Table of Contents

- What is An Emergency Fund?

- Importance of An Emergency Fund

- How Does An Emergency Fund Work?

- How to Build Your Emergency Fund?

- How to Keep Your Emergency Fund?

- Examples of Emergency Funds

- How to Plan Your Investment in An Emergency Fund?

- When Not to Use Emergency Funds?

- Conclusion

- Difference Between AIS and Form 26AS

- Conclusion

Are you aware that every year, nearly 55 million Indians get pushed into poverty due to unexpected medical emergencies? In a country where sudden emergencies or expenses are common, having emergency funds is essential. These funds are your reserved savings that are used for emergency expenses and prevent you from high-interest debts.

Yet only 27% of salaried Indians have a dedicated emergency corpus and nearly three out of four individuals struggle to cover unexpected expenses or income loss. These statistics make such funds even more crucial for achieving financial stability, as these funds help you recover quickly from setbacks.

So, this guide will help you to understand what is emergency fund, how to build an emergency fund and when to use it to achieve stability in your finances and prepare you for life's surprises.

What is An Emergency Fund?

An Emergency Fund is money stored and used to cover unexpected conditions or emergencies. These Funds are collected to cover sudden emergency expenses, such as medical issues, job loss or home maintenance issues.

These funds maintain your financial stability in tough times and enable you to avoid relying on high interest loans or credit cards.

Key Points of the Emergency Funds:

- These cover the unexpected expenses like medical bills, sudden car repairs or sudden income loss.

- It offers savings to cover your living expenses in case of job loss or a decrease in income.

- These can be used in different conditions, such as unexpected travel needs or unforeseen burdens.

- They should be easily accessible in liquid form (like savings accounts or liquid Mutual Funds).

- They are for real emergencies, not for regular expenses.

- According to the experts, these funds should contain an amount equal to 3-6 months of essential living expenses. However, identifying your ideal size depends on your situation and lifestyle.

Now, let us explore why having emergency funds is so essential for your financial well-being.

Importance of An Emergency Fund

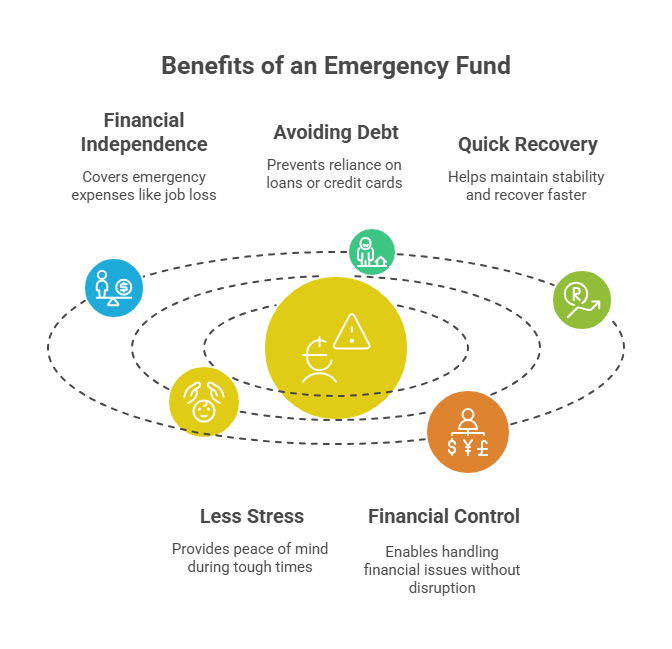

The following are the reason that explains the importance of Emergency Funds for your financial stability:

-

Financial Independence

These funds make you financially independent by covering your emergency expenses, such as job loss or medical issues.

-

Avoiding Debt

Due to the savings in these accounts, you do not need to rely on loans or credit cards that can create financial difficulty for you in the long term.

-

Quick Recovery

Having funds set aside for emergencies helps you keep things running smoothly and recover faster.

-

Less Stress

With these funds, you know that you have savings to rely on in tough times, so you feel more at ease and stress-free.

-

Financial Control

These funds help you to prepare to handle financial problems on your own without impacting your usual expenses.

Understanding the importance is one thing, but knowing how it works in real life makes the concept even clearer, so let us know that in the next part.

How Does An Emergency Fund Work?

Emergency funds work as savings accounts that are reserved for covering unforeseen expenses and maintaining the financial stability of individuals. You collect money in separate, liquid accounts (such as FDs or liquid mutual funds) or cash.

The points given below describe the working of these funds:

- You use the savings collected in these funds in case of an emergency and avoid debts, such as loans or credit cards.

- Prioritisethe recovery of emergency funds as soon as possible to replenish your safety net.

- Ensure that you contribute regularly to these funds, resulting in the fund's growth and easy access whenever needed.

- The Emergency Fundshould not be used for regular expenses or issues that are not urgent.

Must Read: What is the Difference Between SIP and Mutual Fund?

Now, the critical question is, “ How do we build an emergency fund?” Keep reading to learn the process step-by-step.

How to Build Your Emergency Fund?

There are two ways to build an emergency fund for you to achieve financial security:

Building Fund With Savings Accounts (Safe, Secure & Earning Interest)

- Step 1:Decide how much you need in your emergency funds (recommended 3–6 months of essential expenses).

- Step 2:Open a separate account only for your emergency fund.

- Step 3:Choose low risk and quickly accessible options like:

1. High-Yield Savings Accounts

2. Liquid Mutual Funds

3. Fixed Deposits with Premature Withdrawal Facility - Step 4:Set up an automatic transaction of money to your emergency fund from your regular account.

- Step 6:Review your emergency funds frequently (every 6–12 months) and adjust if your expenses change.

- Step 7:Withdraw money from the emergency funds for emergencies only & refill them as soon as possible afterwards.

Building Fund With Cash (For Immediate Access)

Keep a small portion of your emergency fund (about 10–15%) in cash for urgent situations when banks or UPI might not work, such as:

Natural disasters

Power or internet outages

Emergency purchases late at night

Follow the given tips for adequate cash savings:

- Store it securely at homein a locked safe.

- Keep only what you might realistically need for a few days or weeks.

- Replenish it as soon as possible if you use it.

Building is just one part; you also need to know where to keep it, so it stays safe and accessible. Explore the storage options in the next heading.

How to Keep Your Emergency Fund?

Described below are some good options to store your emergency funds:

Savings Account

- Provides easy access through ATMs, UPI and net banking.

- Money is secured by the Deposit Insurance & Credit Guarantee Corporation (DICGC).

- Best for keeping a small portion of emergency funds.

High-Yield Savings Account

- Offer better interest rates than regular accounts.

- Provide relatively easy access to emergency funds.

- Best for keeping a good amount of your funds, especially if you want to earn some interest.

Liquid Funds (Debt Mutual Funds)

- Invest in mature short-term instruments, within 91 days.

- Offers high return potential, quick access, and redemption that can be processed within one business day.

- Best for holding a majority of your emergency funds(Start SIP for better investments).

Short-Term FDs (Fixed Deposits) with Premature Withdrawal

- Offer guaranteed returns.

- Provide capital protection.

- You can store some of your emergency fundsif you can handle a little penalty on early withdrawals..

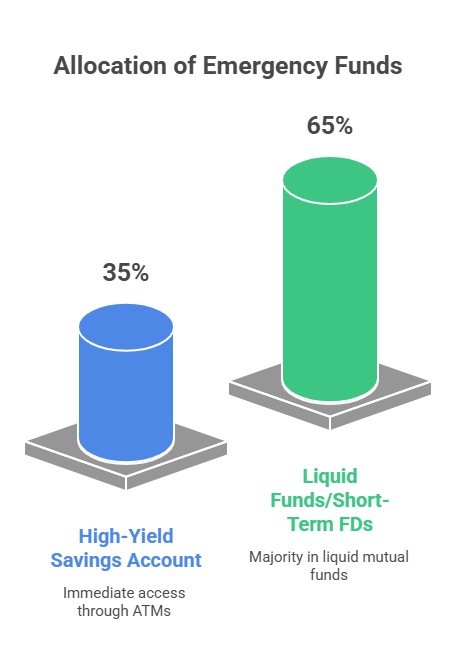

Use a Hybrid Approach (suggested by the experts) to store your Emergency Funds by distributing them in the following ways:

- Immediate Access (30%-40%):Store a small portion in cash with you for urgent situations and easy access.

- Quick Access (60%-70%):Keep the majority of funds in the liquid mutual funds (through SIP) or short-term FDs.

Pro Tip: Use a SWP Calculator for easy withdrawals of your money at regular intervals.

Let us make these ideas more concrete with an example that shows an emergency fund in action.

Also Read: How to Start SIP Investment in India: Guide for Beginners

Examples of Emergency Funds

Here is a breakdown of how emergency funds help you in unexpected situations, using an example:

Assume yourself as a software engineer in a big company with your monthly expenses of Rs 40000, divided as given below:

| Expense | Amount (Rs) |

|---|---|

| Housing (Rent) | 18,000 |

| Utilities (Electricity, water, etc) | 3,000 |

| Debt (Loan, EMIs, etc.) | 7,000 |

| Groceries & Essentials | 6,000 |

| Transportation | 3,000 |

| Insurance (Health/Life) | 2,000 |

| Miscellaneous Essentials | 1,000 |

| GRAND TOTAL | 40,000 |

Now, you want to build an emergency fund that can cover your six months of expenses, that is, Rs 40,000 × 6 = Rs 2,40,000.

So, you open a separate liquid mutual fund account and contribute Rs 10000 every month. You can save the amount worth 6 months' expenses in 2 years.

Suddenly, your company decides to restructure, and you lose your job during the process.

In this case, if you have a 6-month emergency fund of Rs 2,40,000. You will be able to pay your rent, spend on groceries and other essential needs for the next six months, providing you enough time to search for your new employment. Without these funds, you might be forced to accept low-paying jobs or rely on loans that push you into debt.

Once you have an understanding of these funds, the next step is to plan the right investment strategy for your emergency fund.

How to Plan Your Investment in An Emergency Fund?

Here is how you can plan your next investment in emergency funds:

- Step 1:Identify the goal you want to achieve with an emergency fund.

- Step 2:Divide the fund into different layers based on your immediate and short term needs. Follow the described structure:

| Layer | Description |

|---|---|

| Layer 1 | Immediate Access (1 month's expenses) |

| Layer 2 | Quick Access (2-3 months' expenses) |

| Layer 3 | Slightly Less Immediate (Remaining portion) |

- Step 3:Choose low risk and easily accessible instruments for storage.

- Step 4:Diversify across low risk securities to achieve balance and better returns.

- Step 5:Allow automatic transactions to your emergency fund or start SIP into liquid mutual funds for continuous savings.

- Step 6:Review your emergency fund regularly and adjust if required.

Pro Tip: Use an SIP Calculator to know the future returns of your investment.

When Not to Use Emergency Funds?

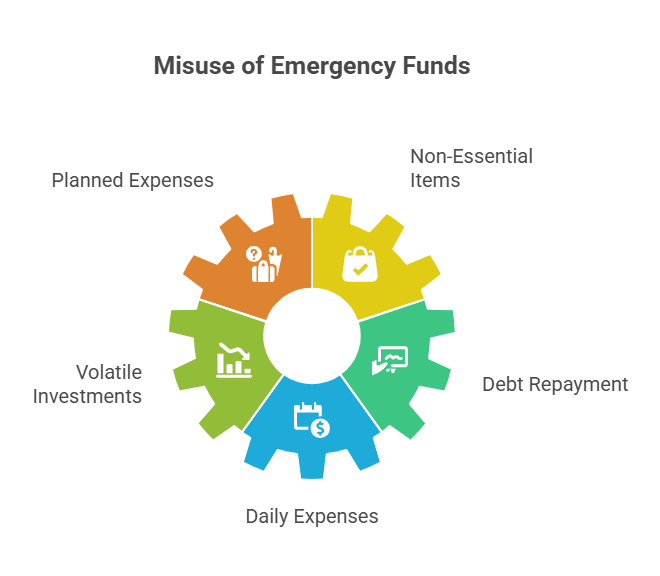

It is essential to understand what does not qualify as an emergency and where you should not use emergency funds:

- Your emergency fundis not for planned expenses like vacations or down payments for new gadgets.

- You should not spend these savings on non-essential items.

- Do not store your emergency fundsin volatile investments like stocks.

- Do not use your emergency fundto pay off existing debt.

- Do not use your emergency fundfor daily expenses and monthly bills.

By understanding both when to use and when not to use these savings, you can ensure your emergency funds serve their true purpose.

Conclusion

In short, Emergency Funds are tools that help you maintain your financial stability. These funds allow you to build a financial cushion for yourself by saving 3-6 months of crucial expenses. You are permitted to access these savings and use them against unexpected events without falling into debt.

The emergency funds should be kept separate from your regular accounts and must be used only in real emergencies. Liquid mutual funds and high-yield accounts are some of the best options to keep your funds.

The best time to build this fund was yesterday and the next best is Today. So, start building yours to secure a stable and stress-free financial future.

Related Blogs:

- Investing in SIP is Good or Bad? Learn the Pros & Cons

- 10 Common SIP Mistakes to Avoid in 2025 for Maximum Returns

FAQs

1. Which Saving Schemes Are The Best To Invest In?

Some of the best saving schemes to invest in 2025 are High-yield savings, liquid mutual funds, fixed deposits and recurring deposits.

2. How does an emergency fund work?

An emergency fund is a separate fund that contains money or savings to use in any unexpected circumstances. It is not for regular expenses.

3. What is the 3-6-9 rule for cash?

This rule states that you should save 3, 6 or 9 months' expenses for emergencies, depending on your job stability and family needs.

4. Is 1 lakh enough for an emergency fund?

Rs 1 lakh for emergency funds is only enough if your monthly essentials are less than Rs 16,000.

5. How much money is needed for an emergency fund?

Usually, 3–6 months of essential expenses are required to build an emergency fund.