Table of Contents

- Overview of Crypto Tax in India 2026

- Crypto Tax Regulations in India: Latest 2026 Updates

- What are Cryptocurrencies in India?

- How Much Tax on Crypto in India is Charged?

- Do You Pay Tax When Buying or Selling Crypto in India?

- Which Crypto Transactions Are Liable to Tax?

- How to Calculate Crypto Taxes (With Examples)?

- Common Online Myths About Crypto Tax in India

- How to Avoid Crypto Tax in India 2026? Legal Truth

- Crypto Tax-Free Countries for Indians

- Crypto Tax Compliance Tips for 2026

- Conclusion

Did you know that Bitcoin, which started in 2009, just exceeded $100,000 and now it is worth more than some countries' GDPs? Yes, this is wild, but true and it has made many investors millionaires almost overnight. But, do you think they managed to keep all their earnings without any cuts? The answer is no; the profits from these cryptocurrencies are subject to crypto tax in India.

This means if you want to cash in your win in India, a flat tax of 30% plus a 1% TDS will take a large portion of your earnings under the 2026 VDA (Virtual Digital Asset) rules. And, this is not all.

Want to know more about the rules of crypto tax in India 2026? Then stick with this post as you are about to unpack each and every detail on these taxes. And there is a little surprise for you that will help you in lowering these taxes. So, do not skip.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Overview of Crypto Tax in India 2026

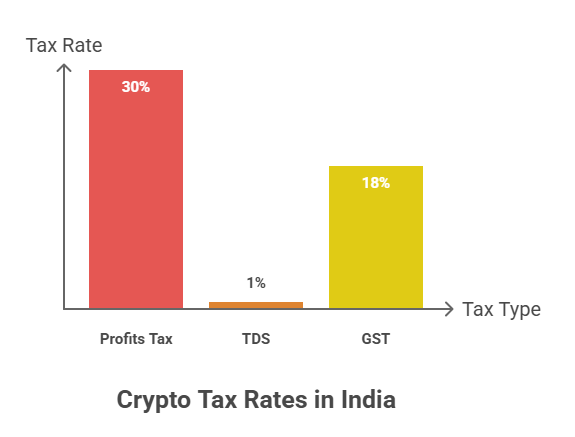

Crypto Tax Rules in India for 2026 treat VDAs (Virtual Digital Assets), like cryptocurrencies and NFTs (Non-Fungible Tokens), under a strict framework. There is a flat 30% tax on the profits of the VDAs with a 4% cess. The primary rules include a 1% TDS (Tax Deducted at Source) on every transfer of VDAs.

In Budget 2025, there were no major changes to these tax rates and the rules from earlier years remained the same while improving compliance.

Now, let us look at the latest guidelines on crypto tax in India.

Crypto Tax Regulations in India: Latest 2026 Updates

The primary VDA taxation remains unchanged under Section 115BBH and Section 194S of the Income Tax Act. The following are the main regulations for the 2026 crypto tax in India on VDAs:

- You cannot offset losses from Virtual Digital Asset transactions against gains from other VDAs, other income sources or carry them forward to future financial years.

- You can only deduct the cost of acquiring a virtual digital asset. You cannot claim expenses like mining costs, transaction fees or general trading expenses.

- Starting in the financial year 2025-2026, you must report all crypto transactions on a special section called "Schedule VDA" in your ITR forms to improve transparency and ensure compliance.

- For transactions on Indian exchanges, the exchange is responsible for TDS deduction, while for P2P or foreign transactions, the buyer is responsible.

Recent Updates and Enforcement

The following are the latest 2026 updates of the crypto tax rules:

- Starting April 1, 2026, the Income Tax Department will have more power during search & seizure operations. They can access digital records, such as emails, social media accounts and online trading platforms, to investigate serious tax evasion.

- India plans to adopt the OECD's CARF (Crypto-Asset Reporting Framework) by April 2027. This will allow automatic sharing of data on overseas crypto holdings and transactions.

- A GST of 18% applies to the service fees and commissions charged by crypto exchanges, but it does not apply to the VDA (Virtual Digital Asset) itself.

Pro Tip: Use a Tax Calculator to quickly estimate tax liability on your gains.

In the next part, let us learn what cryptocurrencies are.

Best Mutual Funds for 2026 Backed by Expert Research

What are Cryptocurrencies in India?

Cryptocurrencies in India can be defined as digital or virtual currencies. They use cryptography for security and operate on a technology called a blockchain, which acts like a public record that everyone can see and verify. They are decentralised because a central bank or the government does not issue them.

Here are the characteristics of cryptocurrency in India:

- They are purely digital assets and do not have a physical form (like coins or notes).

- They are decentralised as they are managed by a P2P (Peer-to-Peer) network and not by a single central authority.

- They use strong cryptographic techniques for security to check transactions and manage the creation of new units.

- It also uses blockchain technology, in which information is recorded in 'blocks'. These blocks are then linked together in a 'chain'.

- The identities of the entities involved in this chain are represented by pseudonyms (wallet addresses), not as personal information.

These are examples of cryptocurrencies:

- Bitcoin (BTC): It is the most famous cryptocurrency, which was the first to be created in 2009.

- Ethereum (ETH): It is known for its smart contract capabilities.

- Tether (USDT)/ USDC:These are stablecoins that are usually linked to a real-world asset, like the US Dollar, to help reduce volatility.

- Ripple (XRP): It focuses on enabling fast cross-border payments for financial institutions.

Cryptocurrencies can be used for:

- Payments for buying goods and services from vendors who accept them.

- It can be used as a holding for a long-term investment for growth.

- Trading for guessing how the prices will change on different exchanges.

- As financial services like lending, borrowing and earning interest in DeFi (Decentralised Finance).

- In India, cryptocurrencies are classified as VDAs (Virtual Digital Assets). Therefore, cryptocurrency tax in India is imposed using the same regulations as VDAs.

Must Read: Tax on Mutual Funds: Complete Guide with Smart Saving Plans

Next, let us know how much tax is charged on the crypto in India.

How Much Tax on Crypto in India is Charged?

The following are the impositions of tax on crypto trading in India:

Taxes on Profits

Gains or profits made from selling, trading or transferring crypto assets are taxed at a flat 30% rate with an applicable surcharge and a 4% cess, regardless of the holding period or your income tax slab rate.

Tax Deducted at Source (TDS)

A 1% TDS is applied to the total sale price for every crypto transaction above a specific amount (Rs 10,000 for non-specified individuals and Rs 50,000 for specified individuals in a financial year). This is an advance tax that you can claim as a credit when you file your ITR.

GST (Goods and Services Tax)

A crypto exchange charges an 18% GST on the service fees or commissions it collects. This tax does not apply to the value of the VDA, like cryptocurrency and NFTs, itself.

Let us understand if you need to pay tax on the purchase and sale of crypto in India.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Do You Pay Tax When Buying or Selling Crypto in India?

In India, you do not pay tax when buying cryptocurrency, but you need to pay tax on the profits you get from selling your crypto. Here is a breakdown of the tax implications when you buy versus when you sell:

When Buying Crypto in India

There is no income tax or capital gains tax simply for buying a VDA. However, you will need to pay an 18% GST on the service fees or commissions charged by the crypto exchange.

When Selling Crypto in India

The moment you sell your crypto for a profit, you get a 30% income tax liability on that gain and 1% of the total sale value is withheld as advance tax (TDS).

You will explore which type of crypto transactions are subject to taxation in India in the next section.

Which Crypto Transactions Are Liable to Tax?

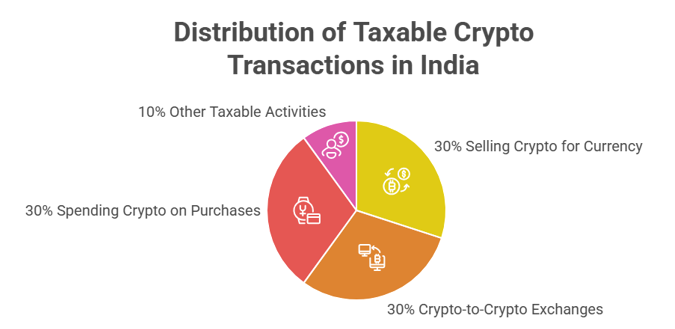

Here are the crypto transactions that are liable to taxation in India:

30% Flat Tax on Gains and 1% TDS Tax Liabilities

- Selling of crypto for Indian Rupees (INR) or any other standard currency.

- Exchanging of cryptocurrencies (crypto-to-crypto trades), including stablecoins.

- Spending your cryptocurrency to purchase goods or services.

Taxable Events Based on Income Tax Slab Rates

Specific activities that generate new crypto assets are taxed as income at your individual income tax slab rate upon receipt. It includes:

- Mining Rewards: You must pay taxes on the fair market value of mined coins when you receive them, treating them as business income.

- Staking Rewards: Earnings from staking are taxed as income from "other sources."

- Airdrops:When you receive airdropped tokens, you must pay taxes on their fair market value as income from other sources, but only if the total value of gifts you get from non-relatives exceeds Rs 50,000 in a year.

- Receiving a Salary in Cryptocurrency: This is also subject to taxation.

- Gifts of Crypto: If the value of gifts from non-relatives is over Rs 50,000 in a financial year, you must pay taxes. However, gifts from close relatives are not taxed.

Non-Taxable Events

- Buying crypto with INR or another currency (only 1% TDS is applied).

- Holding cryptocurrency in a wallet or exchange.

- Transferring crypto between your own personal wallets.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

Moving on, let us learn how to calculate crypto taxes in India.

How to Calculate Crypto Taxes (With Examples)?

For calculating your crypto taxes in India for 2026, first, you need to find out how much profit you make for each transaction. To calculate the profit, you need to subtract your selling price from the purchase price. After discovering your net profit, you will apply a flat 30% tax to it and then include the 1% TDS.

Let us look at the step-by-step calculations of your tax liability with examples for different scenarios:

Scene 1: Selling Crypto for INR (Profit)

Now imagine you bought Bitcoin (BTC) in May 2025 and sold it at a higher price later. The following will be your information-

- Date of Acquisition: May 1, 2025

- Cost of Acquisition: Rs 1,50,000 for 1 BTC

- Date of Transfer: December 1, 2025

- Sale Consideration: Rs 2,20,000 for 1 BTC

Now, to calculate your tax on this Bitcoin, follow the steps-

Step 1: Calculate the Gain or Profit

Profit = Sale Price - Purchase Price

i.e., Rs 2,20,000 - Rs 1,50,000 = Rs 70,000

So, your profit will be Rs 70,000

Step 2: Calculate the 30% Income Tax on Crypto

i.e., 30% of Rs 70,000 = Rs 21,000

Step 3: Apply 1% TDS

It is an advance tax paid on your behalf and would have been deducted by the exchange at the time of sale from the total sale value - Rs 2,20,000.

i.e., 1% of Rs 2,20,000 = Rs 2,200, already paid.

Step 4: Calculate the Tax Due (at filing time)

This is the tax you need to pay. The formula to calculate this tax is-

Total Tax Liability - TDS (already paid) = Net Tax Due

i.e., Rs 21,000 - Rs 2,200 = Rs 18,800

So, your total tax liability is Rs 18,800 + applicable surcharge and cess.

Scene 2: Selling Crypto at a Loss

You cannot use losses from crypto transactions to offset other income, and you cannot carry these losses forward to future years. Imagine the following situation:

- Cost of Acquisition: Rs 1,00,000 for Crypto A

- Sale Consideration: Rs 90,000 for Crypto A

- Total Loss: Rs 10,000

In this case, the Rs 10,000 loss is simply ignored for tax purposes. You cannot use it to reduce other taxable income. The TDS of 1% of Rs 90,000, which will be Rs 900, would still have been deducted at the time of sale. It can be claimed as a credit.

Scene 3: Crypto-to-Crypto Exchange

Exchanging the crypto is also considered a taxable event and is subject to the same tax rules. Now, suppose you used 1 ETH with market value Rs 1,50,000 to buy 0.05 BTC with market value Rs 1,50,000.

Your original cost for that 1 ETH was Rs 1,00,000. Here are the steps to calculate your tax:

Step 1: Calculate the Profit from the Transfer

Profit = Sale Value (value of BTC received) - Cost of ETH

i.e., Rs 1,50,000 - Rs 1,00,000 = Rs 50,000 (Net Profit)

Step 2: Calculate the 30% Income Tax

i.e., 30% of Rs 50,000 = Rs 15,000 (+ surcharge and cess)

Step 3: Apply 1% TDS

Both the buyer and seller in a crypto-to-crypto transaction are responsible for deducting and depositing 1% TDS on their respective portions of the value.

Also Read: Old vs New Tax Regime 2025: Key Differences & Best Choice

Now, in the next part, you will get to know the common myths about the crypto tax in India.

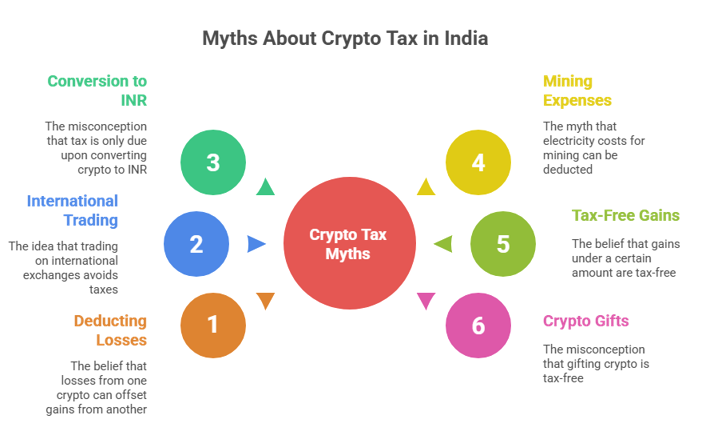

Common Online Myths About Crypto Tax in India

The most common myths about crypto tax in India that many people believe are true are:

- You can deduct losses from one cryptocurrency against gains from another cryptocurrency or other income.

- Trading on international exchanges or using peer-to-peer (P2P) methods means you would not have to pay taxes.

- You only pay tax when you convert crypto to INR (Indian Rupees).

- You can deduct expenses for mining or staking, like electricity costs, from your taxes.

- Gains under a certain amount (e.g., up to Rs 50,000) are tax-free.

- When you give someone cryptocurrency as a gift, you do not have to pay taxes on it.

- All of these are misconceptions and not at all true. Any trading and selling of crypto is liable to taxation in India and needs to follow the tax rules.

Next, let us understand the tricks of avoiding paying crypto tax in India.

How to Avoid Crypto Tax in India 2026? Legal Truth

It is essential to understand that for an Indian tax resident, legally avoiding crypto tax is virtually impossible under the current 2026 guidelines. Here is the "Legal Truth" on the limited ways for minimising or organising their financial affairs related to the Indian crypto tax in 2026:

-

Change Your Tax Residency

The only truly legal way to avoid Indian crypto tax is to become a tax resident of a country that has no tax on cryptocurrencies. For this, you need to move to that country and you can only spend less than 182 days in India during a financial year.

-

Focus on Holding Rather Than Trading

You are only taxed when you transfer (sell or exchange) the crypto. Merely buying and holding the asset in your wallet is not a taxable event.

-

Ensure Strict Compliance and Use Deductions Correctly

You cannot avoid the 30% flat tax, but you can make sure you do not pay too much by using the right, though limited, deductions.

-

Use Exempt Gift Rules

You can receive gifts of cryptocurrency from certain close relatives, like your spouse, parents or siblings, without having to pay taxes on them.

In the next heading, you will get the list of the countries that are crypto tax-free for Indians. So, keep reading.

Crypto Tax-Free Countries for Indians

Here is the list of crypto tax-free countries for Indian residents:

| Country | Tax Policy | Notes for Indians |

|---|---|---|

| UAE | 0% on personal crypto gains/trading | Popular Dubai residency via golden visa; no income tax. |

| Cayman Islands | 0% income, capital gains, corporate tax | Tax haven; high living costs, easy company setup. |

| El Salvador | 0% on Bitcoin (legal tender) | BTC adoption; residency options available. |

| Bermuda | 0% income/capital gains tax | Crypto regulations are friendly; remote work visas. |

| Germany | 0% if held for more than 1 year | EU access; strict short-term taxes apply. |

| Portugal | 0% long-term gains (non-habitual resident) | NHR program expiring soon; Lisbon crypto hub. |

Lastly, let us understand some tax compliance tips for 2026.

Crypto Tax Compliance Tips for 2026

Here are some of the most effective compliance tips for crypto tax in India 2026:

- Document every single transaction and store all information.

- If you are a high-volume trader, use a crypto-specific tax software that can automate your calculations.

- Use Compliant Indian Exchanges for trading.

- Verify the TDS deducted with the official statements.

- File your ITR form correctly, i.e., using ITR-2 and ITR-3 correctly.

- Do not just report trading gains, report all your income streams.

Smart Investments, Bigger Returns

Conclusion

To conclude, Crypto taxes in India for 2026 might seem complicated at first, but understanding the 30% flat rate, 1% TDS and the no-loss-offset rules can help you manage it better.

Using tax software will help you stay organised. Do not let myths confuse you, just keep good records, use compliant exchanges and file your Schedule VDA correctly. Whether you plan to hold long-term or consider tax-free options like the UAE, smart planning can keep you ahead.

Related Blogs:

- Cess Tax on Income Tax: All You Need to Know

- What is Surcharge in Income Tax: Purpose, Slabs & Relief

- What is Tax Planning: Objectives, Types & Importance

FAQs

-

How to report crypto in ITR 2026?

To report crypto in ITR 2026, you need to use Schedule VDA in ITR-2/3, which is a new 2025-26 form section to report all crypto transactions.

-

Is there a foreign exchange crypto tax for Indians?

If you are an Indian resident, you need to pay taxes on foreign exchange and cryptocurrency.

-

Which is the best software for crypto tax in India?

Some of the best crypto tax software in India are Koinly, CoinLedger or ClearTax for auto ITR import.

-

Is crypto holding taxable in India?

No, you do not pay taxes while holding VDAs in wallets or exchanges. Taxes will only apply when you sell or transfer these assets.

-

What is the penalty for missing crypto TDS?

You will pay up to 1% of the transaction value each month, plus interest. Exchanges may receive larger fines.

.webp&w=3840&q=75)