Table of Contents

- What is a Lumpsum Investment in Mutual Funds?

- Calculating Returns on a Lumpsum Investment

- Advantages of lumpsum Investment over SIP

- How Can the Lumpsum Calculator Help You?

- Best Mutual Funds for Lumpsum Investment for Investing

- Taxability on Mutual Funds for Lumpsum Investments

- How is a lumpsum Investment different from SIP?

- Analytical Comparison: Lumpsum vs SIP, Which Gives Better Returns?

- Who Should Invest in Lumpsum Mode?

- Steps to Know Before Committing to Lumpsum Investment Work

- Factors to Consider Before Investing in a Lumpsum Investment

- Conclusion

Do you know why lumpsum investment is one of the most powerful strategies of growing wealth through Mutual Funds? Well, it involves investing a large sum of money in one-go, giving you multi-bagger returns even in the bullish phase. How?

Well, imagine this: In 2015, you decided to invest Rs 5 lakhs in a top-performing mutual fund. “Fast forward to 2025 and that initial investment could have grown to a whopping total of Rs 12-13 lakhs in today's date.” Sounds too good to be true? Well it is.

This is the magic of compounding at work, but it’s important to understand how lumpsum investments really work and if they’re the right choice for you as compared to other investment options like SIP (Systematic investment plan).

Keep scrolling to find out.

What is a Lumpsum Investment in Mutual Funds?

A lumpsum investment is a mode of investing a large sum of money all at once into any mutual fund scheme of your choice. The best part of choosing a lumpsum investment is when the market is rising, your entire lumpsum investment can benefit from the market growth from the outset. Although, lumpsum investment can seem a bit risky when compared to SIP (systematic investment plan) but long term investment wil earn you high returns.

There is another point that makes lumpsum investing a good investment type, it offers a functionality to invest as per your convenience rather than restricting you to monthly or regular investment like in a systematic investment plan.

You can also see it as, “No instalments. No repeated payments. Just a one-time investment that grows over time.”

For instance, if you get a profit of Rs 1 lakh from a business, you can invest it through lumpsum investment in the Best Mutual Funds in India.

Let us know how to estimate returns from your lumpsum mutual fund investment in the next section.

Calculating Returns on a Lumpsum Investment

This formula helps to calculate the returns on a lump sum investment, considering various financial metrics & formulas. The basic formula for calculating investment returns is:

A = P (1 + r/n) ^ nt

Where,

A = Estimated return

P = Value you invested now

r = Rate of compounding returns

t = Time Duration of investment

n = Number of compounded interests in a year

After putting this value in this formula, Lumpsum helps shows the annual return profits.

Moving on, let’s see, “What are the advantages of choosing lumpsum investment to begin your financial journey?”

Read more to learn more.

Advantages of lumpsum Investment over SIP

The SIP and lumpsum have their own advantages. Here is why it can be a smart choice in some situations:

- Higher Growth Potential: If you invest during a market low, your complete amount starts growing from day one, which gives you better returns over time.

- Instant Offer: You do not have to wait for monthly instalments like SIPs. You invest all at once & let the market work on your behalf.

- Easy to Manage: Just one investment to track; no need to monitor monthly payments or multiple transactions.

- Lower Costs: You might pay fees or expense ratios since there are no repeated transactions like in

- Ideal for Big Amounts: Lumpsum provides a better & more convenient option for large amounts. Either you got a bonus or received inheritance money.

Also Read: 7-5-3-1 Mutual fund rule, Simple SIP formula for big returns

In the next heading, you will get to explore, “How a lumpsum calculator can make your investment easier?”

Start Your SIP TodayLet your money work for you with the best SIP plans.

How Can the Lumpsum Calculator Help You?

A lumpsum calculator works as a well-planned & straightforward tool prepared to help mutual fund investors in estimating potential returns on one-time investments over time. Here is how it can help:

- Gives a Clear Return Estimate:This makes long-term planning easier by giving you an accurate picture of how the investment's return grows gradually.

- Easy to Use:Anyone finds it simpler due to the lumpsum calculator tool's simple user interface.

- Helps You Plan Smarter:Potential returns allow you to better plan & determine lumpsum investments, helping to make more informed decisions while purchasing or selling them.

- Keeps Expectations Real:It provides a close estimate, but remember, mutual fund returns depend on market performance, so actual results may vary.

Pro Tip: Use the Lumpsum Calculator to breakdown long calculations into seconds.

Let us walk into the best mutual funds to invest in lumpsum investments & how it works.

Best Mutual Funds for Lumpsum Investment for Investing

The table given below will give you a list of the best mutual funds for lumpsum investment in India along with the key details you should know:

| Scheme Name | Launch Date | AUM (Rs Crores) | 5-Year Rolling Return (%) |

|---|---|---|---|

| Nippon India Multi Cap Fund | March 2011 | Rs 43,472 | ~18–19% |

| Bandhan Core Equity Fund | August 2009 | Rs 49,400 | ~14–15% |

| Nippon India Large Cap Fund | August 2007 | Rs 41,734 | ~13–14% |

| SBI Contra Fund | July 1999 | Rs 45,478 | ~17–18% |

| ICICI Prudential Multi Asset Fund | October 2002 | Rs 59,400 | ~12–13% |

Also Read: What Is a Financial Portfolio? Everything You Need to Know

Before you invest a lumpsum in mutual funds, it is important to understand how your returns will be taxed.

Taxability on Mutual Funds for Lumpsum Investments

The taxation on lumpsum investments in mutual funds has been updated after the post-union budget 2025. You can read the table below:

| Fund Type | Holding Period | Tax Rate |

|---|---|---|

| Equity Funds | Less than 12 months | 20% Short-Term Capital Gains (STCG) |

| More than 12 months | 12.5% Long-Term Capital Gains (LTCG) (after ₹1.25 lakh exemption) | |

| Debt Funds | Any duration | Taxed as per your income tax slab (no indexation) |

| Hybrid Funds | Depend on equity% | Taxed as equity or debt, based on equity allocation |

*The TDS applicable for residents mutual funds is on the income above Rs.10,000/ year. However, for NRIs TDS is deducted at applicable rates as per double taxation avoidance agreement (DTAA), if eligible.

In the next heading, you will see a comparison of “Lumpsum vs SIP.”

How is a lumpsum Investment different from SIP?

The table below draws a difference between lumpsum & SIP in detail:

| Parameter | Lumpsum Investment | SIP Investment |

|---|---|---|

| Investment Style | One-time investment of a large amount | Invests smaller amounts at regular intervals |

| Market Timing Sensitivity | High: Success depends on entering at a low market point | Low: less affected, reducing the impact of market volatility |

| Risk Level | Higher risk if the market fluctuates post-investment | Lower risk due to rupee cost averaging |

| Investor Suitability | Suitable for experienced investors or those with a large corpus or surplus | Ideal for beginners and disciplined investors |

| Return Potential | Can give higher returns if invested during market dips | Offers stable, long-term returns by smoothing out market ups and downs |

| Convenience | Simple – invest once and track performance | Convenient for salaried individuals, like paying monthly EMIs |

| Unit Purchase Strategy | All units purchased at one price point | More units are bought when the market is low and fewer when the market is high |

Don’t Miss Out: SIP or Lumpsum, which is better for you in 2025?

But, what gives better returns, lumpsum vs SIP? The following explanation will answer these questions.

Analytical Comparison: Lumpsum vs SIP, Which Gives Better Returns?

Based on some analytical comparison, let us find out which gives better returns. Here it is:

1. Return Potential (CAGR vs IRR)

- In Lumpsum returnsare calculated using CAGR compounded annual growth rate. If invested during a market down or early bull phase, Lumpsum is favoured to outperform SIP. For instance, if you invested Rs 10 lakh in Nifty 50 from March 2020 to March 2025 could get 13–15% of CAGR.

- SIP returns are better measured using XIRR, Extended Internal Rate of Return. SIP benefits from rupee cost averaging, mostly in volatile markets or fluctuations. For a kind, Rs 20,000 monthly SIP over the same duration might give 11–13% XIRR.

2. Market Timing Sensitivity

- In lumpsum, it is highly affected by market timing, such as if you invest at a market peak can generally reduce short-term & even medium-term returns.

- SIP minimizes timing risk by averaging the cost across market trends. Delivers more stable returnsover the period, especially in volatile markets.

3. Volatility Impact

- The lumpsum investment is a short-term market crisis that can affect the value of the entire corpus. Not best in high-volatility phases unless the investor has a long duration & high risk tolerance.

- In SIP, volatility is in favour. Investors earn more units when markets fall, and raise long-term gains when markets recover.

5. Risk & Liquidity Analysis

- In Lumpsum, high risk due to one-time exposure to investment & liquidity, the entire capital is locked in at once.

- In mutual funds, SIP risk is moderate to low as you invest in quarterly, monthly, and annual & liquidity is flexible, less capital is blocked at any given time.

You can easily know your returns, duration & investment amount using the SIP calculator tool.

Pro Tip: Find out your compound return using the SIP Calculator tool.

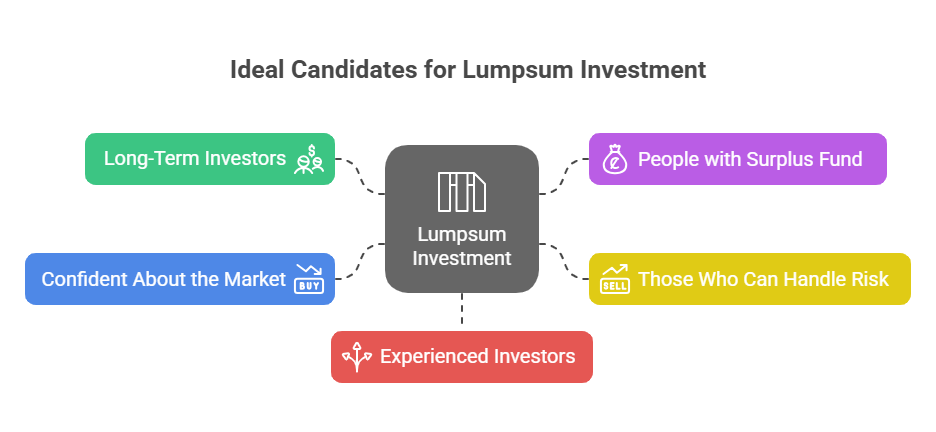

Who Should Invest in Lumpsum Mode?

The lumpsum investment approach is especially beneficial for those aiming for long-term capital appreciation. Here is who should invest in a lumpsum mode:

1. Long-Term Investors

If you stay invested for 5 years or more, lumpsum can give you better returns over time. Suitable for long-term financial goals like retirement or wealth creation, it helps in compounding returns over a long period & is less concerned with short-term market volatility.

2. People with Surplus Fund

Lumpsum mode is great if you have a large corpus, like from inheritance, bonus, or salary savings & selling property then you can invest a large amount in this mutual funds.

3. Those Who Can Handle Risk

Lumpsum investing involves a greater risk with market timing. It is best suited for those who handle high-risk, are comfortable with short-term market fluctuations, power to take calculated risks for higher potential returns.

4. Confident About the Market

Investors who have a basic knowledge of market trends. Confidence in market cycles helps in timing the investment better. Able to analyse market entry points, economic indicators, and sector performance.

5. Experienced Investors

Those who have investment experience generally find lumpsum investments easier than SIP. Their experience helps them tolerate volatility. As they understand portfolio diversification and asset allocation & are less panicked by short-term market news.

Every investor has different financial goals & amounts to invest in mutual funds.

Steps to Know Before Committing to Lumpsum Investment Work

Here are some basic steps to know before committing to lumpsum investment:

- Know Your Goal: Your goal will help you know how long to invest or for what. Saving for retirement, a house, or your child’s future.

- Research: Either you want to invest in mutual funds, stocks, or any other investing instrument. Research past returns and risks before choosing any investment instruments.

- Market analysis: If the market is down, it might be a good time to invest; you will get more value for your money.

- Spread Your Money Smartly: Diversifyyour capital so that it will reduce risks.

- Track: Monitor your investment once in a while. Make changes only if required; do not bother your investment when the market swings.

Smart Investments, Bigger Returns

Factors to Consider Before Investing in a Lumpsum Investment

Investing a large amount at once can be rewarding, but there are some factors to consider:

- Market Conditions: Before investing, analyse the market conditions. Do not invest when the market is at its peak. Invest in parts with a staggered approach.

- Availability of Funds: Use surplus money, which can not cause any loss in daily expenditures. Also, do not use emergency savings or money that you put aside for short-term goals.

- Diversification: This helps to mitigate the risk across the different funds & stocks.

- Analyse: The risk tolerance, duration of investment & financial goals will help you to grow your money smoothly if you analyse before investing.

If you are not preferable of market timing, use a Systematic Transfer Plan Calculator (STP) to know how to move a fixed range of amounts from source schemes to target schemes.

Conclusion

To sum up, Lumpsum investment in mutual funds means investing a large sum of amount at once, rather than in small chunks, unlike SIP. It is best for investors who have a surplus of funds or a windfall with a long-term horizon & the ability to tolerate market swings.

Lumpsum investment is best for the long run & generates higher returns. In short, lumpsum works best when done with proper planning, knowledge of the market & long-term commitment. Investor can prefer the mutual funds scheme according to their financial goals, risk tolerance & suitability. This is a powerful tool for wealth building when used wisely.

Frequently Asked Questions

1. Is lumpsum better than FD?

Yes, it can be due to returns. Lumpsum in mutual funds can give higher returns than an FD, but it comes with more risk. FDs are safer but offer fixed, lower returns.

2. Where is the best place to put a lumpsum of money?

It depends on your financial goals. For higher returns and long-term growth, mutual funds or stocks are good.

3. What is the best day to invest money?

There is no such “best” day. It is better to invest when you are financially prepared. Time in the market matters more than timing the market.

4. Is it the right time to invest in lumpsum?

The right time to invest in a lumpsum is when the market is down or you are investing for the long term & If markets are high, you can invest slowly using STP to reduce risk.

5. What is the best account to put a lumpsum in?

For safety, use a fixed deposit or high-interest savings account. For growth, use a mutual fund or brokerage account.

6. Should I invest a lumpsum or monthly?

If you have a large amount ready, you can invest a lumpsum. But if you want to avoid market fluctuations, then monthly SIPs are better.

7. What does 50,000 lumpsum mean?

It means you invest a large amount of Rs 50,000 all at once, instead of breaking it into smaller chunks.