Table of Contents

- Silver Price Last 10 Years in India: Trend

- Silver Returns in the Last 10 Years in India

- Last 10 Year Gold vs Silver Price Comparison in India

- Key Factors Affecting Silver Prices in India

- Best Ways to Invest in Silver in India

- Why Silver is Moving Faster Than Gold?

- Factors to Consider Before Investing in Silver

- Final Thought

Silver is no longer just a precious metal, now it has evolved into a dynamic investment, storming into record high by breaching ₹4 lakh per kilogram on MCX futures in January 2026, marking one of the fastest rallies ever in Indian commodity markets. Silver price last 10 years in India has reflected a strong uptrend amid global uncertainty, rising industrial demand, and ever-evolving consumer behaviour favouring bullion and ETFs.

Given that, the Economic Survey of India 2025-2026 emphasises silver's growing significance for investors seeking growth and protection, making it a compelling alternative to traditional gold holdings.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Silver Price Last 10 Years in India: Trend

The silver price last 10 years in India climbed from ₹36,800/kg in 2016 to ₹2.8 lakh/kg in early 2026, reflecting ~21.4% CAGR and sharp hike ever since 2020.

From the table below, you can see the continuous rise in the silver price in India through the 10-year silver rate trend.

| Year | Silver Rates (Rs./Kg) |

|---|---|

| 2016 | Rs. 36,990 |

| 2017 | Rs. 37,825 |

| 2018 | Rs. 41,400 |

| 2019 | Rs. 40,600 |

| 2020 | Rs. 63,435 |

| 2021 | Rs. 62,572 |

| 2022 | Rs. 55,100 |

| 2023 | Rs. 78,600 |

| 2024 | Rs. 95,700 |

| 2025 | Rs. 2,62,000 |

| 2026 | Rs. 3,30,000 |

Silver Returns in the Last 10 Years in India

The silver price last 10 years in India shown volatile yet robust returns on investment. It fluctuates between -8% and 36%, consistently rewarding patient investors.

| Year | Yearly Change (%) |

|---|---|

| 2016 | 0.084% |

| 2017 | 0.024% |

| 2018 | -7.1% |

| 2019 | 0.141% |

| 2020 | 0.123% |

| 2021 | 0.36% |

| 2022 | -8.0% |

| 2023 | 0.152% |

| 2024 | 0.319% |

| 2025 | 0.263% |

| 2026 | 0.26% |

Also Read: Future Industry in India 2026: Where Smart Investors Invest

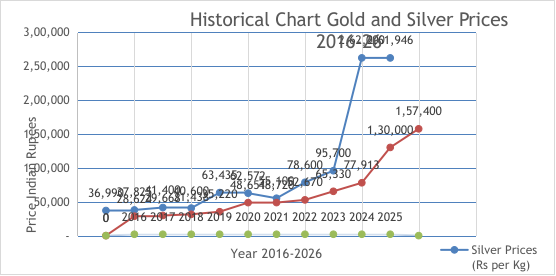

Last 10 Year Gold vs Silver Price Comparison in India

Between 2016 and 2026, gold doubled more than silver in India, but the rise of silver from ~₹37,000/kg to ₹3 lakh+ shows the higher side risk and higher return profile among the precious metals.

Here is the gold vs silver price comparison in India:

Best Mutual Funds for 2026 Backed by Expert Research

Key Factors Affecting Silver Prices in India

The silver price in India is majorly influenced by a mix of global economic trends, currency movements, and domestic industrial demand.

Being both precious and industrial metal, silver reacts to several macroeconomic triggers, here are some:

Industrial Demand

Nearly 50-55% of the global silver demand rises from the following industrial applications:

- Solar Panels

- Electronics

- Electrical Vehicles (EVs)

- Semiconductors

- Medical Equipment

Hence, growth in renewable energy and technology manufacturing directly increases the consumption of silver, pushing prices upward.

Rising US-Iran Tensions

Geopolitical tensions, including those between the US and Iran, pose global challenges. And during such periods, investors shift towards assets that give maximum safety, like gold and silver, which pushes silver demand and drives prices even higher.

US Federal Reserve

The US Federal Reserve interest rate decision triggers silver prices in two ways:

- Lower rate of interest makes silver assets more attractive.

- Higher rates strengthen the dollar and may reduce the demand for precious metals.

Monetary policy often triggers sharp price instability in global bullion markets.

Rupee Depreciation

Silver traded all across the globe traded in US dollars.

- A strong dollar typically pressures global silver prices.

- A weaker Indian rupee makes silver more expensive domestically, even if the global rate remains stable.

Industrial Production & Supply Chain Dynamics

Silver consumption increases due to the expansion of industrial output. This includes electronics, automobiles, and consumer goods. The push towards Indian manufacturing growth further strengthens domestic demand and thus impacts pricing patterns.

Investment Demand

Apart from industrial use, silver sees strong demand through bullion purchases, digital silver and futures trading. During an economic slowdown, investors increase allocation to precious metals as a hedge, boosting prices.

Also Read: Recession in India 2026: Impact on Jobs, Markets and Growth

Start Your SIP TodayLet your money work for you with the best SIP plans.

Best Ways to Invest in Silver in India

Here are the best ways to invest in silver in India, and each catering to different preferences and investment goals:

- Silver Jewellery & Articles: Most Indians prefer silver in the form of jewellery, cutlery, or decorative items. It includes everyday utility with investment, and allows one to enjoy the asset while it appreciates over time.

- Silver Coins: Banks and financial institutions provide silver coins in weights ranging from 1 to 10 grams. These coins are highly liquid, easy to trade, and ideal for small to medium investments.

- Silver Bars: For bulk investors, silver bars are a very popular choice. It offers an affordable and simple way to accumulate large quantities of silver and can be easily converted to cash when required.

- Commodity Futures: Professional investors usually trade silver through Commodity Futures Exchanges. These options allow investors to actively participate in leveraging market trends, price forecasts, and short-term opportunities for higher gains.

- Silver Mutual Funds: Silver MF and ETFs allow market players to gain exposure to silver without holding it physically. These mutual funds and ETFs invest in physical silver and can be accessed via lump-sum investments, thus making them convenient, transparent and suitable for long-term portfolio diversification.

Pro Tip: Use a mutual fund screener to find consistent performers, not just the highest return funds.

Why Silver is Moving Faster Than Gold?

Silver holds a distinctive position in global markets because of its dual role as both a precious metal and an industrial commodity. Moreover, silver remains a comparatively affordable alternative to gold, making it attractive to investors seeking portfolio diversification and a hedge against the uncertainty in the economy.

Several key factors are currently supporting silver prices:

- Increasing investment demand amidst economic uncertainty and inflation concerns.

- Constrained global supply and limited mining growth.

- Technical momentum and breakout trading, as record price levels attract new market participants.

When the silver price rises sharply, momentum-driven investors and traders often enter the market, further amplifying upward price movements and increasing short-term volatility.

Also Read: Will Gold Rate Decrease in Coming Days 2026? Expert Forecast

Factors to Consider Before Investing in Silver

Below are the key factors that one should consider before making informed decisions:

- Daily Silver Rates: Silver price fluctuate on a daily basis on international markets. Monitoring these rates helps investors buy at reliable prices. Keeping a tap on reliable sources regularly ensures informed timing of purchase.

- Investment Amount: The quantity of silver plays a vital role in decision-making. Large investments include bars or coins, whereas smaller amounts can be in coins or jewellery.

- Making Charges: If investing in silver cutlery or ornaments, then it is important to factor in making charges. And these can significantly impact the total cost and resale value.

- Transaction Mode: Ensuring authenticity and verified purity is crucial for maximising long-term returns and resale value. Thus, silver should be purchased via authorised dealers, banks or verified online platforms.

- Certification: Always get a reliable certification for any silver purchase. Certificates guarantee purity, protect against counterfeit products and enhance the silver’s resale potential.

- Silver SIPs: For those who prefer gradual but mindful investment, silver SIP s help accumulate wealth over a period of time, offering flexibility and exposure to silver without a large upfront investment.

Pro Tip: Use the SIP calculator to see how investing longer can significantly increase your final wealth.

Smart Investments, Bigger Returns

Final Thought

To conclude, in just ten years, silver skyrocketed from ₹36,990/kg to ₹3.3 lakh/kg, outperforming gold in volatility and returns. Silver’s dual role as an industrial and precious metal, rising demand from electronics, along with investor interest and supply constraints, fueled this remarkable growth. With multiple investment options, such as coins, bars, jewellery, ETFs, and SIPs, silver offers portfolio diversification and long-term wealth potential as well. This makes it an essential consideration for investors seeking high returns and a hedge against economic uncertainty.

Related Blogs:

- Expected Gold Rate in 2026 in India: Market Prediction

- Smart SIP Strategy to Build a ₹2 Crore Wealth in 2026

FAQs

1. How Has Silver Performed In India Over The Last 10 Years?

Silver rates hiked from ₹36,990/kg in 2016 to ₹3.3 lakh/kg in 2026, showing strong returns (~21% CAGR) and higher volatility as compared to gold.

2. What Factors Influence Silver Rates In India?

Silver is impacted by:

- Industrial demand,

- Global economic trends

- US Federal Reserve policies

- Currency fluctuations

- Geopolitical tensions

- Domestic manufacturing growth.

3. How Does Silver Compare With Gold in Terms of Investment?

Although gold doubled in terms of price over the decade, but the silver delivered high in terms of higher percentage gains but with greater volatility, offering both growth potential and portfolio diversification.

4. What Are The Top Ways To Invest In Silver In India?

Investors can choose:

- Silver jewellery

- Coins, bars

- ETFs, mutual funds

- Commodity futures

- SIPs depending on risk appetite

- Investment goals.

5. Why Is Silver Considered a Good Hedge Against Economic Uncertainty?

The dual role of silver as a precious and industrial metal, along with limited supply and rising investor demand, makes it a trustworthy asset during inflation or market instability.