Table of Contents

- Quant Flexi Cap Fund Overview

- Performance Analysis of Quant Flexi Cap Fund

- Investment Strategy Employed by Quant Flexi Cap Fund

- Portfolio Composition of Quant Flexi Cap Fund

- Benefits of Investing in Quant Flexi Cap Fund

- Who Manages the Quant Flexi Cap Fund

- Risk Analysis of Quant Flexi Cap Fund

- Stock Quality Analysis of the Quant Flexi Cap Fund

- Is Quant Flexi Cap Right for You in 2026?

- Conclusion

Are you looking for an investment that offers flexible equity exposure, high growth potential and dynamic adaptation to market conditions? Presenting to you the Quant Flexi Cap Fund, which stands out as one of the best investment options in 2026 with its active, flexible and dynamic investment strategy.

Sanjeev Sharma and his team have taken this Mutual Fund to new heights, making it well-known for its strong track record, risk mitigation techniques and portfolio management. With impressive 3-year (20.05%) and 5-year (21.8%) returns and a VLRT framework, the fund currently manages assets worth Rs 6,866 crore.

But is it a good choice for you in 2026? Check out this concise Quant Flexi Cap Fund Review, covering its investment strategy, portfolio composition, performance track record and risk factors to answer your questions. Let us dive in.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Quant Flexi Cap Fund Overview

Quant Flexi Cap Fund is an equity mutual fund that dynamically invests in various companies of all sizes, including large, mid and small caps. This flexible approach increases growth opportunities based on market conditions and capitalises on growth potentials across all segments. It is managed by Quant Mutual Fund, which employs a unique, quality-driven investment style based on the VLRT framework.

The fund house established the Quant Flexi Cap Fund in 2008. As of December 2025, the fund has assets (AUM) worth Rs 6,866 crore and an NAV of Rs 112 (as of January 2, 2026) for direct growth. This mutual fund's recent performance has displayed strong growth with remarkable returns, consistently outperforming its benchmark with 21.8% 5-year and 20.05% 10-year rolling returns.

Now, let us analyse the performance and growth of this fund based on its rolling returns.

Performance Analysis of Quant Flexi Cap Fund

The Quant Flexi Cap Fund has delivered strong performance across multiple time horizons, specifically over 5 years and more. It consistently outperforms its benchmark (Nifty 500 TRI) and will position itself as one of the top flexi cap mutual funds in 2026.

Look at the graph below, which shows the rolling returns of the Quant Flexi Cap Fund over 3 and 5 years.

The graph shows that this mutual fund has generated impressive returns for 3 and 5 years and has consistently outperformed its benchmark.

Pro Tip: Use a Quant SIP Calculator to estimate future returns of your Quant mutual fund SIP investments.

Let us understand this fund's investment style and philosophy to generate strong returns.

Best Mutual Funds for 2026 Backed by Expert Research

Investment Strategy Employed by Quant Flexi Cap Fund

The Quant Flexi Cap Fund uses a flexible investment strategy with dynamic asset allocation, aiming for long-term capital appreciation across various sectors and market caps, including large, mid and small caps. It manages volatility through dynamic portfolio management and utilises effective risk management techniques, including stop-loss methods and frequent rebalancing.

The mutual fund follows the VLRT framework to grab arising growth opportunities. The VLRT framework stands for:

| Factor | Description |

|---|---|

| Valuation | Identifying undervalued stocks for quality investments. |

| Liquidity | Monitoring money flows across markets. |

| Risk | Evaluating macro and sector risks for risk management. |

| Timing | Uses market signals to enter or exit positions for optimal returns. |

The Quant Flexi Cap Fund optimises returns using top-down (identifying high-potential sectors according to market cycles) and bottom-up (seeking undervalued stocks or companies with strong fundamentals) approaches.

Must Read: Top 10 Flexi Cap Mutual Funds 2026: High-Return Picks in India

In the next heading, you will explore the sectors in which the fund's portfolio is distributed. Keep reading to know them.

Portfolio Composition of Quant Flexi Cap Fund

The Quant Flexi Cap Fund regularly rebalances its portfolio based on the VLRT method & evaluation of the market trends. The portfolio composition of this fund is as follows:

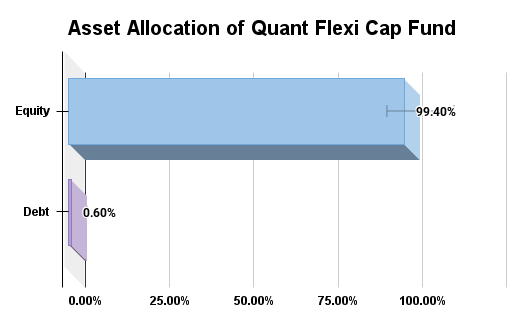

Asset Allocation

The Quant Flexi Cap Fund has an aggressive asset allocation, with 99.40% in equities, indicating strong growth potential and only 0.60% in debt for minimal downside exposure. This mutual fund suits investors who are okay with some market instabilities to achieve long-term capital growth. Let us make it clear with a graph:

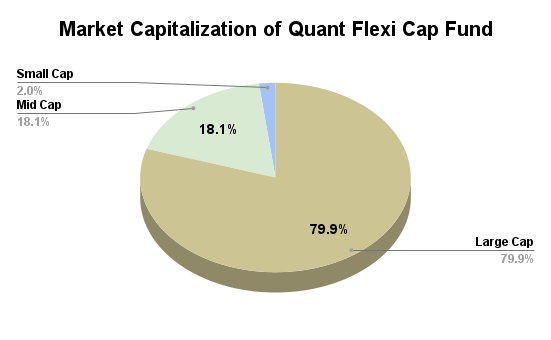

Market Cap Allocation

The Quant Flexi Cap Fund allocates 79.90% to large cap stocks for stability, while mid caps make up 18.14% for growth potential and 1.96% in small caps for high-growth opportunities. This market cap allocation provides a good balance of stability & growth, making it a suitable choice for investors looking to diversify their portfolios. The graph given below shows a clearer picture:

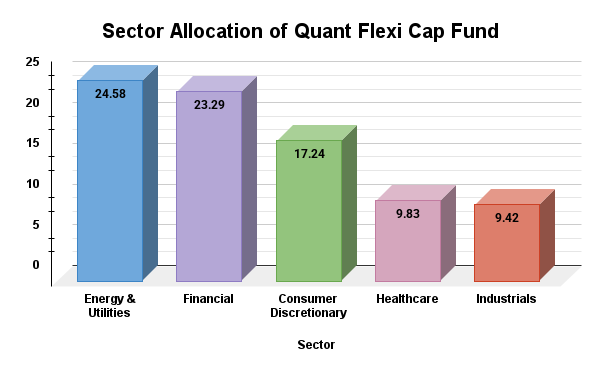

Sector Allocation

The Quant Flexi Cap Fund invests mainly in the Energy & Utilities (24.58%) sector because of the growth potential of this sector. Apart from that, this mutual fund invests in Financials (23.29%), Consumer Discretionary (17.24%), Healthcare (9.83%) and Industrials (9.42%). In 2026, this fund focuses on impressive growth while managing risks effectively with this allocation. Here is a graph representing the sector allocation of the fund:

Let us explore the benefits you can get from investments in this Quant mutual fund.

Benefits of Investing in Quant Flexi Cap Fund

Here are the advantages of investing in the Quant Flexi Cap Fund for 2026:

-

High Return Potential

The fund has shown a strong performance over 5 and 10 years, outperforming its benchmark and category average returns.

-

Flexibility

The fund is not restricted to a single market and can shift its investment dynamically to capitalise on opportunities in the rising markets.

-

Dynamic Asset Allocation

The Quant Flexi Cap Fund dynamically adjusts its portfolio between sectors and market caps based on market changes to optimise returns.

-

Active Management

This fund offers the potential for higher alpha (returns above the benchmark) through active stock selection and tactical allocation.

-

Long-Term Growth Potential

The fund aims to provide long-term growth to the investors by focusing on the undervalued stock options and adapting to market shifts.

-

Short Exit Load Period

The fund has an exit load of 1% for redemption within 15 days of investment (a very short period). After 15 days, there is no exit load.

In the next section, let us reveal the faces of the experts behind this mutual fund's success.

Who Manages the Quant Flexi Cap Fund

The Quant Flexi Cap Fund is managed by a team of financial professionals with expertise in research and portfolio management and CFA and MBA credentials.

This team includes the following names: Sanjeev Sharma (since Oct 3, 2019), Ankit A. Pande (since May 11, 2020), Sandeep Tandon (since Jan 7, 2022), Varun Pattani (since Feb 19, 2025) and Ayusha Kumbhat (since Feb 19, 2025).

The prominent personalities are Sanjeev Sharma, with over 20 years of experience, including 13 years in financial markets and a specialist in identifying inflexion points in securities and Ankit A. Pande, with over 15 years of experience in equity research. Ankit A. Pande has also worked with Infosys Finacle and Kotak Institutional Equities previously.

Now, let us uncover the risk factors associated with the Quant Flexi Cap Fund investment.

Start Your SIP TodayLet your money work for you with the best SIP plans.

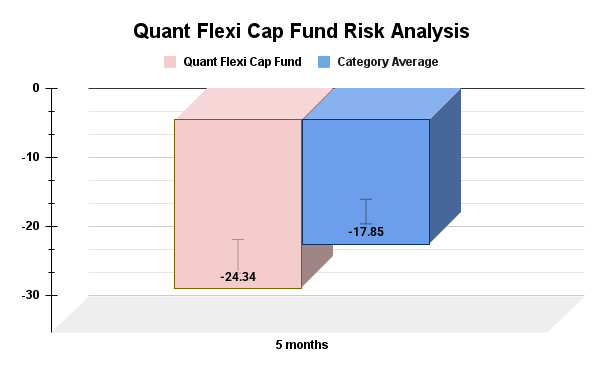

Risk Analysis of Quant Flexi Cap Fund

The Quant Flexi Cap Fund has a high risk level due to its active investment strategy, equity exposure and dynamic allocation. This aggressive approach has led this fund to many higher growths, but it also discloses the volatility of small cap investments. Refer to the graph below that shows the risk comparison of the fund and its benchmark:

The Quant Flexi Cap Fund (16.6%) has about 3.4% (standard deviation) points more volatility than the category average (13.2), suggesting it experiences wider ups and downs. The category average’s Sharpe of 0.75 beats the fund’s 0.57, meaning, on a risk-adjusted basis, the category peers have historically offered better returns per unit of risk taken.

A negative alpha (-1.99) suggests the fund underperformed its benchmark on a risk-adjusted basis, while the category average’s positive alpha (1.46) indicates peers have, on average, added more value beyond the benchmark. At 1.19 beta, this fund is more sensitive to market movements than the average category fund.

Also Read: 3 Best Performing Flexi Cap Mutual Funds: Expert Picks for 2026

Now, let us look at the analysis of the stock quality of the fund.

Stock Quality Analysis of the Quant Flexi Cap Fund

When picking mutual funds, smart investors do not just chase returns, they dig into quality metrics like P/E ratios, earnings growth, sales growth and cash flow growth.

These numbers reveal if a fund's holdings are built on solid businesses with real momentum, or if they are overhyped stocks waiting for a reality check.

Let us break down the latest data for the Quant Flexi Cap Fund against its category average:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 13.58% |

| Earnings Growth | 10.88% |

| Cash Flow Growth | 6.73% |

| P/E Ratio (Valuations) | 27.06 |

Quant's P/E ratio does not have a huge gap, but it means you are paying a slight premium for this fund's portfolio. Peers are growing earnings faster with 10.88% earnings growth. Quant's investments are decent, but they are not at the top. Quant shines with a 13.58% sales growth and 6.73% cash flow growth.

Beyond this fund's potential, the main question is: "Is this fund a good choice for you in 2026?" Keep reading to find out.

Is Quant Flexi Cap Right for You in 2026?

Due to its high risk level, the Quant Flexi Cap Fund is not suitable for all types of investors. Here is the description of the investors who can consider this mutual fund to invest in 2026:

- Investors who are comfortable with high volatility and short-term losses.

- Best for long-term (over 5 to 7 years) investment horizon to benefit from market cycles and compounding.

- Ideal for SIP investments and investors looking to lower average cost by investing through market irregularities.

- Fits investors seeking diversified exposure across large, mid and small-cap stocks.

- Great for those who trust active, data-driven fund management with frequent portfolio adjustments.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Your suitability with this fund depends on your goals, horizon and the level of risk you can handle.

Smart Investments, Bigger Returns

Conclusion

To wrap up the review of the Quant Flexi Cap Fund, it has an established track record for long-term growth with impressive returns, but with a higher risk level and market volatility.

It is suitable for investors who are planning long-term investments and have some experience in the mutual fund industry. If you are an investor, just starting or do not like taking higher risks, a more stable fund might be a better option.

Related Blogs:

- Smart SIP Strategy to Build a ₹2 Crore Wealth in 2026

- Top 10 Mutual Funds for SIP in 2026: Best Picks to Grow Wealth

FAQs

-

What is the minimum investment for SIP and lump sum in the Quant Flexi Cap Fund?

Minimum SIP investment starts at Rs 500 and lump sum begins at Rs 5,000 in the Quant Flexi Cap Fund. -

What is the expense ratio of the Quant Flexi Cap Fund?

The expense ratio of this fund is about 0.70% for direct plans, making it competitively affordable. -

Can NRIs invest in the Quant Flexi Cap Fund and how?

NRIs can invest online via registered brokers or platforms offering mutual fund investments in India. -

What are the exit load and taxation rules for this fund?

An exit load applies if redeemed within 1 year and taxation follows standard capital gains rules, with LTCG benefits after 1 year. -

How does Quant Flexi Cap Fund compare to other flexi cap funds?

Compared to peers, Quant Flexi Cap offers dynamic allocation with strong performance but slightly higher volatility.

_(1).webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)