Table of Contents

- What is Exit Load in Mutual Funds?

- How Does It Work and Why Do AMCs Charge Exit Load?

- Types of Exit Load in a Mutual Fund

- How Do You Calculate Exit Load in a Mutual Fund? With Example

- Exit Load on Different Types of Mutual Funds

- Exit Load on SIP and SWP Investments

- Latest SEBI Guidelines on Exit Load

- Entry Load vs Exit Load: Key Differences

- Tax Implications of Exit Load

- How Does Exit Load Affect Your Returns Over Time?

- Strategies to Avoid or Reduce the Impact of Exit Load Legally

- Exit Load Implications for Investors

- Conclusion

Do you know what happens if you redeem your investment units before the specified holding period? If you withdraw your units prematurely, the AMCs charge you a leaving fee called an exit load. This fee is deducted from your redemption amount and can significantly affect your overall gains.

But why are exit loads in Mutual Funds charged, and how can you avoid them? Well, they are charged for discouraging investors from withdrawing their money too early and promoting long-term investments.

Want to know more? Read this guide to gain a deep understanding of the exit load in mutual funds 2025, its practical examples and SEBI rules. Whether investing in equity or debt funds, SIPs, or systematic withdrawals, knowing how exit loads work helps you plan better and maximise your returns.

What is Exit Load in Mutual Funds?

An exit load in a mutual fund is a withdrawal fee charged by AMCs (Asset Management Companies) when you redeem the units of your investment before the specified minimum holding period. This fee is a percentage or a particular amount of your redemptions, which is deducted from the Net Asset Value (NAV) during withdrawal.

What is the purpose of exit load?

Exit loads are mutual fund redemption charges imposed to discourage premature investment withdrawals. These charges prevent investors from making short-term investments, encourage a long-term mutual fund investing perspective and help maintain portfolio stability while reducing the fund's cost. Therefore, the exit loads are critical in mutual fund investments, but there are also zero exit load mutual funds.

Must Read: Best Mutual Funds to Invest in 2025: Low-Risk Options for High Return

How Does It Work and Why Do AMCs Charge Exit Load?

The exit loads work by charging fees for early redemption of fund units. This cost is a percentage of NAV collected at the time of withdrawal, when redemption is made before the lock-in period or minimum tenure.

Different mutual funds have distinct rules and exit load charges, which are summarised below:

| Fund Type | Exit Load Applicability | Typical Holding Period |

|---|---|---|

| Equity Funds | If redeemed before 12 months | 12 months |

| Debt Funds | May apply if redeemed before 6–12 months | 6 to 12 months |

| Liquid Funds | Charged if redeemed within 7 days | More than 7 days exempt |

| ELSS | No exit load, but 3-year lock-in period | 3 years (mandatory lock-in) |

Here are the reasons why AMCs levied exit loads on mutual funds:

- To stop short-term trading that ruins fund management.

- It is used to protect long-term investors from forced asset sales.

- Covering administrative and transaction costs of redemptions.

- For maintaining fund stability by limiting frequent large withdrawals.

Let us learn the types of exit loads in mutual fund investments.

Types of Exit Load in a Mutual Fund

The following is the primary classification of exit loads in mutual funds 2025:

- Fixed Exit Load: A fee charged on redemption within a specified, preset exit load period, regardless of how long the units were held.

- Stepped Exit Load: The exit load charges reduce as the holding period increases, encouraging longer investments by lowering fees over time.

- Contingent Deferred Sales Load (CDSL): An exit load that decreases with time, resulting in zero exit load over time.

- Dynamic Exit Load: An uncommon but flexible fee structure that may vary based on market conditions or fund performance.

- Fund-Specific Exit Load: The variation of costs by fund types. For example, equity mutual fund exit loads are usually higher, debt mutual fund exit loads are lower & liquid fund exit loads are minimal.

- No Load Funds: Mutual funds with no exit load, but might have a higher expense ratio to cover the expenses.

You will learn how exit loads are calculated in the next heading with an example.

Start Your SIP TodayLet your money work for you with the best SIP plans.

How Do You Calculate Exit Load in a Mutual Fund? With Example

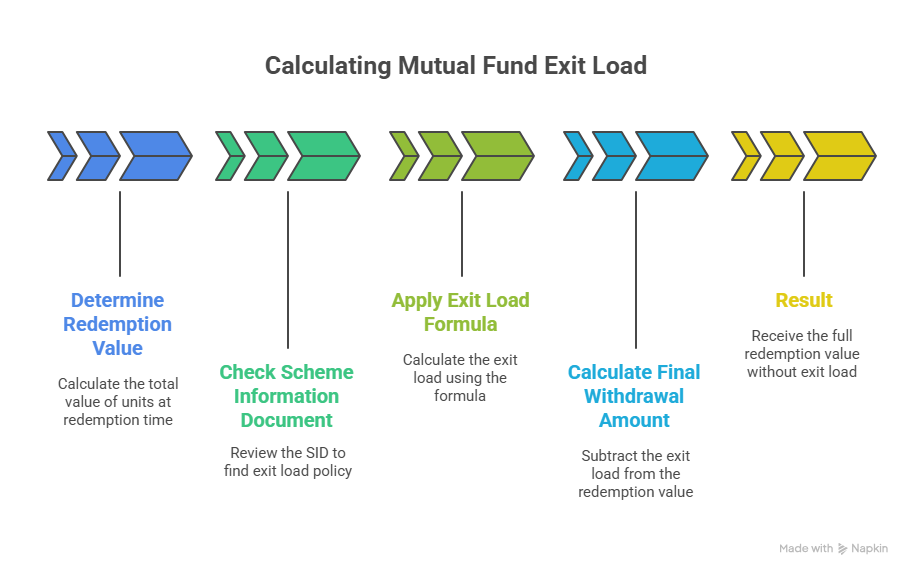

Follow the given steps to calculate your mutual fund redemption charges within a specified period:

Step 1: Determine redemption value (product of the number of units you hold and NAV at that time).

Step 2: Check the Scheme Information Document (SID) to identify the holding period and applicable exit load for the period.

Step 3: Use the given formula for mutual fund exit load calculation:

Exit Load = Redemption Amount × Exit Load Percentage

Step 4: To determine the final withdrawal amount, subtract the calculated exit load charges from your current investment value.

Let us look at a mutual fund exit load example for the exit price after 1 year:

Let us assume the following components-

- Investment Amount: Rs 1,00,000

- NAV at Investment: Rs 100

- Units Purchased: 1,00,000 / 100 = 1,000 units

- Exit Load Policy: 1% if redeemed within 1 year

Now, imagine that you hold the investment for 1 year and the NAV at the time of redemption is Rs 110. So, the redemption value will be Rs 1,10,000 (1,000 units × Rs 110). And, since redemption happens exactly after 1 year and the exit load is typically applicable within 1 year, there is no exit load to be paid.

The holding period of one year is generally the cutoff point for equity mutual funds, at which point the exit load becomes zero. So, the Final Redemption Amount is Rs 1,10,000 (Rs 1,10,000—Rs 0).

Result: In this situation, because the investment was held beyond the 1-year exit load period, you will receive the full redemption value of Rs 1,10,000 without any deduction for the exit load.

Now, let us understand the charges on different types of mutual funds.

Exit Load on Different Types of Mutual Funds

Exit load on mutual funds varies based on the type of fund. Here is a breakdown of mutual fund redemption charges:

Equity Funds: The Equity mutual fund exit load is 1% on the redemptions made within 1 year of investment; after that, the charges are usually zero.

Debt Funds: Many funds have no exit load after 7 days, but some may charge 1% if withdrawn within 7–180 days. The liquid Debt mutual funds exit load is 0.25%–1% for redemption before the specified date.

Hybrid Funds: The exit load charges on these funds usually depend on their equity investments, most often 1% if exited before 12 months. The funds with higher debt exposure have no exit load.

Liquid Funds: The liquid funds exit load applies only if the fund is exited within 7 days. After 7 days, there is no exit load.

ELSS (Equity Linked Savings Scheme): This scheme has a mandatory lock-in period of 3 years. You can not withdraw your units before this period. There is no exit load for this tax-saving fund.

Overnight Funds: Invest in debt & money market instruments with a one-day maturity. These are zero exit load mutual funds.

Let us compare mutual fund options based on their exit load charges:

| Fund Category | Typical Exit Load | When Applicable | Comment |

|---|---|---|---|

| Equity Funds | 1% | If redeemed within 12 months | No load after 12 months |

| Debt Funds | 0.25–1% (varies) | If redeemed within 7–180 days | Some funds have no load after 7/30 days |

| Liquid Funds | Graded, up to 0.007% per day | If redeemed within 7 days | No load after 7 days |

| ELSS | None | Lock-in of 3 years | Early exit not allowed |

In the next heading, you will go through the exit loads implied specifically on SIP and SWP.

Exit Load on SIP and SWP Investments

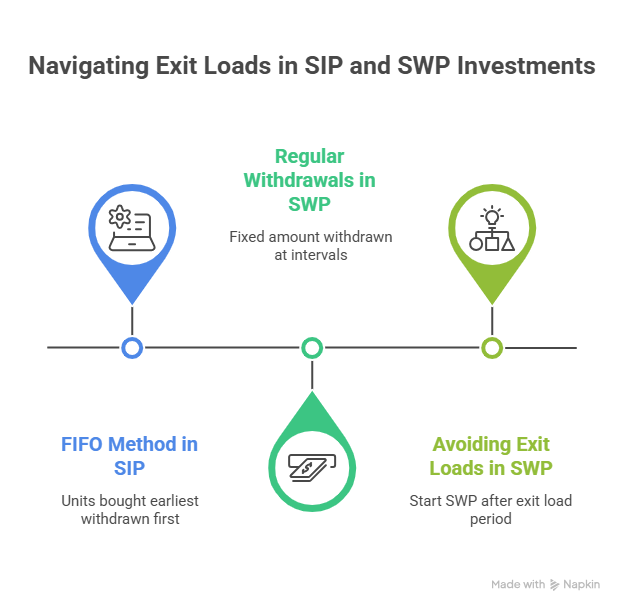

Exit load on SIP (Systematic Investment Planning) and SWP (Systematic Withdrawal Planning) in mutual funds has specific variations, which are described below:

Exit Load on SIP:

Each SIP instalment is treated as an individual investment for exit load charges on SIP investments. Therefore, each SIP instalment's exit load holding period is also calculated separately.

It follows a FIFO (First In First Out) method, which means the units bought at the earliest from the oldest SIP instalment will withdraw first. This method allows partial redemption without incurring a load on specific units.

Exit Load on SWP:

Through SWP, you can withdraw a fixed amount at regular intervals. Each withdrawal is considered a redemption for calculating the exit load. If the units being retreated fall within the specified exit load period, the charges will be deducted from the withdrawal amount.

Starting an SWP only after the exit load period can help avoid these exit load charges.

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Let us understand the latest SEBI guidelines imposed on exit loads.

Latest SEBI Guidelines on Exit Load

Some of the most essential guidelines from SEBI (Securities and Exchange Board of India) on exit load in mutual funds 2025 are:

- Exit loads will be charged only on redemptions before the minimum specified holding period.

- Charges according to SEBI exit load rules: 1% for equity (1 year) and 1% for debt funds (7-180 days).

- SEBI allowed a dynamic exit load structure for AMCs.

- Exemption of exit load charges for switching in regular and direct plans of the same mutual fund scheme.

- SEBI mandates the transparency of exit load details in the scheme information document (SID).

Let us compare the entry and exit loads in the next part.

Entry Load vs Exit Load: Key Differences

Here is the detailed comparison that sets entry loads and exit loads in mutual funds apart:

| Feature | Entry Load | Exit Load |

|---|---|---|

| When Charged | At the time of buying units | At the time of redeeming units |

| Purpose | To cover distribution & admin costs (now abolished) | To discourage early withdrawals and protect the fund |

| Current Status | Abolished by SEBI since 2009 | Still applicable |

| Calculation Basis | Percentage of investment amount | Percentage of redemption amount |

| Impact on Investor | Reduces upfront investment amount | Deducted from redemption proceeds |

| Charged By | Fund at purchase | Fund at redemption |

Keep reading to know the tax implications applied to the exit load charges.

Tax Implications of Exit Load

Exit load charges by AMCs on mutual fund investments do not have any tax implications, but they reduce taxable capital gains. Since exit load is deducted from the redemption amount, only the net amount received is considered when calculating taxable profits.

Formula for calculating taxable capital gains:

Capital Gains = (Redemption Amount – Exit Load) – Original Cost of Investment

The tax is imposed on capital gains (short or long-term, as per holding period), calculated using this formula only as per the Income tax rules. There are no tax implications of exit load charges.

Must Read: How to Calculate Tax On Mutual Fund Redemption?

Now, let us understand the effect of exit load on your profits.

How Does Exit Load Affect Your Returns Over Time?

Here is the impact of exit load on the returns of your mutual fund investments over time:

- Exit load charges reduce your final redemption amount, resulting in lower potential returns.

- The exit fee impacts your gains and lowers your returns if you redeem small gains or losses early.

- Stop early exit and promote longer investments, which allow full returns after the exit load period.

- Frequent exit loads shrink your capital, as a result, you make less money over time.

- Exit load is a real cost that must be considered when evaluating mutual fund performance, not just NAV growth, because it reduces the net returns.

Example comparing short-term vs. long-term impact

Assume a Rs 1,00,000 investment with a 1% exit load if redeemed within 12 months. Otherwise, there will be zero exit load.

| Scenario | Holding Period | Gross Return (NAV Growth) | Gross Redemption Value | Exit Load (1%) | Net Redemption Value | Net Return |

|---|---|---|---|---|---|---|

| Short-Term | 6 Months | 5% (Rs 5,000) | Rs 1,05,000 | Rs 1,050 | Rs 1,03,950 | Rs 3,950 (3.95%) |

| Long-Term | 13 Months | 12% (Rs 12,000) | Rs 1,12,000 | Rs 0 | Rs 1,12,000 | Rs 12,000 (12%) |

According to the table for the two situations, the short-term conditions visibly reduce the net returns. In contrast, in the long-term condition, the investor avoided the exit load and gained the full gross return (before taxes).

As a result, exit load charges significantly impact premature redemptions. You can avoid this impact by holding your investments beyond the exit load period and increasing your returns over time.

Now, the question is, "How do we avoid an exit load?" Keep scrolling to uncover the top strategies.

Strategies to Avoid or Reduce the Impact of Exit Load Legally

The following are the strategies that tell how to avoid exit load or reduce it legally:

- Align your investment duration with the exit load holding period.

- Choose low or zero exit load mutual funds for investment.

- Plan your withdrawal (SWP) carefully and let the exit load period end.

- Leverage the FIFO method for exit load on SIPs.

- Consider switching to a direct plan for exit load.

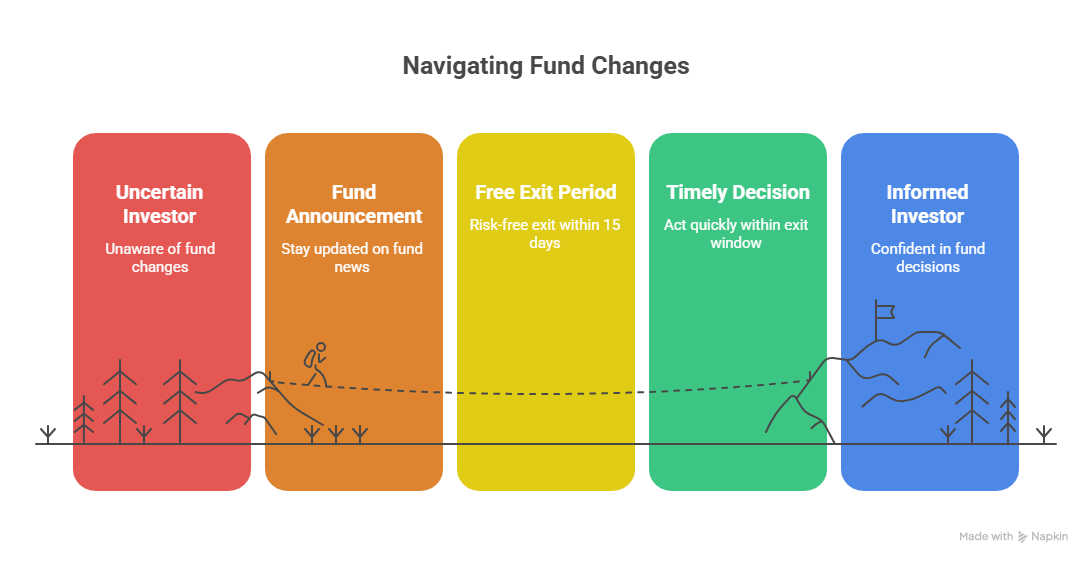

- Use the free exit window when a fund's attributes change.

Pro Tip: Use a SWP Calculator for easy withdrawal of money from your investments.

Now, you will know the exit load implications for the investors.

Smart Investments, Bigger Returns

Exit Load Implications for Investors

The following are the exit load implications for investors:

- Investors get a free exit period of at least 15 daysduring fund changes.

- Investors have a risk-free chance to exitif they disagree with the change.

- You need to stay updated on fund announcementsto make timely decisions.

- The free exit period protects investors during major fund changes without penalty.

- Investors must act quickly, as the exit window is shorter now (15 days vs. 30 days earlier).

Also Read: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

Conclusion

In short, an exit load in mutual funds is a fee AMCs collect when investors redeem their units before a specified minimum holding period. It prevents short-term withdrawals, protects long-term investors & maintains fund stability.

Exit loads differ based on mutual fund type. Understanding exit load charges helps investors avoid surprise charges & plan systematic withdrawals of units for better returns. You should always check the fund’s exit load policy before investing to align it with your financial objectives.

Related Blogs:

- Is SIP a Safe Investment in 2025? Truth Of Secure Investing

- Tax Planning For Salaried Employees: Best Tax Saving Options

- SIP or Lump Sum, Which Is Better for You in 2025

FAQs

-

What happens if I redeem after the exit load period?

If you redeem after the specified period, no exit load is charged and you will receive the full redemption value.

-

Is exit load taxable?

Exit load is not taxed but reduces the redemption amount on which capital gains tax is calculated.

-

Can I avoid paying the exit load?

Yes, by holding units beyond the exit load period, using SWP wisely or taking advantage of free exit windows.

(1).webp&w=3840&q=75)

(1).webp&w=3840&q=75)