Table of Contents

The HDFC Flexi Cap Fund started in January 1995 with the goal of actively managing its strong AUM of Rs.54,682 Crores. It gained popularity due to its impressive performance, attracting significant interest from investors. The key to its success is its flexible investment strategy, which allows it to capitalize on emerging opportunities and navigate varying market conditions effectively.

Now, let's explore whether it remains a strong investment option so that you can start an early SIP and give a boost to your portfolio.

So, how did the fund manager's strategy lead to such impressive success? Let's find out.

Investing Strategy

The HDFC Flexi cap Fund has a focused dynamic and disciplined approach to investing which means it actively manages its portfolio so that it can adapt to changing market conditions. By focusing on identifying high-quality, competitively-positioned companies with strong growth potential and buying them at attractive valuations, the fund aims to optimize returns while managing risks through diversification and strategic positioning, making it a compelling choice for investors seeking long-term capital growth.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

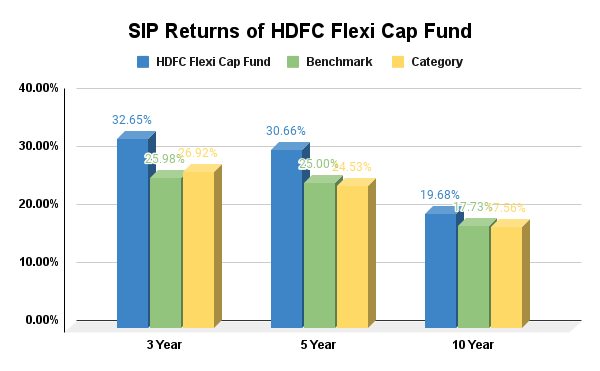

Can HDFC Flexi Cap Fund deliver steady growth and returns through Online SIP investments? Let’s check how much SIP returns this scheme as delivered at different periods.

SIP Returns of HDFC Flexi Cap Fund

Let's say you start a SIP of Rs. 10,000 per month in the HDFC Flexi Cap Fund, what happens at different intervals:

Over a 10-year period

If you had started this SIP 10 years ago, your total investment would have been Rs. 12,00,000 (Rs. 10,000 x 12 months x 10 years).

The value of your investment today would be Rs. 30,04,833.

That's an annualized return of 19.68%, which is significantly higher than the Nifty 500 (17.73%) and the category average (17.56%).

Over a 5-year period

If you had started this SIP 5 years ago, your total investment would have been Rs. 6,00,000 (Rs. 10,000 x 12 months x 5 years).

The value of your investment today would be Rs. 11,22,150 which is an impressive annualized return of 30.66%, surpassing the benchmarks.

Over the last 3 years

If you had started this SIP 3 years ago, your total investment would have been Rs. 3,60,000 (Rs. 10,000 x 12 months x 3 years).

The value of your investment today would be Rs. 5,03,880.

That's an annualized return of 32.65%, compared to the Nifty 500's 25.98% and the category average of 26.92%.

You can take the help of the below graph to study the data more clearly:

This consistent outperformance of the HDFC Flexi Cap Fund across different time frames highlights its potential to generate superior long-term returns for investors through a systematic investment approach.

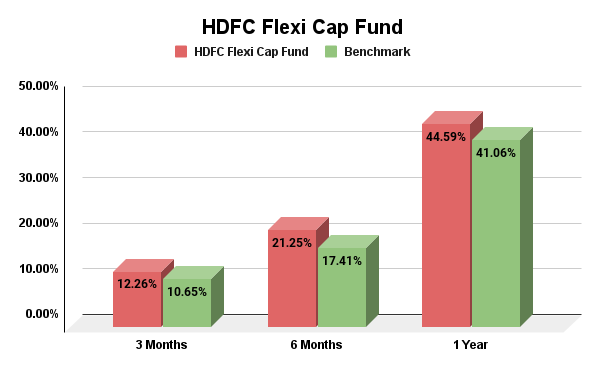

Recent Performance of HDFC Flexi Cap Fund

The performance of this fund over 3 months, 6 months and 1 year is 12.26%, 21.25% and 4459% respectively. In comparison, the category average for the same periods is 10.65%, 17.41% and 39% this shows that the fund has substantially outperformed its category average in every timeframe. However, when we compare this fund to its benchmark, it has outperformed its peer market. You can refer to the below graph for more clarity:

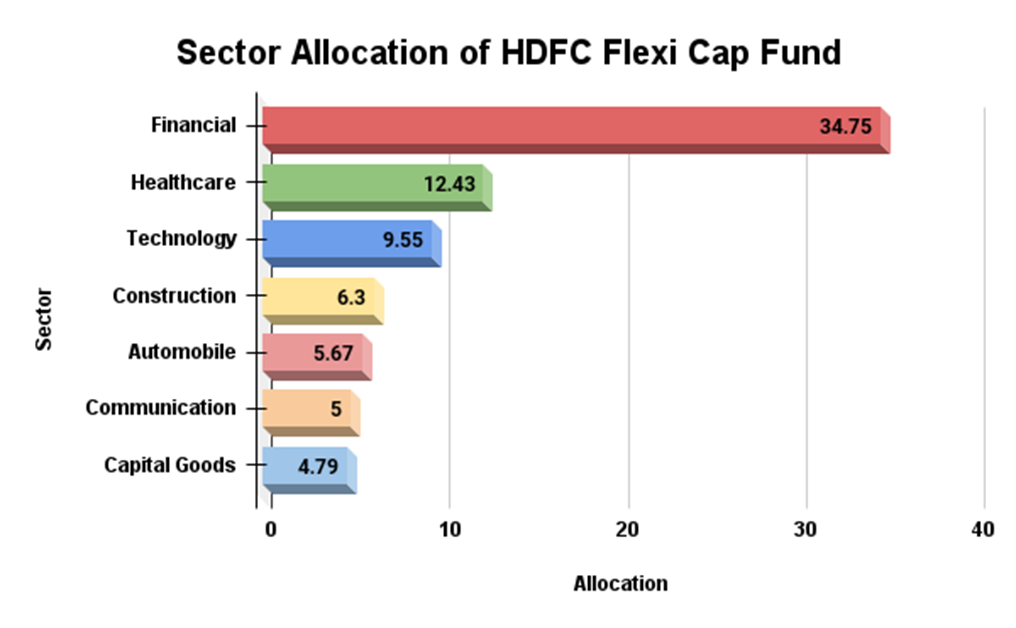

How is the Sector Allocation of HDFC Flexi Cap Fund?

The HDFC Flexi Cap Funds portfolio is primarily allocated to core sectors like 35% financials, 12.43% healthcare, and 10% technology. These sectors are currently undervalued but expected to experience growth in the near future, providing the potential to make high returns.

Additionally, the fund maintains smaller allocations in trending sectors such as 5% communication, 5.67% automobiles, and 4.79% capital goods, which have delivered strong performance over the past 2-3 years. This diversification strategy allows the fund to benefit from recent market trends while managing risk.

The fund has recently increased its allocation to the healthcare sector, anticipating it to enter a growth phase in the business cycle, while reducing its investment in capital goods, likely to book profits from previous gains. This tactical adjustment aligns with the fund's focus on optimizing returns while managing risk.

Overall, the HDFC Flexi Cap Fund's strategic asset allocation, with a focus on core undervalued sectors and selective exposure to high-performing industries, positions it well to deliver consistent and superior returns for investors. You can get help from the below graph to get more clarity:

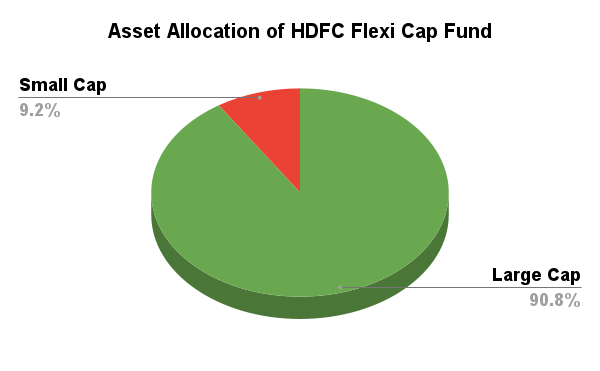

How does the Asset Allocation of HDFC Flexi Cap Fund Looks?

The fund's portfolio includes 46 stocks, with a major allocation of 85.51% in large-cap stocks. This heavy emphasis on large-cap stocks suggests a strategy focused on stability and lower risk, fitting for a market with high valuations. The remaining allocation includes 5.83% in mid-cap stocks and 8.66% in small-cap stocks, providing some growth potential. Overall, the fund behaves more like a large-cap fund, emphasizing safety while still offering exposure to mid and small-cap Mutual Funds.

If you're wondering whether the HDFC Flexi Cap Fund leads to top-notch stock investments, let's examine the quality of its stocks to find out.

Stock Quality of HDFC Flexi Cap Fund

Based on numerous vital measures, the HDFC Flexi Cap fund appears to be on track for growth and stability. It has had 14.39% sales growth, which means that the total revenue from its invested companies has grown by this proportion. Its earnings growth rate is even more outstanding, at 27.42%, suggesting a large increase in profits. The cash flow growth rate is 18.47%, which suggests the fund is earning more cash from its activities, improving its financial health. Finally, the value PE (price-to-earnings ratio) is 20.30. This ratio allows investors to determine if companies are overpriced or undervalued in relation to their profits; a PE of 20.30 indicates a moderate valuation. Overall, these numbers demonstrate that the HDFC Flexi Cap mutual fund is constantly increasing and has strong financial indicators.

Endnote

After reviewing its strategy, past performance, and portfolio allocation, it's clear that the HDFC Flexi Cap Fund is actively managed, aiming to capitalize on market opportunities while emphasizing risk management during downturns. The strong performance data supports the effective execution of its strategy. Therefore, it remains a solid choice for investors seeking actively managed funds. With an early SIP investment, you can grab your chance to maximize returns which is an ideal choice for a long-term approach.

Want to Know More Funds for SIP? Read more:

1. ICICI Prudential Multi Asset Allocation Fund: 18.53% Per Annum SIP Return in 10 Years

.webp&w=3840&q=75)

.webp&w=3840&q=75)