Table of Contents

- What Do You Mean By Income Tax?

- Sources of Income

- Components of Salary

- Income Tax Slabs and Rates

- How To Calculate Income Tax On Salary?

- Deductions and Exemptions of Taxes

- How to Calculate Total Income Tax Liability for New and Old Regimes?

- What are the Two Regimes of Income Tax?

- What are the Benefits of Income Tax?

- How to Save Income Tax?

- What is the Procedure for Income Tax Filing?

- Conclusion

Did you know that the rate of annual growth in net national income (NNI) per capita has increased to 8.6% compared to last year? Yes, but why should it concern you? Let’s find out.

This significant increase highlights the importance of the income tax you pay in shaping the economic environment. Income tax works as the main source of government revenue used for public services and social welfare.

Income tax influences all individuals earning more than Rs.2.5 lakh a year in India. Knowing how to calculate income tax applied to your salary is an essential aspect that enables you to manage your financial growth productively.

In this blog, you will learn how to calculate income tax on salary with example and some basics related to it.

What Do You Mean By Income Tax?

Basically, income tax is a direct tax that is charged by the government on the annual income earned by any individual in a financial year. In India, income tax is managed by the Income Tax Act. It issues rules and regulations for income tax calculation, estimation and gathering.

Income tax is evaluated as a percentage of the total income of an individual that he/she has earned in the whole financial year. The amount collected from this tax is later funded in multiple public services and government schemes like education, healthcare, security and many more.

Now, let us look at the different sources of income you can earn from and that need to be included in your total tax liability.

No math, no stress, use the Tax Calculator to ace your game today.

Sources of Income

Income in general can be defined as the total amount of money you earn from all sources without any tax or deduction applied. Income can be generated from multiple sources like:

| Sources of Income | Description |

|---|---|

| Salary | Money given by your employer for the regular work you do. |

| Rental | Money earns by renting your property like a house or apartment. |

| Self-employment | Money earned by running a business or freelancing. |

| Interest | Money earned by interest on some interest-paying investments. |

| Dividends | Portions of profit a company shares with its shareholders. |

| Capital Gains | Profit generated from selling property. |

| Social Security Social Benefits | Payments made by the state to pensioners, disabled persons, or dependents of deceased employees. |

| Royalties | Money earned from intellectual properties like copyrights, trademarks, etc. |

As stated below, there can be different types of income:

- Income from Salary: Comprises a portion of the remuneration received as a salary or wage.

- Annual Income: Income derived throughout the year from all sources combined, including interest from Mutual Funds

- Taxable Income: The income after deduction and exemption of a certain amount is taxable income. Not every income is liable to tax.

- Chargeable Income: The final amount on which tax is calculated.

- Income Tax Payable: The actual income you need to pay to the government.

You all will agree if I say, “The salary you earn is the main and most important source of your income.”

Let us break down the components of salary in the next section.

Components of Salary

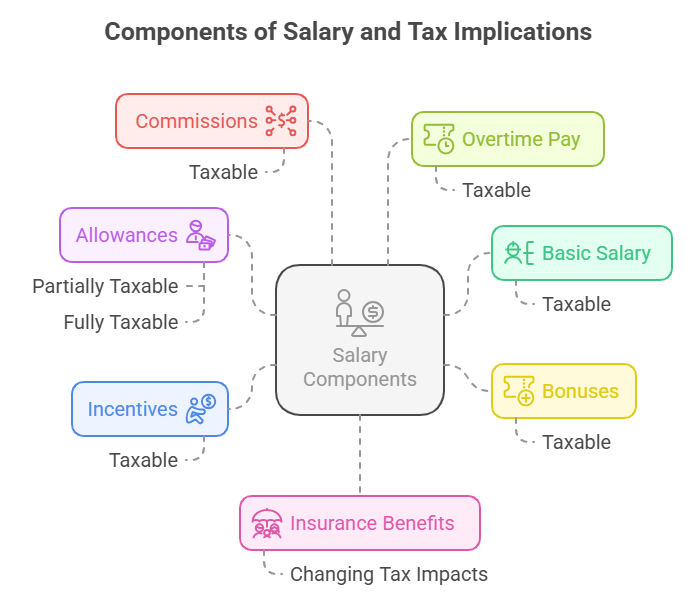

In this part, you will explore various components of salary and will know if they are taxable or not. The components of salary are:

-

Basic Salary

The monthly payment you get on behalf of your work is your basic salary. It is fully taxable.

-

Allowances

These are the additional payments like house rent, conveyance, medical, dearness allowance, etc. They can be partially or fully free from income tax, it depends on the type.

-

Bonuses

The extra money you get as a bonus is considered a part of your taxable income.

-

Incentives

The money you get based on your good performance is an incentive and it is fully taxable.

-

Commissions

Commissions are earned on the sale of the products as a middle party between buyer and seller. It is considered in your taxable income.

-

Overtime Pay

The money you get for the extra work you do apart from your regular hours of work is overtime and is fully taxable.

-

Insurance Benefits

The insurances like health, life and disability insurance provided by the employer can have changing tax impacts.

Now you know which amount of money is taxable, so let's explore the slabs and rates that are applicable for the income tax.

Income Tax Slabs and Rates

The slabs and rates of the income tax, in general, are the limits and percentages to learn how much tax an individual or any business needs to pay. These limits and percentages are set based on the total income levels of the particular entity.

Income tax slabs and percentages are issued and controlled by the government. These may vary from country to country and can also differ according to the taxpayer's status (like an individual, married person or senior citizen).

Income Tax Slabs and Rates for FY 2025-26 (AY 2026-27)

| Income Amount Level | Tax Percentage Applied |

|---|---|

| Rs 0 - Rs 4 lakh | Nil tax. |

| Rs 4 lakh - Rs 8 lakh | 5% |

| Rs 8 lakh - Rs 12 lakh | 10% |

| Rs 12 lakh - Rs 16 lakh | 15% |

| Rs 16 lakh - Rs 20 lakh | 20% |

| Rs 20 lakh - Rs 24 lakh | 25% |

| Above Rs 24 lakh | 30% |

After going through all the information displayed above, you certainly have an idea of the basics of income tax.

Now, there might be another question popping into your mind, “How to know how much income tax is applied to your income, right?”

Well, let's answer your questions in the next part.

How To Calculate Income Tax On Salary?

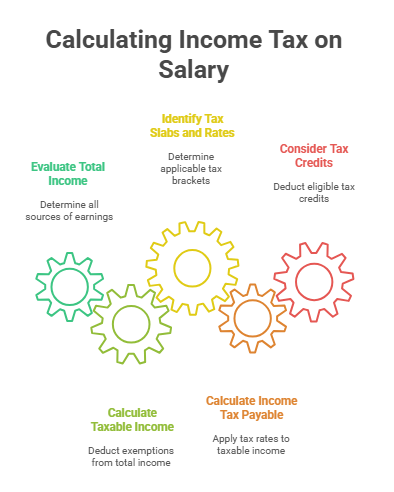

In this part, you will understand How to calculate income tax on salary. Calculating income tax on your salary includes multiple steps, let's go through them one by one:

Step 1: Evaluate your total income

Your total income includes all your sources of earnings that are salary (with allowance, bonus and incentive) and additional sources (like rentals) also.

Step 2: Calculate taxable income

You can get your taxable income by deducting the applied deductions and exemptions from the total income you calculated in the first step.

The formula for calculating the taxable income is:

Taxable Income = Total Income - Deductions

Step 3: Identify tax slabs and rates

Determine your income level, and consider the latest and current tax slabs and rates that are applied to your income level.

Step 4: Calculate income tax payable

According to the tax slabs evaluate the income tax that you need to pay for your total taxable income.

- Break down your taxable income and identify which part falls in each bracket of the slabs.

- Calculate the tax rate applied to each portion of the income.

Step 5: Consider tax credits

Identify if you are eligible for any tax credits, if yes, then deduct the credits from the total taxable income you need to pay.

The final calculation to determine the income tax on your salary is done using the following formula:

Income Tax Payable = Total Tax - Tax Credits

Let's consider an example for your better understanding.

Example of Income Tax On Salary

Let's understand How to calculate income tax on salary with example.

Assume your total income is Rs60,000, your deductions are Rs10,000 and the following are the tax slabs and rates-

| Income Range (Annual) | Tax Rate |

|---|---|

| Up to Rs10,000 | 0% |

| Rs10,001 - Rs30,000 | 10% |

| Rs30,001 - Rs60,000 | 20% |

You would calculate your payable tax as follows:

- Calculate your taxable income

60,000 - 10,000 = 50,000

- Tax calculation based on the tax slabs

First Rs10,000 = 0% (Rs0)

Next Rs20,000 = 10% (Rs2000)

Next Rs20,000 = 20% (Rs4000)

Total Payable Tax = 0+2000+4000 = Rs6000

- Tax credits- assume your credits are Rs500

- The final Tax Payable is

6000 - 500 = Rs5,500

If you want to know what the deductions and exemptions are that can be applied to your income tax, then keep reading.

Deductions and Exemptions of Taxes

Deductions and Exemptions are two important factors of taxes as they can help in reducing your total taxable income. They both reduce the income that is liable to tax. A description is given below:

Deductions

These are particular expenses that are deducted from the total income of the taxpayer. These can be classified into two types: Standard Deduction and Itemized Deduction.

- Standard Deduction: Fixed amount that reduces your taxed income.

- Itemized Deduction: Particular expenses that can be listed on the tax return.

| Itemized Deductions | |

|---|---|

| Medical Expenses | |

| State and Local Taxes | |

| Mortgage Interest | |

| Charitable Contributions | |

| Casualty and Theft Losses | |

Exemptions

This is a particular amount that a taxpayer can subtract from their income and keep for themselves and for those who are dependent on them. This can be classified into two types:

- Personal Exemption: A claim of personal exemption.

- Dependent Exemption: Claimed for those who are dependent on the taxpayer like children or other relatives.

About other types of taxes like What is Advance Tax?.

How to Calculate Total Income Tax Liability for New and Old Regimes?

Before calculating the income tax liability for both new and old regimes, let's discuss what are they.

Old Tax Regime

They generally have higher tax rates but also provide multiple opportunities for tax saving. It allows for various deductions and exemptions.

New Tax Regime

They offer lower tax rates but also offer many opportunities for deductions and exemptions.

Now you know what old and new tax regimes are, so let's learn how to calculate Total Income Tax Liability for both regimes step-by-step:

Step 1: Determine your total income including all sources.

Step 2: Choose the tax regime suitable for you.

Step 3: Calculate taxable income

- Old regime: Subtract eligible deductions and exemptions

Taxable Income (Old) = Total Income - Deductions

- New regime: The taxable income is generally the same as the total income.

Taxable Income (New) = Total Income

Step 4: Use the applicable tax slabs and apply the tax rates.

Step 5: Calculate total tax liability according to tax slabs and add any applicable cess for both regimes.

You learned how to calculate tax liability using two regimes. Let’s see more details for both regimes.

What are the Two Regimes of Income Tax?

Income tax contains various regimes or structures that decide how a particular entity is taxed. The two regimes of income tax that are commonly found in every country are:

1. Progressive Tax Regime:

In this, the tax rate increases as the income of the taxpayer increases. Its key factors include

- Multiple Tax Brackets

- Promote Equity

- Deductions and Credits

2. Flat Tax Regime:

In this, a fixed tax rate is applied for every taxpayer, independent of their income level. Its key factors include

- Simplicity

- Uniformity

- Potential for lower rates

Keep reading further to know an automatic and easy way to calculate income tax on salary.

Income Tax Calculator

An income tax calculator can be defined as a simple but valuable tool that is used to calculate income tax liability or total payable tax for taxpayers.

This calculator does so by taking some inputs (such as income, deductions, exemptions and applicable tax rates) from the taxpayers, based on which it calculates the payable tax for the taxpayers.

Its key features include:

- Easy to use user interface for a good user experience.

- Separate input fields for different types of income sources.

- Fields to enter various deductions and exemptions.

- Automatic update to display the latest tax slabs and rates.

- Input fields for multiple tax credits.

- Automatic calculation of taxable income based on the inputs.

- Ability to compare different scenarios.

- Print and save options.

- Privacy and security.

What are the Benefits of Income Tax?

Now after going through the whole post and knowing what is income tax and how to calculate income tax on salary with example, you must be wondering how it is beneficial.

Here are some benefits of income tax:

-

Revenue Generation for the government

Income tax is a primary source for the government to generate revenue that is used to fund essential public services (like education, healthcare, etc.) and support social welfare programs.

-

Redistribution of Wealth

The taxpayer with higher income needs to pay more tax, this factor allows the redistribution of wealth from higher-income individuals to lower-income individuals, thus also supporting social equity.

-

Economic Stability and Growth

Income tax revenue can be invested in development projects, which can help to create more jobs, improve transportation, and strengthen overall economic productivity.

-

Encouragement of Compliance and Civic Responsibility

Paying taxes develops a sense of responsibility among individuals as they contribute to the development of their community and country which generates a thought of accountability.

-

Stabilization of the Economy

Income tax is like an automatic stabilizer for the economy. In the case of an economic downturn, the income of individuals automatically decreases, which leads to lower tax liabilities, this will maintain consumer spending and stabilize the economy.

And now, because you know what income tax is and how to calculate income tax on salary with example, in the next part, some tips are waiting for you on how to save income tax.

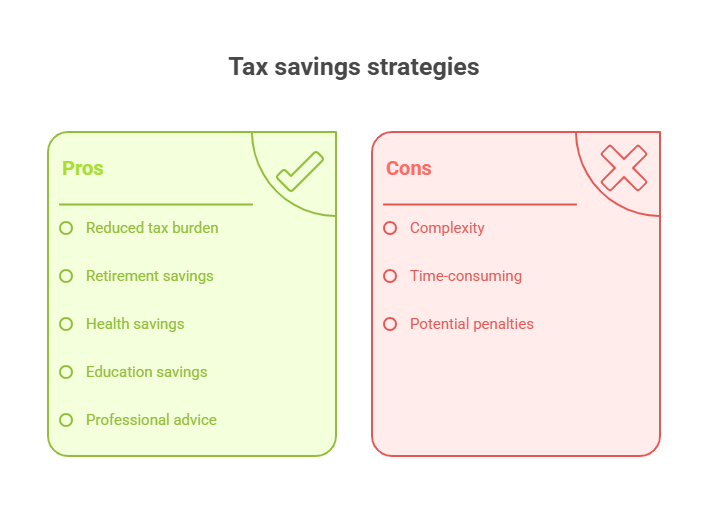

How to Save Income Tax?

Saving income tax can be said to be a common objective for everyone including individuals and businesses. There are many ways to save on income tax.

Here are some pro tips for you:

- Make a good utilization of the applicable deductions.

- Consider investing in retirement accounts like a 401(k) or an Individual Retirement Account (IRA).

- Look for available credits and take advantage of them.

- Recommended to contribute to Health Saving Accounts (HSAs).

- Invest in tax-advantaged accounts like Flexible Spending Accounts (FSAs) and 529 College Savings Plans.

- Take tax-loss harvesting into consideration.

- Maintain and keep accurate records of all income, expenses and deductions.

- Consult tax professionals.

- Stay updated always about tax law changes.

- Plan for major life events.

The main point to always remember in the case of paying taxes is to file them within the issued time limit, or you can be charged interest and penalties.

Keep scrolling to learn how to file income tax.

What is the Procedure for Income Tax Filing?

The procedure of filing income tax is an essential process for taxpayers to disclose their income, evaluate tax liability and pay taxes.

The step-by-step process to file for income tax is given below:

Step 1: Collect your all relevant documents like income statements, investment statements, receipts for deduction and the previous year's tax returns.

Step 2: Choose the right tax form (like 1040, 1040A or 1040EZ and business forms) according to your status and income sources.

Step 3: Identify your filing status as it can impact your tax rates and eligibility for the credits.

Step 4: Report all sources of your income and calculate the total income.

Step 5: Claim all applicable and liable deductions and tax credits.

Step 6: Calculate your tax liability after applying for deductions and credits.

Step 7: Fill out the tax form accurately and provide the complete and correct information. Then review the form and sign it.

Step 8: File your tax return by the deadline, there are several ways for the same like e-filing and paper filing.

Step 9: Make sure to pay all the taxes you own before or by the deadline to avoid penalties.

Step 10: After the filing process is complete, keep all records and documents secure with yourself.

Conclusion

In short, Income tax plays an important role in the economy of the community and country as well. Paying the income taxes on time an individual can contribute to the economic growth of the country.

Paying taxes on time also helps in the financial growth of an individual by improving their cash flow and they can also avoid paying extra for penalties.

Also Read :

- All of My Mutual Funds Are Negative: What Should You Do?

- How Much GST on Gold is Charged in India? 2025 Update

- Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

- What is Tax Planning: Objectives, Types & Importance

FAQs

-

How much tax for 17 lakhs salary?

For those earning between Rs 8,00,000 and Rs 12,00,000, the tax rate is 10%, it is different for different income levels and the tax increases as the income increases.

-

How to calculate tax on salary?

Tax rates issued by the government are different for different levels of income. The following is the formula to calculate the income tax payment:

Income Tax Payable = Total Tax - Tax Credit

-

What is the tax on a 40 lakh salary?

For AY 2025-26, imagining that there are no other deductions, the final tax to be paid by an individual entity with a taxable salary of Rs 40 lakh will be around Rs 9 lakh, including cess and surcharge.

-

How to withdraw pension contribution in EPF?

To withdraw pension contributions from your EPF account, you need to fill out forms and file a withdrawal for pension. If you haven't completed 10 years of service, then fill out Form 10 and Form 10D if you have. The process can be done online through the EPFO website or offline by submitting the form to your jurisdictional EPF office.

-

How to calculate gross income from different sources of income?

Find your Gross Total Income (GTI) by adding all your income from all sources. Identify allowed deductions and subtract these from your GTI to get your AGTI.