Table of Contents

- Understanding BSE and NSE

- What is the Difference Between BSE and NSE?

- Which is Better for Beginners: BSE or NSE?

- How to Invest in BSE for Beginners?

- How to Invest in NSE for Beginners?

- Factors to Consider for Beginners Before Investing in NSE or BSE

- Which is More Reliable, BSE or NSE?

- Similarities Between BSE and NSE

- How to Decide Whether to Invest in NSE or BSE?

- Why Do Traders Prefer NSE Over BSE?

- What is the Difference Between Sensex and Nifty Options Trading?

- Conclusion

The first doubt that comes to mind when starting with the stock market is, "BSE or NSE, which is better for beginners?", right? While both stock exchanges are SEBI-regulated and reliable, BSE may be better for beginners because of its diverse stock list and stability in the market.

As Asia's oldest stock exchange, the BSE (Bombay Stock Exchange) has lower trading volume and liquidity, making it popular Mutual Funds beginners.

But the active traders are more into the NSE (National Stock Exchange) due to its advanced electronic trading system and high liquidity.

Let us dive deep to know which is better for long term, NSE or BSE, for your wealth creation.

Understanding BSE and NSE

The BSE and NSE are two of the largest stock exchanges in India. Both stock exchanges are headquartered in Mumbai, India. Let’s learn about them in detail:

-

BSE (Bombay Stock Exchange)

Established in 1875, BSE is the oldest stock exchange in Asia and the sixth largest in the world, with a total market capitalization exceeding Rs 500,000 crores as of May 2024. “Did you know there are over 6000 companies listed under the BSE offering diverse financial products?”

Sensex is the benchmark index of BSE and was introduced in 1986. It consists of 30 companies that are distributed across more than 10 sectors of trading. BSE also has other index dominances, which are BSE 100, BSE 200, BSE 500, BSE MIDCAP, BSE SMLCAP, BSE PSU, BSE Auto, BSE Pharma, BSE FMCG and BSE Metal.

-

NSE (National Stock Exchange)

Established in 1992, NSE is popular for its advanced electronic trading system. It is the fifth-largest stock exchange in the world, with a market capitalization also exceeding Rs 500,000 crores as of May 2024. There are around 1600 companies listed under the NSE. NSE offers various products including equities, derivatives, debt and ETFs.

The benchmark index of the NSE is Nifty 50. It involves the top 50 large-cap companies. The other indices of NSE involve Nifty 100, Nifty Next 50, Nifty Midcap 50, Nifty Small Cap 250 and India Vix index.

What is the Difference Between BSE and NSE?

There are two major trading platforms in India, BSE and NSE, both used for trading stocks and other securities. But they differ in many ways.

Let us look at the detailed comparison between BSE and NSE:

| Features | BSE | NSE |

|---|---|---|

| Established | 1875 | 1992 |

| Location | Mumbai | Mumbai |

| Benchmark Index | Sensex 30 | Nifty 50 |

| Listed Companies | Over 5000 | Around 1600 |

| Market Capitalization | Over Rs.500,000 crores (May 2024) | Over Rs.500,000 crores (May 2024) |

| Trading Volume & Liquidity | Lower | Higher |

| Technology | BOLT (BSE Online Trading) | Advanced electronic trading since inception. |

| Global Ranking | 6th largest (by market cap) | 5th largest (by market cap) |

| Products Traded | Equities, derivatives, mutual funds and bonds. | Equities, derivatives, debt, ETFs, etc. |

| Trading Network | Around 450 cities | Over 1,500 cities |

| Trading Hours | 9:15 AM to 3:30 PM | 9:15 AM to 3:30 PM |

| Settlement Cycle | T+1 | T+1 |

| Regulator | SEBI | SEBI |

| Investor Base | A broader investor base, including long-term investors and smaller companies. | More active traders and institutional investors. |

Well, scratching your heads while thinking, “Which is better for beginners, BSE or NSE?” will do you little, so let’s get you some answers in the next heading.

Which is Better for Beginners: BSE or NSE?

As a beginner, choosing one stock exchange can be a hard decision to make. However, both are reliable, having differences that can impact your early trading experience.

For beginners, the Bombay Stock Exchange (BSE) is considered a more suitable option than the NSE as it has a higher risk level.

Here are the reasons to determine "Why BSE is better than NSE for beginners":

- Exposure to Various Sectors: BSE offers a wide range of listed companies, including many rising companies in mid and small cap stocks. It provides beginners with various investment options to select from.

- Lower Volatility: BSE has low trading volumes, which means it is less volatile than NSE. This makes navigation easier for new investors.

- Less Experienced: NSE is better for investors with some experience due to its advanced technology and high liquidity. BSE has lower liquidity, lowering the associated risk level.

- SEBI Regulated: Both stock exchanges are regulated by the SEBI. They have similar trading hours and offer secure, user-friendly online platforms.

If you are a beginner, the BSE with its big stock list and steadier market might be easier to get into mutual funds. Once you gain more experience and want to trade more actively, you can always switch to the NSE.

On that note, let’s get you started on, “Step-by-step guide on starting your investments via BSE.”

How to Invest in BSE for Beginners?

The following is a beginner-friendly guide for investing through BSE (Bombay Stock Exchange):

- Step 1: Select a SEBI-regulated broker or an online trading platform that provides access to the BSE.

- Step 2: Open an account for trading by completing the KYC. You can link it to your bank account for an easy transaction.

- Step 3: Add funds to your account and start trading.

- Step 4: Research about the stocks and consider investing in Best Mutual Funds when you are a beginner.

- Step 5: Set your investment budget and decide on an amount. Consider diversifying across various sectors to avoid risks.

- Step 6: Place an order to buy the desired stock at the market price.

- Step 7: After trading, regularly monitor your investment.

Know your future returns using the SIP Calculator in 3 easy steps.

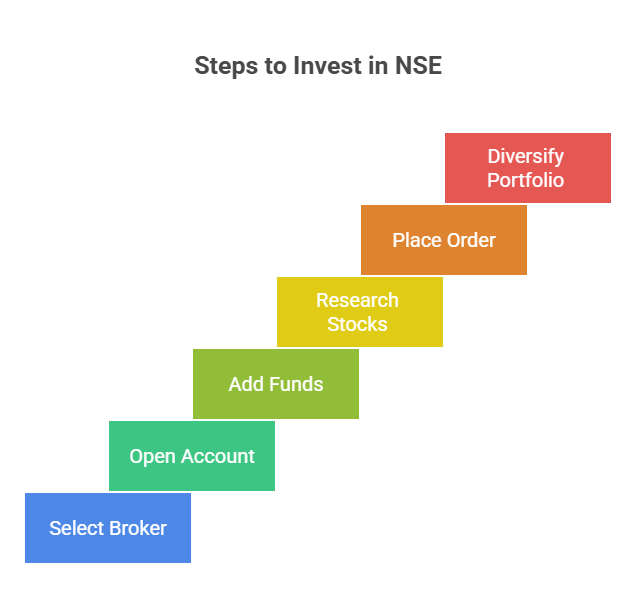

How to Invest in NSE for Beginners?

Here are the 6 simple steps that will help you kick-start your investments through NSE:

- Step 1: Select a SEBI regulated broker or an online trading platform that provides access to the NSE.

- Step 2: Open an account for trading by completing the KYC. You can link it to your bank account for an easy transaction.

- Step 3: Add funds to your account and start trading.

- Step 4: Research the stocks and start with well-known and stable companies.

- Step 5: Place an order to buy a desired stock at the market price.

- Step 6: Diversify across different areas to avoid risks and focus on long-term wealth creation.

Get a chance to create your own screen using the Mutual Fund Screener to get the top picks.

Factors to Consider for Beginners Before Investing in NSE or BSE

Listed below are the factors that you should consider as a beginner before investing in the stock exchanges:

- The trading volume and liquidity of the stock exchange and their impact.

- Companies that are listed on the exchange for stock selection.

- The technology used for trading and the trading experience.

- Your investment goals and risk tolerance.

- The reaction of stock exchanges to market volatility.

- Picking a reliable broker or an online trading platform.

- Distributing your investment across various sectors to avoid risks.

- Preparation for changing market and sticking to the investment plan.

- Dedication to continuous learning and research.

- Understanding the tax implications of your investments.

Now, you must be wondering, which option is more reliable for you according to your financial situation, right? Let us dive into the reliability factor of the exchanges.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Which is More Reliable, BSE or NSE?

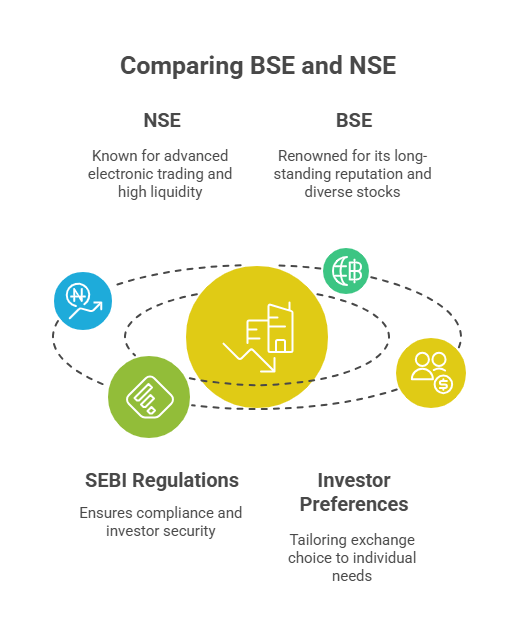

Both stock exchanges are regulated platforms and are highly reliable and secure for trading in the Indian market. However, for active users, NSE is considered more reliable and BSE is good for long-term investors.

BSE is more suitable for conservative investors who like to sit back and watch their investments grow over time, which makes it reliable for beginners. While NSE has better software for high-risk online transactions, making it suitable for seasoned investors who can take risks.

NSE is famous for its advanced electronic trading system, providing high liquidity, increased speed, minimum downtime and robust risk management systems. BSE is the oldest exchange in Asia, carrying a long-standing reputation and trust among investors. It offers a diverse range of stocks for investing and has a trading system called BOLT. But the trading volume and liquidity are lower than those of the NSE.

The SEBI regulations that are applied on both stock exchanges are used to confirm compliance with financial rules, transparency and investor security. Picking the right exchange platform depends on the trading style, investment goals and preferred companies of an individual.

Similarities Between BSE and NSE

There are many similarities between NSE and BSE, ensuring a secure and effective investing environment for the investors.

The key similarities are:

| Similarity | Description |

|---|---|

| Regulatory | Both are SEBI-regulated, ensuring honest trading practices and investor safety. |

| Listing and Trading | Companies can list shares and trade on both stock exchanges. |

| Financial Instruments | Both offer investment options in equities, derivatives, debts, ETFs and mutual funds. |

| Technology | Both use advanced electronic trading platforms for efficiency & transparency in transactions. |

| Trading Hours | Both work from 9:15 AM- 3:30 PM, Monday to Friday. |

| Popularity | Both are widely known, trusted & used by many investors across India. |

After understanding the basics, the question arises,” How do I decide in which exchange I should invest?”. Well, let us know how.

How to Decide Whether to Invest in NSE or BSE?

If you want to invest in the Indian stock market, there are two primary options: BSE and NSE. Each offers a wide range of securities to fulfil various trading styles and investment strategies.

But choosing one from both of them can be a little confusing.

Here are the factors to look at when choosing between BSE and NSE:

-

Trading Volume and Liquidity

NSE has higher trading volume and liquidity, so it is easy and fast to buy and sell securities. However, BSE has lower trading volume and liquidity as it has more listed companies.

-

Stock Selection

BSE has over 5000 listed companies ( mostly mid and small cap stocks) and NSE has over 2000 listed companies( focus on large cap stocks).

-

Investment Style

NSE is a preferred choice for active traders due to its fast execution and high liquidity. BSE is a popular choice among investors with a long-term horizon due to its wide range of stocks.

-

Product Offerings

Both stock exchanges offer products in equities, debts, derivatives and ETFs, but NSE rules in derivatives and options trading.

-

Technology and Efficiency

NSE has an advanced and fully electronic trading system for efficient trading and BSE has also upgraded its trading system with BOLT( BSE Online Trading).

-

Index Preference

For the investors who follow the Nifty 50 index, they can choose NSE and investors who follow the Sensex should go with BSE.

-

Trading Fees

Transaction cost is the same for both stock exchanges, but the bid-ask spread is a little lower for NSE. The fees of the broker depend on who you are picking and your trading plan.

Now that we get what makes these markets trustworthy, let us look at why most traders usually pick the NSE for their daily trades.

Why Do Traders Prefer NSE Over BSE?

The main reasons that investors prefer the National Stock Exchange (NSE) over the Bombay Stock Exchange (BSE) are the higher liquidity, quick trade execution and command in derivatives of NSE.

NSE consistently delivers much higher trading volumes than BSE, which allows traders to buy and sell shares fast with minimum impact on price and low bid-ask spreads.

The advanced electronic trading infrastructure of NSE allows faster and reliable execution of orders. It is crucial for traders who need to react quickly to market movements. NSE also holds a good position in the derivatives market of India, offering more opportunities and better pricing for traders.

This understanding brings us to an important point: the differences between trading options on the BSE and NSE's main indexes. Let us look at how trading Sensex options stacks up against trading Nifty options.

What is the Difference Between Sensex and Nifty Options Trading?

The Sensex and Nifty are the benchmark indices of BSE and NSE, respectively. Let us look at the comparison between the Sensex and the Nifty options trading:

| Aspect | Sensex Options Trading | Nifty Options Trading |

|---|---|---|

| Underlying Index | SENSEX (top 30 companies) | NIFTY 50 (top 50 companies) |

| Exchange | BSE | NSE |

| No. of Stocks | 30 stocks | 50 stocks |

| Liquidity & Volume | Lower | Higher |

| Popularity | Less popular among traders. | Most popular options contracts in India. |

| Volatility | It can be more volatile due to fewer stocks. | Slightly less volatile due to broader diversification. |

| Contract Specifications | May differ in lot size, tick value, and expiry dates. | Standardized, widely traded and tight spreads. |

| Market Participants | Attracts long-term investors. | Attracts active traders and institutions. |

| Regulatory | SEBI-regulated | SEBI-regulated |

Now that you know what makes each exchange alike, different and cool in its own way, you are in a good spot to pick the one that fits you best as you start investing and think about your goals.

Conclusion

To conclude, BSE or NSE, which is better for beginners, it is clear that BSE stands out as a more beginner-friendly exchange. With its broad stock selection, lower volatility and relatively stable market, it is an appropriate starting point for those who are new to the stock market.

Both exchanges are safe, reliable and SEBI-regulated, providing a secure trading environment to the investors. While BSE is better for new investors, NSE is highly suitable for experienced investors.

You can switch to NSE after gaining some experience from BSE, as you may find it more appropriate for active trading. However, you should consider your investment goals, risk tolerance and trading strategy to determine which stock exchange is most suited for you.

Also Read :

- Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

- What is Tax Planning: Objectives, Types & Importance

- What is Corpus Meaning in Finance Mutual Funds?

FAQs

-

What are NSE and BSE in The Stock Market?

NSE (National Stock Exchange) & BSE (Bombay Stock Exchange) are the two largest stock exchanges of India. They allow you to purchase and sell shares in companies.

-

How Has NSE Become More Popular Than BSE?

NSE has become more popular than BSE due to its high liquidity, faster trade execution and dominance in the derivatives.

-

Which exchange should investors transact in, NSE vs BSE?

Investors can transact on NSE for higher liquidity and fast execution. They can choose BSE for broader stock options and long-term investing.

-

Can I purchase stocks on BSE and sell them on NSE, or vice versa?

You can purchase stocks on BSE and sell on NSE or vice versa only after a T+1 day and not for intraday trades.

-

What are the primary stock indices for BSE and NSE?

The stock index for BSE is the Sensex 30 & the stock index for NSE is the Nifty 50. This index serves as a benchmark for the exchange.

-

When are the trading hours for NSE and BSE?

Both NSE & BSE stock exchanges have the same trading hours, that is, from 9:15 AM to 3:30 PM, Monday to Friday.

.webp&w=3840&q=75)