Table of Contents

The title of the blog clearly sums up as far as the introduction goes. Let us uncover the best Manufacturing Mutual Funds to invest in 2024. We will explore the top 5 funds that shine in investing style, consistent returns, strong management, quality portfolios, and smart risk management.

Moreover, we will reveal the minimum SIP amount for you to start your investments at the earliest.

Join us to discover the future stars of the manufacturing sector and learn how to build a winning portfolio.

List of 5 Best Manufacturing Funds for SIP in 2024

| Scheme Name | Launch Date | AUM (Cr) | 3 Months Returns (%) | 6 Months Returns (%) |

|---|---|---|---|---|

| Axis India Manufacturing Fund | 21-Dec-23 | 5,909 | 12.19% | 27.77% |

| ABSL Manufacturing Fund | 31-Jan-15 | 1,109 | 8.68% | 19.32% |

| ICICI Prudential Manufacturing Fund | 11-Oct-18 | 5,960 | 9.32% | 21.53% |

| Kotak Manufacturing in India Fund | 22-Feb-22 | 2,339 | 10.34% | 22.30% |

| Quant Manufacturing Fund | 14-Aug-23 | 905 | 11.99% | 18.44% |

| Category Average | 10.84 | 21.87 | ||

| NIFTY 500 TRI | 8.06 | 14.24 | ||

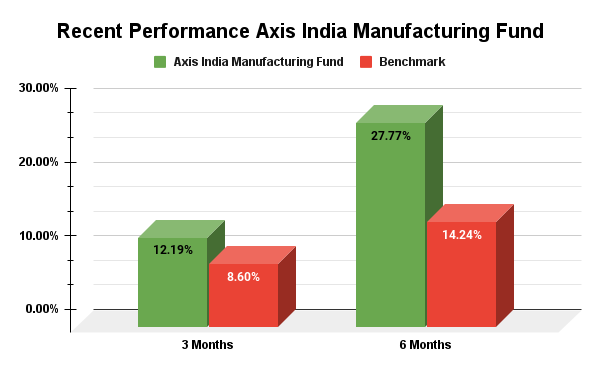

1. Axis India Manufacturing Fund

Based on a manufacturing theme, the Axis India Manufacturing Fund launched on 21st December 2023 has very smartly played its strategy of picking quality companies in the portfolio which has made it possible to achieve 27.77% returns in six months and outperform both category average and benchmark. The fund is currently managing an AUM of Rs.5,909 Crores but you can start your SIP in this stock at just Rs.500.

Check the below graph for data:

Furthermore, let’s say you start a SIP of ₹3000 per month and kept for 15 years, you would have spent a total of around ₹5.4 lakh. At the same time, your investment would be worth almost a whopping ₹15 lakh approx.

use the SIP Calculator to see the returns for yourself.

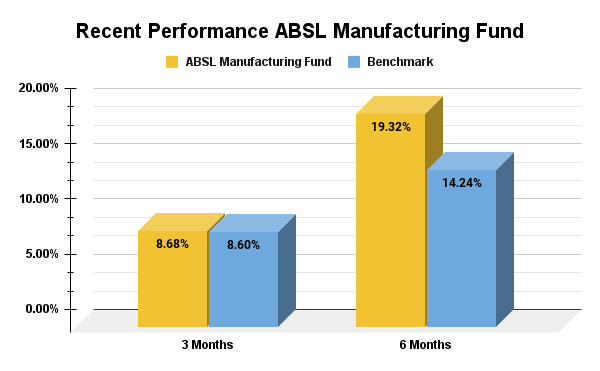

2. ABSL Manufacturing Fund

Next, we have ABSL Manufacturing Fund, which laid its foundation back in 2015, if you had invested Rs.3000 at that time you would have spent Rs.3, 48,000 and made it worth Rs.7, 69,503 in today's date. This is because they have a strong focus on their earnings growth and continuously position themselves in the competitive market. If quality management based on industry trends is what you are up for then you can start your investments at just Rs.1000 in a SIP.

Let’s look at the graph to understand the data more easily:

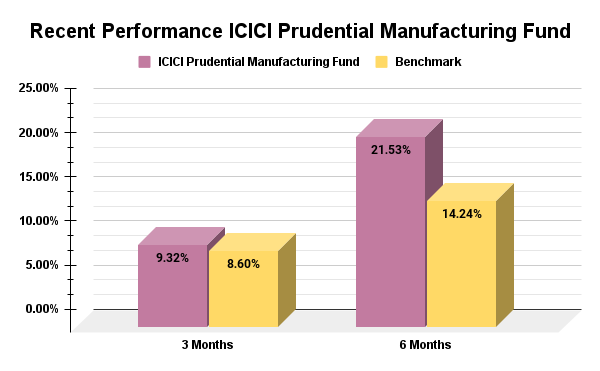

3. ICICI Prudential Manufacturing Fund

The ICICI Prudential Manufacturing Fund established in 2018 has been a consistent performer delivering 29.35% annualized returns in the last 5 years, showcasing its outperformance in both category and benchmark index. Mr. Anish Tawakley renowned for expertise in sector-specific funds has been managing since its inception expertly using his 26+ years of experience. Additionally, it offers minimum investments at just Rs.500 making it accessible to a large no. of investors.

Let’s see the data to track the performance with more clarity:

Well if you had started a SIP in it with Rs.3000 since its start, the total investment spent will be Rs.2,13,000 and you would have made Rs.5,25,588 in today's date.

Initially, you can start an early SIP in this stock at only Rs.500 and make your chance to build wealth.

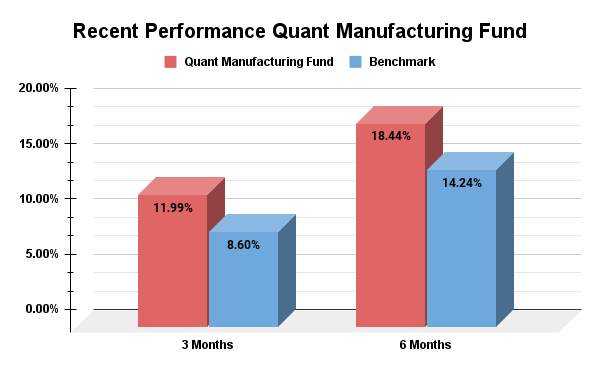

4. Quant Manufacturing Fund

After the launch of Quant Manufacturing Fund on 14th August 2023, we have seen an amazing performance making 11.99% returns in just 3 months. Expertly managed by Mr. Sandeep Tandon using predictive analysis and VLRT model to help him time the market effectively, which has led to the consistent performance of Quant's Schemes. If you don't want to lose this excellent opportunity to expand your portfolio, the starting amount of SIP is just Rs.1000.

See the below graph to study the returns made by this stock:

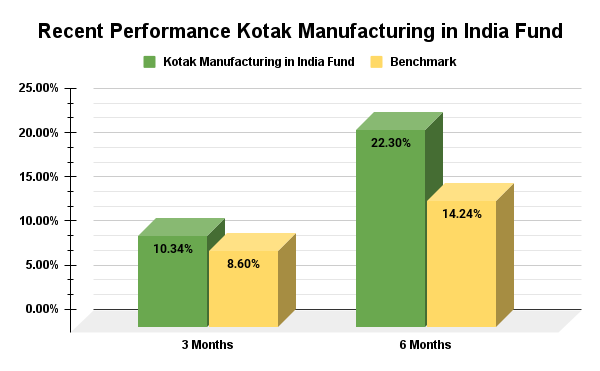

5. Kotak Manufacturing in India Fund

Lastly, we have Kotak Manufacturing in India Fund which was launched 2 years back while making 43.4% returns in 1 year, it has successfully beaten its benchmark of 34.51% as it prioritizes finding strong operational companies which gives it stable revenues and profitability.

Let's see if you started a SIP of Rs.3000 since its launch you would have spent Rs93,000 and made it worth Rs.1, 36,494 as of today.

So why wait when you can easily start your investments at just Rs.100, which makes it affordable to a wide range of investors.

Now refer to the below graph to check the data yourself:

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Why SIP is the Best Investment Option?

The following points give strong reasons to prove SIP in Mutual Funds is the best way to invest:

-

Discipline in Saving

SIP helps you save money regularly by investing a fixed amount each month, turning saving into a habit.

-

You can Start Small

You can begin investing with just INR 500 a month, making SIPs accessible even with lower earnings or savings.

-

No Need to Time the Market

SIP takes away the stress of trying to time the market. When prices are high, you buy fewer shares; when prices are low, you buy more, balancing out over time.

-

Power of Compounding

Returns from SIPs are reinvested, leading to growth due to the compounding effect over time.

-

Flexibility to Stop Anytime

You can stop SIPs without penalties. Just opt out through your Demat account, unlike FD and RD.

-

Skip When Needed

If funds are tight, you can skip a month without any charges and continue investing when you can.

-

Invest More with Extra Income

If you earn more, you can start additional SIPs in different mutual funds to diversify your investments.

-

Keep Emotions Out

SIP encourages disciplined investing, helping you avoid making impulsive decisions based on market fluctuations.

Final Note- Who Should Invest in Manufacturing Funds?

This is your only chance to act differently from the regular crowd. If you are looking for a unique opportunity, seems like you found one. This scheme will score good returns in the long run so keep a minimum investment horizon of 5-7 years via SIP. These funds are smartly filtered on every parameter and are best suited for investors looking to create diverse portfolios in the manufacturing sectors rather than going with regular equity categories.

Read a Detailed Analysis of Each Scheme by an Expert.

1. ABSL Manufacturing Equity Fund: 46% Annualized SIP Returns

2. Quant Manufacturing Fund: Comprehensive Review and Analysis 2024

3. Axis India Manufacturing Fund: What Experts Say About It?

.webp&w=3840&q=75)

.webp&w=3840&q=75)

_(1).webp&w=3840&q=75)