Table of Contents

- What is ARN?

- What is an ARN Number in a Mutual Fund and Why is It Required?

- Benefits of an ARN in Mutual Funds

- Who Can Apply for an ARN Number?

- How to Apply for an ARN Code in Mutual Funds?

- How to Check If a Mutual Fund Distributor's ARN is Valid?

- Difference Between ARN and EUIN

- How Can You Renew Your ARN Code?

- Conclusion

Imagine investing in a mutual fund while trusting your distributor, who is a scammer and is only aiming to earn money for himself, not for you. Scary, right? But that is precisely how many investors end up in the wrong schemes and get tricked. Well, here is the good part, you are not helpless in this situation and do not need to be an expert. All you need is to understand one small but powerful code called ARN in Mutual Fund.

Now the question is "What is ARN and why is it crucial for a safe mutual fund investment?" An ARN is an AMFI Registration Number that tells you whether a distributor is genuinely certified, regulated and traceable in the system. It is basically a distributor's licence to sell mutual funds.

In this post, you will explore every detail about the ARN in a mutual fund and will know how checking this one number can make your mutual fund investing far safer and more transparent. So, let us dive in.

What is ARN?

ARN is the AMFI Registration Number, also referred to as Application Reference Number. It is a unique number or code that is assigned to a mutual fund distributor in India. It is issued by the AMFI (Association of Mutual Funds in India) and is only given to the distributors who have cleared the specified certification exam and met regulatory requirements. This number is proof that the distributor or agent is qualified, authorised and regulated to sell mutual funds.

Why is ARN important?

An ARN in mutual funds ensures that the distributor who is selling or giving advice on the mutual fund products is certified and has undergone the necessary training to assure investors that they are dealing with a professional and that there is no fraud. Every transaction of the fund includes the distributor's ARN, which helps regulators and fund companies keep track of all activities and investors can also check if their distributor is for real. Therefore, ARN is essential for maintaining a trustworthy and professional mutual fund market ecosystem.

Now, let us understand why ARN is required in mutual funds.

What is an ARN Number in a Mutual Fund and Why is It Required?

In mutual funds, an ARN number or code is a unique and mandatory ID issued by AMFI to certified individuals or other entities (like banks or platforms) and declares them as qualified mutual fund distributors. It is an alphanumeric code provided to the agent who has met the necessary regulatory requirements, like passing the NISM (National Institute of Securities Markets) exam and registration with AMFI.

This system connects every mutual fund transaction to the registered intermediary, allowing for the tracking of commissions, trail fees and compliance. It serves as a license to operate within the Indian mutual fund industry.

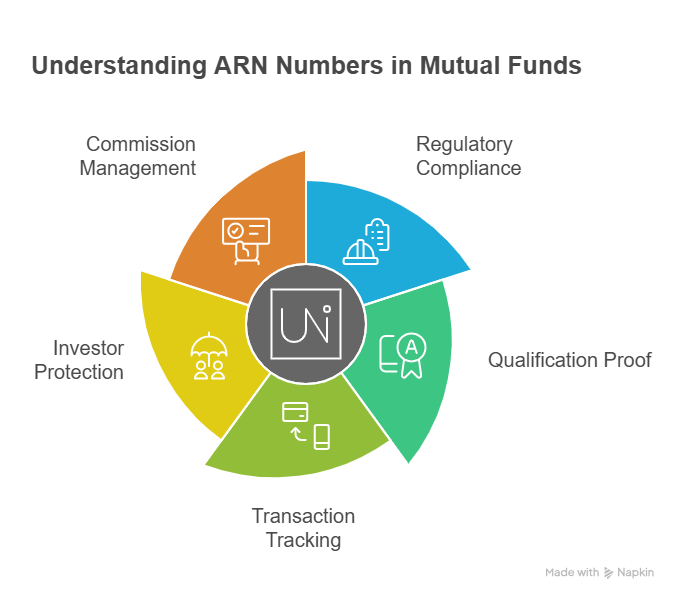

These numbers are required for several reasons, like regulatory compliance, qualification proof, tracking transactions of mutual funds via SIP or a lump sum and investor protection. AMC also uses it for tracking sales generated by specific distributors for efficient commission management.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Next, let us know the primary benefits of an ARN number.

Benefits of an ARN in Mutual Funds

Here are the primary benefits of an ARN in mutual fund investments for different profiles:

Benefits for Mutual Fund Distributors

- For a distributor, an ARN number is a mandatory license that makes them a legal and professional mutual fund distributor in India.

- To earn legitimate commissions, a distributor needs to have an active ARN to receive payments and ongoing fees from AMCs.

- The ARN makes it easier to track sales, AUM and commission data and helps distributors manage their business effectively.

Benefits for Investors

- Investors can get assurance that the distributor they are entrusting their money to is a certified professional and not a fraud.

- If an investor has a complaint or problem, they can quickly find the right negotiator by using the ARN, making it easy to resolve issues.

- Investors can check the status of their distributor online and learn about the channels used for their investments and see how it is handled.

Benefits for Regulators and the Industry

- The ARN system provides a structured framework to regulators like SEBI and AMFI to monitor distributors' activities.

- It creates a clear system that identifies who is responsible for each mutual fund transaction and ensures compliance rules are followed.

- Regulators and industries use combined ARN data to analyse the market, create policies and ensure fair practices in the mutual fund industry.

Must Read: Best Mutual Funds to Invest in 2025: Low-Risk Options for High Return

In the next heading, let us learn who can apply for an ARN code.

Who Can Apply for an ARN Number?

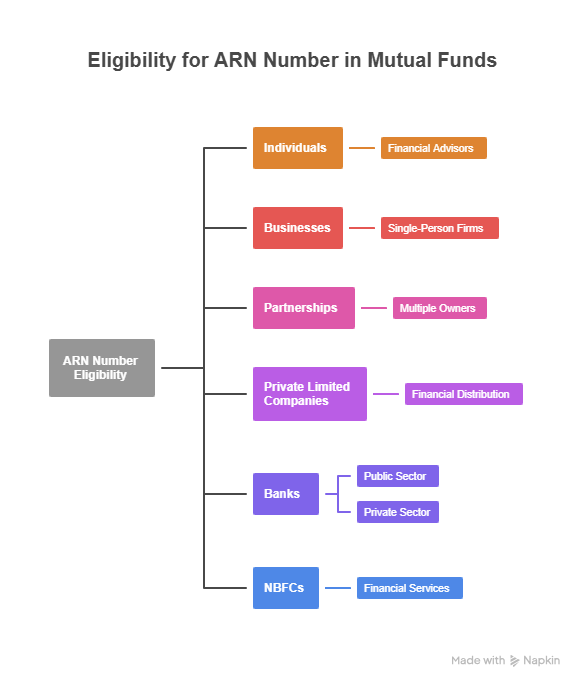

The following individuals & entities can apply for an ARN in mutual funds if they meet the educational and regulatory requirements:

- Individual or independent financial advisors who wish to sell mutual fund products.

- Businesses or firms owned and run by a single person.

- Partnership firms that two or more individuals own.

- Private limited companies that offer financial distribution services.

- Both public and private sector banks that offer mutual fund products can get an ARN.

- NBFCs (Non-Banking Financial Companies), which offer various financial services, can also apply.

- LLPs or Limited Liability Partnerships that blend features of both partnerships and corporate structures.

- FinTech companies or online platforms that offer online mutual fund transactions.

Now, let us learn how to apply for an ARN code in mutual funds.

Start Your SIP TodayLet your money work for you with the best SIP plans.

How to Apply for an ARN Code in Mutual Funds?

Here is the description of everything that is required for an ARN in mutual funds, along with the process to apply:

Mandatory Requirements for ARN

- You need to pass the NISM (National Institute of Securities Markets) Series V-A: Mutual Fund Distributors Exam. Your certificate is valid for 3 years.

- You need to have a completed KYC with current details with a SEBI-registered KRA (KYC Registration Agency).

Documents Required to Apply for an ARN

- Valid NISM Certificate

- Proof of Identity (PAN Card or Aadhaar Card)

- Proof of Address

- Passport-sized photograph

- Bank account details (Cancelled Cheque)

Detailed Application Process

Follow these steps to apply for your ARN in mutual funds:

- Step 1: Go to the official CAMS (Computer Age Management Services) portal and create your account.

- Step 2: Fill out the application & upload the necessary documents.

- Step 3: Pay the application fee & apply for an ARN.

- Step 4: Go to the selected POS (Point of Service) and complete your biometric verification.

- Step 5: Wait for the AMFI to issue your unique ARN code and associated identity card.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

Let us understand how to find an ARN number in a mutual fund in the next part.

Finding an ARN Number in a Mutual Fund

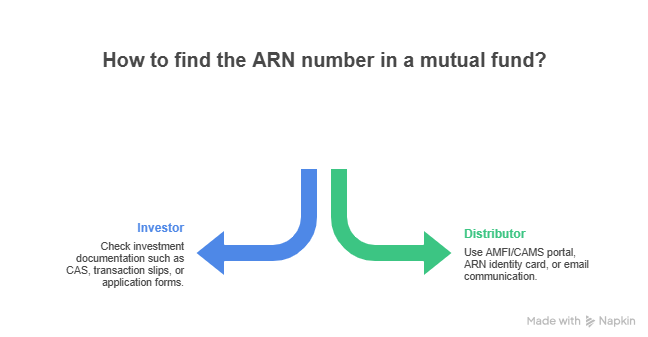

You can check out a few specific places to find an ARN in mutual funds, based on your profile:

For Investors (Verifying a Distributor)

If you are an investor who has transacted through a distributor, the ARN should be available on your investment documentation:

- Consolidated Account Statement (CAS): Your CAS from CAMS or KFintech will show the ARN of your transaction's distributor.

- Transaction Confirmation Slips/Emails: The confirmation slip you receive after investing will have the distributor's ARN.

- Application Forms: The application form you filled out when first investing will have a designated field with the distributor's ARN.

For Distributors (Retrieving Your Own ARN)

If you are a certified distributor who has forgotten or misplaced your ARN:

- AMFI/CAMS Portal: You will get your ARN on the official AMFI website or CAMS ARN portal where you registered yourself.

- ARN Identity Card: Your physical or digital ARN identity card issued by AMFI will have the number printed on it.

- Email Communication: The initial approval email from AMFI or CAMS confirming your registration will contain the ARN code.

In the next section, you will understand how to check whether your distributor's ARN is valid.

How to Check If a Mutual Fund Distributor's ARN is Valid?

The following is the process to check the validity of your mutual fund distributor's ARN:

Step 1: Collect the distributor information from the official AMFI website.

Step 2: Look for a verification tool or a search utility.

Step 3: Enter the distributor's ARN on the tool.

Step 4: If the distributor's ARN is valid, the portal will show the registration details linked to the ARN. You will see the following information:

- The name of the individual who holds the ARN.

- ARN status, which should show as Active or Valid.

- The expiration date of the registration or ARN.

Also Read: Top 10 Mutual Funds for SIP in 2025: Best Picks to Grow Wealth

Now, let us learn what the difference is between an ARN and an EUIN.

Difference Between ARN and EUIN

Here is the detailed comparison between an ARN and an EUIN in mutual funds:

| Aspect | ARN | EUIN |

|---|---|---|

| Issued To | Distributors, brokers, firms (e.g., banks, platforms) | Individual employees, relationship managers, sales staff |

| Purpose | Authorizes entity to sell mutual funds; tracks firm-level transactions and commissions | Tracks a specific advisor for accountability, mis-selling prevention; remains with the individual across employers |

| Issuance | After the NISM Series V-A exam for entities | After the NISM exam for individuals, auto-issued with ARN for sole proprietors |

| Validity | 3 years, renewable via CPE | Permanent, linked to PAN; re-mapped on job change |

| Requirement | Mandatory on all transactions for distributor legitimacy | Mandatory if specific employee advises; optional ("YES" if execution only) |

Next, let us explore the renewal process of an ARN number.

How Can You Renew Your ARN Code?

The ARN must be renewed every three years before it expires. For this, you need the NISM Certification/CPE (Continuing Professional Education) course, active KYC and Aadhaar linkage. Here is the detailed renewal process of the ARN:

- Step 1: Go to the official AMFI website and log in.

- Step 2: Verify NISM status (the system automatically checks it).

- Step 3: If required, upload a passport-sized photo.

- Step 4: Pay the renewal fee (approx Rs 1,770 for individuals, including GST).

- Step 5: Confirm the renewal of your ARN number.

You can manage the renewal process and check your status through the AMFI Distributor Corner portal anytime.

Pro Tip: Use a SWP Calculator to plan for your regular mutual fund unit withdrawals.

Smart Investments, Bigger Returns

Conclusion

To wrap up, an ARN in mutual funds is a crucial concept in the mutual fund world. It shows if a distributor is truly qualified, keeps regulators updated and helps track every commission payment.

By understanding ARN and how it is different from EUIN, you are not just following a rule, you are protecting your money and making better investment decisions for your future wealth creation.

Related Blogs:

1. Tax on Mutual Funds: Complete Guide with Smart Saving Plans

2. What is Risk in Mutual Fund and Its Types?

3. Top 5 Mutual Funds for Lumpsum Investment 2026: Expert Picks

FAQs

-

How does ARN prevent fraud in mutual funds?

It blocks unauthorised sellers and traces commissions accurately, protecting investors from scams.

-

Is ARN mandatory for all mutual fund investments?

Yes, SEBI rules require a valid ARN on every transaction unless it is direct (execution-only) or the applications get rejected.

-

What happens if ARN is missing or invalid on a mutual fund form?

Transactions are rejected or treated as direct plans without commissions, protecting investors from unregulated advice.

-

How long is an ARN valid, and what if it expires?

ARNs are valid for 3 years and require renewal via CPE (Continuing Professional Education) credits and fees.

-

Can investors buy mutual funds without an ARN?

You can invest directly through an AMC or online platforms to save on costs by avoiding distributors, but without personalised advice.