Table of Contents

Do you want to keep most of your earned money to yourself while following the tax rules? This is exactly what tax planning will do to you. Tax planning is all about organizing your finances in a smart way to minimize your tax payments and maximize your savings legally.

Strong tax planning allows you to make informed decisions and benefit from eligible deductions and credits while preparing you for the changes in tax laws.

Let’s take a closer look at what is tax planning and how to do it right.

What is Tax Planning?

In simple words, tax planning can be described as categorizing your finances to reduce your tax bills. It is all about making decisions to keep more of your money.

Assume you are getting ready for a big trip, you would not just throw everything into a bag without thinking, right?

Instead, you would plan things out, pack sensibly and look for the best offer for your trip.

Tax planning is similar; you ought to be cautious, not just reacting when tax time hits.

Do you want to know, “What are the main purposes of planning your taxes?” Here are a few:

-

Lowering Taxable Income

The main goal of tax planning is to reduce your taxable income. You can do this through many ways like taking advantage of deductions & credits.

-

Avoiding Legal Issues

Tax planning is not about saving money only; it keeps you on the fair side of the law too. By planning everything about your tax earlier, you can avoid points that are related to inaccurate reporting of your income.

-

Increasing Savings

Effective tax planning is a solution for saving more money. By understanding your tax responsibilities, you can manage your money in a better way and save more for future goals.

-

Finance Stability

Tax planning can help you to keep your financial state stable. By knowing what your tax liabilities are in advance, you can adjust your budget wisely & avoid unpleasant surprises when tax season comes around.

Be tax-savvy, not tax-sorry! Use a free Tax Calculator to get it right.

Now that you what is tax planning, let’s take a look at different types of tax planning that are suitable for your financial goals.

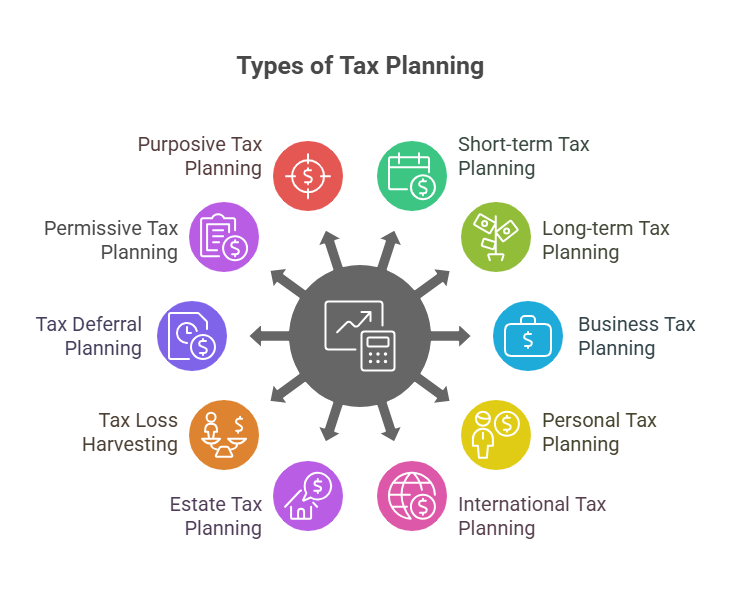

Types of Tax Planning

There are different ways through which you can employ effective and efficient tax planning practices.

The following are the types of tax planning that will be beneficial for you:

-

Short-term Tax Planning

Tax planning is done to reduce the total taxable income for the current financial year is called short-term tax planning. It includes maximizing deductions, using tax credits and timing when you earn income or spend money.

-

Long-term Tax Planning

Long-term tax planning is the concept of designing a strategy that works for saving your money for the long term. Here, you can plan for retirement, think about investments and arrange your estate to reduce future tax liabilities.

-

Business Tax Planning

This focuses on helping businesses to get the best way for their tax obligations. It involves selecting the proper business structure (like an LLC or corporation), managing values and utilizing business deductions and credits.

-

Personal Tax Planning

This is employed for individual taxpayers and their specific financial needs. This includes approaches like investing in a tax-efficient way, maximizing retirement contributions and planning for big life changes.

-

International Tax Planning

This is an important strategy for individuals and businesses that trade internationally. It involves understanding tax treaties, reporting foreign income and following international tax laws.

-

Estate Tax Planning

This is deployed to reduce taxes on someone's assets after their death. These strategies can involve using trusts, gifting to others and making charitable donations to reduce estate taxes.

-

Tax Loss Harvesting

This is a strategy mainly used in investment portfolios to balance profits with damages. It helps lower taxable income by selling off investments that are not performing well.

-

Tax Deferral Planning

This type of tax planning approach permits you to delay your tax payment until a later date in the future. The common techniques used for doing so involve investing in retirement accounts or using investment choices that let you postpone taxes.

-

Permissive Tax Planning

This is about taking benefit of the legal choices tax laws permit you. It uses deductions, credits and exemptions that the government allows.

-

Purposive Tax Planning

This is a more planned approach to tax planning. It analyzes your financial situation & helps you make decisions that align with your long-term objectives.

Alright, now let’s get to the good stuff. Here are some tips to help you with your tax planning.

Strategies for Effective Tax Planning

Composing a good strategy is an important stop in the journey of your effective tax planning for reducing your overall tax liabilities.

Described below are some elements of effective tax planning strategy:

-

Splitting Income

Income splitting means sharing income among family members to take advantage of lower tax rates. If your partner or kids earn less, moving some income to them can reduce your overall tax bill.

-

Utilizing Tax Deductions

Stay on top of your expenses throughout the year. Whether it’s medical bills, donations or business costs, every little bit of deductions can lower your taxable income.

-

Using Tax Credits

Unlike deductions which lessen your taxable income, tax credits cut down on what you owe directly. Look up credits you might qualify for. It’s like finding a little treasure!

-

Investing Wisely

Think about putting your money into tax-friendly accounts like a 401(k) or IRA. These can help you save for retirement while also lowering your taxable income.

-

The 5 D Rules of Tax Planning

To make your tax planning even more effective, consider the "5 D Rules." It stands for deduction, deferment, diversification, distribution and documentation. These principles can guide you in managing your tax obligations smartly.

| Principles | Description |

|---|---|

| Deduction | Keep track of all possible deductions. |

| Deferment | If possible, consider deferring income to a future year when you might be in a lower tax bracket. |

| Diversification | Spread your investments across various asset classes. |

| Distribution | Think about how you can distribute income among family members or entities. |

| Documentation | Keep thorough records of all your financial transactions. |

In India, tax planning has its own twists. If you are in India then you need to follow the laws over here.

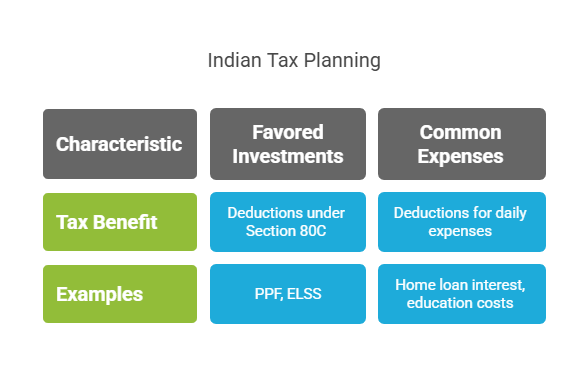

Tax Planning in the Indian Context

The tax laws differ from country to country. The Indian tax system has specific rules and deductions.

Let us see what are they:

-

Favored Investments for Indians

For example, under Section 80C, you can subtract investments in things like the Public Provident Fund (PPF) or Equity Linked Savings Scheme (ELSS). These not only help you save on taxes but also in your wealth creation over time.

-

Utilization of Common Expenses

You can also claim deductions for daily expenses like home loan interest & education costs. Being aware of these can help you save more on taxes.

Now, let us clear up a common misunderstanding: tax planning and tax management are not the same. Keep reading to know the difference.

Tax Planning vs. Tax Management

Given below are some key differences between tax planning and tax management:

| Aspect | Tax Planning | Tax Management |

|---|---|---|

| Definition | The process of strategizing to minimize tax liability. | The ongoing process of ensuring compliance with tax laws. |

| Focus | Long-term financial goals and tax efficiency. | Day-to-day management of tax obligations and filings. |

| Frame | Typically involves future-oriented strategies. | Involves current and immediate tax responsibilities. |

| Activities | Identifying deductions, credits, and tax-saving strategies. | Preparing and filing tax returns and managing payments. |

| Objective | Reduce taxable income and enhance financial growth. | Ensure compliance and avoid penalties. |

| Approach | Proactive and Strategic. | Reactive and operational. |

| Frequency | Review annually or as financial situations change. | Ongoing throughout the year. |

So, after going through all this information, you must be wondering, "Why bother with tax planning?", right?

Well, let's see what are the benefits you pain while doing a smart tax planning.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Benefits of Tax Planning

The main purpose of doing effective tax planning is to make your financial intentions welcoming to you.

Here are some benefits that you can get from effective tax planning:

-

Enhanced Financial Growth

Clever tax planning can lead to better financial growth. Lowering your tax liability means you can put more toward investments and savings.

-

Improved Retirement Savings

Tax planning can also help you save for your retirement. By using accounts with tax benefits, you are not only grooming for the future but also lightening your current tax load.

-

Stability & Predictability in Financial Planning

Tax planning provides you with stability & predictability in your financial planning. Knowing your tax debt in advance helps you budget productively and stay on top of your finances.

-

Preparing for Tax Responsibility

As tax season approaches, it is crucial to prepare for your tax obligations. Here are some steps to take:

| Steps To Take | What To Do |

|---|---|

| Establishing a Tax Calendar | Make a calendar for tax deadlines so you can keep track of when returns are due and when you need to make payments. |

| Staying Informed on Tax Law Changes | Because tax laws change often, it is vital to keep yourself informed. |

Thinking about these benefits, it's clear that good tax planning is not just about saving money, it is about building a strong base for your financial future.

Conclusion

To conclude, effective tax planning is key for those who want to make the most of their money and pay less in taxes. Understanding the concept of different types of tax planning and using skilled approaches can help you keep more of what you earn and reach your financial objectives.

When you start planning your taxes, think about starting a SIP in the best mutual funds. These investment instruments can help grow your money over time and may even offer some tax improvement.

By pairing tax planning with smart investments, you can set yourself up for a safe financial future.

Also Read :

1. Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

2. What is Input Tax Credit? Examples, Eligibility and GST Rules

FAQs

-

What Is Tax Planning?

Tax planning can be defined as organizing your finances to reduce your tax bills. It is all about making decisions to keep more of your money.

-

What are the Objectives of Tax Planning?

The main objective of tax planning is to reduce tax liability, increase deductions, ensure compliance, raise savings and reach financial goals.

-

What Are the Different Tax Planning Strategies in India?

The tax planning strategies in India use deductions under Sections 80C & 80D, invest in tax-saving accounts and plan for growth.

-

What steps Should Be Taken When Planning Taxes?

You should evaluate your financial state, know applicable deductions or credits, make a tax calendar and take guidance from a tax professional.

-

Can tax planning help avoid penalties and audits?

Yes, effective tax planning confirms accurate description and observance, decreasing the risk of penalties and audits.

-

How can tax planning improve long-term financial stability?

Tax planning helps supervise liabilities, increases savings and assists investment growth, investing to overall financial stability.

-

What is tax management?

The functioning process of ensuring compliance with tax laws, controlling payments and filing returns accurately and timely is known as tax management.

_(1).webp&w=3840&q=75)