Stability, consistent returns and trusted names are the things most investors look for when investing in mutual funds. Large cap mutual funds can give you all these, but the question is which one is a safe bet for your long-term investment in 2025? Let me introduce you to the SBI Large Cap Fund (formerly known as SBI BlueChip Fund), which manages assets of over Rs 54,000 crore as of October 2025.

Now, you must be wondering why SBI funds only and not others. Well, did you know that the SBI Large Cap Mutual Fund is now the second-largest in the large-cap category? Yes, it is true, SBI Mutual Funds is one of the biggest names in this industry, with 5-year returns of 15.05% that outperformed its benchmark. This is not all; the 13.55% SIP returns over 5 years are also impressive, making your wealth creation easy.

Want to know more? Dive into this post that will give you everything you want to be convinced to add this fund to your portfolio. From its returns to its risks, this SBI large cap fund review has it all.

SBI Large Cap Fund Review

The SBI Large Cap Fund (formerly known as the SBI Bluechip Fund) is one of India's best equity mutual funds. This fund primarily focuses on building long-term capital by investing in large-cap equity stocks of well-established companies in the top 100 by market cap. It is popular for providing stability and consistent growth potential to the investors.

This scheme from SBI Mutual Funds was launched on February 14, 2006. It is considered a high-risk investment, therefore, it is only suitable for investors with a long-term horizon (5-7 years).

Here are the details of the SBI Large Cap Fund scheme:

| Factors | Regular Plan | Direct Plan |

|---|---|---|

| NAV | Rs 95.68 | Rs 106.23 |

| AUM | Rs 54,688 Cr | Rs 54,688 Cr |

| Expense Ratio | 1.48% | 0.81% |

| Exit Load | 0.25% if redeemed within 30 days, 0.10% after 30 days but on or before 90 days |

0.25% if redeemed within 30 days, 0.10% after 30 days but on or before 90 days |

| Benchmark | NIFTY 100 TRI | NIFTY 100 TRI |

| Minimum SIP Amount | Rs 500 | Rs 500 |

| Minimum Lumpsum Amount | Rs 5,000 | Rs 5,000 |

(As of 2025)

Must Read: Top 10 Mutual Funds for SIP in 2025: Best Picks to Grow Wealth

Now, let us look at the analysis to see whether SBI large cap funds are suitable for your long-term investments.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Is the SBI Large Cap Fund Safe for Long-Term Investments?

The SBI Large Cap Fund is a reliable large cap equity fund that allocates at least 80% of its portfolio to large-cap stocks. This approach offers relatively safer investments than mid and small cap funds, which are more volatile. In 2025, the mutual fund held about 40-42 stocks, with 83.9% exposure to large-cap companies and impressive sector diversification, thereby reducing the risk associated with any single company.

Like any other equity investment, the SBI large cap fund also carries risks. However, with its diverse portfolio, experienced management, large AUM and strong long-term performance, it offers a good level of safety for long-term investors. The fund has lower volatility and delivers strong risk-adjusted returns, making it suitable for investors seeking exposure to Indian equity markets while managing risks.

Overall, the SBI Large Cap Fund is a solid option for investors who want the stability of large-cap stocks along with the potential for reliable growth over the long term.

Let us look at the top 5 holdings of the SBI Large Cap Funds:

| Company Name | Sector | % of Total Holdings |

|---|---|---|

| Reliance Industries Ltd. | Refineries & Marketing | 7.88% |

| HDFC Bank Ltd. | Private Sector Bank | 7.35% |

| ICICI Bank Ltd. | Private Sector Bank | 7.13% |

| Larsen & Toubro Ltd. | Civil Construction | 5.45% |

| Infosys Ltd. | IT - Software | 3.96% |

In the next part, let us review the fund's performance using its rolling returns and SIP returns.

Performance Analysis of SBI Large Cap Fund

Here is the performance analysis for the SBI Large Cap Fund based on its rolling and SIP returns:

Rolling Returns

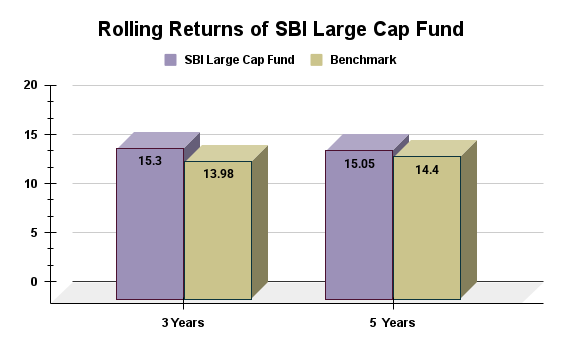

SBI Large Cap Fund has consistently outperformed its benchmark (NIFTY 100 TRI) with both returns and consistency. Over 3 years, where the benchmark stood at 13.98% returns and 67.92% consistency, the fund delivered 15.3% returns with 74.41% consistency. Similarly, over 5 years, the fund delivered 15.05% returns with 72.94% consistency, while the benchmark delivered 14.4% returns with 72.32% consistency. Look at the graph below:

The graph shows the fund's strength in generating steady returns while consistently surpassing its benchmark.

SIP Returns

SBI Large Cap Fund delivered moderate, stable SIP returns over time, recording 13.19% for 3 years and 13.55% for 5 years. Although the returns are slightly below the category average and benchmark, the fund remains reliable for long-term wealth creation, thanks to its consistent approach and bluechip focus.

The fund's active management helps it overcome market volatility to achieve stability and growth.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Now, let us look at the investment approach employed by the SBI Large Cap Fund.

SBI Large Cap Fund Investment Style

Saurabh Pant, the fund manager of SBI Large Cap Fund, has a balanced, thoughtful investment style, making it a good fit for anyone who wants both stability and growth over time. He has a clear investment philosophy, investing in top-quality large cap companies with strong fundamentals and proven leadership, always balancing stability and risk management.

Instead of just following the trend, Pant uses a mix of top-down and bottom-up approaches to select stocks with the potential to grow remarkably. This careful selection process means the portfolio includes 40-42 diversified stocks, helping to limit risk.

Although the fund has nearly half its assets in its top 10 holdings, it remains well-diversified, with a low turnover rate of 28.8%, showing the fund's commitment to quality investments. The fund's defensive style helps protect your money during market instability, making it a reliable choice for investors who want moderate risk and a longer investment horizon.

In the next part, you will explore the portfolio composition of the fund. So, keep reading.

Portfolio Composition of SBI Large Cap Fund

Here are the sector, asset and market cap allocation of the SBI large cap fund that shows how the fund diversifies its investments:

Asset Allocation

Most of the assets of the SBI Large Cap Funds are placed in equities with 96% allocation, followed by small portions in debt (about 0.67%) and cash (about 3.65%). The fund's heavy equity exposure means investors can benefit from top Indian companies, while its limited debt and cash holdings help manage liquidity during market fluctuations.

According to the graph, the fund focuses on steady growth while keeping risk low. It offers flexibility to adapt to changing market conditions.

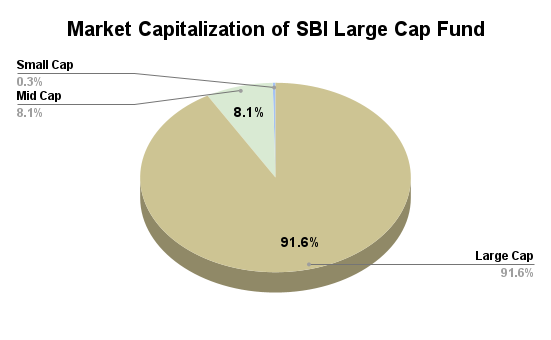

Market Cap Allocation

SBI Large Cap Fund allocates over 91% of its market cap to large-cap stocks to minimise risk and ensure steady returns, about 8% to mid-caps to boost growth and just 0.33% to small caps to keep volatility low. Prefer the graph below:

This market cap allocation shows the stability the fund provides to its investors.

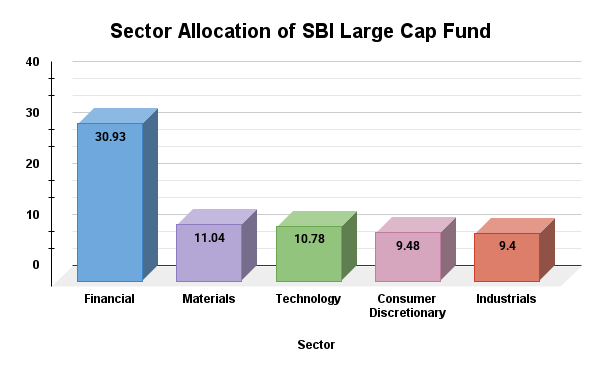

Sector Allocation

This large-cap fund has built its portfolio around sectors like financials (30.93%) for maximum stability and growth and materials (11.04%) to add exposure to infrastructure and industry. At the same time, reasonably allocating to technology, consumer discretionary and industrials to capture key market trends.

This allocation across India's growth engines helps mitigate the risks associated with the SBI large cap fund.

Also Read: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

Now, let us analyse the mutual fund's stock quality and risk measures.

SBI Large Cap Fund Stock Quality and Risk Analysis

The following are the reviews of the stock quality and risk measures that are included in the SBI Large Cap Mutual Fund investments:

Stock Quality Analysis

SBI Large Cap Fund invests in high-quality stocks with a P/E ratio of 25.06, showing the fund focuses on well-established companies. The fund's stocks show strong earnings growth of 12.17% and sales growth of 12.41%, which are on par with those of similar funds. However, cash flow growth at 13.24% is better than the category average, indicating strong financial health and solid business operations.

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 12.41% |

| Earnings Growth | 12.17% |

| Cash Flow Growth | 13.24% |

| P/E Ratio (Valuations) | 25.096 |

This mix of earnings, sales and cash flow makes the fund appealing for investors.

Analysing Risk Measures

SBI Large Cap Fund has a lower risk than its peers. Its standard deviation is 11.3, while the category average is 12.72. The fund’s Sharpe ratio of 0.65 is better than average, indicating it offers improved returns for the level of risk taken. Although the Alpha is slightly negative at -0.15, it suggests that the fund lags its benchmark. The Beta is 0.9, showing it is less volatile than the market.

| Fund or Category | Standard Deviation | Sharpe Ratio | Alpha | Beta |

|---|---|---|---|---|

| Nippon India Large Cap Fund | 11.3 | 0.65 | -0.15 | 0.9 |

| Category Average | 12.72 | 0.64 | -0.01 | 1 |

The fund delivers steady performance with modest risk, making it a good choice for investors.

Pro Tip: Use a SWP Calculator to plan for your regular mutual fund unit withdrawals.

Lastly, let us know the mastermind behind the fund's success story.

Knowing the Fund Manager of the SBI Large Cap Fund

The one who controls the operations of the SBI Large Cap Fund and whose investment strategies have taken this fund to its highest is none other than Saurabh Pant. He is a seasoned investor with deep expertise in equity research and large-cap management.

Saurabh has been the lead manager of SBI mutual fund since 2024. He has over 15 years of experience in capital markets. He joined SBI Funds Management as a research analyst and is now a specialist in equity fund management.

Previously, Saurabh worked for companies such as Shah & Sequeira Invst. Pvt. Ltd. and ICFAI-Securities Research Centre as an Equity Research Analyst. His expertise lies in large-cap investing with a focus on stable, high-quality companies. Under his management, the fund now ranks second-largest in the large-cap category.

Smart Investments, Bigger Returns

Concluding SBI Large Cap Fund Review

To wrap up, the SBI Large Cap Mutual Fund is one of the best options in the large cap category, with remarkable long-term returns, such as 15.05% rolling returns and 13.55% SIP returns in 5 years.

As of October 2025, the fund manages an AUM of Rs 54,000 crore, with a current NAV of Rs 95, under the guidance of its manager, Saurabh Pant. But despite the impressive track record, you must align this fund with your goals, investment horizon and risk profile before investing to grow in the future.

Related Blogs:

1. Best Mutual Funds to Invest in 2025: Low-Risk Options for High Return

2. SBI Multicap Fund Review 2025: Best for Long-Term Investment?

3. Is SBI Small Cap Fund a Good Investment? Experts Review

FAQs

-

Who is the SBI Large Cap Fund Best Suited for?

The SBI Large Cap Fund is suitable for investors seeking long-term growth with moderate risk.

-

How does the SBI Large Cap Fund compare with other large-cap funds?

This fund consistently delivers competitive returns and is ranked among the leading large-cap schemes in India.

-

Does the SBI Large Cap Fund have any lock-in period or exit load?

There is no lock-in period. The exit load is up to 0.25% if redeemed within the first 30 days.

-

Can SBI Large Cap Fund beat inflation?

Historically, the fund has beaten inflation, thanks to its long-term capital appreciation track record in the large-cap space.

-

How are returns of the SBI Large Cap Fund taxed?

Short-term gains (redeemed within one year) are taxed at 20%. Long-term gains (over one year) exceeding Rs 1.25 lakh are taxed at 12.5%.

.webp&w=3840&q=75)

.webp&w=3840&q=75)