Table of Contents

- Real Data Showing How Long-Term SIPs Build Wealth

- The Right Investor Mindset for SIP Success in 2026

- Top 5 SIP Mistakes Hurting Your 2026 Returns and How to Fix Them

- Smart SIP Strategy to Build a Rs 2 Crore Corpus in 2026

- 2026 SIP Strategy Timeline: When to Start, Pause or Increase

- What is the Best SIP Amount for Beginners in 2026?

- Smart SIP vs Lump Sum vs STP: 2026 Comparison

- Conclusion

Did you know that, according to AMFI, 77% of SIP investors quit within 3 years of their investments? Yes, it is true and they miss the benefit of compounding that can turn Rs 10,000 monthly investments into a Rs 1.6 crore corpus. Are you making the same mistake? Then stop, because you are about to get a reality check.

Now, what if there is an investment strategy that can build you Rs 2 crore over 20 years of investments only? Yes, you heard it right. The investment strategy of including additional purchases and a stock SIP to your regular SIP investments can increase your returns significantly.

Dive into this guide to know the details of this investment strategy by MySIPonline experts that can take your investments to the next level.

Real Data Showing How Long-Term SIPs Build Wealth

According to the AMFI's data, 77% of the investors from 100% stop their SIPs in 3 years only because of the short-term fluctuations they face in the investment. Because investors do not continue their investment for the long term (at least 7-10 years), they do not get any compounding benefits, which is why they are unable to create their wealth and fulfill their investment goals.

Let us do a test with some real data to check how SIPs in the long term can result in your growth and why stopping them due to some short-term loss is not the right thing to do.

We will take three random categories, say large cap, flexi cap and small cap. Now, assume doing a Rs 10,000 monthly SIP in the oldest funds of these categories over 20 years. So, with this SIP amount, your total corpus (total amount invested) will be Rs 24 lakh.

In the large-cap category, the oldest fund is ABSL Large Cap Fund. In the flexi-cap category, you have HDFC Flexi Cap Fund and the small-cap category fund is Kotak Small Cap Fund. Look at the table below, which shows how much wealth you will make in each fund:

| Category | Oldest Fund | Corpus Value | XIRR |

|---|---|---|---|

| Large Cap | ABSL Large Cap | ₹1.15 Cr | 14% |

| Flexi Cap | HDFC Flexi Cap | ₹1.50 Cr | 16% |

| Small Cap | Kotak Small Cap | ₹1.60 Cr | 16.65% |

The above table shows that the investments in every fund and category would result in a corpus of more than 1 crore for a Rs 10,000 SIP over 20 years. This data proves that SIPs held for longer periods will definitely give you good results and profits.

Now, let us discuss the mindset an investor should have for a successful SIP investment.

Start Your SIP TodayLet your money work for you with the best SIP plans.

The Right Investor Mindset for SIP Success in 2026

According to the experts from MySIPonline, to succeed with a SIP (Systematic Investment Plan) in 2026, investors should focus on three key factors: discipline, patience and adaptability. This mindset is essential to deal with market fluctuations and economic changes. The following are the things you should consider while investing in SIPs:

- Set a long-term investment horizon, at least 7-10 years, to benefit from compounding.

- Continue your investments while avoiding the market cycles to benefit from rupee cost averaging.

- Stay focused on your Rs 2 crore corpus investment goal.

- Do not chase past performers and instead review your portfolio quarterly based on fundamentals.

- Take market volatility as an opportunity and increase your SIPs during market dips for better averaging.

- To build resilience, diversify your investments across different equity-type funds.

- Limit any single fund to 25-30% of your total portfolio.

The following are the actionable habits for 2026:

- Set realistic expectations and aim for annual returns of 12-15% from diversified equity SIPs. Do not expect guaranteed returns of over 20%.

- Track progress annually against benchmarks like Nifty 50 TRI, adjusting only for life changes like income hikes.

- Studies show that regular investments perform better than trying to time the market 90% of the time over 10 years, so be patient with your investments.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Next, you will know the common SIP mistakes every investor makes and learn how you can avoid them.

Top 5 SIP Mistakes Hurting Your 2026 Returns and How to Fix Them

The following are the top 5 mistakes that can affect your returns in 2026 and the strategies to avoid them:

No Clear Goal

Mostly, investors start their investments without any goal or objective, which leads to a pause or redemption of investments in the short term due to market cycles.

The solution is to set a goal and a fixed horizon before investing. Do not consider the market cycle ups and downs during your tenure.

Lack of Market Cycle Awareness

Market moves in cycles and it has a bull phase, bear phase and recovery phase. According to historical data, the market falls and recovers 2-3 times every 10 years and 4-5 times in 20 years.

Knowing in which phase the market is when you invest can help you do better SIP investment planning.

There are many factors to understand a market cycle, but the main factor is the interest rate cycle. When the RBI decreases the interest rate, the bull phase starts and when the rate increases, the bear phase starts. So, plan your SIP according to it.

Wrong Approach for Mutual Fund Selection for SIP

Mostly, investors choose a fund based on past performance only, which is not the right approach. Always prioritize the investment style of the fund more than its past performance.

Fund selection should be based on its investment style, and note that the fund uses a buy-and-hold approach.

Choose a high-risk and high-growth fund for SIPs, because in these funds, you get 18-20% lump-sum returns and 12-14% SIP returns (low because of averaging). SIP returns in less risky funds may fall below 10%.

Selecting the Wrong SIP Amount

Many investors either end up investing more than their budget and cannot continue it, or they just test it with a small amount, which does not give any results.

The best approach for selecting your SIP amount is to fix your targeted amount or goal amount first. Then use the MySIPonline SIP calculator to estimate your monthly SIP amount by entering some details, such as your tenure and expected corpus.

If the monthly SIP amount you get comes under your financial budget, then start your SIP investment for creating your long-term wealth.

Wrong Way of Managing SIP Investments

Nowadays, every investor uses a digital platform like MySIPonline for their investments and then they check their returns daily, which is not the right approach. You should not check your returns regularly, do it periodically (monthly, quarterly, etc).

Do not look at how much returns your investment made, but check how much the fund made, if it beat its peers or benchmark and if it performed well in the current market cycle.

Must Read: Top 10 Mutual Funds for SIP in 2026: Best Picks to Grow Wealth

Moving on, let us look at the investment strategy that will make you achieve your goals.

Smart SIP Strategy to Build a Rs 2 Crore Corpus in 2026

If you can command market cycles, then you can make better returns than your regular SIP investments by making a better investment strategy in the same investment horizon. Here is the investment strategy, explained step by step, made by our MySIPonline experts that can take your investment game to the next level:

Divide your investment tenure into two phases. Let us say your investment horizon is 10 years, then the first phase will be of first 5 years and the second phase will be the next 5 years.

For the First Phase

Step 1: Understanding the market cycle and its positions.

Two primary parameters of this are the interest rate cycle and valuation. Use them to determine if the market is in a bull phase, saturated phase, bear phase or recovery phase.

- If the market is in a bear phase, then you should choose a high growth fund under small cap or mid cap category and investment your 100% (total) amount through SIP.

- If the market is in a bull phase, then you should invest in a diversified category like multi-cap or flexi-cap. The fund should follow a buy-and-hold growth style and not invest the full amount through SIP; instead, save a small amount in liquid and debt funds.

Step 2: Additional purchase planning or strategy

Here to improve your position, you need to increase your additional purchase for every 5% fall in your investment. Follow this structure:

- In the first 5% dip, do additional buy.

- In the second 5% dip (10%), increase your investment.

- In the third 5% dip (15%), do higher allocations and so on.

For the Second Phase

Step 1: Start a SWP (Systematic Withdrawal Plan) on the total SIP corpus from the first phase, with the same amount as the SIP amount.

Step 2: With the amount you redeemed with SWP, start a SIP in the stocks.

Step 3: To select a stock for SIP, choose any theme or sector that you find very positive for the next 5 years. In that sector or theme, select businesses with-

- High Return on Investment

- High Sales Growth

- Low Valuation (P/E ratio)

Or you can take advice from your financial advisor for a better analysis and then select one.

This strategy protects your investment from all ways, from upside as well as from downside. If in the second phase also the market corrections also happen, then you can apply the additional purchase approach here also. When your total tenure is over, you can compare how this strategy made you better returns than a regular SIP investment, in the same time period.

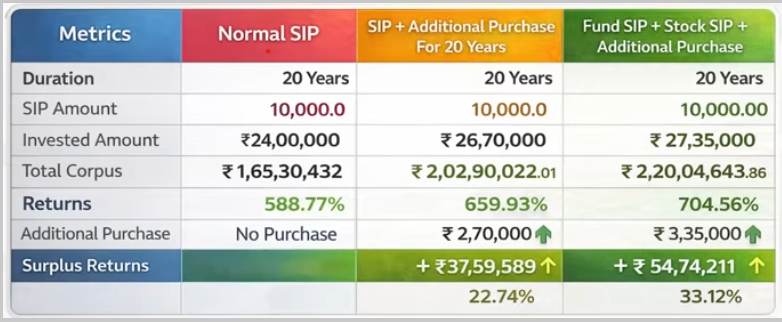

Look at the example below with three different cases and compare their returns to know which strategy worked the best:

Pro Tip: Use a SWP Calculator to plan for your regular mutual fund unit withdrawals.

Now, let us know the key timelines for SIP investments in 2026.

2026 SIP Strategy Timeline: When to Start, Pause or Increase

A 2026 SIP strategy timeline gives you a clear plan for starting, growing, and adjusting your investments to reach your goal of Rs 2 crore. This plan considers expected market changes, inflation around 4-5% and possible interest rate cuts. These are the key timelines:

- Start your SIP immediately in Q1 2026 (January-March).

- Increase the investment by 10-20% in Q2 (April-June) after reviewing Q1 performance and income hikes.

- Pause your investments temporarily for 1 to 3 months during extreme events, such as a correction of over 20% in the Nifty index.

- Move your funds to debt investments before you return to investing at higher amounts.

- Check how your investments compare to benchmarks, like the Nifty 50, which is up 12-15% this year.

- If the markets stabilize, increase your SIPs by 15%, focusing on flexi-cap funds.

- In Q4 (October-December), increase your top-up to 20-25% before the year ends for tax harvesting.

- Review your annual returns and adjust your investments if any fund goes over 30% of your total portfolio.

Also Read: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

In the next section, you will know what the ideal investment amount is for a beginner to start a SIP in 2026.

What is the Best SIP Amount for Beginners in 2026?

The best SIP amount for beginners in 2026 starts at Rs 500 to Rs 1,000 monthly, scaling to Rs 5,000 to Rs 15,000 based on individual income, goals and risk tolerance to steadily build toward a Rs 2 crore corpus over 15-20 years. Here are the recommended SIP amounts based on your level:

| Profile | Monthly SIP | 10-Year Projection (12% CAGR) | Rationale |

|---|---|---|---|

| Absolute Beginner (₹25k salary) | ₹500 – ₹1,000 | ₹1 – ₹2 lakhs | Builds habit; most funds allow minimum SIP of ₹100–₹500. |

| Moderate (₹50k – ₹1 lakh salary) | ₹5,000 – ₹10,000 | ₹13 – ₹26 lakhs | Balances growth with affordability; rupee cost averaging works effectively. |

| Ambitious (₹1.5 lakh+ salary) | ₹15,000 – ₹25,000 | ₹39 – ₹65 lakhs | Accelerates wealth creation; step-ups help reach ₹2 crore goal by the 2040s. |

Lastly, let us compare the SIP investments with other options for 2026.

Smart Investments, Bigger Returns

Smart SIP vs Lump Sum vs STP: 2026 Comparison

Here is a clear and short comparison of SIP vs Lump Sum vs STP for your 2026 investments:

| Aspect | Smart SIP | Lump Sum |

|---|---|---|

| Core Method | SIP + cycle allocation + dip buys + Phase 2 SWP in stock SIP | One-time full investment |

| Risk Profile | Medium (cycle protection) | High (all-in timing) |

| Cash Flow | Monthly ₹10,000 (15% yearly step-up) | ₹12 lakh upfront |

| Timing Need | Low (process-driven) | High (bull market start critical) |

| 2026 Fit | Perfect (bear → bull → dip cycle) | Risky (Q1 rally or bull trap?) |

Conclusion

In short, the investment strategy by MySIPonline experts of dividing your tenure into two phases and adding the concept of stock SIP and additional purchase in your investment game can significantly increase your overall investment corpus in comparison with the regular SIP investments in mutual funds.

Related Blogs:

- Top Performing Equity Mutual Funds 2026: Highest Return Picks

- Top 5 Mutual Funds for Lumpsum Investment 2026: Expert Picks

FAQs

-

Best Funds for Smart SIP Strategy in 2026?

In a bear market, consider investing in Kotak Small Cap and HDFC Mid-Cap. In a bull market, look at HDFC Flexi Cap and Parag Parikh Flexi Cap.

-

Should I Stop SIP During 2026 Market Corrections?

Never stop, corrections in the market are chances to buy. When the Nifty falls by 5%, increase your SIP by 25% to reduce your average cost.

-

Smart SIP vs Regular SIP: Real Return Difference?

Smart SIP achieved a return of 659%, while regular SIP saw a return of 588%. With the stock phase, returns can exceed 700%.

-

How Does the RBI Interest Rate Cycle Affect Smart SIP 2026?

If interest rates drop (expected in Q1 2026), money will flow into stocks, leading to a bull market, which is suitable for flexible-cap investments.

-

Is Small Cap Safe for Smart SIP Post-2025 Correction?

Mid and small-cap stocks are valued at 28 times their earnings, compared to 40 times at their highest point, which we consider fair.

.webp&w=3840&q=75)