Table of Contents

- What are Angel Investors?

- Why Angel Investors Matter for Indian Startups?

- List of Top 10 Angel Investors in India in 2025

- Profiles of the Top Angel Investors in India

- Some Success Stories of Startups Backed by Top Indian Angel Investors

- Challenges Faced by Angel Investors and Startups

- Trends Transforming the Future Outlook of Angel Investing in India

- Conclusion

"I have a business idea that has the potential to gain great success in the future, but I do not have enough money to make it a reality". If that sounds like you, then welcome, you are exactly where you need to be. Starting a successful startup is tough, especially when you are low on cash. But the good thing is, there are some individuals called angel investors who invest in great startup ideas like yours.

These investors put their money, experience and connections into early-stage startups when most others hesitate. In 2025, some names like Kunal Shah, Anupam Mittal, Kunal Bahl, Rohit Bansal and Ramakant Sharma stand out as the biggest angel investors who have backed several startups like yours.

Want to know more about them? Let us dive into the stories of these top 10 angel investors in India who are turning ideas into success stories across the country.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

What are Angel Investors?

An angel investor is an individual who gives financial support to startups or businesses that are in their early growth stage and in return, they ask for ownership equity or convertible debt. These investors use their personal wealth, which differentiates them from traditional lenders.

They often invest in promising startups and support them when the risk is high and other investors are hesitant. Angel investors are wealthy individuals who have extra money to invest. They are often retired business owners or company executives.

In India, angel investors usually invest large amounts of money, which is regulated by the government bodies like SEBI. They are essential for helping new businesses grow by supporting them in their early stages.

Must Read: Top 10 Foreign Institutional Investors in India You Must Know

Let us know the importance of these investors for the startup companies in India.

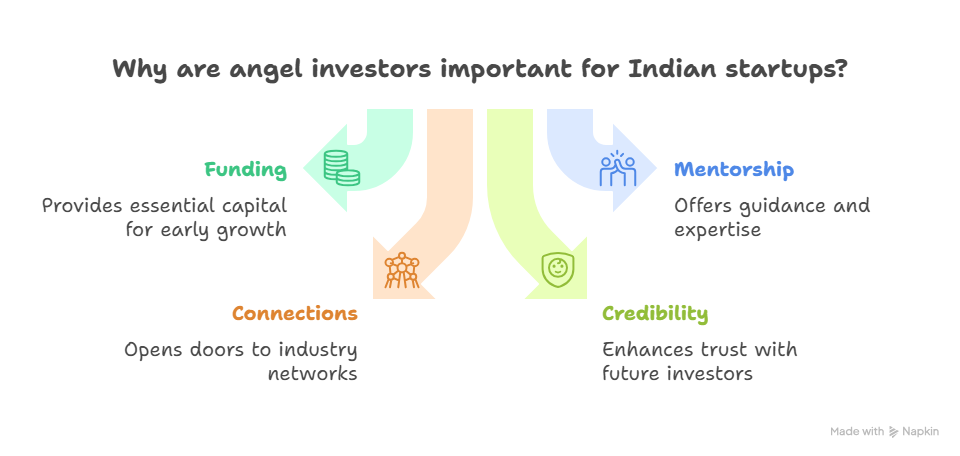

Why Angel Investors Matter for Indian Startups?

Angel Investors are essential for Indian Startups because, apart from the funding, they frequently offer guidance, mentorship, business expertise and valuable connections with the industry, which small businesses may not have. All these things help the young companies to grow efficiently and succeed in the future.

After entrepreneurs have used up their personal savings and money from friends and family, angel investors truly come into the picture as crucial early supporters. These investors are often experienced business leaders or successful entrepreneurs who do not just bring capital, they bring invaluable mentorship and connections, opening doors to customers, partners and future investors.

Being accepted by a respected angel network like the Indian Angel Network or Mumbai Angels instantly boosts a startup’s credibility, increasing the trust of future investors. Unlike venture capitalists who seek quick returns, angel investors are patient, focusing on long-term growth.

In the next heading, you will be introduced to the biggest Angel Investors in India. So keep reading.

Best Mutual Funds for 2026 Backed by Expert Research

List of Top 10 Angel Investors in India in 2025

Behind every successful startup is a fearless believer who saw the future first. For 2025, Kunal Shah became the face of angel investors, as he does not just invest money, he invests belief, with over 287 startups backed. His vision continues to redefine industries and create futures by investing in businesses like CRED, Razorpay and Unacademy.

Well, this is just one case, there are many following the same path. Some of the most famous ones are listed here for you:

| Investor Name | Total Startups Backed | Famous Investments | Sector Focus | Investment Style |

|---|---|---|---|---|

| Kunal Shah | 287+ | CRED, Razorpay, Unacademy | Fintech, SaaS, Consumer tech | Early stage, seed, founder-focused, fintech specialist |

| Anupam Mittal | 117+ | Ola, Shaadi.com, BigBasket | Consumer internet, Fintech, Mobility, Healthtech, D2C | Early stage, diversified, long term value creation |

| Kunal Bahl | 50+ | Snapdeal | E-commerce, Startups | Early seed-stage, ecommerce-focused |

| Rohit Bansal | 50+ | Snapdeal | E-commerce, Consumer tech | Early seed-stage, founder-investor |

| Ramakant Sharma | 119+ | Livspace, Purplle | Consumer, Enterprise SaaS | Early stage, consumer-centric |

| Lakshmi Narayanan | 30+ | Cognizant, Freshworks | IT Services, SaaS | Growth stage, SaaS and IT Services specialisation |

| Abhishek Goyal | 60+ | Lenskart, Ola | Consumer tech, Mobility | Early stage, consumer innovation focused |

| Dr Ritesh Malik | 40+ | Innov8, Health startups | Healthtech, Co-working spaces | Early-stage, sector specialist |

| Aman Gupta | 70+ | boAt | Consumer electronics, Lifestyle | Early and growth stage, brand-driven |

| Rajan Anandan | 123+ | Rapido, Capillary Technologies, The Good Glamm Group | Internet services, Mobility, SaaS | Diverse portfolio, growth and early stage |

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Now, let us dive deep into the profiles of these angel investors.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Profiles of the Top Angel Investors in India

Here are the details of the top Indian angel investors:

1. Kunal Shah

With over 150 investments in growing sectors like fintech, AI, healthtech and consumer tech, Kunal Shah is the winner of the competition for the top angel investor in India. Known for his mentorship and industry expertise, he has backed more than 287 startups and has a net worth of around $500 million.

He is the founder of CRED and Freecharge, which are fintech startups in India. He is also an advisor to AngelList, Sequoia Capital and Y Combinator.

2. Anupam Mittal

He is the one who started the platform of Shaadi.com and he is also an early investor in Ola and BigBasket. These familiar names, which are only screaming success, show his ability in the market. His focus is on consumer internet, mobility and fintech. He has backed more than 117 startups in India.

3. Kunal Bahl

He is an active seed-stage investor with investments made in huge businesses like Snapdeal (also a co-founder). His primary focus is on e-commerce and tech startups and he is famous for his hands-on founder support.

4. Rohit Bansal

Similar to Kunal, he is also an early-stage investor and a partner of Snapdeal. His concentration is on the consumer and e-commerce sectors and he is an active mentor for young businesses.

5. Ramakant Sharma

With the attention on consumer and enterprise technology, Ramakant has an excellent profile in investing, as he is known for operational expertise and consumer-brand building. He is one of the founders of Livspace and SaaS.

6. Lakshmi Narayanan

Following the same path as the investor listed above, he is also an early investor in SaaS firms like Freshworks. Apart from this, he is a former CEO of Cognizant and has an interest in the IT services, SaaS and enterprise startups. He offers growth-stage investment experience to startups.

7. Abhishek Goyal

With the tag of early investor of Lanskart and Ola, the focus of Abhishek is on consumer tech and mobility startups. He is known for spotting emerging consumer trends in the market.

8. Dr Ritesh Malik

He is an angel investor and an entrepreneur as well. The sectors at the aim of Dr Ritesh are healthtech and co-working spaces. He combines sector expertise with active startup mentoring and builds a future for more than 40 startups.

9. Aman Gupta

As a co-founder, he started the most well-known large consumer electronics brand, boAt. This introduction is enough to prove his expertise. But he primarily invests in lifestyle and consumer product startups and focuses on brand-building and scaling.

10. Rajan Anandan

So, he is the last one on the list of the top 10 angel investors in India, but that does not make him a lesser legend. Let us count his success stories first: the former head of Google India, investor in Rapido and part of the Good Glamm Group. He is known for strategic guidance and growth-stage expertise and focuses on mobility, SaaS and internet services.

Also Read: Top 10 Investors in India 2025: Portfolios and Winning Strategies

Well, these were the biggest gamers of the angel investing industry. Next, let us look at some success stories of the startups that were funded by these top 10 angel investors in India.

Some Success Stories of Startups Backed by Top Indian Angel Investors

Here are some of India’s most exciting businesses that skyrocketed to success with the support of renowned investors:

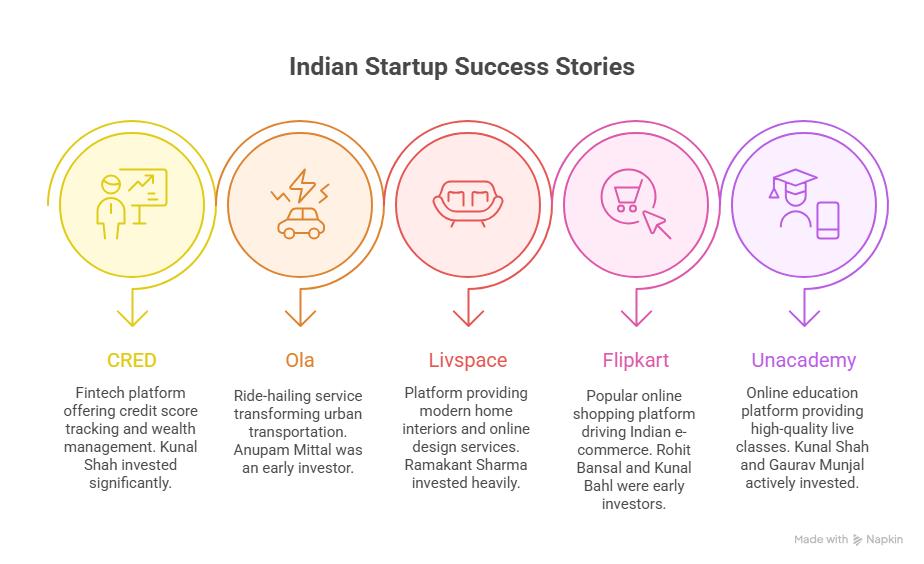

1. CRED

- It is a famous fintech platform in India (based in Bengaluru) offering excellent services like credit score tracking, curated offers, lending and wealth management products to individuals.

- Angel Investor:Kunal Shah (Founder) has personally invested significant capital in CRED, including a $19 million injection in a recent funding round. He has been actively supporting CRED’s growth since founding it in 2018.

2. Ola

- Ola is one of India’s top ride-hailing services. It changes how people get around cities with its app for booking cabs. It has expanded to multiple transportation modes and services.

- Angel Investor:Anupam Mittal, founder of Shaadi.com, was an early investor in Ola, backing the company in its initial seed and early funding rounds.

3. Livspace

- This platform is working in favour of several beings, especially household women, by providing modern home interiors at their fingertips. It offers complete designing and construction services online.

- Angel Investor:Ramakant Sharma, co-founder of Livspace, also invested heavily in early funding rounds, coupling capital with his operational experience.

4. Flipkart

- It is a highly popular online shopping platform in India, which has been one of the main reasons behind the development of the Indian e-commerce sector.

- Angel Investor:Rohit Bansal and Kunal Bahl, co-founders of Flipkart, were early angel investors themselves, using their resources and network to grow the platform from scratch into a multi-billion dollar company.

5. Unacademy

- It is a well-known platform that provides online education in India. This platform has brought a big change in the education technology space by giving high-quality knowledge via live classes and courses.

- Angel Investors:Kunal Shah and Gaurav Munjal (co-founder of Unacademy) actively invested and backed the platform during its early growth stages.

Now, you will go through the challenges that the investors and startups face.

Pro Tip: Use a Tax Calculator to quickly estimate tax liability on your mutual fund gains.

Challenges Faced by Angel Investors and Startups

In India, there is a particular set of challenges that are faced by both angel investors and startups, including:

Challenges Angel Investors Face

- High risk of facing a loss of investments.

- They do not have immediate access to cash, as these investments are a long-term commitment.

- The struggle of finding promising startups in India from a large number of businesses.

- Startups often expect high valuations that do not match the market.

- Guiding the startups takes a lot of time, which is not possible for angels who also have other jobs.

- Changes in regulations, such as the recent SEBI one for angel funds, are unexpected.

Challenges Startups Face in India

- Collecting funds or money, especially in the early stage.

- Confusing and Inconsistent regulations in different states.

- Finding employees with the right skills and talent is difficult due to increasing competition.

- To be successful in the Indian markets, they need heavy marketing.

- The shortage of experienced investors in tier 2 and 3 cities.

- The poor conditions, like unreliable internet and frequent power outages in some areas.

- Continuous pressure of quick growth from investors.

Let us look at the new trends that are changing angel investments in India.

Trends Transforming the Future Outlook of Angel Investing in India

In 2025, angel investing in India is growing quickly through several trends, showcasing a promising future. The following are the recent trends that are changing the face of angel investments in India for a brighter future:

- The hype of joining angel networks is ditching solo investing in 2025.

- Investors' new interest in sectors like fintech, healthtech, deeptech, AI and climate tech.

- The entry of AI-driven research for choosing startups in the investor's investment strategy.

- Priority changing from quick growth to the startups with strong business models and clear goals.

- Increased investments into Tier 2 and 3 towns to find new talent across India.

- The support from the Government (like the Startup India initiative and the removal of the angel tax) is making investing safer.

- Choosing startups that provide social and environmental benefits.

However, the picture of India's future shows major growth and innovation with over 100,000 startups and a growing angel investor community.

Smart Investments, Bigger Returns

Conclusion

To conclude, Angel investors are the leaders who are fueling India’s growing startups by providing them with funding at the early stages. They not only provide money, but they also provide experience, mentorship and valuable connections to these young businessmen.

This support helps startups tackle their biggest challenges in the early stages. India has over 100,000 startups and organized angel networks are growing quickly and together, they are helping to make India a leader in the global startup world.

Related Blogs:

1. Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

2. Top 10 Richest Men in Asia 2025: Shocking Net Worths Revealed

FAQs

-

How are angel investors different from venture capitalists?

Venture capitalists seek quick returns, while angel investors often use personal wealth and focus on long-term growth.

-

What sectors do the angel investors in India focus on the most?

Many leading angel investors concentrate on fintech, consumer internet, healthtech, SaaS, AI, climate tech and deeptech sectors.

-

How do startups benefit from angel investors' backing?

The startups gain credibility, access to networks and customers and increased chances of attracting future investors.

-

How can new startups attract angel investors in India?

Startups can attract investors by showing how well their product meets customer needs and can gain early success.

-

How has government support helped angel investing in India?

The government programs like Startup India and the elimination of the angel tax made it easier for local and foreign investors to fund startups.

_(2).webp&w=3840&q=75)

.webp&w=3840&q=75)