Table of Contents

- What is a Load in Mutual Funds?

- What Is Entry Load in Mutual Funds?

- What Is Exit Load in Mutual Funds?

- Difference Between Entry Load vs Exit Load

- How Entry Loads Historically Affected Mutual Fund Returns?

- How Do You Calculate Exit Load in Mutual Funds, With an Example?

- Exit Loads on Different Types of Mutual Funds

- Strategies to Reduce or Avoid Exit Loads in Mutual Funds

- Entry Load vs Exit Load: Which Matters Most in 2025?

- Expert Tips for Investors

- Conclusion

Mutual fund investments are a great way to grow financially in 2025, but what about the expenses these investments include? Studying these extra charges or loads is essential for your effective investment planning. Two main costs associated with MF investments are the entry load and exit load in mutual fund. But, the million-dollar questions are, "What is the main difference between entry load vs exit load?" and "How do these loads impact your investment returns?"

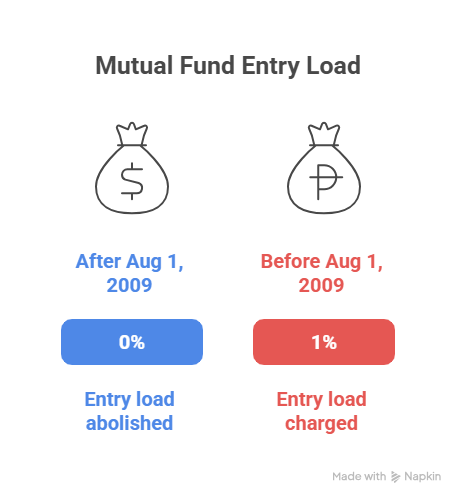

Simply put, an entry load in a mutual fund is a fee you pay when you buy units. At the same time, an exit load is a charge for selling those units early. But, are you aware that SEBI abolished entry loads in India in 2009? Yes, it is true. SEBI banned entry loads long ago to increase investment transparency. Therefore, the exit loads are the ones that matter most for mutual fund investments in 2025.

Are you curious to know more? Dive into this detailed guide to uncover more interesting facts about these loads and compare "Entry Load vs Exit Load" to determine which matters the most in 2025.

What is a Load in Mutual Funds?

A load in Mutual Funds is the charge imposed on investors for buying and selling the fund's units. These loads are not included in the fund's expense ratios and directly minimize the returns. Based on the loads, mutual funds can be classified as load and no-load funds.

The loads in the mutual funds can be classified as:

- Entry loads: Also known as Front-End Load, it is charged when investing or buying units in mutual funds.

- Exit loads: These are the Back-End Loads, which are charged when the investor redeems or sells the units before a specific period.

- Level Load: A recurring fee is charged annually as part of the fund’s ongoing expense ratio.

Let us understand these loads in detail in the next part.

What Is Entry Load in Mutual Funds?

An entry load is a fee investors pay when purchasing units or investing in a mutual fund. This charge covers the fund’s distribution and operational costs and is charged as a percentage of the investment amount.

How does it work?

With the entry load, the actual amount invested in the funds would be less than the amount contributed by the investor.

For instance, if you invest Rs 5,000 in a fund with a 1% entry load, Rs 50 will be deducted as an entry load and only Rs 4,950 will be invested in the fund.

Current status of entry loads in India:

Mutual fund investments in India are regulated by the SEBI (Securities & Exchange Board of India), which bans entry loads in India. This abolishment came into effect on August 1, 2009.

These loads were banned to benefit investors by making mutual fund investments more accessible and transparent and ensuring that the entire investment amount goes towards wealth creation.

Now, let us look at what exit loads are in mutual funds.

What Is Exit Load in Mutual Funds?

The exit load is a fee the AMCs impose on investors when they redeem or sell their mutual fund units before the minimum specified holding period. It is a percentage of the NAV (Net Asset Value) or redemption value at the withdrawal time.

How does it work?

The mutual fund scheme clearly states in its Scheme Information Document (SID) a specific period during which the exit load is applicable. If an investor redeems their units within this period, the exit load is applied to the value of the sold units.

Purpose of Exit Loads:

- Discourage Short-Term Trading

- Maintain Fund Stability

- Protect Investors With Long-Term Perspective

- Offset Transaction Costs

Also Read: What is Exit Load in Mutual Fund? Ultimate Guide With Example

Let us unlock the key differences between mutual funds' entry and exit loads.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Difference Between Entry Load vs Exit Load

Here is the key comparison between exit and entry loads in mutual funds:

| Feature | Entry Load | Exit Load |

|---|---|---|

| When Charged | At the time of purchasing fund units | At the time of redeeming (selling) fund units. |

| Deducted From | Initial investment amount | Proceeds received on redemption. |

| Purpose | To cover distribution or admin costs (now abolished) | Discourage premature withdrawal; cover admin costs. |

| Current Status | Abolished in India since August 2009 | Still applicable for many schemes. |

| Typical Value | Was ~2–2.5% of the invested amount | Usually, 0.5–1% of the redemption amount. |

| Applicability | Not charged by Indian funds today | Charged if redemption is before the specified period. |

Let us learn about the past effect of entry loads on mutual fund returns.

How Entry Loads Historically Affected Mutual Fund Returns?

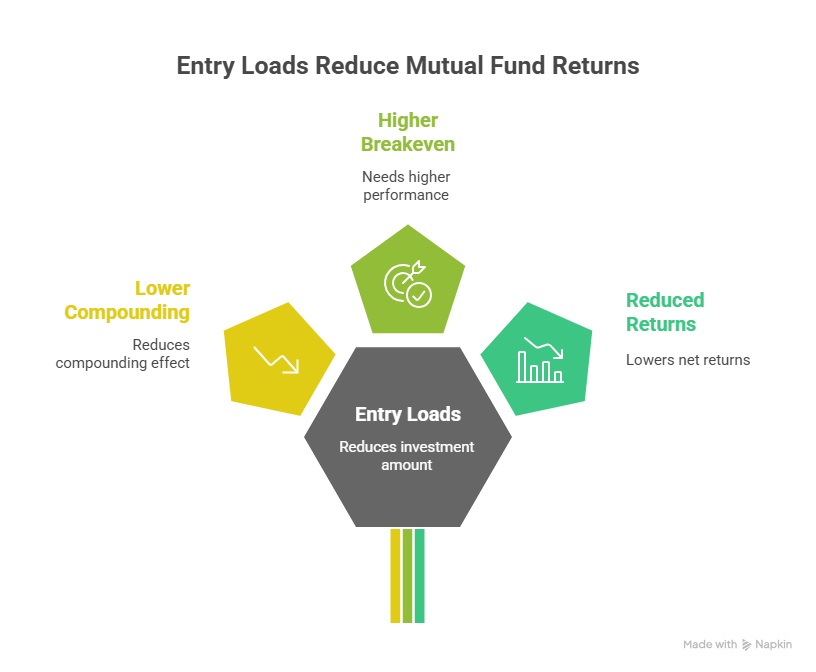

Entry loads directly and negatively impact the mutual fund's returns from the start by reducing the investment amount. Here is how it historically affected the mutual fund returns:

1. Reduced the Actual Amount Invested

Entry loads directly impacted mutual funds by reducing the amount invested instantly and only the remaining amount was used for investments.

2. Lowers the Starting Base for Compounding

Compounding works by generating returns on the principal amount, so deducting the investment amount resulted in an immediate lower compounding effect.

3. Higher Performance Requirements to Break Even

With an entry load, the mutual fund must earn enough to pay off the upfront fee before the investors can start making money on their investments.

4. Reduced Overall Net Returns

Entry loads directly reduce investors' net returns. The fund's return might have been impressive, but after the initial entry fee, the investor's personal net return would be lower.

5. Shifting to Direct Plans and Lower Costs

India's ban on entry loads encouraged investors to shift to direct plans with lower expense ratios or costs. It was a big step towards increasing transparency and making mutual fund investing more investor-friendly.

In the next section, you will learn how to calculate the exit load on your investments.

How Do You Calculate Exit Load in Mutual Funds, With an Example?

The exit load in a mutual fund is calculated as a percentage of the redemption amount (the current NAV when you sell the units) if the withdrawal occurs within the specific holding period defined by the fund house.

Formula for calculating exit load:

Exit Load = Redemption Value X Exit Load Percentage

For example, let us use a real-world situation with an ICICI Prudential fund. Assume you made a lump sum investment in an ICICI Prudential equity fund, with:

- Initial Investment Date: January 15, 2025

- Investment Amount: Rs 1,00,000

- NAV at Investment: Rs 50 per unit

- Units Purchased: Rs 1,00,000 / Rs 50 = 2,000 units

Now, let us imagine two cases and see the impact of these loads:

Case 1: Redemption within the exit load period

Let us say you redeemed your investment on September 15, 2025 (8 months after investment) with a NAV of Rs 55. Therefore,

- Redemption Value: 2,000 units × Rs 55 = Rs 1,10,000

- Applicable Exit Load: Since the redemption is within 12 months, the 1% exit load applies.

- Exit Load Amount: Rs 1,10,000 × 1% = Rs 1,100

- Net Redemption Amount Received: Rs 1,10,000 - Rs 1,100 = Rs 1,08,900

Here, an exit load of Rs 1,100 was deducted because the redemption occurred within the specified period.

Case 2: Redemption after the exit load period

Let us say you completed the holding period and redeemed your investment on January 20, 2026 (Just over 12 months after investment) with a current NAV of Rs 60. So,

- Redemption Value: 2,000 units × Rs 60 = Rs 1,20,000

- Applicable Exit Load: Since the redemption is after 12 months, the exit load is 0%.

- Exit Load Amount: Rs 1,20,000 × 0% = Rs 0

- Net Redemption Amount Received: Rs 1,20,000 - Rs 0 = Rs 1,20,000

In this case, no exit load was charged because the investment was held beyond the holding period.

In the next heading, let us understand how much exit load is applied to the different fund types.

Exit Loads on Different Types of Mutual Funds

The table given below displays and compares the exit loads applied to different types of mutual funds:

| Mutual Fund Type | Typical Exit Load | When Applicable | Comments |

|---|---|---|---|

| Equity Funds | 1% | If redeemed within 1 year | Some funds may have zero exit load after 1 year |

| Debt Funds | 0%–1% (often zero for short duration/overnight) | If redeemed within 7–180 days | Higher for accrual schemes; many short-term funds have none |

| Hybrid Funds | Usually 0.5%–1% | If redeemed within 1 year | Arbitrage funds: generally exit load within 30–60 days |

| Liquid Funds | Up to 0.007% per day for 7 days, then 0% | If redeemed within 7 days | No exit load after 7 days |

| ELSS (Tax-Saving) | None | Not Applicable | 3-year lock-in; cannot redeem before lock-in ends |

| Sector/Thematic Funds | 1% | If redeemed within 1 year | Same as standard equity fund rules |

| Index Funds/ETFs | 0% or 1% (varies by scheme) | If redeemed within the scheme's time frame | Many index/ETF funds have no exit load |

Must Read: How to Calculate Tax On Mutual Fund Redemption?

Let us explore strategies to help you reduce or avoid your exit loads.

Strategies to Reduce or Avoid Exit Loads in Mutual Funds

Mentioned below are the key strategies that can reduce or eliminate the exit loads on your mutual fund investments:

- Holding investments beyond the exit load period.

- Choosing funds with no or low exit loads.

- Planning best SIP redemptions strategically.

- Utilizing Systematic Withdrawal Plans (SWPs) carefully.

- Using Systematic Transfer Plans (STPs).

- Switching from regular to direct plans without an exit load.

- Keeping track of the investment date for each SIP instalment.

- Understanding the fund documents and seeking advice.

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

The main question is, " Which matters for 2025 investments, Entry or Exit load?" Keep scrolling to know.

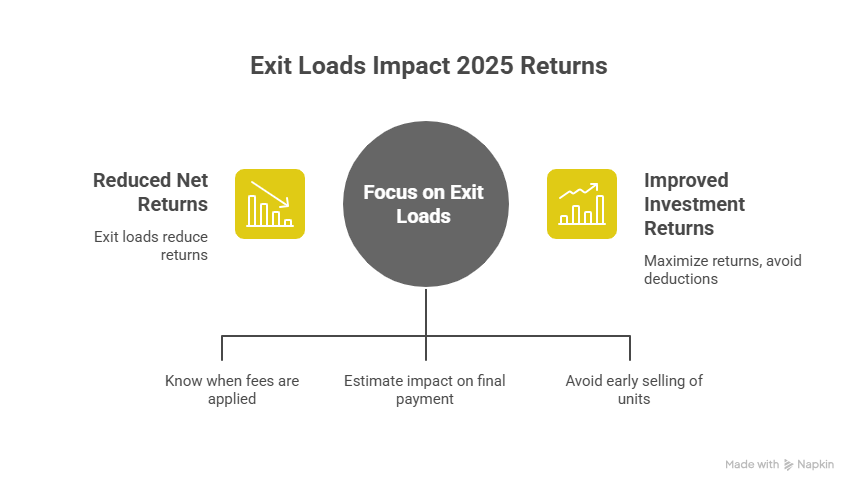

Entry Load vs Exit Load: Which Matters Most in 2025?

For the financial year 2025, exit loads matter more than entry loads when investing in mutual funds, as they are the only type of load that still directly affects investors. SEBI abolished entry loads in India in August 2009 to make mutual fund investments transparent and investor-friendly. Therefore, entry loads do not impact returns or costs in 2025.

Here is why exit loads still matter for investments in 2025:

- Stopping investors from selling their mutual fund units early to protect long-term investors and maintain fund stability.

- The exit load is deducted from the withdrawal amount, directly reducing the final payment and impacting your net returns.

- Ignoring the exit fee, you could get unexpected return deductions and have less money than planned.

In the next section, you will explore expert suggestions for your next mutual fund investment. So, do not miss out.

Expert Tips for Investors

Here are some expert tips for mutual fund investors to make informed investment decisions in 2025:

- Understand the load structure before investing.

- Avoid early exits and invest for a long time.

- Use the best SIPsfor systematic mutual fund investing.

- Diversify your portfolio to balance risk & returns.

- Regularly review the fund performance & stay updated.

- Use online tools to estimate returns & plan your investments.

- Stay updated on SEBI's regulatory changes.

- Take expert advice from financial advisors if needed.

Smart Investments, Bigger Returns

Conclusion

In short, exit loads are the ones that matter the most between Entry and exit loads for mutual fund investments in 2025. Entry loads were abolished by SEBI on August 1, 2009, in India.

So, exit loads are the only charges applicable for investments in 2025 and beyond, promoting long-term investments while discouraging early exits or withdrawals of investment units.

Related Blogs:

- FD vs Mutual Fund: Which Is Better To Invest in 2025

- Is SIP a Safe Investment in 2025? Truth Of Secure Investing

- SIP or Lump Sum, Which Is Better for You in 2025

FAQs

-

What is the Exit and Entry Load?

An entry load is a charge for buying (investing) units in a fund and an exit load is a charge for selling (redeeming) units of a mutual fund.

-

Is the entry load applicable in 2025?

No, SEBI abolished entry loads in 2009 to promote transparency and reduce upfront investment costs in mutual funds.

-

Which load matters more in 2025, entry or exit load?

Exit loads matter more as entry loads are abolished. Understanding and managing exit loads helps maximize net returns.

-

How has the abolition of entry loads impacted investors?

It reduced the upfront cost of investing, allowing full investment to grow, improving long-term wealth creation for investors.

-

Why take loads seriously?

Loads matter because they reduce your returns. Managing loads carefully protects your investment growth in 2025.

_(1).webp&w=3840&q=75)

.webp&w=3840&q=75)