Table of Contents

- Franklin India Multi Asset Allocation Fund NFO Overview

- Will Franklin India Multi Asset Allocation Fund Adopt the Best Asset Allocation Strategy?

- Is it Good to Invest in Franklin India Multi Asset Allocation Fund NFO 2025?

- What are the Modes of Investing in Franklin India Multi Asset Allocation Fund in India?

- Who Should Invest in Franklin India Multi Asset Allocation Fund NFO?

- Quick Recap to Why Investing in Franklin India Multi Asset Allocation Fund is a Good Idea

- To Conclude Franklin India Multi Asset Allocation Fund Review

The Franklin Templeton Mutual Fund introduces one multivitamin for your overall portfolio wealth: The Franklin India Multi Asset Allocation Fund NFO.

Yes, you read that right. This open-ended scheme plans investments in mixed assets like equity, debt and commodities. Offering an all-in-one portfolio started on July 11th and will close its subscription on July 25th, 2025.

Are you ready to ditch your traditional investments and level up with a multi-diversified scheme that offers "Growth + Relative Stability + Hedge?”

If yes, then at the end of the Franklin India Multi Asset Allocation Fund review, you will know if this is the best NFO 2025 for you.

Scroll down to read more.

Franklin India Multi Asset Allocation Fund NFO Overview

Here is the key information about the newly launched NFO by Franklin Templeton Mutual Fund in 2025:

| Scheme Name | Franklin India Multi Asset Allocation Fund |

|---|---|

| Issue Open Date | 11-Jul |

| Issue Close Date | 25-Jul-25 |

| Category | Equity: Multi Asset Fund |

| Benchmark | 65% Nifty 500 + 20% Nifty Short Duration Index + 5% Domestic price of gold + 5% Domestic price of silver + 5% iCOMDEX composite Index |

| Minimum Application Amount | Rs.500 |

| Fund Managers | Janakiraman Rengaraju, Rajasa K, Rohan Maru, Pallab Roy, Sandeep Manam |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

| Facilities Offered | Lumpsum/SIP/SWP |

Will Franklin India Multi Asset Allocation Fund Adopt the Best Asset Allocation Strategy?

This latest NFO by Franklin Templeton Mutual Fund is using a well-planned asset allocation strategy, dividing the Franklin India Multi Asset Allocation Fund NFO investments into 3 folds, such as:

- Equity for Growth: Planning active management with 30-80% money invested in Nifty 500.

- Debt for Stability: 10-25% as per the regime in debt securities.

- Commodities for Hedge: Investing in commodities like bullions and industrial metals up to 10-25%.

Overall, the newly launched NFO 2025 under the Multi Asset Allocation Funds category takes a long-term approach, focusing more on quality and buying stocks based on the GARP model (Growth at a Reasonable Price).

Start Your SIP TodayLet your money work for you with the best SIP plans.

Is it Good to Invest in Franklin India Multi Asset Allocation Fund NFO 2025?

The below points suggests that investing in this newly launched Franklin India Multi Asset Allocation Fund NFO is worth it:

1. Robust Track Record

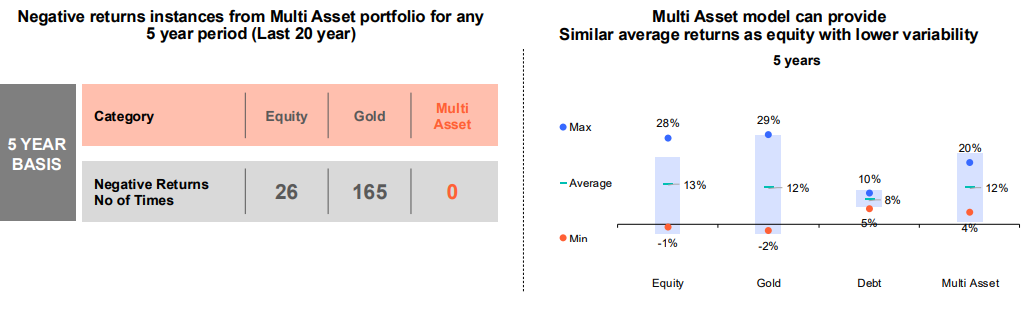

In the below given graph, you can see the 20 year historical returns of the multi asset allocation fund category shows that over the years, outperformance in gold mutual funds cushions the underperformance in Equity Funds.

* The above returns are based on average daily rolling returns for 5 year period from May 31st, 2005 till May 2025.

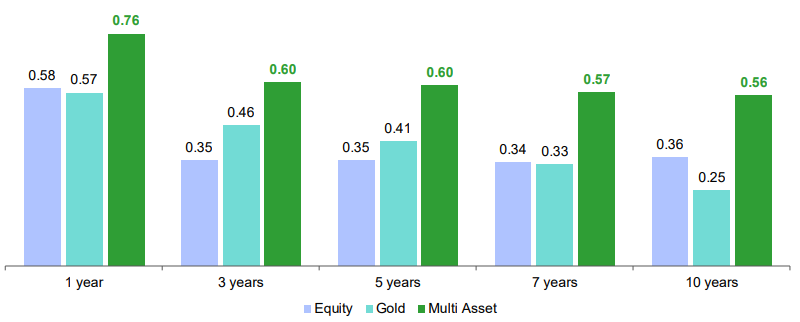

2. Strong Risk Adjusted Returns

This New Fund Offer follows a multi-asset framework that will give you better risk-adjusted returns across multiple time frames.

You can take a look at the below graph to see the returns under equity, gold and multi asset categories delivered over the years:

3. Diversified Investments

This latest NFO 2025 has a well-distributed portfolio invested in Gold Mutual Funds and Gold ETFs, giving a safe-haven appeal to attract investors.

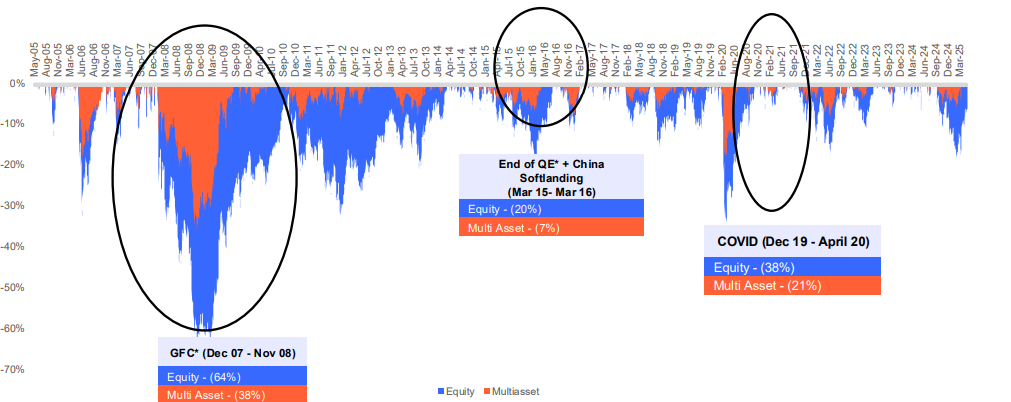

4. Ability to Lower Risk

The Franklin India Multi Asset Fund follows a multi-asset model that gives you similar average returns as equity with lower downside risk, especially as you see the graph below, during Covid-19 times, multi asset stood at 21% drawdowns only:

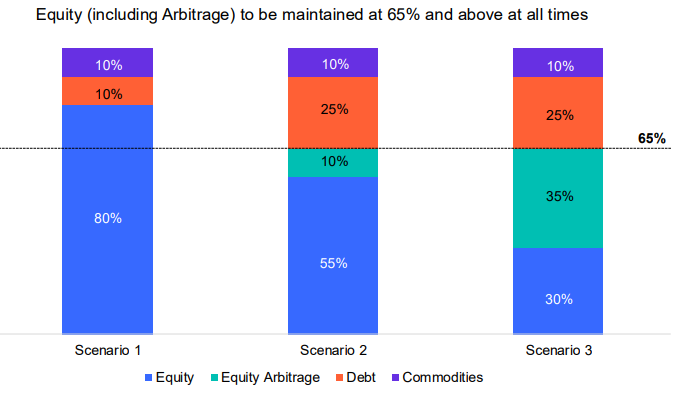

5. Taxation Benefits Under Equity

The Franklin India Multi Asset Allocation Fund NFO follows an equity-oriented taxation policy, maintained at 65% and above at all times.

See the chart below to see the data in different scenarios:

What are the Modes of Investing in Franklin India Multi Asset Allocation Fund in India?

The Franklin India Multi Asset Allocation Fund review reveals that there are three ways you can start your investments ASAP:

- Lumpsum Investment

- SIP (Systematic Investment Plan)

- STP (Systematic Transfer Plan)

In short, this latest NFO offers potential for long-term compounding returns with downside protection to create wealth.

Pro Tip: Plan a wise money swap using the STP Calculator free of cost.

Who Should Invest in Franklin India Multi Asset Allocation Fund NFO?

The Franklin India Multi Asset Allocation Fund NFO is a good choice for investors who are looking for:

- Long-Term Wealth Creation: If you want to grow your money over time by investing in a mix of stocks, bonds and commodities.

- Disciplined Investing: If you want a planned, systematic and disciplined investment option to investing instead of making impulsive decisions, the Franklin India Multi Asset Allocation fund offers exactly that.

- Asset Class Diversification: If you want to spread your investments across different areas to reduce risk.

- Downside Protection: If you’re looking for ways to protect your investments from potential losses in difficult market conditions.

- Lower Volatility: If you prefer less fluctuation in your investments and want a strategy that balances risk and return.

This fund is a best fit for you if a long-term investment, diversified portfolio solution with a balanced approach to risk is what you seek.

Quick Recap to Why Investing in Franklin India Multi Asset Allocation Fund is a Good Idea

Here is a quick summary of gathering insights on whether investing in Franklin India Multi Asset Allocation Fund is a good idea in 2025:

- All-in-one diversified portfolio.

- Proprietary model for selection of asset classes.

- Helps protect better downside risk.

- Helps in reducing portfolio volatility.

- Equity-oriented taxation on your SIP investments.

- Established investment track record that promises a long-term opportunity for wealth creation.

To Conclude Franklin India Multi Asset Allocation Fund Review

The Franklin India Multi Asset Allocation Fund review reveals that even though investors' dilemmas, such as "Is it the right time to invest?" or "How should I diversify?" are justified, this latest NFO offers the perfect solution. How?

Well, it is built upon the world of multi-asset investing, aiming for wealth generation, optimising risk and returns, risk diversification, long-term goals and downside protection.

In our expert opinion, the best option for you would be to Start SIP in this NFO with a small amount, see the performance yourself (this way, you can increase your investment later) and weather out any market fluctuations.

_(1).webp&w=3840&q=75)

.webp&w=3840&q=75)