Table of Contents

In 2025, while most headlines were talking about the market booms and crashes due to global uncertainties, there were some investors who were quietly multiplying their fortunes, turning the turbulence of 2025 into impressive gains. One of these top investors in India is Radhakishan Damani, with a net worth of Rs 1,29,000 crore, whose journey from retailer to market leader is the perfect example.

Well, he was not the only one setting the benchmarks high, there were other legends also, such as Rekha Jhunjhunwala, Ashish Kacholia, Mukul Agrawal and many others. They play a big part in the remarkable 16% returns of India’s stock market in 2025, amid global issues.

Want to know more about the top investors in India? Dive in this blog to explore the portfolios of the top 10 investors in India in 2025, exploring their key holdings and how their disciplined approaches could inspire your own investment journey. So, let us get started.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Listing Top 10 Investors in India

In 2025, the Indian stock market is vibrant, with a diverse mix of seasoned and young investors driving wealth growth in India.

For the year 2025, key figures shaping India's financial landscape include many popular investors like Radhakishan Damani, Rakesh Jhunjhunwala and Ashish Kacholia. They demonstrate how combining traditional stock picking with investments in fast-growing sectors like tech and private equity can create a significant impact.

Here is a list of India’s top 10 investors in 2025:

| Investor | Estimated Net Worth | Main Holding | Investment Style |

|---|---|---|---|

| Radhakishan Damani | Rs 1,29,000 crore | D-Mart (Avenue Supermarts) | Value investing, long-term hold |

| Rekha & Rakesh Jhunjhunwala | Rs 60,000+ crore | Titan Company | Long-term, high conviction investing |

| Ashish Kacholia | Rs 3,300 crore | Shaily Engineering | Mid-cap focused, high-growth stocks |

| Mukul Agrawal | Rs 1,900 crore | ASM Technologies | Mid-cap growth focus |

| Akash Bhanshali | Not publicly estimated | Gujarat Fluorochemicals | Growth-focused |

| Nemish Shah | Rs 2,700 crore | Lakshmi Machine Works | Value investing, long-term |

| Vijay Kedia | Not publicly estimated | Tejas Networks | Value investing, SMILE philosophy |

| Ashish Dhawan | Rs 6,600 crore | IDFC First Bank | Private equity, research-driven |

| Kunal Shah | Not publicly estimated | Razorpay (startups) | Angel investing, active startup investor |

Must Read: Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

These were the top 10 investors of India in 2025, but what about the future of India's stock market? The future of India's financial system lies in the hands of young entrepreneurs and angel investors, who are driving growth in start-ups, technology and emerging sectors.

Keep reading to know the top young Indian investors in 2025.

Best Mutual Funds for 2026 Backed by Expert Research

Top Young Investors in India

Here is the table introducing some of the most influential young investors in India, who are reshaping the investment world with innovative approaches and bold strategies.

For Stock Market Investments:

| Investor | Estimated Net Worth | Main Holding | Investment Style |

|---|---|---|---|

| Nikhil Kamath | Rs 20,700 crore | Zerodha | Long-term value + growth, tech-focused |

| Ashu Sehrawat | Not publicly disclosed | Short-term trades | High-risk trading, short-term momentum |

| Bhavook Tripathi | Rs 1,000+ crore | R Systems International | Mid-cap focused, opportunistic value |

| Mukul Agrawal | Rs 1,900 crore | ASM Technologies | Mid-small cap growth focused |

For Startup and Angel Investments:

| Investor | Estimated Net Worth | Main Holding | Investment Style |

|---|---|---|---|

| Kunal Shah | Rs 4,000 crore | CRED | Angel investor, fintech-focused |

| Ritesh Agarwal | Rs 5,500 crore | OYO Rooms | Venture capital/angel investor |

| Ankush Sachdeva | Rs 1,500 crore | ShareChat | Strategic angel investor, tech innovator |

| Vijay Shekhar Sharma | Rs 9,500 crore | Paytm | Fintech pioneer, growth-stage investor |

| Gaurav Munjal | Rs 1,200 crore | Unacademy | Ed-tech and fintech focus |

| Kunal Bahl & Rohit Bansal | Rs 8,000 crore (combined) | Snapdeal | Early-stage investors, VC style |

| Kaivalya Vohra & Aadit Palicha | Not publicly estimated | Zepto | Young tech entrepreneurs, early-stage investors |

Also Read: Top 10 Youngest Billionaires in India 2025: Ranked by Net Worth

Now, let us take a deep look inside the portfolios of the top 10 investors in India.

Portfolios of the Top 10 Investors in India

Here are the detailed top investors' portfolios in India 2025:

1. Radhakishan Damani

He started Avenue Supermarts, also known as D-Mart. He is recognised for his focus on value and his long-term investment approach. His portfolio is mainly concentrated in D-Mart, which is also the primary source of his wealth and contains 67% of his equity portfolio. The following are the holdings of Damani:

- Avenue Supermarts (D-Mart)

- VST Industries (Tobacco company)

- Trent (Partof Tata Group)

- Sundaram Finance

- Blue Dart Express

- 3M India

- Advani Hotels & Resorts

2. Rakesh Jhunjhunwala

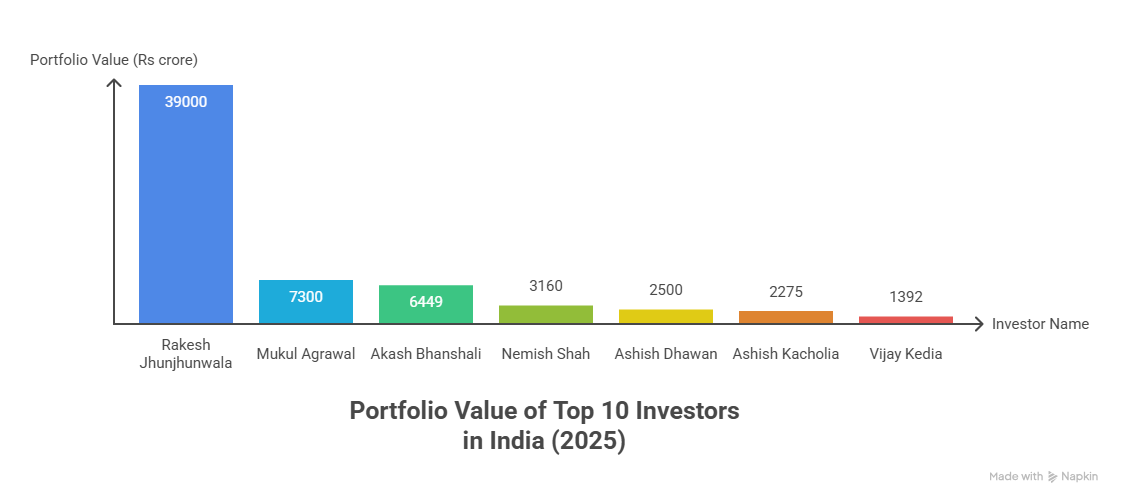

The Jhunjhunwala family has one of the biggest and most well-known investment portfolios in India. After the unfortunate passing of Rakesh Jhunjhunwala, his wife, Rekha Jhunjhunwala, now manages this portfolio, which is worth over Rs 39,000 crore as of September 2025. The primary holdings of the Jhunjhunwala family are:

- Titan Company

- Metro Brands

- Canara Bank

- Crisil (Credit rating and research company)

- Federal Bank

- Fortis Healthcare

3. Ashish Kacholia

Ashish Kacholia is well known for investing in mid-cap companies that have strong growth potential. As of September 2025, his portfolio was valued at over Rs 2,275 crore. The top holdings of Kacholia include:

- Shaily Engineering Plastics (Valued at Rs 366.2 crore)

- Safari Industries (India)

- Beta Drugs

- Man Industries (India)

- Qualitek Labs

- Balu Forge Industries

4. Mukul Agrawal

He is a passionate stock picker who manages the firm Param Capital. His publicly disclosed portfolio is worth over Rs 7,300 crore as of September 2025. Mukul Agrawal's primary investment holdings are:

- ASM Technologies

- Neuland Laboratories

- Radico Khaitan (Alcoholic beverages company)

- PTC Industries

- Dishman Carbogen Amcis

5. Akash Bhanshali

He is the head of Principal Investments at ENAM Holdings. He manages a portfolio worth over Rs 6,449 crore (As of September 2025), that combines research-driven returns with long-term vision. The following are the investments of Bhanshali:

- Gujarat Fluorochemicals

- One97 Communications (Paytm)

- Sudarshan Chemical Industries

- Laurus Labs

- Schneider Electric Infrastructure

6. Nemish Shah

An expert value investor, Nemish Shah is a co-founder of the Enam Group. As of September 2025, his portfolio is worth over Rs 3,160 crore and focuses on industrial and manufacturing companies. His value investments are:

- LMW Ltd. (Lakshmi Machine Works)

- Asahi India Glass

- Elgi Equipment

- Bannari Amman Sugars

7. Vijay Kedia

He is a self-made investor who is highly known for his investment style, SMILE, which stands for Small in size, Medium in experience, Large in aspiration and Extra-large in market potential. As of September 2025, he manages a portfolio of over Rs 1,392 crore with the following holdings:

- Tejas Networks

- Elecon Engineering

- Atul Auto

- Cera Sanitaryware

- Yatharth Hospital & Trauma Care Services

8. Ashish Dhawan

Ashish Dhawan is one of the founders of a private equity firm called ChrysCapital. He is also a well-known philanthropist. His individual portfolio is over Rs 2,500 crore as of September 2025. His investment holdings are:

- IDFC First Bank

- Religare Enterprises

- Mahindra & Mahindra Financial Services

- Equitas Small Finance Bank

9. Kunal Shah

He is a very active angel investor in the Indian startup ecosystem. He is also the founder of CRED. Kunal Shah's portfolio consists of:

- Startups likeRazorpay, Unacademy & Shiprocket

- Early-stagetech companies

- Ganesh Housing and Suraj

10. Anupam Mittal

He is the founder of People Group (including Shaadi.com) and a judge on Shark Tank India. He has an extensive portfolio of startup investments. He is an active angel investor. He uses a "T5" investment framework (Total Addressable Market, Team, Timing, Technology and Traction) to evaluate potential startup investments. His investments are:

- Startup-Rapido, MediBuddy & LetsVenture

- Early-Stage Investment in Startups

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Now, let us understand what new investors can learn from these top stock market investors in India.

What New Investors Can Learn from India’s Top 10

India’s top investors built their success by staying patient, researching every investment and sticking with good companies through the ups and downs. They show that you do not need magic to build wealth, just need stable investing, avoiding past mistakes and thinking about long-term potential growth.

New investors should focus on the quality of the stocks, avoid going after quick profits & trust the power of regular, consistent investing. Learning from these experts, you can also build wealth step by step, just as these top investors did.

The best way for new investors to follow the habits of India’s top investors is through mutual funds and Systematic Investment Plans (SIPs). These allow you to invest regularly, diversify your portfolio and stay invested for the long term.

Pro Tip: Use a Mutual Fund Screener to search, filter, and compare mutual funds.

Smart Investments, Bigger Returns

Conclusion

In short, the list of top 10 investors in India for 2025 includes portfolios like Radhakishan Damani, Rekha Jhunjhunwala, Ashish Kacholia, Mukul Agrawal, Akash Bhanshali, Nemish Shah, Vijay Kedia, Ashish Dhawan, Kunal Shah and Anupam Mittal.

They show that wealth is built by combining patience, focus, research and a passion for smart investing. For beginners, best SIP plans in mutual funds are a simpler way to start building stable wealth, inspired by these top investors' disciplined approach.

Related Blogs:

1. Top 10 Richest Men in Asia 2025: Shocking Net Worths Revealed

2. Top 10 AMC in India 2025: Listed by AUM

3. Top Investment Banking Companies in India: Who To Trust?

FAQs

-

What type of stocks do top Indian investors prefer?

India's top investors generally prefer sectors like FMCG, finance, technology and healthcare.

-

What are some winning strategies used by India’s top investors?

They believe in long-term holding, deep research, value investing and adding to high-conviction bets even in market downturns.

-

How do top investors select stocks for their portfolios?

They thoroughly evaluate business models, management quality, company fundamentals and long-term industry trends before investing.

-

What mistakes do these top investors avoid?

They typically avoid short-term theories, ignore market noise and avoid emotional decision-making when markets get volatile.

-

How do I track the portfolios of leading investors in India?

You can follow public disclosures (like shareholding patterns), finance news portals and investment tracking platforms to see what top investors are buying or selling.

_(1).webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)

_(2).webp&w=3840&q=75)