on particular areas.

- Regulatory Framework: SIF provides safe and transparent investments (through SEBI), but due to its flexible nature, it can be riskier than MFs.

Now, let us explore which Investment Strategy SIF funds work on?

What is the SIF Investment Strategy?

The investment strategies followed by the SIF funds in India are more flexible and dynamic than traditional mutual funds. They are categorized under three strategies:

Equity-oriented Strategies (invest in equity and related instruments)

- Equity Long-Short Fund: Mainly invests in equity (min 80%) with short positions through derivatives (max 25%).

- Equity Ex-Top 100 Long-Short Fund: Invest in stocks (min 65%) outside the market cap's top 100 with derivatives (max 25%).

- Sector Rotation Long-Short Fund: Select some sectors (max 4) and rotate investment in them according to their performance with short exposure.

Debt-oriented Strategies (invest in debt instruments)

- Debt Long-Short Fund: Invest across debt instruments with short exposure through hedging derivatives.

- Sectoral Debt Long-Short Fund: Invest across two sectors of debt (at least), with 75% in one sector and 25% max exposure through debt derivatives.

Hybrid Strategies (equity and debt investments collectively)

- Active Asset Allocator Long-Short Fund: Invest across multiple asset classes (equity, debt, derivatives, REITs/InvITs and commodity derivatives) by shifting dynamically.

- Hybrid Long-Short Fund: Invest flexibly in equity (min 25%) and debt (min 25%) with short exposure (max 25%).

How are the investment strategies of SIF funds in India different from those of mutual fund strategies? They differ due to some factors like Flexibility, Derivatives and Exposure to Alternative Assets.

Now, you will learn the requirements to meet for investing in Specialised Investment Funds in India.

What are the Requirements for Specialised Investment Funds (SIF)?

The requirements that you should meet for investing in Specialised Investment Funds are listed below:

-

Minimum Investment

A minimum investment of Rs 10 lakhs is required to invest across SIF funds in India. It applies at the level of Permanent Account Number (PAN) and does not apply to accredited investors.

-

Maintaining Threshold

Investments in SIFs can be done through systematic approaches such as SIP, SWP and STP. However, you need to maintain the threshold amount of Rs 10 lakhs or you may need to redeem the entire remaining amount.

-

Investor Suitability

The SIF investments are recommended to experienced investors and HNIs, who understand the market changes and have high-risk potential and are familiar with complex investment products and strategies.

Pro Tip: Use a SIP calculator to know the return rates to match your financial goals accurately.

Who Can Set Up a Specialised Investment Funds?

There are two routes for proving eligibility for setting up Specialised Investment Funds:

Sound Track Record Route

It describes what a mutual fund must have.

- At least 3 years of operational history is a must.

- Need an average AUM of Rs 10,000 crore or more over the past three years.

- No regulatory actions should be taken against AMC or the sponsor in 3 years.

Alternate Route

It is established when the track record criteria are not met.

- Must appoint a CIO with at least 10 years of management experience and AUM of Rs 5000 crore (min).

- At least one more fund manager with 3 years of experience (min) is needed.

- No regulatory action against AMC or the sponsor.

More Requirements

- AMC needs to submit a detailed application to SEBI for approval.

- There should be a different brand name and identity for SIF from the regular mutual funds of the AMC.

- Resources used to carry out operations can be shared among SIFs and mutual funds by AMC.

Now, you must be thinking, “What benefits would I get by investing in SIFs?”

Let us answer your question.

After the basics, let us answer your curiosity to know, “How to invest in SIF?”

Start Your SIP TodayLet your money work for you with the best SIP plans.

How to Invest in SIF for Beginners?

Due to the complex nature and higher risk of Specialised Investment Funds, it is crucial to be cautious when investing in SIF as a beginner. Follow the given steps to make your first investment:

Step 1: Check Your Eligibility and Financial Situation

- Keep your investment amount ready, that is, Rs 10 lakhs (min) for SIF.

- Evaluate how much risk you can endure before investing.

- Check your investment horizon and goal with SIF's strategy.

Step 2: Understanding SIF's Nature and Strategies

- Research and learn what is SIFand its investment strategies in detail.

- Explore the available investment options and choose the reliable one.

- Carefully read the offer document and the scheme information document (SID) of the SIF.

Step 3: Choose a Reputable AMC that offers SIFs

- Research well and select an AMC registered with SEBI with a strong track record.

- Consider knowing about the fund manager (his track record, experience and investment philosophy).

Step 4: Complete Your KYC

- Provide all required documents and complete your KYC with the AMC.

- Give identity proof, address proof and income proof as per SEBI.

Step 5: Invest in an SIF Scheme

- Select an SIF scheme that meets your goals and risk tolerance.

- SIF allows investment with lump-sum, SIP, SWP and STP for you.

- As SIF restricts liquidity, check redemption rules, lock-in periods and any penalties included.

Step 6: Track Your Investment

- Monitor your investment performance regularly.

- Be updated about any changes in the regulatory or market trends.

Important Read: What is the Best Date for SIP? Tip for Smart Investors

What are the Benefits of New SIF SEBI Funds?

The Specialised Investment Funds offer several benefits, including flexible investment strategies and access to niche markets. The benefits include:

-

Advanced Investing Strategies

SIF allows accessibility to advanced investment strategies that were only available through PMS or AIFs in traditional investments.

-

Flexibility and Customization

SIF allows fund managers to freely apply different strategies and asset allocation techniques, resulting in customized investment approaches.

-

Higher Returns Potential

SIF investments generate higher returns than traditional investments by involving dynamic, advanced and specialized investment approaches.

-

Portfolio Diversification

SIF funds in India provide diversification of portfolios across alternative assets and niche markets, which were not accessible through regular funds.

-

Expert Management

The funds under SIF or Specialised Investment Funds are managed by professional fund managers, who have expertise in strategy execution and risk management.

-

Regulations

SIF investments fall under the regulatory authority of SEBI, offering transparency, disclosure and security to investors.

-

Covering the Gap

SIF offers a balance between flexibility, growth potential and regulatory oversight by bridging the space between mutual funds and PMS.

Let us look at the main factors that set the traditional mutual funds apart from the Specialised Investment Funds.

Smart Investments, Bigger Returns

What is the Difference Between a Mutual Fund And an SIF?

Both Mutual Fund and Specialised Investment Funds (SIF) are investment options that are regulated by SEBI and pool money from investors to invest across asset classes. Yet, they serve distinct investor needs and work differently. Let us look at the comparison between them:

| Feature | Mutual Fund | SIF |

|---|---|---|

| Minimum Investment | ₹500 or less | ₹10 lakh |

| Target Investors | Retail, beginner, small savers. | HNI, sophisticated, risk-tolerant. |

| Strategy Flexibility | Rigid (defined by SEBI categories). | Highly flexible, niche, or thematic. |

| Customization | Limited | High; can be concentrated or thematic. |

| Asset Universe | Mostly listed equity/debt. | Listed, unlisted, private equity, alternatives. |

| Liquidity | Highly liquid, daily redemption. | Moderate; open/closed/interval structure. |

| Regulation & Reporting | Very strict, daily NAVs | Strict, with scenario risk disclosures. |

| Risk Profile | Low to moderate | Moderate to high |

Important: Always analyse your investment goals and risk appetite and check their compliance with the fund’s goals and risk levels to make informed decisions.

Let us check out the things you should keep in mind before investing in SIF funds in India.

Things to Consider Before Investing In SIFs

The SIF funds in India offer advanced investment strategies that were not involved in regular funds but they also involve more complexity and risks. To overcome these risks, you need to consider the following before investing:

-

Eligibility

You need to prepare the minimum investment amount of Rs 10 lakhs to invest in SIFs.

-

Investment Goals

Go for a long-term investment horizon if interested in investing in SIF, as it often targets long-term growth.

-

Risk Tolerance

Identify your risk tolerance and match it with the risks associated with SIF investments, as they may carry higher risk.

-

Liquidity

It is not easy to withdraw your investments from SIF because it invests in illiquid funds with lower liquidity.

-

Investment Strategy

SIFs employ diverse and complex strategies, so investors need to understand them thoroughly.

-

Regulations

To avoid sudden shock, revise the guidelines of SEBI and learn any terms you are specifically interested in.

-

Expenses

SIF has a higher fee structure than traditional mutual funds, so you need to understand its impact on your returns.

Must Read: 5 Common Mistakes To Be Avoided Before Investing In Mutual Funds

Now, a question must have arrived in your mind,” What does the SIF have to offer you?” Let us dive into that.

What Does SIF Offer Investors?

Here is the list of benefits offered by the Specialized Investment Funds to investors:

| Benefits Offered By SIFs | Description |

|---|---|

| Strategy Flexibility | Advanced, customized tactics (long-short, sectoral, multi-asset). |

| Niche Access | Sectors like infrastructure, start-ups, or real estate. |

| Portfolio Diversification | Exposure across multiple asset classes. |

| Higher Risk-Adjusted Returns | Potential for Greater upside via flexible mandates and tools. |

| Professional Management | Only experienced AMCs and managers, with regulatory oversight of SEBI. |

| Liquidity & Customization | Flexible redemption and investment structures. |

Zoning out, thinking whether SIF provides you with some risk mitigation factors. Wake up, let us look at the factors in the next part.

Risk Mitigation in SIF

Risk management is one of the main benefits you get by investing in SIFs. Here are the strategies that SIF funds in India uses to keep your investments safe:

-

Exposure Limits

SIF allocates assets to individual sectors or companies to mitigate the concentration risks. It has 15% exposure in equity and 20%-25% in fixed income to ensure diversification.

-

Regulatory Oversight

SIF funds in India provide a detailed exposure to investors to keep them well-informed about the risks involved and ensure transparency and security.

-

Accredited Investors

Investors who meet a pre-defined criterion and get an investment opportunity are accredited investors. This exemption comes with higher due diligence and risks.

-

Flexible Structures

Flexible opportunities like open-ended and closed-ended options provide a balance between returns and risks, allowing managers to match investment horizons with risk levels.

Wondering, SIF investments are suitable for or not. Well, you will know in the next heading.

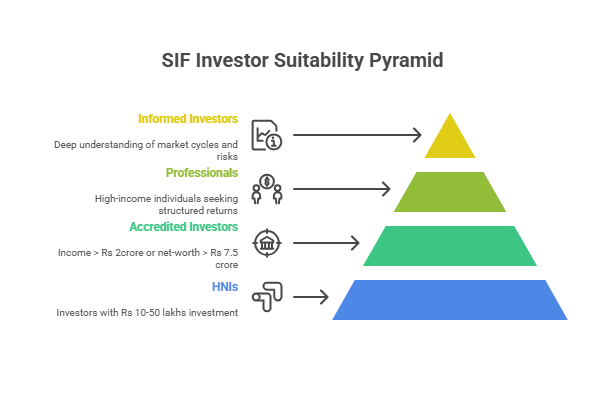

Who Should Invest in SIF?

Specialised Investment Funds are not suitable for everyone. They act as a bridge between MF and PMS, serving specific investors who fall under the following categories:

-

HNIs (High-Net-Worth Individuals)

Investors with Rs 10-50 lakhs of investment, who can deal with the complexity of SIF but do not want to invest in PMS.

-

Accredited Investors

Investors who meet the specific criteria, in this case with income more than Rs 2crore or net-worth more than Rs 7.5 crore.

-

Professionals

Individuals with high income, seeking structured and flexible approaches that can give high returns, including doctors, entrepreneurs and others.

-

Informed Investors

Individuals who have a deep understanding of market cycles, trends, changing conditions, liquidity risks and long-term capital allocation.

Now, here comes the most important question:” Is SIF investment right for your financial future?” Let us dive into that.

Is a SIF Right For You?

The SIF funds in India are relevant for investors who are experienced in investing and understand market dynamics. Investors who are comfortable with high risk levels can invest in the SIFs' strategies, like derivatives and short-selling. These complex strategies result in high volatility and potentially greater losses.

To invest in these funds, you are required to meet the minimum threshold limit (Rs 10 lakhs), which may not be a good condition for many. This may not be a good option if you are new to investing, have low risk tolerance, have limited capital and are unfamiliar with complex approaches.

But if you are looking for sophisticated strategies, desire diversification in niche markets, have a long-term perspective, prefer a regulated environment and possess required capital, you should consider investing in SIF funds in India for wealth creation.

The compatibility of the Specialised Investment Funds depends on your financial situation, investment goals and risk tolerance. You should align the investment strategies of SIF with your financial situation and then decide if you should invest.

Conclusion

In short, Specialised Investment Funds represent a bold evolution in the investment world. SIF investments offer an appealing blend of advanced strategies and niche market exposure with flexibility to investors who want to invest beyond the limits of traditional mutual funds.

Because of the high risk level, SIF funds in India are not ideal for everyone, they demand financial knowledge and a keen understanding of market risks. This condition makes these funds appropriate for HNIs and institutional investors who can meet the minimum threshold requirement of Rs 10 lakhs for investing in SIF.

Related Blog: Start SIP by Choosing the Best Mutual Funds in India

FAQs

-

What is SIF by SEBI?

A Specialised Investment Fund (SIF), as defined by SEBI, is basically a way for wealthy investors to invest their money in different investment approaches.

-

How to start SIF in India?

Eligibility to launch SIFs in India requires either established mutual funds (Rs 10,000 crore AUM) or newer AMCs with special talent (CIO with 10+ years of experience).

-

Is SIF investment safe?

The new asset class of SEBI, SIF, carries a high risk level due to its exposure to niche markets and complex investment strategies.

-

How is SIF taxed in India?

SIF funds in India are taxed at 20% for short-term gains and 12.5% for long-term gains.

-

What is the minimum investment in SIF?

The minimum threshold for investing in SIF is Rs.10 lakh (at PAN level) across all SIF investment strategies.

.png&w=3840&q=75)

.webp&w=3840&q=75)