Table of Contents

Are you wondering how to avoid paying all your taxes in one go? Advance tax lets you pay your taxes in smaller chunks throughout the year instead of at the end.

This way, you can make things a lot easier and also avoid any penalties while investing in Mutual Funds in India..

In this blog, you will learn what advance tax is, how to calculate it, who needs to pay it and why it’s a smart idea to stay on top of it.

Keep reading to find out how you can manage your taxes better and stress-free.

What Do You Mean By Advance Tax?

In simple words, advance tax can be defined as paying a small part of your total annual estimated tax amount in advance rather than at the end of the year.

Advance tax in income taxes is generally a partial payment method paid throughout the year. This tax is paid by corporate taxpayers, unlike other taxes, which are deducted at the source end by itself.

Another tax reduction is the responsibility of the payer; they should deduct it before giving the income to the taxpayer, whereas paying the advance tax is the responsibility of the salaried taxpayers.

How to Calculate Advance Tax?

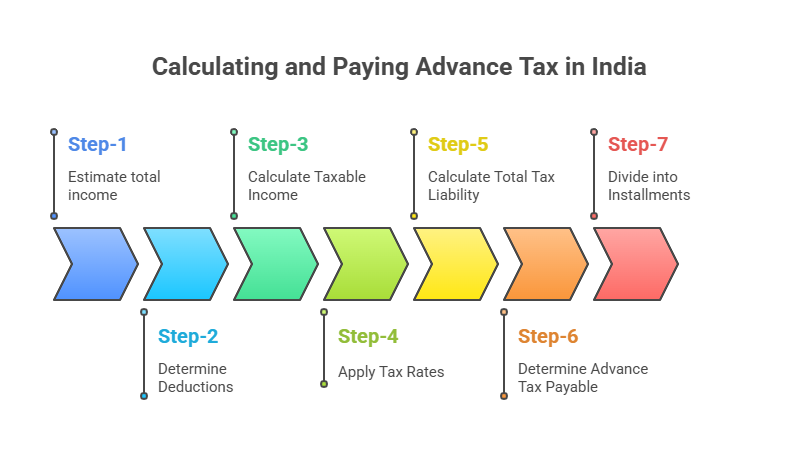

Let's go through a step-by-step process of calculating advance tax in income tax:

Step 1: Estimate Presumptive Income

Calculate your net income from all sources including your salaries, your SIP or Mutual Fund, nonsalary income and other income sources also.

Step 2: Determine Deductions

Identify the deductions under the Income Tax Act that you are eligible for such as Section 80C, Section 80D, Section 24(b) and others.

Step 3: Calculate Taxable Income

Reduce the deductions from your gross total income to get the income you need to pay. Here is the formula:

Taxable Income = Total Income - Deductions

Step 4: Apply Tax Rates

Use the relevant tax rates for the assessment year to calculate your overall tax liability.

Step 5: Calculate Total Tax Liability

According to the taxable income, evaluate the total tax liability by using the given formula:

Total Tax Liability = Tax on Taxable Income - Tax Credits

Step 6: Determine Advance Tax Payable

If your calculated tax liability is more than Rs 10,000 you need to calculate advance tax and pay it in instalments.

Advance Tax = Estimated Tax Liability - Tax Already Paid

Step 7: Divide into Instalments

Advance tax is normally paid in instalments throughout the year, which means you need to pay instalments according to the due dates in India.

How to File Advance Tax in Income Tax?

The filing of advance tax in income tax is a little elongated process. There are a series of steps that you need to follow when filing an advance tax. Below is a step-by-step process for filing advance tax:

Determine Your Tax Liability

- Calculate the total tax liability based on the applicable tax rates of your financial year which includes your total financial worth of the year.

- You need to include your salary, business returns, capital gains, mutual fundresources or any other source of income.

Calculate Advance Tax

- Based on the estimated annual gross income you need to calculate the advance tax that you need to pay in installments.

- The advance tax can be normally calculated by using the formula given below-

Advance Tax = Estimated Tax Liability - Tax Already Paid

- Advance Tax can also be calculated by simply using a tax calculator. This calculator automates the tax calculating process based on inputs provided by the user.

Pro Tip: Want to dive deep in What is Tax calculator? Click Here!

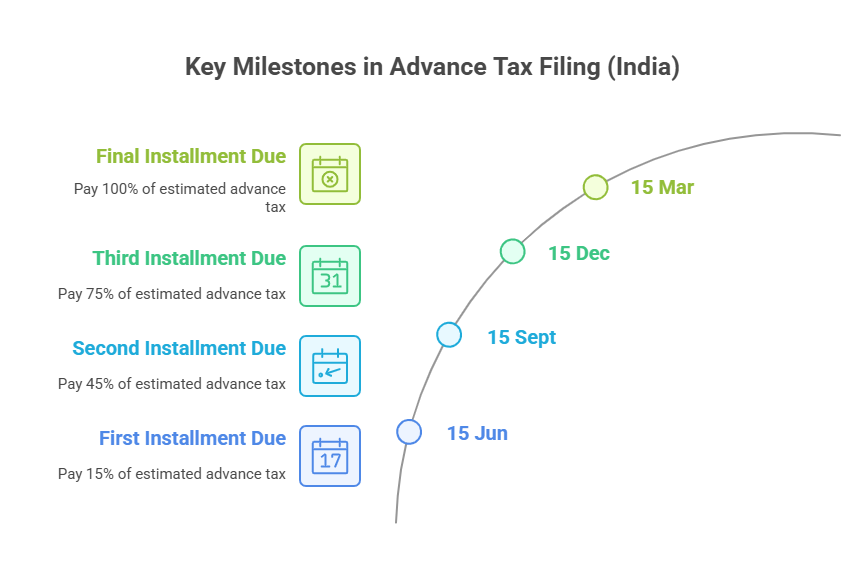

Know The Due Dates

- Get to know the due dates of the advance tax payments. These due advance tax dates may vary for different countries but are often set quarterly.

- The due dates in India are:

| Due Dates | Tax Payment |

|---|---|

| 15 June | 15% |

| 15 September | 45% |

| 15 December | 75% |

| 15 March | 100% |

Make The Payment

- Timely payments can be typically made online on the tax authority's website or at assigned banks (offline payments).

- Choose a payment method (such as cheque, cash and online payment).

- Make sure you have the necessary details like PAN(Permanent Account Number) or TIN (Tax Identification Number).

Fill Out The Required Forms

- According to your legal authorities, you may need to fill out some necessary forms when paying the tax.

- In India, you would use Form 280 for the advance tax payments.

Keep Records

- After making the tax payment keep your instalment details or acknowledgement reserved.

- This will be helpful for your future reference when filing your annual tax return.

File Your Annual Tax Return

- At the end of your financial year, you need to file your annual tax return, these advance payments made by you throughout the year will be included in your annual tax return.

- The advance income tax payments will be deducted from your total tax liabilities when filing your annual tax return.

Review and Adjust

- You need to regularly monitor your income source and make adjustments in advance tax payments in case your income increases.

- It is really important to manage your taxes to avoid paying any extra or unnecessary penalties.

Do you know what is advance tax benefits? Let’s cover that in the next heading.

Benefits of Paying Advance Tax

There are several benefits of paying advance tax in income tax for the taxpayers, which help them manage their overall tax liabilities.

Some of the key benefits are listed below:

-

Avoiding Penalties and Interest Amount

Paying advance tax can help taxpayers avoid the penalties and interest rate that are applied in the case of late payment and underpayment of the tax.

-

Better Financial Planning

By paying advance tax in income tax taxpayers can divide their tax liabilities throughout the year, which reduces the burden of budget management and manages cash flow.

-

Reduced year-end stress

You can pay the tax in installments throughout the year rather than paying that amount all at once in lump-sum at the end of the year.

-

Improved cash-flow management

As you do not need to pay the tax in lump-sum you can align your income better with your tax which automatically improves your cash management.

-

Credit Against Final Tax Liability

Paying tax in advance is like crediting a small amount of money little by little against the total tax liability, it reduces the amount owned at year-end.

-

Encourages Tax Compliance

Paying advance tax regularly can develop a habit that encourages a sense of responsibility towards the country in an individual.

-

Easier Tracking of Tax Obligations

By paying advance tax in instalments you can keep track of your tax liabilities easily and can improve your cash flow management.

-

Potential for Tax Planning Opportunities

By paying taxes in instalments throughout the year, taxpayers can get opportunities for tax planning and enhancement.

-

Peace of Mind

Paying advance taxes in income tax reduces the stress of paying the total tax liability in one go at the end of the year, providing peace of mind.

-

Support for Government Revenue

Paying your taxes correctly and on time can help the government funds and increase revenue throughout the year.

Who Should Pay Advance Tax in India?

If your total tax liability after considering TDS (Tax Deduction at Source) is more than Rs 10,000 then you are eligible to pay the advance tax otherwise you are free.

What is advance tax applied to? It apply to a wide range of taxpayers in India including individuals, business owners, freelancers and citizens with additional sources of income like SIP, rental, direct mutual funds, etc.

The wide range of taxpayers of advance tax includes:

- Individuals with salary income as well as additional income sources.

- Self-employed taxpayers, freelancers and professional income holders.

- Hindu Undivided Families (HUF).

- Companies whether domestic or foreign.

- Partnership Firms.

- Trusts and AOPs (Associations Of Persons).

- Senior Citizens (60 and above) need to pay this tax if they have any other sources of income like rents, SIP, Mutual Funds, etc.

Tips For Managing Advance Tax Payments

Managing your tax payments is very important in order to avoid penalties and interest incomes. Here are some tips for you that you can follow to easily maintain your tax payments:

- Regularly evaluate your income from all sources. Use past data and current trends to do well-informed calculations.

- Keep track of deductions and exemptions that are available under the Act of Income Tax.

- Use tax calculators and SIP calculator (mutual fund returns calculator) for easy and accurate evaluation of your tax liabilities.

- Avoid missing the deadlines of payments by marking the due dates on your calendar or setting a reminder.

- Create a budget and keep a part of your income separate for tax payments each month.

- Making online payments is a faster and more convenient method.

- If your income changes during the year, re-evaluate your advance tax liability and make extra payments if needed.

- Keep a detailed record of your payments made it will be a handful during your annual tax return filing.

- If you are unaware of your tax duties or need any guidance consider consulting a tax professional.

- Keep yourself updated about any change in tax laws, rates and regulations that can affect your advance tax liability.

- Identify tax credits and apply them in your calculations after checking if you are eligible for them. They will help you reduce your total liability.

- You can consider using financial or accounting management software that will help you track your expenses, income and tax payments.

Conclusion

In short, paying taxes is necessary and crucial for an individual and the economy at the same time. Advance tax helps reduce the burden of paying the total annual tax at once by dividing it into installments.

Advance tax helps taxpayers maintain their cash flow, income and their tax liabilities as well. Advance payment of the tax also contributes a handful to the improvement of government revenue and economic growth.

If you start SIP in mutual funds, then automatically your tax liabilities will be triggered. What is advance tax is doing here is simplifying your tax payments.

FAQs

-

What is advance tax?

Advance tax is simply a tax that you need to pay in advance in installments, rather than in a single payment at the end of the accounting year. It is also known as a pay-as-you-earn tax. -

How do I calculate advance tax?

You need to calculate the total annual income of the financial year and then calculate your tax liability. You can use online tax calculators or consult with a tax professional to help you with these calculations. -

When do I need to pay advance tax?

Advance taxes are generally paid in instalments throughout the financial year, with specified due dates set by the tax authorities. To avoid penalties or interest charges it is crucial to pay these taxes on time. -

What happens if I do not pay advance tax?

If you do not pay your advance tax or underpay it, you may need to pay interest charges or penalties. It is very important to keep up with your advance tax payments to avoid any extra payments or interest rates. -

Can I adjust my advance tax payments later?

If your actual tax liability at the end of the year is different from your estimated liability, you can change your advance tax payments in the last instalment. This allows you to avoid any overpayment or underpayment of taxes. -

Can I get help with calculating advance tax?

If you're not sure about how to calculate advance tax, it's a good call to ask for guidance from a tax professional or accountant. They can help you negotiate the process and confirm that you are meeting your tax responsibilities accurately and on time.