Table of Contents

- Axis Services Opportunities Fund NFO Basic Details

- Causes of Growth for Axis Services Opportunities Fund

- What is the Axis Services Opportunities Fund Strategy?

- Why Invest in Axis Services Opportunities Fund NFO?

- Who Should Invest in Axis Services Opportunities Fund NFO 2025?

- To Conclude Axis Services Opportunities Fund Review

Introducing you to the newly launched Axis Services Opportunities Fund, a thematic category fund that is built on the motto, "Sectors that serve your growth, now ready to serve your portfolio."

This latest NFO by the Axis Mutual Fund, which has started its subscription from 4th July, will soon close on 18th July 2025.

However, if you find yourself asking, "Is it good to invest in opportunities fund?"

Well, the answer is quite simple: the services sector makes up to 53% of the Nifty 500 Index, including banks, IT, finance and power generation, making this new arrival the best NFO 2025 to satisfy your long-term financial goals.

Now, without further delay, let's start the Axis Services Opportunities Fund Review by covering its key details.

Axis Services Opportunities Fund NFO Basic Details

The table below covers the key information on the newly launched Axis Services Opportunities Fund NFO 2025:

| Scheme Name | Axis Services Opportunities Fund NFO |

|---|---|

| Issue Open Date | 4th July 2025 |

| Issue Close Date | 18th July 2025 |

| Category | Equity: Thematic Fund |

| Benchmark | Nifty Services Sector TRI |

| Minimum Application Amount | Rs.100 |

| Fund Managers | Mr. Sachin Relekar & Mr. Shreyash Devalkar |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

| Facilities Offered | Lumpsum/SIP/SWP |

When in doubt, Mutual Funds are a wise route.

Causes of Growth for Axis Services Opportunities Fund

The two major mega value contributors that have supported the services industry to flourish are:

- Formalization

- Technology

Now, you might be thinking, how? Well, formalization gave a major shift from being unorganised to organised. With GST being implemented, the revenue collection became organized, gaining huge market share through scale advantages.

Next, technology helped the services to increase productivity and increase the profitability of businesses. For example, platforms like e-commerce, OTT media have helped to grow the tech innovation in providing you with fast and right services.

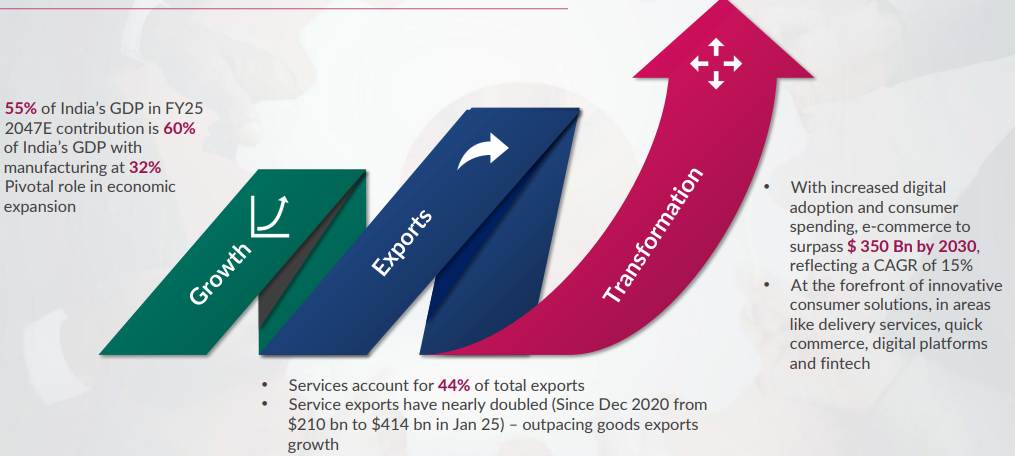

You see from the above picture that the services sector went through three phases, growth, exports and transformation.

In this, 55% of India's GDP in FY25, where economic expansion played a major part. Alongside, services account for 44% of total exports and have doubles since Dec 2020 from $210 bn to $414 bn in Jan 25.

Start Your SIP TodayLet your money work for you with the best SIP plans.

What is the Axis Services Opportunities Fund Strategy?

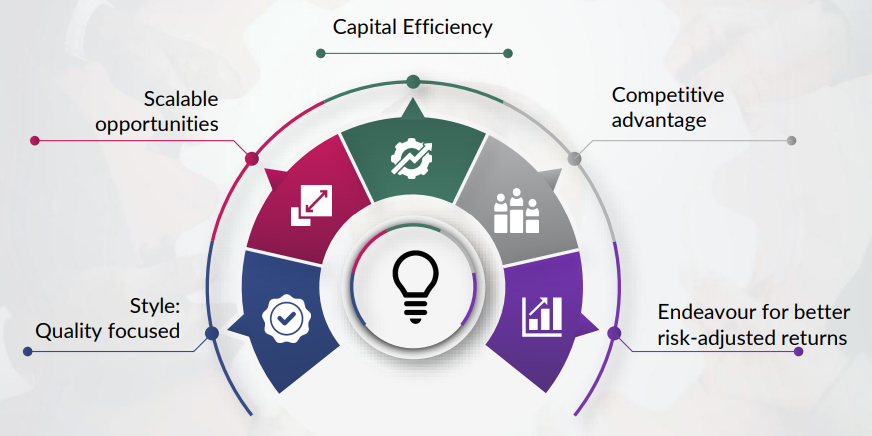

This newly launched NFO by Axis Mutual Fund has applied an innovative approach, where the management of the Axis Services Opportunities Fund is concerned, using a large universe flexicap approach. It means, instead of keeping the portfolio concentrated towards a particular market cap, this latest NFO will diversify money into large, mid and small caps without any fixed allocation.

Moreover, it will use a bottom-up approach while picking quality stocks to derive scalable investment opportunities that will give high returns in the long term.

Let’s move to the next heading, addressing the important question, “Is it Good to Invest in Axis Services Opportunities Fund NFO now?”

Why Invest in Axis Services Opportunities Fund NFO?

The following are some compelling reasons that make investing in the newly launched Axis Services Opportunities Fund NFO a perfect fit for 2025:

-

Higher Profitability Growth

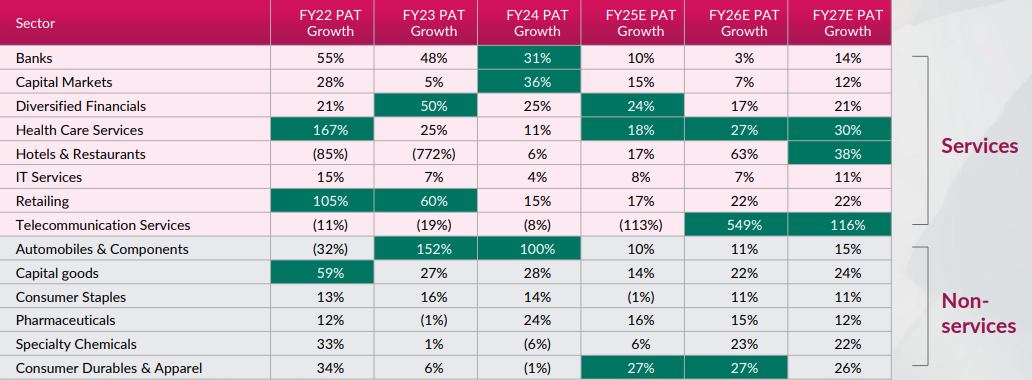

The 2 of the top 3 sectors of PAT growth are services contributing to the higher profitability growth of the services sector.

You can look down at the table below which shows sectors showing growth along with their growth percentage:

-

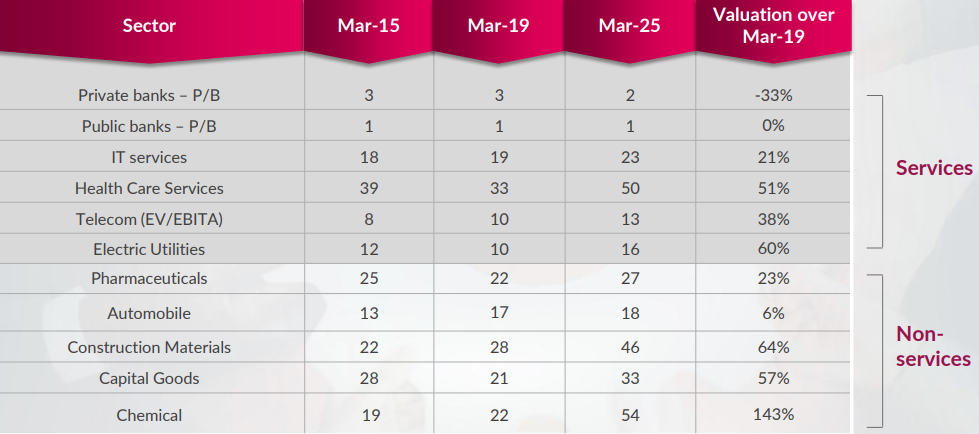

Better Placed Valuation

The service sector valuation over 2019 is lower compared to non-services, where the major contributors were the electric utilities at 60%, telecom services at 38% and health care services at 51%.

You can see the valuations over time of these sectors in the table given below:

-

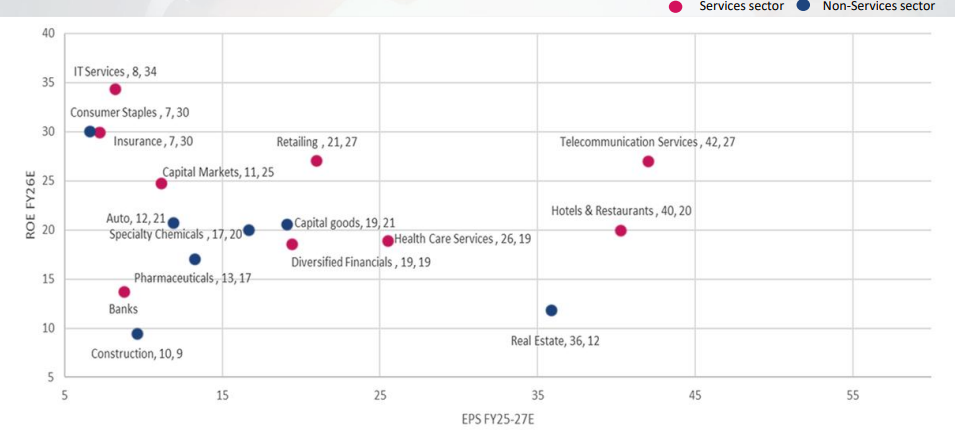

Higher Earnings with High ROE

It’s not just the profitability but also higher earnings that will drive services funds to a whole another level.

The pink dot in the below chart shows the services sectors along with the high return on investment ratio:

-

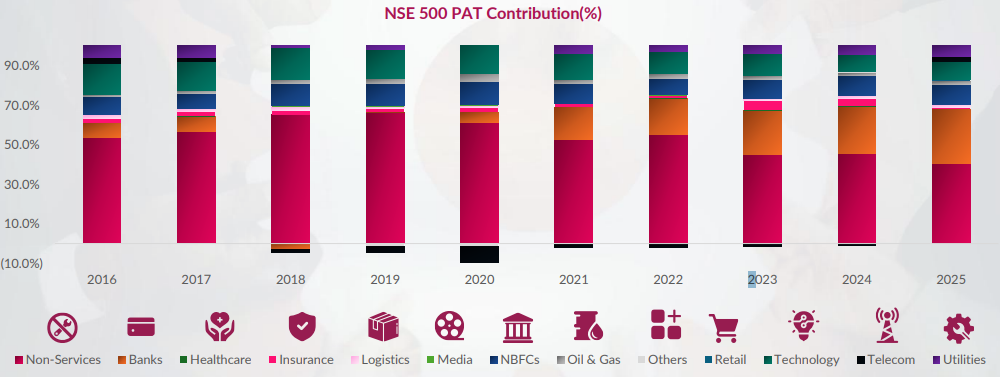

Shift in Profit Dynamics

The services are on the rise with a shift in profit dynamics driven by a broadening sector and their improved profitability, especially in telecom, quick commerce, hospitals, logistics and banks.

See for yourself in the graph given below:

Who Should Invest in Axis Services Opportunities Fund NFO 2025?

This new fund offer by the Axis Mutual Fund is best suited for the following type of investors:

- Long-term growth seekers (5+ years) who want to ride structural tailwinds in India’s formalising, tech-enabled services economy and can stay through full market cycles.

- Thematic satellite allocators already holding a diversified core equity portfolio but wanting up to more than 10 % in a focused services bet for return-enhancement.

- Moderate-to-high risk-tolerance investors comfortable with mid-/small-cap volatility and style concentration in a single sector basket.

- SIP investors with patience who prefer staggered entry to smooth NFO-period flows and valuation swings.

- Tax-efficient equity seekers needing an ELSS-like holding period (three years plus) to benefit from long-term capital-gains treatment but without the lock-in.

To Conclude Axis Services Opportunities Fund Review

To wrap up the Axis Services Opportunities Fund Review, it is a fresh chance to invest in the backbone of India’s economy's services sector. From banks and telecom to hospitals and logistics, these are the businesses you rely on every day, and they are only getting stronger.

If you are looking to grow your money over the long term and want to be part of India’s changing economy, this newly launched NFO could be a smart start.

But here is a fund fact, "You don’t need to invest a big amount, even a small SIP can help you benefit from this growing sector." Think of it as investing in the everyday services that keep India moving forward.

.webp&w=3840&q=75)