Table of Contents

- What is a Surcharge in Income Tax?

- Why Does India Charge a Surcharge on Income Tax?

- Surcharge Section in the Income Tax Act

- What Happens If You Choose the New Tax Regime?

- What Are Income Tax Slabs?

- Is Rs.12 Lakh Income Tax-Free? Know with the example.

- What is Marginal Relief in Income Tax?

- Who Can Claim Marginal Relief in Income Tax?

- What is the Health and Education Cess & Why Is It Added?

- Exemptions/Deductions Under New Tax Regime (FY 24-25)

- What Deductions Are Still Available Under the New Tax Regime?

- How to Calculate Income Tax Liability Under the Old Tax Regime?

- Final Thoughts

Why do some people end up with a higher tax bill? The answer lies in this tricky word: "surcharge." It is because of an extra tax on your income tax. If your earnings cross certain limits, the government takes an extra payment from your income. The rules depend on the old or new tax regime. How? Let's find out

In this blog, you explore what a surcharge is, who has to pay it, the applicable slabs, possible relief options, how marginal relief works under the new tax regime announced in the Union Budget 2025.

All along this post will also be answering the viral question: Is earning above Rs12 lakh tax-free, or just a myth?

Let us keep it real, taxes can be confusing & just when you think you have figured out your income tax, there is this extra thing called a surcharge. So what is it?

What is a Surcharge in Income Tax?

A surcharge is an extra tax you pay on top of your regular income tax. It applies when you earn more than a certain threshold.

Think of it like this: Assume you are ordering a pizza at a restaurant. The menu says Rs300, but then the bill comes & it is Rs330. Why? Because there is a service charge added. That is what a surcharge feels like, an added tax on your main tax bill.

In India, the surcharge starts if your total income is more than Rs50 lakh in a year. And it increases as your income goes higher. If you earn more than Rs50 lakh, include the surcharge in your tax planning.

Remember: If your income is on the higher side, do not forget to add the surcharge when calculating your total tax.

You might be thinking, “Why is there this extra tax? What is the reason behind it?”

Why Does India Charge a Surcharge on Income Tax?

The surcharge is the government's process of collecting an extra tax from high-income earners who are already doing well financially. That extra money goes toward running the country, building roads, improving hospitals, funding education and so on.

That is why the surcharge mainly affects people with higher incomes and it becomes a hot topic every tax season.

Must Read: How To Calculate Income Tax On Salary?

Surcharge Section in the Income Tax Act

The Income Tax Act of India has a section that explains who has to pay the surcharge, how much it is, and when it knocks in. These rules can change every year in the Union Budget. So for FY 2024-25,

Here is what it looks like:

-

Surcharge in Income Tax for Individuals (FY 2024–25)

If you are an individual, your surcharge depends on your income. Here is a quick breakdown:

| Your Income (Rs.) | Surcharge Rate | What It Means |

|---|---|---|

| More than Rs.50 lakh | 10% of your income tax | You pay 10% extra on your tax amount |

| More than Rs.1 crore | 15% of your income tax | You pay 15% extra on your tax amount |

| More than Rs.2 crore | 25% of your income tax | You pay 25% extra on your tax amount |

| More than Rs.5 crore (Old Regime) | 37% of your income tax | You pay 37% extra on your tax. This is the highest surcharge layer |

Think of your income like a layered cake, the more layers (income), the more frosting (surcharge) the government adds on top!

-

Surcharge Rates for Different Taxpayers ((FY 2024–25)

Here is a quick breakdown of different taxpayer:

| Type of Taxpayer | When Surcharge Applies | Surcharge Rate | Conditions |

|---|---|---|---|

| Individuals / HUFs (Old Regime) | Income > Rs.50 lakh | 10% to 37% | 10% for income > Rs.50L, up to 37% for income > Rs.5 Cr |

| Individuals (New Regime) | Income > Rs.50 lakh | Capped at 25% | Maximum surcharge reduced from 37% to 25% |

| AOP (only companies as members) | Income > Rs.1 crore | 15% | AOPs with only companies as members |

| LTCG on listed equity & units | On gains from shares, mutual funds, etc. | 15% max | Capped surcharge on long-term capital gains |

| Domestic companies (Section 115BAA/115BAB) | No income limit | 10% | No escape due to the absence of limit |

| Firms / LLPs / Local Authorities | Income > Rs.1 crore | 12% | Flat 12% surcharge on tax amount if income crosses Rs.1 crore |

High earners pay more surcharge but under the new regime, the max limit is now 25% (instead of 37%).

Important Read: What is Professional Tax in Salary? Learn Tax Slabs, Deductions

What Happens If You Choose the New Tax Regime?

The new tax regime offers reduced tax rates, and a lot of individuals are moving toward it these days. However, there is an exception, such as you are not eligible for most of the standard deductions, such as 80D (for health insurance), 80C (for investments like LIC and PPF), or HRA (House Rent Allowance).

So, you might be thinking, “If I choose the new regime, do I still have to pay that extra surcharge?” Yes, you do. The surcharge still applies even if you are under the new tax regime.

Remember that in the new regime, the maximum surcharge is limited to 25%, even if your income is more than Rs5 crores.

This change is due to reason to make the new regime attractive to high-income taxpayers, who would have been exposed to a 37% surcharge under the old regime. Thus, the new regime results in tax savings if you have a high income and avoid claiming many deductions.

Quickly talk about income tax slabs because they are super important in calculating your overall tax.

What Are Income Tax Slabs?

Think of tax slabs like stair steps. The more money you earn, the higher the step & higher tax rate you reach.

In the old tax regime, the income tax slabs looked like this:

| Income Tax Slabs Income | Tax Rates |

|---|---|

| Up to Rs.2.5 lakh | No tax |

| Rs.2.5 lakh to Rs.5 lakh | 5% |

| Rs.5 lakh to Rs.10 lakh | 20% |

| Above Rs.10 lakh | 30% |

In the new regime, the slabs are more spread out and look like this:

| Income Tax Slabs Income | Tax Rates |

|---|---|

| Up to Rs.3 lakh | No tax |

| Rs.3–6 lakh | 5% |

| Rs.6–9 lakh | 10% |

| Rs.9–12 lakh | 15% |

| Rs.12–15 lakh | 20% |

| Above Rs.15 lakh | 30% |

Understanding these slabs helps you know how much tax you will pay and whether a surcharge applies to you.

The key takeaway from this:

- Surcharge = extra taxfor high-income earners.

- It helps fund national development.

- Knock in when your income jumps Rs50 lakh.

- Old vs. New Regime: ASurcharge applies in both, but the limit at 25% in the new one.

- You may continue to increase your tax management strategy by staying informed about your income tax slab.

Now, here is a question that often pops up, “Is an income of Rs 12 lakhs tax-free?” Let’s find out in the next heading.

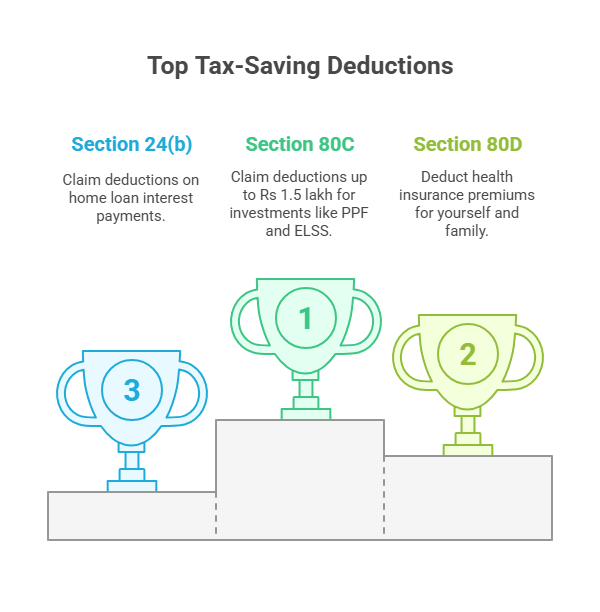

Is Rs.12 Lakh Income Tax-Free? Know with the example.

No. However, with the right deductions and exemptions, you can visibly reduce your taxable income.

Suppose you earn Rs.12 lakh in a financial year. Here is how you can make it tax-free:

- Deductions under Section 80C: You can claim deductions up to Rs 1.5 lakh for investments in specified instruments like PPF, ELSS, or life insurance premiums.

- Health Insurance Premiums: Under Section 80D, you can claim deductions for health insurance premiums paid for yourself and your family.

- Interest on Home Loan: If you have a home loan, you can claim deductions on the interest paid under Section 24(b).

By using these deductions, you may lower your taxable income by less than Rs.2.5 lakh and thus prevent you from paying taxes.

Now, let us talk about something that can be a lifesaver, “marginal relief”.

What is Marginal Relief in Income Tax?

Marginal relief is a rule under Section 87A of the Income Tax Act. It makes sure that taxpayers whose income is more than Rs.12 lakhs by a small margin do not pay more tax than their actual income. Without marginal relief, a small increase in income above Rs.12 lakhs could lead to an equally higher tax burden.

“Do you wonder what happens if your income slightly exceeds Rs. Rs.12 lakh?”

Well, to answer this, the marginal relief secures if your income is more than Rs12 lakh by Rs. 10,000, the additional tax you will pay is Rs10,000.

Point to Remember: Marginal relief applies only to incomes below Rs. 12.75 lakh, after which regular tax calculations are applied.

Pro Tip: Use the free Tax Calculator to know how much return you need to file within minutes.

Do you have any idea who can claim marginal relief? Let's understand by the next headline.

Who Can Claim Marginal Relief in Income Tax?

Marginal relief claims are calculated by a system made for:

- Local Individuals: It applies to both salaried & non-salaried local taxpayers.

- Income Range: Applicable for taxable incomesbetween Rs.12,00,000 & Rs.12,75,000.

- Disqualified: Non-residents, Hindu Undivided Families(HUFs) & other groups are not eligible for marginal relief.

To Calculate marginal relief, you need to determine the additional tax you would pay due to the surcharge and compare it to the additional income you earned. If the additional tax exceeds the additional income, you can claim marginal relief to reduce your tax burden.

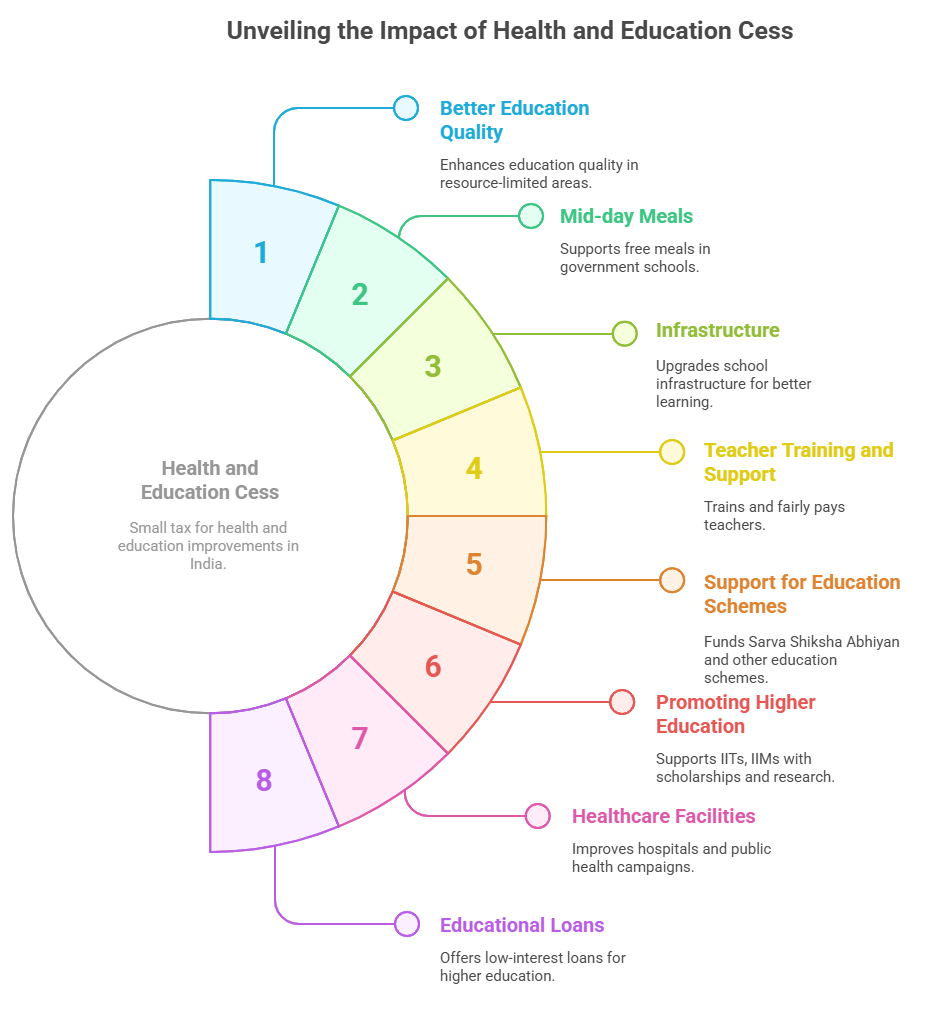

What is the Health and Education Cess & Why Is It Added?

The Health and Education Cess is a small extra tax that the Indian government adds on top of your regular income tax. It was introduced in 2018, replacing the older education cess. Cess has a specific purpose allotted for Health & Education.

There a several reasons it is added & where your money goes:

- Better education in quality: Helps improve the quality of education where resources are limited.

- Giving Mid-day meals: Supports the free meal program in government schools so that children get food and stay in school.

- Infrastructure: Used to upgrade school infrastructure for a better learning environment.

- Teacher training & Support: Helps train teachers and ensures they are paid fairly.

- Support for education schemes: Programs like Sarva Shiksha Abhiyan& Rashtriya Madhyamik Shiksha Abhiyan are provided by this.

- Promoting Higher education: Supports top institutions like IITs & IIMs with scholarships and research funding for development.

- Healthcare Facilities: Helps improve hospitals, rural medical facilities, and public health campaigns.

- For Educational loans: Some of the money is used to offer low-interest loans for students going for higher studies.

In Simple Words, when you pay this 4% Health and Education Cess, you are helping build better schools and better healthcare, and giving more people access to education and medical care.

Exemptions/Deductions Under New Tax Regime (FY 24-25)

Exemptions and deductions are two different terms that have individual purposes in reducing your tax burden, but they create a lot of confusion for individuals, so let us understand with examples:

1. Tax Exemptions Income

This is income that is completely tax-free and does not even enter into your taxable income calculation.

Example:

- The House RentAllowance (HRA) part of it can be excluded.

- Agricultural income

- Gifts from close relatives

- Leave Travel Allowance (LTA)

In simple words, it is the income you earn but do not need to show for tax.

2. Tax Deductions

Tax deductions lower your taxable income if you have spent or invested money in particular allowed categories.

Example:

- 1.5 lakh under Section 80C (that is LIC, PPF, EPF, ELSS)

- 25,000 under 80D for health insurance

- Home loan interest as per Section 24

In simple words, you earned this much, but since you spent or invested smartly, you will be taxed on a lower amount.

Under the new tax regime, many exemptions and deductions have been removed. However, some remain. For instance, you can still claim deductions for:

- Employer’s contribution to NPS

- Certain allowances for government employees

- Interest on home loans (subject to conditions)

What Deductions Are Still Available Under the New Tax Regime?

The new regime is made to simplify tax calculations; it is essential to know what deductions you can still claim. For example, contributions to the National Pension Scheme (NPS) and certain allowances for government employees are still available.

| Deduction / Benefit | Amount / Limit | Who Can Claim It |

|---|---|---|

| Standard Deduction | Rs75,000 | Salaried individuals & pensioners |

| Employer’s Contribution to NPS (Sec 80CCD(2)) | Up to 14% (Govt) Up to 10% (Others) |

All employees with an NPS account |

| Agniveer Corpus Fund (Sec 80CCH) | 100% of the contribution | Agniveers under Agnipath scheme |

| Family Pension Deduction | Rs25,000 or 1/3rd of pension (whichever is less) | Family pensioners |

| Transport Allowance for Disabled Persons | As per the rules | Salaried individuals with disabilities |

| Conveyance Allowance | Actual expenses reimbursed | Salaried employees |

| Travel on Tour/Transfer | Actual expenses | Salaried employees |

| Daily Allowance | Actual expenses | Salaried employees |

| Perquisites for Official Work | Varies | Salaried employees |

| Voluntary Retirement (VRS) Exemption (Sec 10(10C)) | Up to Rs5 lakh | Employees opting for VRS |

| Gratuity Exemption (Sec 10(10)) | Up to Rs20 lakh (Govt norms) | Retired employees |

| Leave Encashment on Retirement (Sec 10(10AA)) | Up to Rs3 lakh (non-govt) | Retired employees |

| Gifts from Employer | Up to Rs5,000 | All employees |

| Additional Employee Cost Deduction (Sec 80JJA) | 30% of additional employee cost | Businesses hiring new employees |

How to Calculate Income Tax Liability Under the Old Tax Regime?

Even though most deductions like 80C, HRA, etc. are not available in the new tax regime, you can still enjoy a few important tax benefits. Here is a clear step:

| Step | What to Do | Example (Assume Income: Rs12,00,000) |

|---|---|---|

| 1 | Calculate Gross Total Income (Salary, Rent, etc.) | Rs12,00,000 |

| 2 | Deduct eligible exemptions & deductions | e.g., 80C (Rs1.5L), 80D (Rs25K), HRA, etc. → Rs2L |

| 3 | Arrive at Taxable Income | Rs12,00,000 - Rs2,00,000 = Rs10,00,000 |

| 4 | Apply Slab Rates (see table below) | Rs1,12,500 (as per slabs below) |

| 5 | Add Surcharge (if applicable) | Not applicable (Income < Rs50L) |

| 6 | Add Health & Education Cess (4% of tax) | Rs1,12,500 × 4% = Rs4,500 |

| 7 | Total Tax Liability = Tax + Cess | Rs1,12,500 + Rs4,500 = Rs1,17,000 |

In Simple Words:

- If you are salaried or a pensioner, you can still save tax using these.

- The new regime removes many benefits, but not everything is gone.

- Use this list to plan your salary and retirement benefits smartly.

Final Thoughts

To sum up, the surcharge on income tax is crucial for maximizing your returns. While it increases the tax burden, surcharge relief is available in some cases to reduce its impact. Knowing the surcharge slabs and rules can help you plan your taxes better.

Tax planning is not just about numbers or income. It is about making smart choices in financial journey.

Also Read :

1. Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

2. What is Tax Planning: Objectives, Types & Importance

Frequently Asked Questions

-

Why do I get charged a surcharge?

A surcharge is an additional cost that you can charge users to cover the expenses of accepting credit or debit cards. Credit or debit card payments are liable to the charge. You cannot charge a customer more than it costs you to process the transaction.

-

What are the disadvantages of surcharge?

Surcharges can make goods and services more expensive, which can upset customers and make them less loyal. People might feel that the extra fee is unfair and they could choose to shop elsewhere where there are no extra charges. When it comes to income taxes, higher earners might end up paying more, leaving them with less money to spend or invest.

-

What is the percentage of the surcharge fee?

Surcharges are typically a percentage of the total purchase price and can range from 1% to 4%.

-

How to get the best benefits of marginal relief?

Marginal relief offers benefits when a high surcharge is paid.

-

How to avoid a surcharge?

If the taxable income falls below a certain tax bracket, then only it is possible to avoid the surcharge. However, the surcharge is subject to marginal relief.