Table of Contents

- What is a Windfall Tax in India?

- How Windfall Taxes Work?

- Examples of Windfall Taxes

- Industries Most Affected by Windfall Taxes

- Advantages of a Windfall Tax

- Disadvantages of a Windfall Tax

- Who is Liable to Pay Windfall Taxes?

- Alternatives to a Windfall Tax

- Difference Between Windfall Taxes and Regular Taxes

- Conclusions

Did you know that the Indian oil companies earned Rs 86,000 crore in net profit overnight during the war between Russia and Ukraine? Shocking, right? But are these industries the only ones that benefit from the unexpected events and challenges? No, these companies can not keep all their profits due to a special government-imposed Windfall Tax, which redistributes extra earnings earned during a crisis fairly in society, including you.

The windfall tax in India is a special levy that has reshaped the fortunes of entire Indian industries, making it one of the hottest topics trending on Google in 2025.

Now, there must be a bunch of queries in your mind, such as “Who actually pays this tax?” or “How is windfall tax different from regular tax?” Well, do not worry, this blog will simplify it for you with real-world examples, clear explanations, interesting facts and easy guides so that you can understand its impact on businesses and the country.

What is a Windfall Tax in India?

In India, a Windfall Tax is a special tax imposed by the government on companies that have gained unexpected and excessive profits because of external factors beyond their control, such as wars, a boom in global commodity costs or global events. This tax is not applied to the income earned from a business or job, but to the profits earned from the sudden market change.

For instance, the increased margins Indian oil companies experienced during the Russia-Ukraine conflict.

How is the windfall tax calculated?

The Indian government implements this tax using a Special Additional Excise Duty (SAED), which is revised every two weeks. The tax rates for Windfall Taxes are not fixed. Calculating this tax includes setting a baseline or profit level for industries, identifying the excess profits and applying the tax rate.

What is the purpose of a windfall tax?

These taxes are most commonly imposed on the oil, gas and mining industries, but they can also impact telecom, lottery winnings and inheritances. The government imposes these taxes on companies to capture and redistribute the extra profit from crises or wars equally throughout society.

Also Read: What is Tax Planning: Objectives, Types & Importance

Now, let us go through the work process for the Windfall taxes in detail.

How Windfall Taxes Work?

Windfall Taxes work by targeting the earnings from external sources. It is a temporary tax imposed on companies, industries or individuals. The process of charging a Windfall Tax is:

- Step 1: Occurrence of an external event that increases profits in a particular sector.

- Step 2: The government averages past profits to establish a baseline.

- Step 3: Profits exceeding this baseline are classified as "excess" or "windfall."

- Step 4: A higher tax rate is applied only to these excess profits.

- Step 5: The collected revenue is used for public welfare practices.

The Windfall Tax Debate and Controversy:

- Arguments in Favour: This tax increases fairness by redistributing the profit earned from unexpected conditions and the government can also generate revenue for social welfare.

- Arguments Against: This tax creates uncertainty for businesses, leading to higher customer prices, as companies may pass the tax burden on.

Let us study some real examples of windfall taxes and their impact on specific industries.

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Examples of Windfall Taxes

Some of the crucial examples of the windfall taxes are:

India (2022-2024)

In July, a windfall tax was imposed on oil companies like Oil India, GAIL and ONGC due to the Russia and Ukraine war. The tax rates reached Rs. 23,250 per tonne of crude oil and generated revenue of over Rs. 65,600 crore from oil and Rs. 52,700 crore from exports. It was abolished in December 2024.

United Kingdom (1997,2022-present)

Privatised utilities (1997): Tony Blair's government put a special tax on privatised utilities such as water and electricity because these companies were sold cheaply and made a lot of money.

Energy companies (2022): Due to the Ukraine war, the UK government introduced the EPL (Energy Profits Levy) on oil and gas producers, initially set at 25% and increased to 35% in 2023 to support households. The tax has been extended to 2030.

European Union (2022)

Due to the Ukraine war and global energy crisis (2021 to 2023), the EU imposed a windfall tax on the fossil fuel industries to contribute to energy affordability initiatives for households and businesses. States including Greece, the Netherlands, Spain, and Italy also established their own versions with different tax rates.

United States (1980)

During the OPEC oil embargo & the Iranian Revolution, the US imposed a windfall tax on domestic oil companies in the 1970s and 1980s. However, the tax generated less income than expected and reduced domestic oil production, increasing reliance on imports, which led to its abolition in 1988.

Let us see, "Why is a windfall tax imposed on oil companies and other industries?"

Must Read: Tax Planning For Salaried Employees: Best Tax Saving Options

Industries Most Affected by Windfall Taxes

The industries that have the most significant impact from the windfall taxes include:

-

Oil & Gas

This industry is mainly targeted because of its exposure to global price irregularities during wars or crises. Due to the windfall tax on oil & gas, the net earnings of these companies reduce and make the alteration of production & sales strategies necessary.

-

Mining & Commodities

The mining sector is affected by an extra tax, which is imposed when mineral prices rise unexpectedly. This additional tax can increase operational costs for mining companies & impact their growth & cost structures.

-

Banking & Financial Services

The windfall tax can highly impact the financial and banking sector, particularly during economic imbalances or after regulatory gains. It lowers net earnings, causing bank share prices to drop and interest rates on loans to rise.

-

Pharmaceuticals

This industry can face an uncertain profit surge during major public health emergencies (like the COVID-19 pandemic), when demand for medicines or vaccines surges, making it reliable for windfall taxes. These taxes reduce supernormal profits in the pharma industry.

-

Technology

This sector is not commonly affected, but it can be a target during major shifts in market demands. Tech companies, especially those with monopoly power, may face higher taxes, leading to reduced investment, innovation and growth.

In the next heading, you will explore the benefits of imposing windfall taxes.

Start Your SIP TodayLet your money work for you with the best SIP plans.

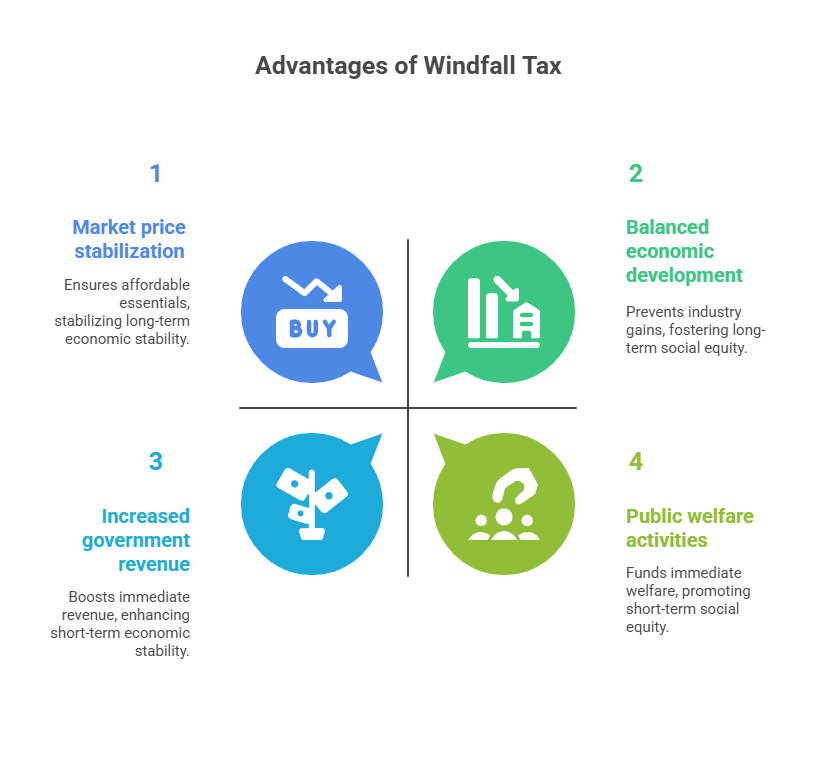

Advantages of a Windfall Tax

Here are the advantages of a windfall tax:

- It increases government revenue during a crisis, without additional taxes on the general people.

- This tax is used as a fund for public welfare activities, thus supporting economic recovery.

- By distributing the extra profit equally in society, this tax expands fairness and reduces wealth differences.

- It supports balanced and long-term economic development by preventing specific industries from using these gains.

- The tax stabilises the market prices, making essential needs more affordable for ordinary people.

Everything has its own good and bad side. Similarly, there are also some disadvantages of windfall taxes. Let us learn them next.

Disadvantages of a Windfall Tax

Here are the disadvantages of a windfall tax:

- This tax reduces the profits companies can earn during the favourable conditions.

- Due to this tax, companies might invest less in research and development.

- The unexpected nature of this tax can cause business uncertainty.

- It can increase the price for consumers if the company shifts the burden to the commoners.

- To maintain profits, companies might reduce hiring and cut out job opportunities, reducing employment.

Now the main question is, "Who needs to pay this tax and if you fall under this category?" Keep reading to know.

Pro Tip: Use a SWP Calculator for easy withdrawal of money from your investments.

Who is Liable to Pay Windfall Taxes?

Here is the description of companies or industries and individuals who are liable to pay this tax:

Windfall Taxes on Companies in India

The Windfall tax is primarily imposed on companies and industries that usually earn high profits from external events. The most affected industries include:

| S. No. | Industry |

|---|---|

| 1 | Oil and Gas Companies |

| 2 | Energy Producers and Utility Providers |

| 3 | Mining Companies |

| 4 | Pharmaceutical Companies |

| 5 | Technology Companies |

| 6 | Telecommunication Companies |

Windfall Taxes on Individuals in India

Normally, the windfall tax is only imposed on corporations and industries, but some countries have extended it to individuals in some particular conditions. they are liable if they gain large, unforeseen amounts, such as through lottery winnings or inheritance.

Now, let us explore some alternatives that the government of India considers.

Important: How To Calculate Income Tax On Salary With Example: Unfolded

Alternatives to a Windfall Tax

Some alternatives to the windfall taxes that governments and economists consider include:

- Progressive Corporate Taxation: Raise of ongoing corporate tax rates slowly.

- Price Caps & Market Regulation: Charging price controls on essential goods or services.

- Profit Sharing Mechanisms: Mandating businesses to share extra profits with employees.

- Reinvestment in Sustainable Energy: Companies (especially fossil fuels) are required to reinvest earnings into green energy projects.

- Temporary Surcharges: Imposing temporary higher rates on corporate income during growth periods.

In the next part, let us understand how a windfall tax is different from regular taxes.

Smart Investments, Bigger Returns

Difference Between Windfall Taxes and Regular Taxes

Here is the detailed comparison that highlights the main differences between windfall taxes and regular taxes:

| Aspect | Windfall Tax | Regular Tax |

|---|---|---|

| Purpose | To tax unexpected, extraordinary profits due to external events or market changes. | To generate consistent, predictable revenue from general Business and individual earnings. |

| Application | Applied selectively to specific industries or companies with excess profits. | Applies broadly across many sectors and taxpayers. |

| Duration | Usually temporary and event-driven. | Permanent and ongoing. |

| Profit Basis | Tax is levied on profits exceeding a baseline or normal profit level. | Taxed on all taxable income and profits. |

| Effect on Business | May discourage investment and innovation due to unpredictability. | More predictable, it encourages regular compliance and planning. |

| Purpose of Revenue Use | Redistribution of excess profits for social and economic benefit. | General government expenditure and services. |

| Calculative Complexity | Requires defining and calculating "excess profits," which can be complex. | Well-established rules and systems for calculation and collection. |

| Fairness Perception | Seen as redistributive but can be viewed as punitive by businesses. | Generally accepted as a fair tax system, despite rate variations. |

Pro Tip: Use a Mutual Fund Screener to search, filter, and compare mutual funds.

Conclusion

To wrap up, the windfall tax is a special tax that ensures the redistribution of the extra income earned by the industries from unexpected events in society. This tax boosts fairness and government revenue for the public welfare, but it can also increase uncertainties in businesses and lower their growth, making it an issue for debates.

You need to stay updated on the windfall tax process and how it affects industries and individuals to manage sudden policy changes and market instability.

Related Blogs:

- Best SIP Plans to Reach 1 Crore for a 50k Salary?

- Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

FAQs

-

Why Does the Indian Government Impose a Windfall Tax?

The purpose is to redistribute unexpected profits that are not from business fairly within society and use them for public welfare.

-

Which Industries Were Most Affected by the Windfall Tax in India in 2025?

The most affected Indian industries in 2025 were oil and gas, mining and commodity sectors due to the rise in their profits from price surges.

-

When was the Windfall Tax Introduced and Abolished in India?

In India, the windfall tax was introduced in July 2022 due to the rise in crude oil prices from the Russia-Ukraine war and was stopped in December 2024.

-

Is the Windfall Tax permanent or temporary?

The Windfall Tax is a temporary measure applied during unexpected profit phases and is withdrawn once conditions normalise.

-

How did the abolition of the Windfall Tax affect the Indian economy?

The termination helped improve oil & gas companies' profitability, encouraged higher production and made an investment-friendly environment in the energy sector.

.webp&w=3840&q=75)